California Charitable 2007-2026

What is the California Charitable Form CT-1?

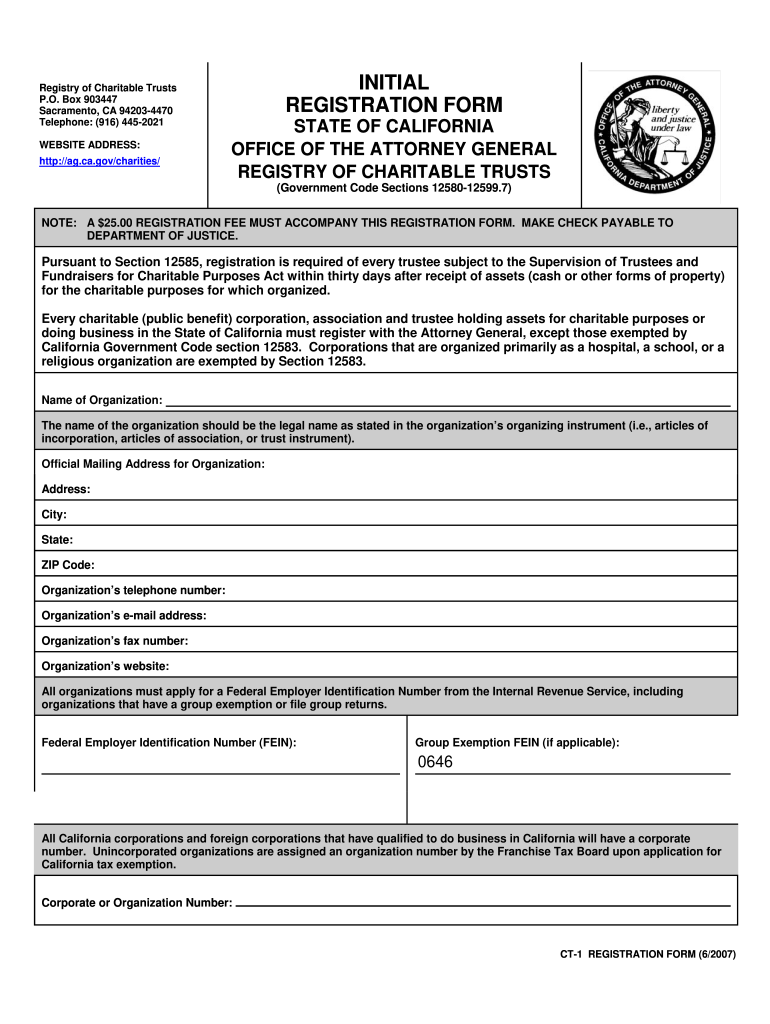

The California Charitable Form CT-1 is an essential document for organizations seeking to register as charitable entities within the state. This form serves as the initial registration application for nonprofit organizations that intend to solicit charitable contributions. By completing this form, organizations can ensure compliance with California's regulations governing charitable activities, thereby establishing their legitimacy and trustworthiness in the eyes of potential donors.

Steps to Complete the California Charitable Form CT-1

Completing the California Charitable Form CT-1 involves several key steps to ensure accuracy and compliance. First, gather all necessary information about your organization, including its legal name, address, and mission statement. Next, provide details on the organization’s structure, such as whether it is a corporation, trust, or unincorporated association. After filling out the required fields, review the form for completeness and accuracy. Finally, submit the form to the appropriate state agency, ensuring you meet any specific filing deadlines.

Legal Use of the California Charitable Form CT-1

The legal use of the California Charitable Form CT-1 is governed by state laws that require charitable organizations to register before soliciting donations. This form not only helps organizations comply with legal requirements but also protects the public by ensuring that only legitimate charities operate within the state. Proper use of the form includes adhering to all instructions and providing truthful information, as any discrepancies can lead to penalties or delays in registration.

Required Documents for the California Charitable Form CT-1

When completing the California Charitable Form CT-1, several documents are typically required to support your application. These may include the organization’s articles of incorporation, bylaws, and a detailed description of the charitable purpose. Additionally, financial statements or budgets may be necessary to demonstrate the organization’s viability. Having these documents ready can streamline the application process and help ensure compliance with regulatory standards.

Form Submission Methods for the California Charitable Form CT-1

The California Charitable Form CT-1 can be submitted through various methods, including online submission, mail, or in-person delivery. For online submissions, organizations can utilize the state’s designated portal, which often provides a more efficient processing time. If submitting by mail, ensure that the form is sent to the correct address and consider using a trackable mailing option. In-person submissions can be made at designated state offices, allowing for immediate confirmation of receipt.

Penalties for Non-Compliance with the California Charitable Form CT-1

Failure to comply with the requirements associated with the California Charitable Form CT-1 can result in significant penalties. Organizations that do not register before soliciting donations may face fines, legal action, or even revocation of their charitable status. It is crucial for organizations to adhere to all filing deadlines and maintain accurate records to avoid these consequences and ensure ongoing compliance with state regulations.

Quick guide on how to complete form ct 1

Handle California Charitable anytime, anywhere

Your daily business tasks may require extra attention when handling state-specific business documents. Regain your office time and decrease the printing costs linked to document-focused operations with airSlate SignNow. airSlate SignNow offers a variety of pre-uploaded business documents, including California Charitable, which you can utilize and share with your business associates. Control your California Charitable effortlessly with robust editing and eSignature features and send it directly to your recipients.

Steps to obtain California Charitable in a few clicks:

- Choose a form pertinent to your state.

- Click on Learn More to access the document and confirm its accuracy.

- Select Get Form to start working with it.

- California Charitable will instantly open in the editor. No additional actions are needed.

- Utilize airSlate SignNow’s advanced editing tools to complete or modify the form.

- Locate the Sign feature to create your signature and eSign your document.

- When ready, click Done, save the changes, and access your document.

- Send the form via email or text, or use a link-to-fill option with your partners or allow them to download the document.

airSlate SignNow signNowly reduces the time spent managing California Charitable and allows you to access vital documents in one place. A comprehensive collection of forms is organized and designed to support key business processes required for your company. The sophisticated editor minimizes the risk of errors, as you can swiftly amend mistakes and review your documents on any device before sending them out. Start your free trial today to explore all the benefits of airSlate SignNow for your daily business operations.

Create this form in 5 minutes or less

FAQs

-

What disgusts you about the current medical education, especially the MBBS curriculum in India?

Quite a few actually.No idea why we have a full 6 months extra for year 2. Absolute waste of time. Can trim the course to 4+1 years.No emphasis whatsoever on clinical medicine.No training in First Aid, basic surgical skills, critical care scenarios prior to joining internship, they just ask for a BLS at the “end” of internship. Not really sure how BLS will help after finishing the whole internship.Too much emphasis on non clinical gross anatomy rather than practical application to surgery. No wonder kids in year 1 MBBS fear anatomy as a monster.Exam pattern is too subjective. Have a good handwriting and draw few random cartoons, you get good marks. RIP logic.You realise your whole 4 and half years’ medical training is absolute trash once you start working in the hospital as an intern when you don't even know ABC for a trauma patient.Too much emphasis on how to describe a lump in surgery rather than discussing meaningful imaging and operative plan.Useless discussions on whether the power of a limb was 2/5 or 3/5 rather than discussion on how to optimise a stroke patient and deal with his rehab.People are just worried about all the anomalies of a gall bladder but have no clue how to position a patient for lap cholecystectomy.No freakin guidelines on when to use blood or antibiotics leading to complete wastage of resources and antibiotic resistance.Pharma talks at length about difference mechanisms of drugs but you end up with no clue as to which inotrope to use during sepsis.A few peripheral elective postings like radio, dermat shoo away medical students, effectively limiting the imagination in that direction. I heard people say “You don't know anything, why do you even come?” I was like “I thought we are supposed to learn stuff here”.Too much focus on teaching all the causes of pancreatitis but having no idea how to hold a difficult conversation with a patient’s relative.Denying the importance of imaging like CT and MRI and emphasis on plain X rays as you are too “junior” for this stuff. But right at the start of internship, you are supposed to know when to order a CT scan for head injury. What????Practical exams are another big joke. All you need to do is get the long case discussion right and you stand a good chance to pass. By the same token, have a horrible initial discussion and it will scar your performance for the day. No second chance ?Faculty suggesting outdated and irrelevant books like Hutchinson which are of absolutely no use in present times. Older edition was good maybe.Emphasis on outdated clinical examination techniques. No one really does all the fancy varicose veins tests now as there was little evidence to support their use in routine practice. Further we are completely oblivious of the use of bedside doppler which is a far greater useful tool.Guy learns in and out chest anatomy in year 1 MBBS but doesn't know how to place a chest drain in safe triangle.Beautiful subjects like forensic med are reduced to clown by teaching them in closed classrooms with old, image-less PPTs which can be mind numbing rather than involving the students in a post mortem session or showing practical applications.Precious time is lost reading biochem from satyanarayan as reading lippincott doesn't help you through exam questions, while the other book puts across basic fundamentals of clinical importance.Same story with Cunningham and Guyton, don't really know why the faculty was big on these but I found them thoroughly useless for any purpose.I could go on but I made peace with the fact that the system in its current form can't be changed.You just let go of it and build yourself up the way you want.I keep hearing news of changes in curriculum and other related BS but practicality is far less and I don't think this is going to change anytime sooner.

-

How can I legally purchase a GLOCK pistol in the US?

Simple answer is: Don't break any applicable laws while doing it and you'll be good to go!Federal law requires that you be at least 21 years of age to purchase a handgun from an Federal Firearms License holding dealer, but in most states you will need to be 21 or older to legally possess a handgun no matter where you buy it. So, figure age 21 or older, and you'll be safe. Federal law prohibits certain people from possessing firearms or ammunition. The main one is convicted felons, but there are several other similar classes of people, the least of which is anyone who has been convicted of a misdemeanor domestic assault or abuse. Most state laws follow federal law in this regard. In some states, you must have a permit to acquire a handgun. Get it. It's no big deal. It's not a permit to carry, just to acquire. You must have it if you buy a handgun from an individual or even if you accept it as a gift if its from anyone other than immediate family members, such as your parents.After that, buy your Glock. Buying through an FFL dealer is your best bet, but there is generally nothing wrong from buying from an individual if you do it right. Preferably it's someone you already know at least some and have no reason to believe is selling it in bad faith. In other words, your best judgement indicates that it's probably not stolen or has been used to commit a crime with. If you're getting it in the case with accessories at roughly market price and the individual doesn't seem to be in an especially big hurry to sell it, you're probably all right. If he's selling it very cheaply and acts like he wanted it gone yesterday, that's not a good sign and buying from him once you've observed that could potentially expose you to culpability for purchasing a stolen pistol if the authorities come to believe that you should have known the deal wasn't legitimate.Once you purchase it, to be fully legal, I'd recommend lawfully taking it home with you. A locking tool box or a small suitcase, even a cardboard box well secured with tape should be all right. The key is that it's not readily accessible and too large to conceal on your person. Put it in the trunk or somewhere where you can't signNow it while driving. Once you're on your own property, you can typically carry or conceal it any way you want with no problem.

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

How do I fill out Address Line 1 on an Online Form?

(street number) (street name) (street suffix)101 Main StreetYou can query the post office on your address, best as you know it, for the “standard” way of presenting your address. USPS.com® - ZIP Code Lookup or whatever service is offered in your country. That will tell you the standard way to fill out address lines.

Create this form in 5 minutes!

How to create an eSignature for the form ct 1

How to create an electronic signature for the Form Ct 1 in the online mode

How to generate an electronic signature for your Form Ct 1 in Google Chrome

How to make an eSignature for putting it on the Form Ct 1 in Gmail

How to generate an eSignature for the Form Ct 1 from your smartphone

How to generate an eSignature for the Form Ct 1 on iOS devices

How to generate an eSignature for the Form Ct 1 on Android devices

People also ask

-

What is airSlate SignNow’s pricing for California Charitable organizations?

airSlate SignNow offers flexible pricing plans tailored for California Charitable organizations, ensuring they can access affordable eSigning solutions. Our pricing includes various tiers, allowing nonprofits to choose a plan that best fits their budget and signing needs. To learn more about specific pricing for California Charitable entities, visit our pricing page.

-

How can California Charitable organizations benefit from using airSlate SignNow?

California Charitable organizations can streamline their document processes with airSlate SignNow, signNowly reducing paperwork and enhancing efficiency. By utilizing our platform, charities can easily send and eSign important documents, ensuring compliance and saving time. This leads to improved donor engagement and better management of resources.

-

Does airSlate SignNow integrate with other tools used by California Charitable organizations?

Yes, airSlate SignNow seamlessly integrates with various applications commonly used by California Charitable organizations, such as CRM systems, payment processors, and cloud storage services. These integrations enhance workflow efficiency, allowing charities to manage their documents alongside other essential tools. This ensures that your organization can operate smoothly without switching between multiple platforms.

-

Can airSlate SignNow help California Charitable organizations with compliance?

Absolutely! airSlate SignNow is designed to help California Charitable organizations maintain compliance with state and federal regulations governing electronic signatures. Our platform provides features such as audit trails and secure storage, ensuring that all signed documents are legally binding and meet compliance requirements. This peace of mind allows charities to focus on their mission.

-

Is it easy to use airSlate SignNow for California Charitable organizations?

Yes, airSlate SignNow is user-friendly and designed for ease of use, making it accessible for California Charitable organizations of all sizes. Our intuitive interface allows users to quickly send and eSign documents without extensive training. This simplifies the process, enabling charities to devote more time to their charitable activities rather than administrative tasks.

-

What types of documents can California Charitable organizations eSign using airSlate SignNow?

California Charitable organizations can eSign a wide range of documents using airSlate SignNow, including donation agreements, volunteer contracts, and grant applications. Our platform supports various document formats, making it easy for charities to digitize their paperwork and expedite their processes. With airSlate SignNow, charities can manage all their essential documents efficiently.

-

Are there any special features for California Charitable organizations with airSlate SignNow?

airSlate SignNow offers special features designed to meet the unique needs of California Charitable organizations, such as customizable templates and bulk sending options. These features help streamline document management and enhance collaboration within teams. Additionally, our platform provides tools for tracking the status of documents, ensuring that charities stay organized and informed.

Get more for California Charitable

- Boe 146 res rev form

- 568 booklet franchise tax board state of california ftb ca form

- 2016 form 3809 targeted tax area deduction and credit summary 2016 form 3809 targeted tax area deduction and credit summary

- Boe 82 authorization for electronic transmission of data boe 82 authorization for electronic transmission of data boe ca form

- Ftb form 568 2001

- 2005 california resident income tax return form 540

- 540 instructions form

- Ftb 3601 transmittal of annual 1098 1099 5498 w 2g information for tax year

Find out other California Charitable

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors