Form 540 2021

What is the Form 540

The Form 540 is a California state income tax return used by residents to report their income and calculate their tax liability. It is primarily for individuals who are not claimed as dependents on someone else's tax return. This form is essential for ensuring compliance with state tax laws and allows taxpayers to claim various credits and deductions that can reduce their overall tax burden.

How to use the Form 540

To use the Form 540 effectively, taxpayers should first gather all necessary financial documents, including W-2s, 1099s, and any other income statements. The form requires individuals to report their total income, calculate deductions, and determine their tax liability. It is advisable to follow the instructions provided with the form carefully to ensure accurate completion and compliance with state regulations.

Steps to complete the Form 540

Completing the Form 540 involves several steps:

- Gather all relevant income documents, such as W-2s and 1099 forms.

- Fill out personal information, including name, address, and Social Security number.

- Report total income from all sources on the designated lines.

- Calculate adjustments to income, if applicable.

- Claim deductions and credits available to you.

- Calculate your total tax liability based on the provided tax tables.

- Sign and date the form before submission.

Legal use of the Form 540

The Form 540 is legally binding when completed accurately and submitted to the California Franchise Tax Board. Taxpayers must ensure that all information provided is truthful and complete, as any discrepancies could lead to penalties or audits. Utilizing electronic filing options can enhance security and streamline the submission process, ensuring compliance with legal requirements.

Filing Deadlines / Important Dates

Taxpayers must be aware of key deadlines associated with the Form 540. Typically, the filing deadline is April 15 of each year, unless it falls on a weekend or holiday, in which case it may be extended. Additionally, taxpayers should be mindful of any extensions that may apply and ensure that they file their returns on time to avoid penalties and interest on unpaid taxes.

Form Submission Methods (Online / Mail / In-Person)

The Form 540 can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online: Many taxpayers choose to file electronically through approved tax software, which can simplify the process and reduce errors.

- Mail: The completed form can be mailed to the appropriate address as specified by the California Franchise Tax Board.

- In-Person: Taxpayers may also visit local tax offices to submit their forms directly.

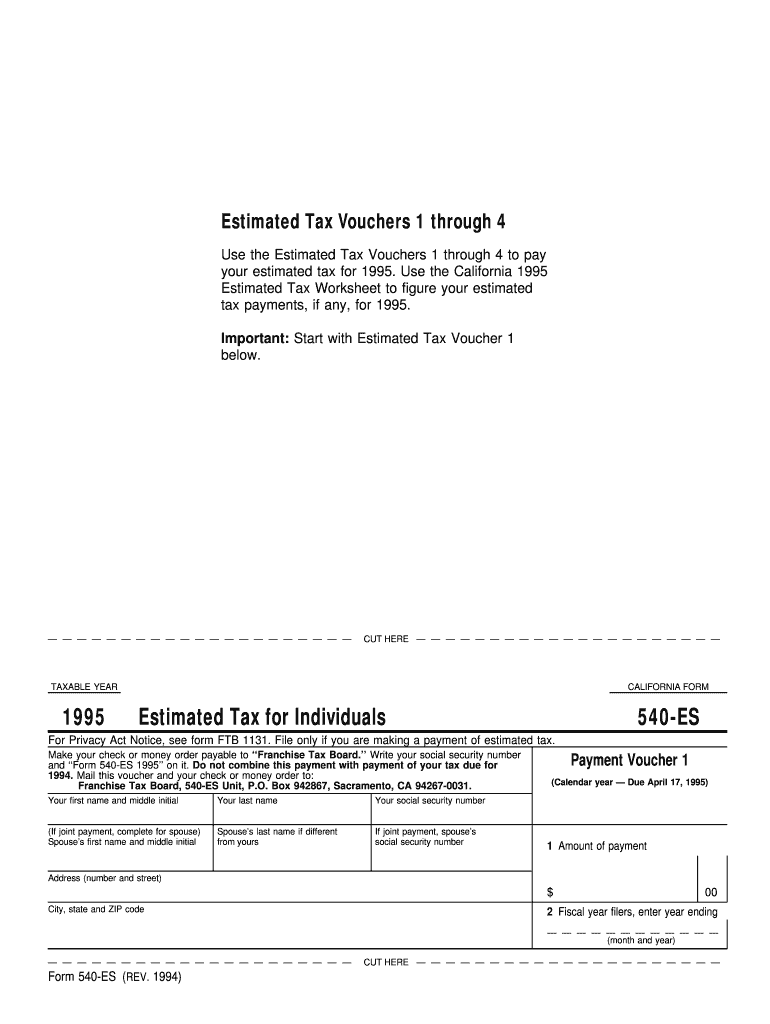

Quick guide on how to complete 1994 form 540 1995

Effortlessly manage Form 540 on any device

Digital document management has become increasingly popular among companies and individuals. It serves as a perfect eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the required form and securely store it online. airSlate SignNow provides all the necessary tools to generate, edit, and electronically sign your documents swiftly without delays. Handle Form 540 on any device using the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

How to modify and electronically sign Form 540 effortlessly

- Obtain Form 540 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize key sections of your documents or redact sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional ink signature.

- Verify all the details and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Form 540 to ensure excellent communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1994 form 540 1995

Create this form in 5 minutes!

How to create an eSignature for the 1994 form 540 1995

The way to generate an electronic signature for a PDF in the online mode

The way to generate an electronic signature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The way to create an eSignature straight from your smart phone

The best way to make an eSignature for a PDF on iOS devices

The way to create an eSignature for a PDF document on Android OS

People also ask

-

What is Form 540 and why is it important?

Form 540 is a California resident income tax return form used by individuals to report their income and claim deductions. Understanding how to complete Form 540 accurately is crucial for ensuring compliance with tax regulations and avoiding penalties.

-

How can airSlate SignNow help with Form 540 submission?

airSlate SignNow simplifies the process of preparing and submitting Form 540 by allowing users to electronically sign and send documents securely. This tool streamlines your tax documentation process, making it easier to manage and submit Form 540 without unnecessary delays.

-

Is there a cost associated with using airSlate SignNow for Form 540?

airSlate SignNow offers various pricing plans tailored to different business needs, ensuring you can find an economical solution for managing Form 540. With its cost-effective options, you can manage your document signing needs without breaking the bank.

-

What features does airSlate SignNow provide for managing Form 540?

airSlate SignNow offers features like customizable templates, automatic reminders, and secure storage, all essential for managing Form 540 efficiently. These capabilities not only help in reducing errors but also enhance the overall user experience.

-

Can I integrate airSlate SignNow with other applications for Form 540?

Yes, airSlate SignNow allows for seamless integrations with various applications such as Google Drive, Dropbox, and CRM systems. This means you can consolidate your tax documentation, including Form 540, and streamline your workflow across different platforms.

-

What are the benefits of using airSlate SignNow for Form 540?

One of the primary benefits of using airSlate SignNow for Form 540 is the enhanced efficiency it provides. By using electronic signatures and document tracking, you can save time and reduce the hassle traditionally associated with tax form submissions.

-

Is airSlate SignNow secure for handling Form 540 documents?

Absolutely, airSlate SignNow prioritizes security, ensuring that all data related to Form 540 is encrypted and protected against unauthorized access. The platform complies with industry standards for document security, giving you peace of mind while handling sensitive information.

Get more for Form 540

- Sr pdf workflow sr pdf workflow form

- Membership rewards request for american express form

- Publication 3965 rev october got kids you may be able to take the child tax credit form

- B e t t e r d i ag n ost i c s form

- Buyout contract template form

- Histocytology request formidexx reference laborat

- Nwcg task book for the positions of intermediate faller fal2 and advanced faller fal1 pms 311 91 form

- Idexx cytology form

Find out other Form 540

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now

- Sign Pennsylvania Insurance Business Plan Template Safe

- Sign Pennsylvania Insurance Contract Safe

- How Do I Sign Louisiana Legal Cease And Desist Letter

- How Can I Sign Kentucky Legal Quitclaim Deed

- Sign Kentucky Legal Cease And Desist Letter Fast

- Sign Maryland Legal Quitclaim Deed Now

- Can I Sign Maine Legal NDA

- How To Sign Maine Legal Warranty Deed

- Sign Maine Legal Last Will And Testament Fast

- How To Sign Maine Legal Quitclaim Deed

- Sign Mississippi Legal Business Plan Template Easy

- How Do I Sign Minnesota Legal Residential Lease Agreement

- Sign South Carolina Insurance Lease Agreement Template Computer