Form Il 1040 2020

What is the Form Il 1040

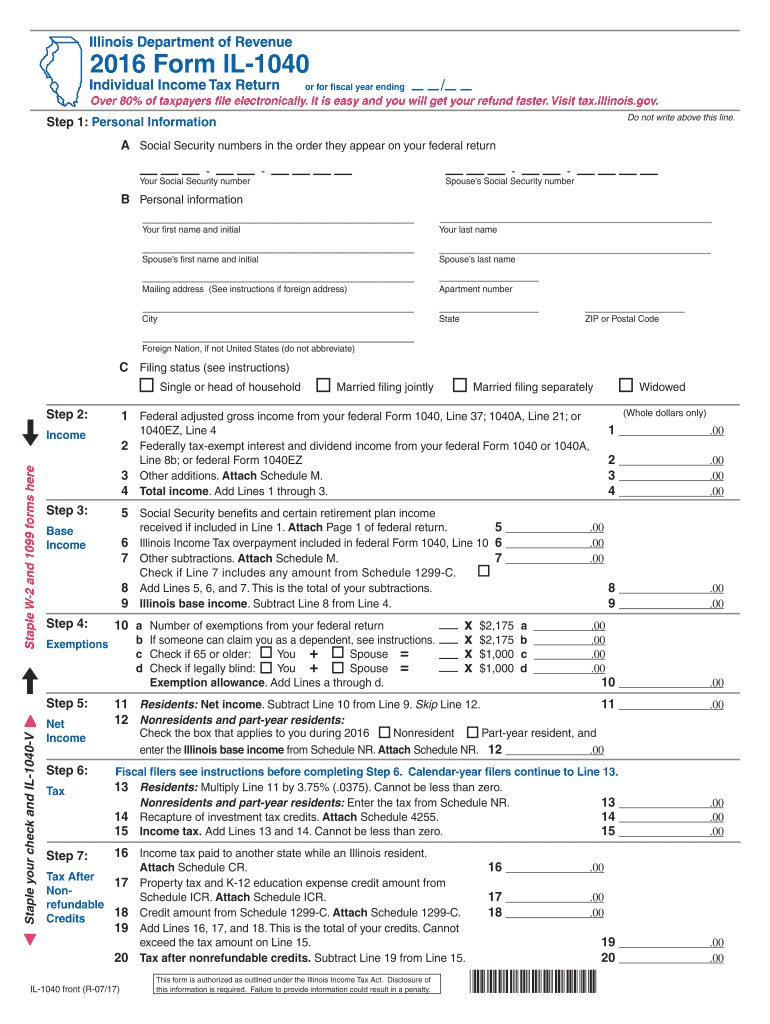

The Form Il 1040 is an essential tax document used by residents of Illinois to report their income and calculate their state tax liability. This form is part of the state's income tax system and is designed for individual taxpayers. It includes various sections where taxpayers can report income from different sources, claim deductions, and calculate their overall tax owed or refund due. Understanding this form is crucial for compliance with state tax laws and ensuring accurate reporting of financial information.

How to use the Form Il 1040

Using the Form Il 1040 involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, such as W-2s, 1099s, and any records of deductions. Next, fill out the form by entering your personal information, income details, and applicable deductions. It is important to follow the instructions provided with the form carefully to avoid errors. Once completed, you can submit the form through the appropriate channels, ensuring that you meet all filing deadlines to avoid penalties.

Steps to complete the Form Il 1040

Completing the Form Il 1040 requires a systematic approach to ensure accuracy:

- Gather your financial documents, including income statements and deduction records.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income from all sources, including wages, interest, and dividends.

- Claim any deductions you qualify for, such as those for education or health expenses.

- Calculate your total tax liability based on your income and deductions.

- Determine whether you owe taxes or are due a refund.

- Review the form for accuracy and completeness before submission.

Legal use of the Form Il 1040

The legal use of the Form Il 1040 is governed by state tax laws. It must be completed accurately and submitted on time to avoid legal repercussions. The form serves as a legal declaration of your income and tax liability, and any discrepancies can lead to audits or penalties. Therefore, it is vital to ensure that all information provided is truthful and complete, as the state has the authority to impose fines for non-compliance or fraudulent reporting.

Filing Deadlines / Important Dates

Filing deadlines for the Form Il 1040 are crucial for taxpayers to keep in mind. Typically, the form must be submitted by April 15 of each year, aligning with federal tax deadlines. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. Taxpayers should also be aware of any specific extensions or changes in deadlines, particularly in response to extraordinary circumstances, such as natural disasters or public health emergencies.

Required Documents

To complete the Form Il 1040 accurately, certain documents are essential. These include:

- W-2 forms from employers detailing your earnings.

- 1099 forms for any freelance or contract work.

- Documentation for any deductions, such as receipts for medical expenses or educational costs.

- Records of any other income sources, such as rental income or investment earnings.

Having these documents ready will facilitate a smoother filing process and help ensure compliance with state tax regulations.

Quick guide on how to complete form il 1040 2016

Prepare Form Il 1040 easily on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without hold-ups. Handle Form Il 1040 on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Form Il 1040 with ease

- Locate Form Il 1040 and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Mark signNow portions of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you would like to send your form—via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and eSign Form Il 1040 and ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form il 1040 2016

Create this form in 5 minutes!

How to create an eSignature for the form il 1040 2016

How to create an electronic signature for your PDF document in the online mode

How to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature right from your mobile device

How to create an electronic signature for a PDF document on iOS devices

How to create an electronic signature for a PDF on Android devices

People also ask

-

What is Form Il 1040 and why is it important?

Form Il 1040 is the individual income tax return used by residents of Illinois to report their income to the state. It is important because it ensures compliance with state tax laws and determines the amount of tax owed or refund due. Using airSlate SignNow simplifies the eSigning process for Form Il 1040, making it easier to file accurately and on time.

-

How can airSlate SignNow help with electronic signatures for Form Il 1040?

airSlate SignNow offers an intuitive platform that allows users to eSign Form Il 1040 securely and efficiently. Our easy-to-use interface ensures that you can complete your tax documents with legally binding signatures in just a few clicks. This saves time while ensuring compliance with the electronic signature laws.

-

Is airSlate SignNow affordable for small businesses preparing Form Il 1040?

Yes, airSlate SignNow provides cost-effective plans suitable for small businesses needing to manage Form Il 1040 efficiently. We offer various subscription options that fit different budgets, allowing businesses to choose a plan that meets their specific requirements without stretching their resources.

-

What features does airSlate SignNow offer for managing Form Il 1040?

airSlate SignNow comes equipped with powerful features including reusable templates, document tracking, and bulk sending, which are ideal for managing Form Il 1040. Additionally, its integration capabilities with popular accounting software streamline the tax preparation process, making it more efficient and organized.

-

Can I integrate airSlate SignNow with my tax software for Form Il 1040?

Absolutely! airSlate SignNow integrates seamlessly with various tax software applications to facilitate the processing of Form Il 1040. This integration ensures that your electronic signatures and documents flow directly into your tax preparation tools, minimizing manual data entry and potential errors.

-

What security measures does airSlate SignNow provide for Form Il 1040 documents?

Security is paramount when handling sensitive documents like Form Il 1040. airSlate SignNow employs industry-leading encryption protocols and secure access controls to ensure that all your documents are protected. Our platform also complies with regulatory standards, giving you peace of mind about the safety of your information.

-

How can I get started using airSlate SignNow for Form Il 1040?

Getting started with airSlate SignNow for Form Il 1040 is simple. You can sign up for a free trial on our website, explore our features, and easily upload your tax forms. Once registered, you can begin eSigning and managing your documents in minutes without any technical expertise.

Get more for Form Il 1040

- Atlas valley country club membership form

- Department of community amp neighborhood services form

- Cross connection control amp backflow prevention device test and maintenance report form

- Architectural review board submission form

- Membership form california state university east bay www20 csueastbay

- H r 218 the law enforcement officers safety act and s form

- Seatle dci form permit transfer electrical sign seatle dci form permit transfer electricalsign

- Naugatuck ct current items for bid form

Find out other Form Il 1040

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word