Property Tax Exemptions Form 2015

What is the Property Tax Exemptions Form

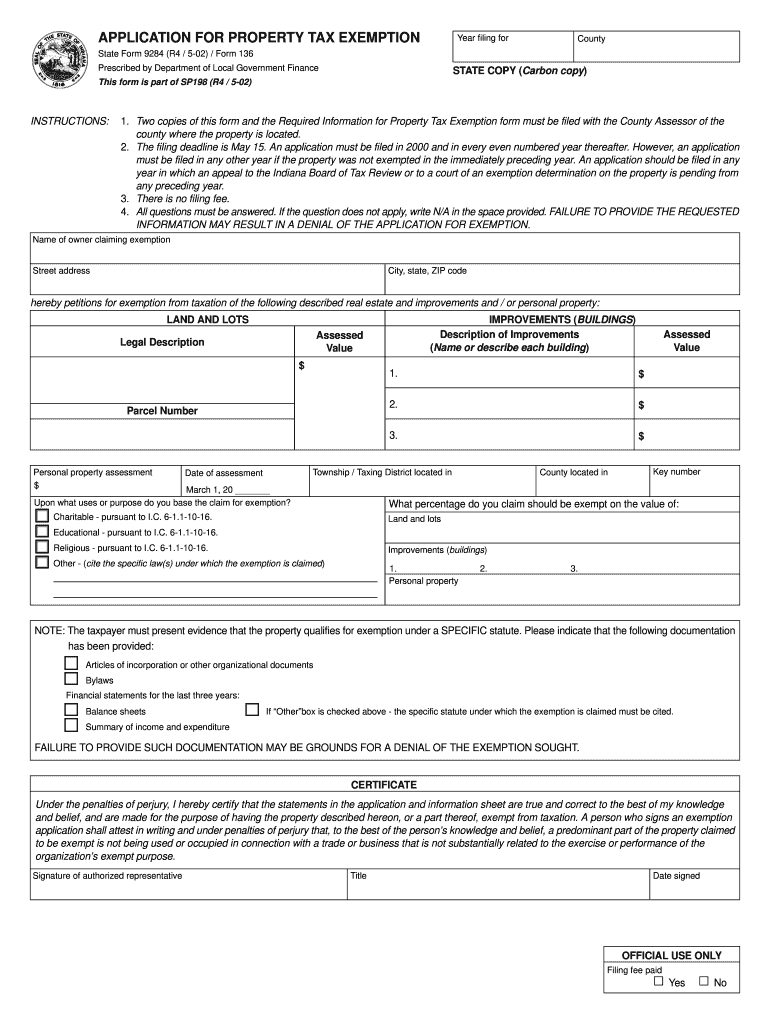

The Property Tax Exemptions Form is a crucial document used by property owners in the United States to apply for tax exemptions on their properties. This form allows individuals or businesses to request reductions or eliminations of property taxes based on specific criteria, such as ownership status, property use, or eligibility for certain programs. Understanding the purpose of this form is essential for anyone looking to benefit from potential tax savings.

How to use the Property Tax Exemptions Form

Using the Property Tax Exemptions Form involves several steps to ensure accurate completion and submission. First, gather all necessary information, including property details and eligibility criteria. Next, fill out the form carefully, providing accurate data as required. After completing the form, review it for any errors or omissions. Finally, submit the form according to your local jurisdiction's guidelines, which may include online submission, mailing, or in-person delivery.

Steps to complete the Property Tax Exemptions Form

Completing the Property Tax Exemptions Form requires attention to detail. Follow these steps for a successful submission:

- Identify the specific exemption you are applying for.

- Collect necessary documentation, such as proof of ownership or income statements.

- Fill out the form, ensuring all fields are completed accurately.

- Double-check the information for accuracy and completeness.

- Submit the form by the designated deadline.

Legal use of the Property Tax Exemptions Form

The legal use of the Property Tax Exemptions Form is governed by state and local laws. It is essential to ensure that the form is completed in compliance with these regulations to avoid any legal issues. The form must be signed and submitted within the specified time frame to be considered valid. Understanding the legal implications helps property owners navigate the exemption process effectively.

Eligibility Criteria

Eligibility for the Property Tax Exemptions Form varies by state and locality. Common criteria include:

- Ownership of the property, whether residential or commercial.

- Specific use of the property, such as for charitable purposes or as a primary residence.

- Income limits that may apply to certain exemption programs.

It is important to review local guidelines to determine if you qualify for the exemption you are seeking.

Form Submission Methods

Submitting the Property Tax Exemptions Form can be done through various methods, depending on local regulations. Common submission methods include:

- Online submission through the local tax authority's website.

- Mailing the completed form to the appropriate tax office.

- Delivering the form in person to the local tax office.

Each method may have different requirements and deadlines, so it is advisable to check with your local authorities for specific instructions.

Quick guide on how to complete property tax exemptions form 2002

Complete Property Tax Exemptions Form seamlessly on any device

Digital document management has gained immense traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents rapidly without delays. Manage Property Tax Exemptions Form on any platform using the airSlate SignNow Android or iOS applications and simplify any document-driven workflow today.

The easiest way to modify and electronically sign Property Tax Exemptions Form with ease

- Find Property Tax Exemptions Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight essential sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form retrieval, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Property Tax Exemptions Form to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct property tax exemptions form 2002

Create this form in 5 minutes!

How to create an eSignature for the property tax exemptions form 2002

How to create an eSignature for a PDF in the online mode

How to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

How to create an electronic signature from your smart phone

How to generate an eSignature for a PDF on iOS devices

How to create an electronic signature for a PDF file on Android OS

People also ask

-

What is a Property Tax Exemptions Form?

A Property Tax Exemptions Form is a document that allows property owners to claim exemptions from property taxes based on specific eligibility criteria. This form typically requires detailed information about the property and the owner. By submitting this form, individuals can potentially lower their property tax burden.

-

How does airSlate SignNow handle the Property Tax Exemptions Form?

airSlate SignNow offers a streamlined process for completing and submitting the Property Tax Exemptions Form. With our easy-to-use platform, you can create, send, and eSign the form securely. Our system ensures that all necessary information is accurately captured, making submissions more efficient.

-

What are the benefits of using airSlate SignNow for Property Tax Exemptions Forms?

Using airSlate SignNow for your Property Tax Exemptions Form offers several advantages, including faster processing times and enhanced security. Our platform allows for real-time collaboration, ensuring that all necessary signatures are obtained quickly. This can lead to a more effective, less stressful filing experience.

-

Is there a cost associated with using airSlate SignNow for Property Tax Exemptions Forms?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective compared to traditional methods. We offer flexible pricing plans that cater to different needs, ensuring you receive value for your investment. Check our website for detailed pricing information.

-

Can I integrate airSlate SignNow with other platforms to manage Property Tax Exemptions Forms?

Absolutely! airSlate SignNow supports integrations with various platforms to help you manage your Property Tax Exemptions Forms more effectively. Whether you use CRMs, document management systems, or other software, our integrations allow for seamless data transfer and enhanced productivity.

-

How secure is the submission of the Property Tax Exemptions Form through airSlate SignNow?

Security is a top priority at airSlate SignNow. When submitting your Property Tax Exemptions Form, all data is encrypted and stored securely to protect sensitive information. We comply with industry standards to ensure your documents are safe throughout the entire signing process.

-

Can I track the status of my Property Tax Exemptions Form with airSlate SignNow?

Yes, airSlate SignNow provides comprehensive tracking for all your documents, including the Property Tax Exemptions Form. You can see when the document is sent, viewed, and signed, allowing you to stay informed throughout the entire process. This feature enhances communication and efficiency.

Get more for Property Tax Exemptions Form

- Kcommonopinionsallopns96 953137p ca8 uscourts form

- Quarterly occupancy and waitlist report form

- Form 23 rev 11

- Filling out form 5329 for retirement taxes

- Form 1041 schedule j accumulation distribution for certain complex trusts irs

- Car installment payment contract template form

- Dd form 3160 ampquotnon temporary storage nts release formampquot

- Counter drug position application form

Find out other Property Tax Exemptions Form

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile