PA Schedule D PA 20SPA 65 D FormsPublications 2020

What is the PA Schedule D PA 20SPA 65 D FormsPublications

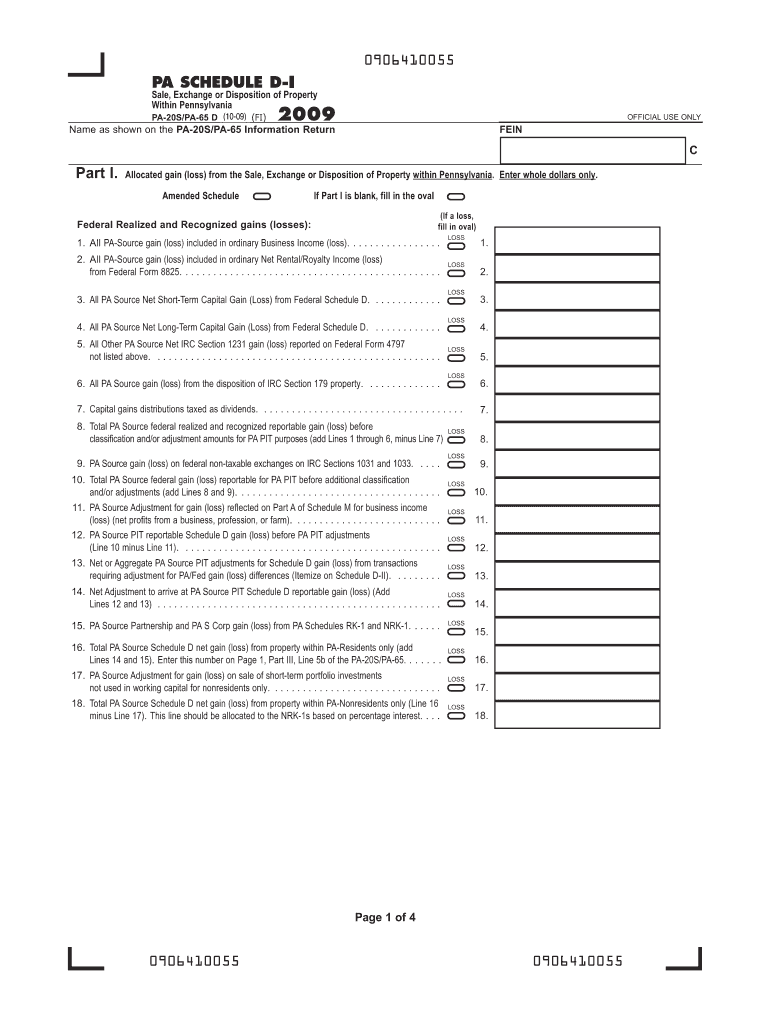

The PA Schedule D PA 20SPA 65 D FormsPublications is a tax form used by individuals and businesses in Pennsylvania to report capital gains and losses. This form is essential for taxpayers who have sold or exchanged capital assets, as it helps determine the tax implications of those transactions. It is part of the Pennsylvania Department of Revenue's suite of tax forms and is crucial for accurate tax reporting.

How to use the PA Schedule D PA 20SPA 65 D FormsPublications

To effectively use the PA Schedule D PA 20SPA 65 D FormsPublications, taxpayers should first gather all relevant documentation regarding their capital transactions. This includes records of sales, purchases, and any associated costs. Once all information is collected, the taxpayer can fill out the form, detailing each transaction and calculating the total capital gains or losses. The completed form must then be submitted along with the Pennsylvania personal income tax return.

Steps to complete the PA Schedule D PA 20SPA 65 D FormsPublications

Completing the PA Schedule D PA 20SPA 65 D FormsPublications involves several key steps:

- Gather all necessary documentation related to capital gains and losses.

- Fill out the taxpayer information section at the top of the form.

- List each capital transaction, including the date of sale, amount received, cost basis, and any adjustments.

- Calculate the total capital gains and losses by summing the individual transactions.

- Transfer the net capital gain or loss to the appropriate section of your Pennsylvania personal income tax return.

Legal use of the PA Schedule D PA 20SPA 65 D FormsPublications

The PA Schedule D PA 20SPA 65 D FormsPublications is legally recognized as a valid document for reporting capital gains and losses in Pennsylvania. To ensure its legal validity, taxpayers must accurately complete the form and adhere to all relevant tax laws and regulations. Proper filing is crucial, as errors or omissions can lead to penalties or audits by the Pennsylvania Department of Revenue.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the PA Schedule D PA 20SPA 65 D FormsPublications. Typically, the deadline for submitting this form coincides with the Pennsylvania personal income tax return deadline, which is usually April 15 each year. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. It is essential to stay informed about any changes to these dates to avoid late filing penalties.

Required Documents

When completing the PA Schedule D PA 20SPA 65 D FormsPublications, taxpayers should have several documents on hand, including:

- Records of all capital asset transactions, including purchase and sale documents.

- Statements showing any capital gains or losses from investments.

- Documentation of expenses related to the acquisition or sale of assets.

- Previous tax returns that may provide context for current filings.

Quick guide on how to complete 2009 pa schedule d pa 20spa 65 d formspublications

Easily prepare PA Schedule D PA 20SPA 65 D FormsPublications on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without interruptions. Manage PA Schedule D PA 20SPA 65 D FormsPublications on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign PA Schedule D PA 20SPA 65 D FormsPublications effortlessly

- Locate PA Schedule D PA 20SPA 65 D FormsPublications and then click Get Form to begin.

- Utilize the tools provided to fill out your document.

- Highlight important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select how you wish to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Alter and electronically sign PA Schedule D PA 20SPA 65 D FormsPublications while ensuring seamless communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2009 pa schedule d pa 20spa 65 d formspublications

Create this form in 5 minutes!

How to create an eSignature for the 2009 pa schedule d pa 20spa 65 d formspublications

The best way to generate an eSignature for a PDF file in the online mode

The best way to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The way to create an eSignature from your smartphone

How to create an eSignature for a PDF file on iOS devices

The way to create an eSignature for a PDF file on Android

People also ask

-

What are PA Schedule D PA 20SPA 65 D FormsPublications?

PA Schedule D PA 20SPA 65 D FormsPublications are official forms used for reporting capital gains or losses in Pennsylvania. These forms are essential for taxpayers looking to accurately file their state taxes while ensuring compliance. With airSlate SignNow, you can easily access these forms and complete them electronically.

-

How does airSlate SignNow help with PA Schedule D PA 20SPA 65 D FormsPublications?

airSlate SignNow streamlines the process of filling out PA Schedule D PA 20SPA 65 D FormsPublications by offering templates and an electronic signing solution. Users can conveniently complete their forms online, saving time and reducing errors. The platform also allows for secure document storage and sharing.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers a range of pricing plans tailored to accommodate different business needs, making it cost-effective for everyone. Each plan includes access to features relevant for managing PA Schedule D PA 20SPA 65 D FormsPublications effectively. You can choose a plan based on the volume of documents you handle.

-

Can I integrate airSlate SignNow with other accounting software?

Yes, airSlate SignNow seamlessly integrates with various accounting software, which enhances your ability to manage PA Schedule D PA 20SPA 65 D FormsPublications. This integration allows for automatic updates and data synchronization, ensuring your documents are always accurate. Check out our integration options to find the best fit for your business.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides robust document management features including electronic signatures, form templates for PA Schedule D PA 20SPA 65 D FormsPublications, and secure storage. These tools enable users to organize and manage their forms efficiently. Additionally, you can track document status and history, enhancing workflow transparency.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely! airSlate SignNow implements advanced security measures to ensure that your PA Schedule D PA 20SPA 65 D FormsPublications and other tax documents are protected. We use encryption, secure access, and authentication protocols to keep your information confidential and safe from unauthorized access.

-

Can I access airSlate SignNow on mobile devices?

Yes, airSlate SignNow is mobile-friendly, allowing you to complete and eSign your PA Schedule D PA 20SPA 65 D FormsPublications on the go. Our mobile application ensures you can manage documents anytime, anywhere. This flexibility is perfect for busy professionals who need to stay productive outside the office.

Get more for PA Schedule D PA 20SPA 65 D FormsPublications

- Instructions for form nyc 204 partnership return

- Form it 217 claim for farmers school tax credit tax year

- Jayco jay flight owners manual form

- New india assurance policy schedule cum certificate of insurance pdffiller form

- Events contract template form

- Smm service scope of work contract template form

- Smartsheet management contract template form

- Smma contract template form

Find out other PA Schedule D PA 20SPA 65 D FormsPublications

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement