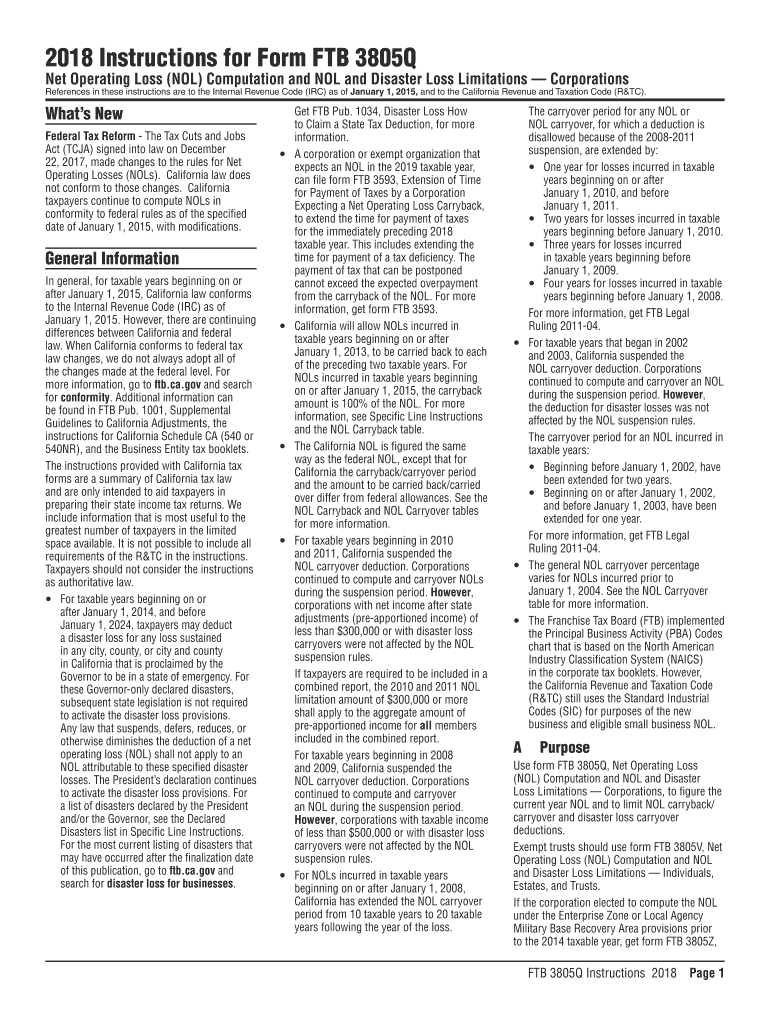

Ca Form 3805q Instructions 2018

What is the CA Form 3805Q Instructions?

The CA Form 3805Q Instructions provide detailed guidance for completing the California Form 3805Q, which is used for claiming tax credits related to the California Franchise Tax Board. This form is essential for businesses and individuals looking to navigate their tax obligations effectively. Understanding the instructions ensures that users can accurately report their financial information and claim eligible credits.

Steps to Complete the CA Form 3805Q Instructions

Completing the CA Form 3805Q involves several key steps to ensure accuracy and compliance. Follow these steps for a smooth process:

- Gather Required Information: Collect all necessary financial documents, including income statements, expense reports, and prior tax returns.

- Review Instructions: Carefully read the CA Form 3805Q Instructions to understand the requirements and guidelines.

- Fill Out the Form: Enter the required information in the appropriate sections of the form, ensuring accuracy in all entries.

- Double-Check Entries: Review the completed form for any errors or omissions before submission.

- Submit the Form: Follow the submission guidelines outlined in the instructions, whether online, by mail, or in person.

Legal Use of the CA Form 3805Q Instructions

The legal use of the CA Form 3805Q Instructions is crucial for ensuring compliance with state tax laws. These instructions outline the legal framework under which the form operates, detailing how to properly claim tax credits and fulfill reporting obligations. Adhering to these instructions helps avoid potential legal issues and penalties associated with incorrect filings.

Who Issues the Form?

The CA Form 3805Q is issued by the California Franchise Tax Board (FTB). This state agency is responsible for administering California's tax laws and ensuring compliance among taxpayers. By following the guidelines provided by the FTB, users can ensure that they are utilizing the form correctly and in accordance with state regulations.

Filing Deadlines / Important Dates

Understanding filing deadlines is essential for timely submission of the CA Form 3805Q. The deadlines may vary based on the type of taxpayer and the specific credits being claimed. Generally, forms must be filed by the tax return due date, which is usually April 15 for individual taxpayers. It is advisable to check the California Franchise Tax Board's official calendar for any updates or changes to these important dates.

Required Documents

To complete the CA Form 3805Q, certain documents are required to support the information provided. These may include:

- Income statements

- Expense receipts

- Prior year tax returns

- Documentation for claimed credits

Having these documents on hand will facilitate a smoother completion process and ensure that all claims are substantiated.

Quick guide on how to complete ca form 3805q instructions 2019

Effortlessly Prepare Ca Form 3805q Instructions on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally conscious substitute to traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Ca Form 3805q Instructions on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The simplest method to edit and eSign Ca Form 3805q Instructions effortlessly

- Obtain Ca Form 3805q Instructions and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that task.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to preserve your modifications.

- Choose how to share your form, via email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or mislaid files, tedious form searching, or errors that require new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Ca Form 3805q Instructions and guarantee outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ca form 3805q instructions 2019

Create this form in 5 minutes!

How to create an eSignature for the ca form 3805q instructions 2019

How to generate an electronic signature for a PDF in the online mode

How to generate an electronic signature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature straight from your smart phone

How to make an eSignature for a PDF on iOS devices

The best way to generate an eSignature for a PDF document on Android OS

People also ask

-

What is the form 568 booklet?

The form 568 booklet is an essential guide for completing California's Form 568, which is necessary for limited liability companies (LLCs) to report taxes and fees. It provides detailed instructions and information on how to fill out the form accurately, ensuring compliance with state regulations.

-

How can airSlate SignNow help with the form 568 booklet?

airSlate SignNow streamlines the process of filling out and electronically signing the form 568 booklet. Our user-friendly platform allows businesses to gather signatures and send documents securely, saving time and reducing paperwork for LLCs.

-

Is there a cost associated with using the form 568 booklet in airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate businesses of all sizes. While the form 568 booklet itself is free, utilizing our eSignature services can enhance your document management for a minimal fee, offering excellent value for LLCs.

-

What features does airSlate SignNow offer for the form 568 booklet?

Our platform includes robust features like customizable templates, real-time collaboration, and secure cloud storage, all tailored to assist users with the form 568 booklet. These functionalities simplify document preparation, making the process efficient and transparent.

-

Can I integrate airSlate SignNow with other tools for handling the form 568 booklet?

Yes, airSlate SignNow seamlessly integrates with various productivity and business applications, enhancing your workflow when dealing with the form 568 booklet. This includes popular software like Google Drive and Salesforce, ensuring a unified approach to document management.

-

What are the benefits of using airSlate SignNow for the form 568 booklet?

Using airSlate SignNow for the form 568 booklet provides numerous benefits, including increased efficiency, reduced turnaround times, and improved accuracy in document processing. Our platform ensures your documents are securely signed and delivered, keeping your business compliant.

-

Is training available for using the form 568 booklet in airSlate SignNow?

Absolutely, airSlate SignNow offers comprehensive resources, including tutorials and customer support, to help users effectively utilize the form 568 booklet. Our dedicated team ensures you can navigate our platform effortlessly to maximize its advantages.

Get more for Ca Form 3805q Instructions

Find out other Ca Form 3805q Instructions

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word