California Resident Income Tax Return Form 540 2019

What is the California Resident Income Tax Return Form 540

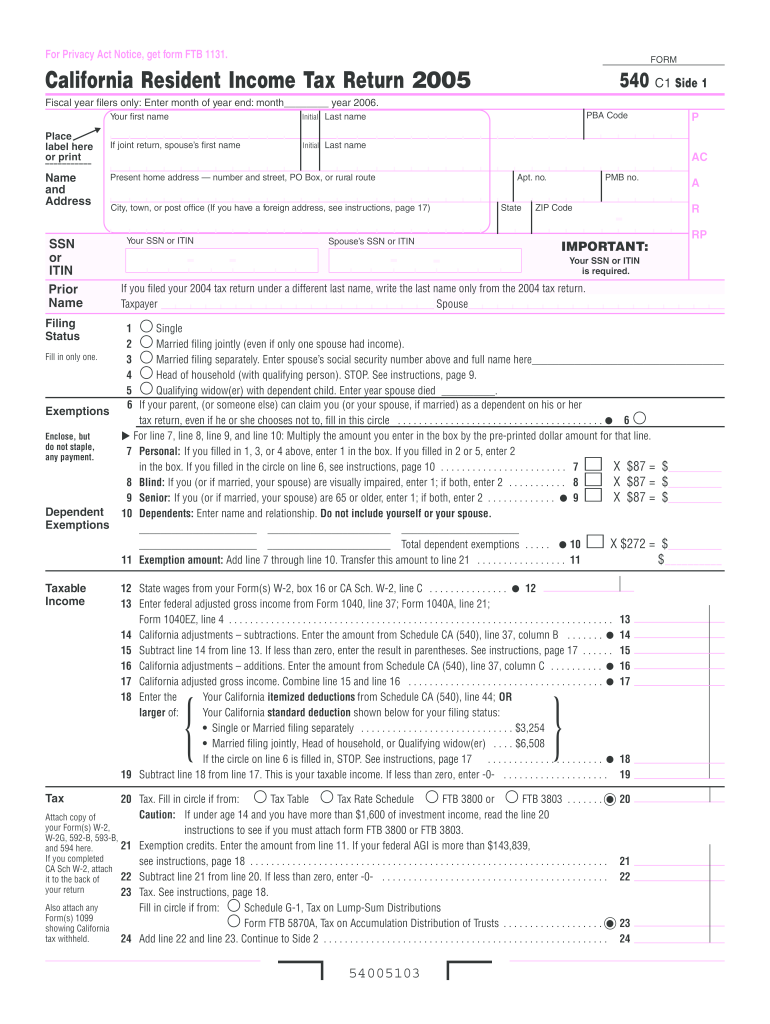

The California Resident Income Tax Return Form 540 is a state-specific tax form used by residents of California to report their income, calculate their tax liability, and determine any refunds owed. This form is essential for individuals who earn income within the state, as it helps ensure compliance with California tax laws. It includes various sections for reporting wages, interest, dividends, and other sources of income, as well as deductions and credits applicable to California residents.

Steps to complete the California Resident Income Tax Return Form 540

Completing the California Resident Income Tax Return Form 540 involves several key steps:

- Gather necessary documents, including W-2 forms, 1099s, and any other income statements.

- Fill out personal information, such as your name, address, and Social Security number.

- Report all sources of income in the designated sections, ensuring accuracy.

- Claim any eligible deductions and credits to reduce your taxable income.

- Calculate your total tax liability using the provided tax tables.

- Review the completed form for any errors or omissions.

- Sign and date the form before submission.

How to obtain the California Resident Income Tax Return Form 540

The California Resident Income Tax Return Form 540 can be obtained through several methods. Residents can download the form directly from the California Franchise Tax Board's website. Alternatively, paper copies are often available at local libraries, post offices, and tax preparation offices. Additionally, many tax software programs include the option to fill out and file the Form 540 electronically, simplifying the process for users.

Legal use of the California Resident Income Tax Return Form 540

The California Resident Income Tax Return Form 540 is legally binding when completed accurately and submitted in accordance with state laws. To ensure its legal validity, taxpayers must provide truthful information and maintain all supporting documentation. E-signatures are accepted, provided they comply with relevant eSignature laws, ensuring that the form is recognized as a legitimate document by the California tax authorities.

Filing Deadlines / Important Dates

Taxpayers must be aware of key deadlines associated with the California Resident Income Tax Return Form 540. Typically, the filing deadline is April 15 of each year, aligning with federal tax deadlines. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial for taxpayers to file on time to avoid penalties and interest on any unpaid taxes.

Required Documents

To complete the California Resident Income Tax Return Form 540, certain documents are necessary. These include:

- W-2 forms from employers showing annual wages.

- 1099 forms for other income sources, such as freelance work or interest.

- Records of any deductions, such as mortgage interest statements or medical expenses.

- Proof of any tax credits claimed, such as education credits or child tax credits.

Form Submission Methods (Online / Mail / In-Person)

The California Resident Income Tax Return Form 540 can be submitted through various methods. Taxpayers have the option to file online using tax preparation software, which often provides guidance and ensures accuracy. Alternatively, forms can be printed and mailed to the California Franchise Tax Board. For those who prefer in-person assistance, many tax preparation services offer the option to file the form directly at their locations, providing support throughout the process.

Quick guide on how to complete 2005 california resident income tax return form 540

Effortlessly Prepare California Resident Income Tax Return Form 540 on Any Device

The management of online documents has become widely accepted among both businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, as you can easily find the necessary form and safely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without any delays. Handle California Resident Income Tax Return Form 540 on any device using airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

The Easiest Way to Edit and eSign California Resident Income Tax Return Form 540 with Ease

- Find California Resident Income Tax Return Form 540 and click on Get Form to initiate.

- Use the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you prefer to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require reprinting new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign California Resident Income Tax Return Form 540 and ensure outstanding communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2005 california resident income tax return form 540

Create this form in 5 minutes!

How to create an eSignature for the 2005 california resident income tax return form 540

How to create an eSignature for your PDF file in the online mode

How to create an eSignature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature from your smartphone

How to generate an electronic signature for a PDF file on iOS devices

The best way to generate an eSignature for a PDF file on Android

People also ask

-

What is the California Resident Income Tax Return Form 540?

The California Resident Income Tax Return Form 540 is a document used by residents of California to report their income and calculate their state taxes. This form is essential for ensuring compliance with California tax laws and for determining any tax refunds or payments owed to the state.

-

How can airSlate SignNow help me with my California Resident Income Tax Return Form 540?

airSlate SignNow offers a user-friendly platform to easily prepare, send, and eSign your California Resident Income Tax Return Form 540. The platform simplifies the filing process, making it quick and secure to manage your tax documents digitally.

-

Is there a cost to use airSlate SignNow for my tax return forms?

Yes, airSlate SignNow offers different pricing plans to cater to varying needs, including individual users and businesses. The plans are cost-effective and provide access to features that streamline the process of preparing your California Resident Income Tax Return Form 540 and other documents.

-

Can I integrate airSlate SignNow with other applications for my tax filing needs?

Absolutely! airSlate SignNow features integrations with various applications including accounting software and document management systems. This means you can efficiently manage your California Resident Income Tax Return Form 540 alongside your other finance tools.

-

What features does airSlate SignNow provide for eSigning tax documents?

airSlate SignNow provides robust eSigning features that ensure your California Resident Income Tax Return Form 540 is signed securely and legally. With advanced security protocols, you can feel confident that your documents are protected throughout the signing process.

-

How does airSlate SignNow ensure the security of my tax documents?

Security is a top priority at airSlate SignNow. When working with sensitive documents like the California Resident Income Tax Return Form 540, we use industry-standard encryption and secure cloud storage to protect your information from unauthorized access.

-

Can I collaborate with others when preparing my California Resident Income Tax Return Form 540 using airSlate SignNow?

Yes, airSlate SignNow allows for easy collaboration. You can invite others to review or co-sign your California Resident Income Tax Return Form 540, ensuring that all necessary parties can contribute and finalize the tax document efficiently.

Get more for California Resident Income Tax Return Form 540

- Form 40sp download pdf

- I love my india class 4 worksheets with answers form

- North santiam sportsman club form

- Gold coast authorization form

- Game theory for applied economists solution manual pdf form

- Parentguardian informed consent form tcdsb

- Advertisement form

- 4905 51 avenue stony plain alberta t7z 1y1 phone form

Find out other California Resident Income Tax Return Form 540

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF