Iowa Individual Income Tax Short Form IA 1040A Mag Tax 2012-2026

What is the Iowa Individual Income Tax Short Form IA 1040A Mag Tax

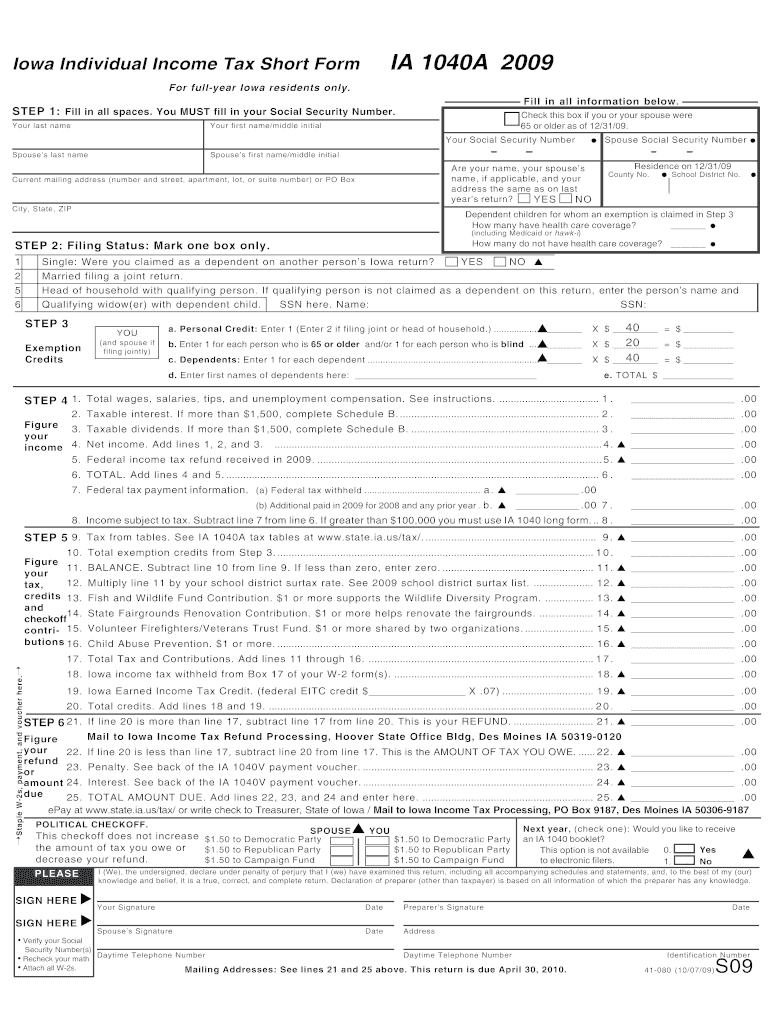

The Iowa Individual Income Tax Short Form IA 1040A Mag Tax is a simplified tax form used by eligible taxpayers in Iowa to report their income and calculate their state tax liability. This form is designed for individuals with straightforward financial situations, allowing for a more efficient filing process. It typically accommodates various income types, including wages, pensions, and interest, while excluding more complex deductions and credits available on longer forms.

How to use the Iowa Individual Income Tax Short Form IA 1040A Mag Tax

To effectively use the Iowa Individual Income Tax Short Form IA 1040A Mag Tax, taxpayers should first ensure they meet the eligibility criteria for this simplified form. Gather all necessary financial documents, including W-2s and any other income statements. Carefully follow the instructions provided with the form, filling in personal information, income details, and any applicable tax credits. After completing the form, review it for accuracy before submitting it to the Iowa Department of Revenue.

Steps to complete the Iowa Individual Income Tax Short Form IA 1040A Mag Tax

Completing the Iowa Individual Income Tax Short Form IA 1040A Mag Tax involves several key steps:

- Gather all relevant financial documents, including W-2s and 1099 forms.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income from all sources as indicated on the form.

- Apply any eligible tax credits or adjustments to your income.

- Calculate your tax liability based on the provided tax tables.

- Sign and date the form to certify its accuracy.

- Submit the completed form via your chosen method: online, by mail, or in person.

Legal use of the Iowa Individual Income Tax Short Form IA 1040A Mag Tax

The Iowa Individual Income Tax Short Form IA 1040A Mag Tax is legally binding when completed and submitted according to state regulations. To ensure compliance, it is essential to provide accurate information and adhere to the filing deadlines set by the Iowa Department of Revenue. Electronic submissions must also meet the requirements outlined in the relevant eSignature laws, ensuring that the form is recognized as valid in legal contexts.

State-specific rules for the Iowa Individual Income Tax Short Form IA 1040A Mag Tax

Taxpayers using the Iowa Individual Income Tax Short Form IA 1040A Mag Tax must be aware of specific state rules that govern its use. These include eligibility requirements, such as income thresholds and filing status. Additionally, Iowa has unique tax credits and deductions that may apply, which are distinct from federal tax regulations. Staying informed about these state-specific guidelines is crucial for accurate tax reporting and compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Iowa Individual Income Tax Short Form IA 1040A Mag Tax typically align with federal tax deadlines. For most taxpayers, the due date for submission is April 30 of the tax year. If the deadline falls on a weekend or holiday, it is extended to the next business day. Taxpayers should also consider any extensions available, which may alter their filing timeline.

Quick guide on how to complete iowa individual income tax short form ia 1040a 2009 mag tax

Complete Iowa Individual Income Tax Short Form IA 1040A Mag Tax effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the appropriate form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and sign your documents quickly and efficiently. Manage Iowa Individual Income Tax Short Form IA 1040A Mag Tax on any device with airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

The easiest way to modify and sign Iowa Individual Income Tax Short Form IA 1040A Mag Tax without hassle

- Obtain Iowa Individual Income Tax Short Form IA 1040A Mag Tax and then click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight key sections of the documents or obscure sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your needs in document management in just a few clicks from any device of your choice. Edit and sign Iowa Individual Income Tax Short Form IA 1040A Mag Tax and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct iowa individual income tax short form ia 1040a 2009 mag tax

Create this form in 5 minutes!

How to create an eSignature for the iowa individual income tax short form ia 1040a 2009 mag tax

How to create an electronic signature for your PDF online

How to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

How to create an eSignature straight from your smartphone

How to create an electronic signature for a PDF on iOS

How to create an eSignature for a PDF document on Android

People also ask

-

What is the Iowa Individual Income Tax Short Form IA 1040A Mag Tax?

The Iowa Individual Income Tax Short Form IA 1040A Mag Tax is a simplified tax form designed for individuals with straightforward income situations. This form allows taxpayers to report their income, claim deductions, and calculate their tax liability efficiently. By using this form, you can streamline your filing process and ensure compliance with state tax regulations.

-

Who should use the Iowa Individual Income Tax Short Form IA 1040A Mag Tax?

The Iowa Individual Income Tax Short Form IA 1040A Mag Tax is ideal for individuals with simple tax situations, such as those who do not itemize deductions. If you earn a basic income and qualify for standard deductions, this form will facilitate a quick and easy filing experience. It is particularly useful for those new to filing taxes or who prefer a straightforward process.

-

What are the benefits of using airSlate SignNow for the IA 1040A Mag Tax form?

Using airSlate SignNow for the Iowa Individual Income Tax Short Form IA 1040A Mag Tax provides a user-friendly interface for eSigning and sending documents securely. The platform enhances efficiency by allowing you to complete and submit your tax documents digitally. Additionally, it offers tracking features that help you stay informed about the status of your submissions.

-

How much does it cost to eSign the Iowa Individual Income Tax Short Form IA 1040A Mag Tax with airSlate SignNow?

airSlate SignNow offers affordable pricing plans that cater to various needs, including individual users who need to eSign documents like the Iowa Individual Income Tax Short Form IA 1040A Mag Tax. You can choose from monthly or annual subscriptions, ensuring you only pay for what you need. The platform also provides a free trial, so you can explore its features before committing.

-

Can I integrate airSlate SignNow with other software for managing my tax documents?

Yes, airSlate SignNow easily integrates with various software solutions, enhancing your ability to manage the Iowa Individual Income Tax Short Form IA 1040A Mag Tax and other documents. Popular integrations include CRM systems, document storage services, and accounting software. These integrations allow for seamless workflow and better document management.

-

What features does airSlate SignNow offer for completing the IA 1040A Mag Tax form?

airSlate SignNow provides several essential features for completing the Iowa Individual Income Tax Short Form IA 1040A Mag Tax. Users can utilize customizable templates, easy-to-use editing tools, and secure eSigning options. These features are designed to simplify the filing process, ensuring you can complete your tax documents efficiently.

-

Is electronic filing of the Iowa Individual Income Tax Short Form IA 1040A Mag Tax supported?

Yes, electronic filing of the Iowa Individual Income Tax Short Form IA 1040A Mag Tax is supported when using airSlate SignNow. The platform allows you to prepare your tax documents digitally and submit them directly to the Iowa Department of Revenue. This feature ensures a quick and efficient filing process.

Get more for Iowa Individual Income Tax Short Form IA 1040A Mag Tax

- 1800463 0095 form

- Health alaska govdphepi2020 provider agreement to receive state supplied vaccine form

- Spay station consent form pasados safe haven pasadosafehaven

- Tenancy residential 462649178 form

- Child care registration form

- Bcertificateb of age rhode island department of labor and training form

- Group enrollment application change form fill and sign

- Chelation therapy informed consent agreement dr bloem drbloem

Find out other Iowa Individual Income Tax Short Form IA 1040A Mag Tax

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word