Form 3805Q Net Operating Loss NOL Computation and NOL and 2021-2026

What is the Form 3805Q Net Operating Loss NOL Computation?

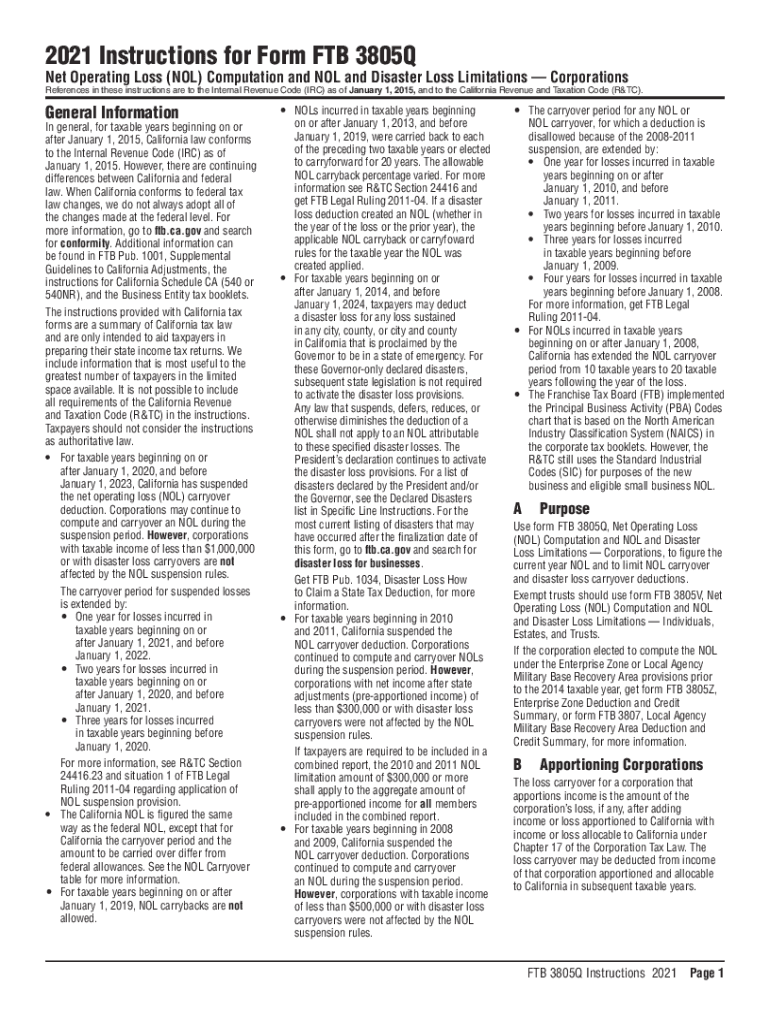

The Form 3805Q is a crucial document used in California for calculating Net Operating Loss (NOL) deductions. This form allows taxpayers to report their business losses and apply them against taxable income in other years, potentially reducing their overall tax liability. Understanding the NOL computation is essential for businesses aiming to optimize their tax positions, especially during challenging financial periods.

Steps to Complete the Form 3805Q Net Operating Loss NOL Computation

Completing the Form 3805Q involves several key steps:

- Gather necessary financial documents, including income statements and prior tax returns.

- Calculate your current year’s net operating loss by subtracting your total deductions from your total income.

- Fill out the form accurately, ensuring all figures are correct and supported by documentation.

- Review the form for any errors or omissions before submission.

- Submit the form by the designated deadline to ensure compliance with California tax regulations.

Legal Use of the Form 3805Q Net Operating Loss NOL Computation

The Form 3805Q is legally recognized for calculating and reporting net operating losses in California. It adheres to state tax laws and guidelines, making it a legitimate tool for taxpayers. Proper use of this form can help ensure that businesses are compliant with tax regulations while maximizing their potential deductions. Failure to use the form correctly may result in penalties or disallowed deductions.

Filing Deadlines for Form 3805Q

Timely filing of the Form 3805Q is essential to avoid penalties. Typically, the form must be submitted along with your California tax return by the due date of the return, including extensions. It is important to keep track of any changes in deadlines, as these can vary based on specific circumstances or legislative updates.

Eligibility Criteria for Using the Form 3805Q

To qualify for using the Form 3805Q, taxpayers must meet certain criteria. Generally, businesses must have incurred a net operating loss during the tax year and must be operating within California. Additionally, the losses must be attributable to the business activities reported on the tax return. Understanding these eligibility requirements is crucial for ensuring that the form is applicable to your situation.

Examples of Using the Form 3805Q Net Operating Loss NOL Computation

Consider a small business that experienced a significant drop in revenue due to unforeseen circumstances, such as a natural disaster. By using the Form 3805Q, the business can report its losses and potentially carry them forward to offset future taxable income. Another example includes a startup that has not yet turned a profit; the form allows them to document their losses and utilize them in future tax years, aiding in cash flow management during growth phases.

Required Documents for Form 3805Q Submission

When preparing to submit the Form 3805Q, certain documents are necessary to support your claims. These may include:

- Income statements showing total revenue and expenses.

- Previous tax returns for reference.

- Any documentation substantiating the losses claimed.

- Records of any adjustments made to prior year losses.

Quick guide on how to complete 2021 form 3805q net operating loss nol computation and nol and

Prepare Form 3805Q Net Operating Loss NOL Computation And NOL And effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents quickly without delays. Manage Form 3805Q Net Operating Loss NOL Computation And NOL And on any platform with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to modify and electronically sign Form 3805Q Net Operating Loss NOL Computation And NOL And with ease

- Locate Form 3805Q Net Operating Loss NOL Computation And NOL And and then click Get Form to get started.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow particularly provides for that purpose.

- Create your signature using the Sign tool, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Verify the information and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 3805Q Net Operating Loss NOL Computation And NOL And and ensure superior communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form 3805q net operating loss nol computation and nol and

Create this form in 5 minutes!

People also ask

-

What is the form 568 booklet?

The form 568 booklet is a crucial tax document for California Limited Liability Companies (LLCs). It provides essential information regarding the LLC's income, expenses, and tax obligations. Understanding how to properly complete the form 568 booklet is vital for compliance with state regulations.

-

How can I obtain a form 568 booklet?

You can easily obtain a form 568 booklet through the California Franchise Tax Board's website or directly from airSlate SignNow. Using airSlate SignNow, you can access templates and guides to help you navigate the form's requirements. This makes it easier for businesses to manage their LLC tax documents effectively.

-

Is there a cost associated with using airSlate SignNow for the form 568 booklet?

airSlate SignNow offers competitive pricing plans that allow you to efficiently manage the form 568 booklet alongside other documents. Our flexible plans ensure that you only pay for what you need. Check our website for detailed pricing options tailored for businesses of all sizes.

-

What features does airSlate SignNow offer for the form 568 booklet?

airSlate SignNow provides a range of features to help you with the form 568 booklet, including electronic signatures, document templates, and secure storage. Our platform streamlines the process, ensuring you can prepare and submit your booklet effortlessly. Additionally, you can collaborate with team members in real-time to ensure accuracy.

-

Can airSlate SignNow integrate with other tools I use for filing the form 568 booklet?

Yes, airSlate SignNow integrates seamlessly with various business applications, including accounting software and CRM systems. This integration allows for a smooth workflow when managing the form 568 booklet. You can send, sign, and save your documents without switching between different platforms.

-

What are the benefits of using airSlate SignNow for managing the form 568 booklet?

Using airSlate SignNow for the form 568 booklet offers numerous benefits, including enhanced efficiency, cost savings, and improved compliance. Our user-friendly platform simplifies the eSignature process, allowing your team to complete documents quickly and securely. This way, you can focus on your business rather than paperwork.

-

How does airSlate SignNow ensure the security of my form 568 booklet?

Security is a top priority at airSlate SignNow. We utilize advanced encryption methods to protect your data while you prepare and store the form 568 booklet. Additionally, we comply with industry standards to ensure that your sensitive information remains safe and secure at all times.

Get more for Form 3805Q Net Operating Loss NOL Computation And NOL And

- Tenants maintenance repair request form new mexico

- Guaranty attachment to lease for guarantor or cosigner new mexico form

- Amendment to lease or rental agreement new mexico form

- Warning notice due to complaint from neighbors new mexico form

- Lease subordination agreement new mexico form

- Apartment rules and regulations new mexico form

- Nm cancellation form

- Amendment of residential lease new mexico form

Find out other Form 3805Q Net Operating Loss NOL Computation And NOL And

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template