Pennsylvania 65 2018

What is the Pennsylvania 65

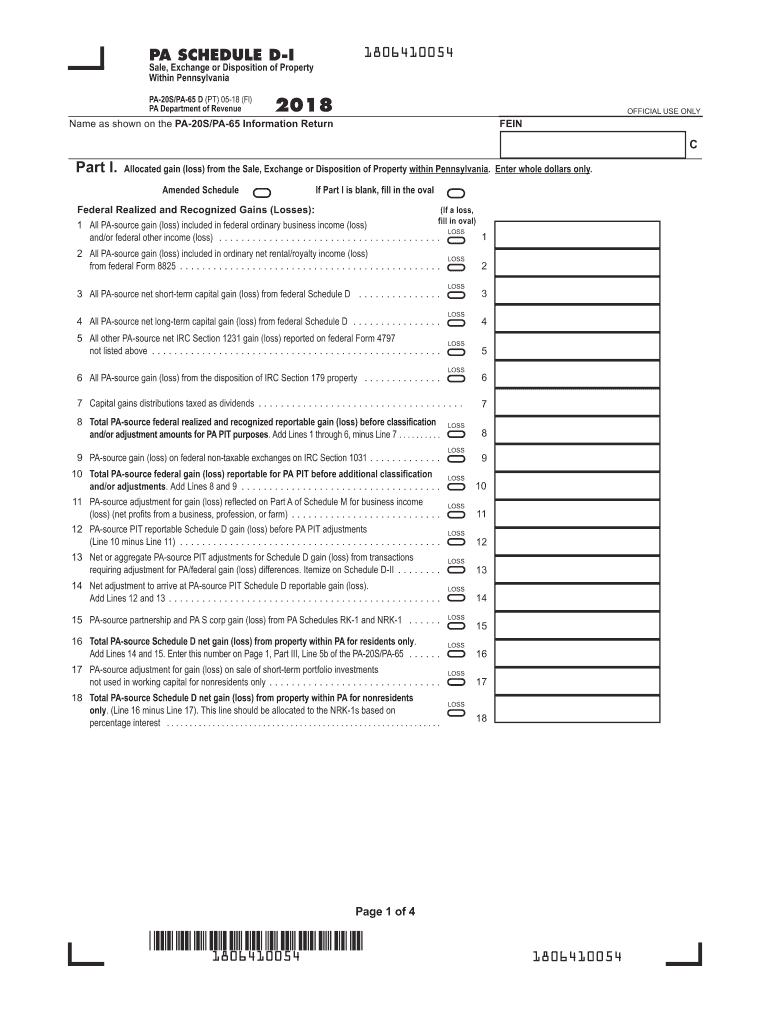

The Pennsylvania 65 is a tax form used by individuals and businesses in Pennsylvania to report income and calculate tax liabilities. This form plays a crucial role in ensuring compliance with state tax regulations. It is essential for taxpayers to understand the specific purpose of this form, as it helps in accurately reporting income earned within the state.

How to use the Pennsylvania 65

Using the Pennsylvania 65 involves several steps to ensure accurate completion. Taxpayers must gather all necessary financial documents, including income statements and expense records. The form requires detailed information about income sources, deductions, and credits. Once all information is compiled, the form can be filled out either digitally or on paper, depending on the taxpayer's preference.

Steps to complete the Pennsylvania 65

Completing the Pennsylvania 65 involves a systematic approach:

- Gather all relevant financial documents, such as W-2s, 1099s, and receipts for deductions.

- Carefully read the instructions provided with the form to understand each section.

- Fill out the form accurately, ensuring that all income is reported and deductions are claimed appropriately.

- Review the completed form for any errors or omissions before submission.

- Submit the form by the designated deadline, either online or via mail.

Legal use of the Pennsylvania 65

The Pennsylvania 65 must be used in accordance with state tax laws. It is important for taxpayers to be aware of the legal implications of submitting this form. Accurate reporting is essential to avoid penalties or audits. The form serves as a legal document, and any false information can lead to serious consequences.

Filing Deadlines / Important Dates

Filing deadlines for the Pennsylvania 65 are critical for compliance. Typically, the form must be submitted by April 15 of the following year for individual taxpayers. Businesses may have different deadlines based on their fiscal year. It is advisable to check for any updates or changes in deadlines to ensure timely filing.

Required Documents

To successfully complete the Pennsylvania 65, taxpayers need to prepare several documents:

- W-2 forms from employers to report wages and tax withheld.

- 1099 forms for other income sources, such as freelance work or interest earned.

- Receipts for deductible expenses, including business-related costs and charitable contributions.

- Any prior year tax returns that may provide useful information for the current filing.

Who Issues the Form

The Pennsylvania 65 is issued by the Pennsylvania Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. For any inquiries regarding the form or tax-related issues, individuals can contact the Department of Revenue for assistance.

Quick guide on how to complete 2018 pa nonresident withholding tax worksheet for partnerships

Effortlessly Prepare Pennsylvania 65 on Any Device

Managing documents online has become increasingly common among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Handle Pennsylvania 65 on any device with airSlate SignNow's Android or iOS applications and simplify any document-related processes today.

How to Modify and Electronically Sign Pennsylvania 65 with Ease

- Obtain Pennsylvania 65 and click on Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for this purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send the form, whether by email, SMS, or a shareable link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, cumbersome form navigation, or mistakes that necessitate printing additional document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Pennsylvania 65 to ensure outstanding communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2018 pa nonresident withholding tax worksheet for partnerships

Create this form in 5 minutes!

How to create an eSignature for the 2018 pa nonresident withholding tax worksheet for partnerships

How to make an electronic signature for your 2018 Pa Nonresident Withholding Tax Worksheet For Partnerships in the online mode

How to generate an eSignature for the 2018 Pa Nonresident Withholding Tax Worksheet For Partnerships in Google Chrome

How to create an electronic signature for putting it on the 2018 Pa Nonresident Withholding Tax Worksheet For Partnerships in Gmail

How to make an eSignature for the 2018 Pa Nonresident Withholding Tax Worksheet For Partnerships straight from your mobile device

How to create an eSignature for the 2018 Pa Nonresident Withholding Tax Worksheet For Partnerships on iOS

How to generate an electronic signature for the 2018 Pa Nonresident Withholding Tax Worksheet For Partnerships on Android devices

People also ask

-

What is the Pennsylvania 65 plan offered by airSlate SignNow?

The Pennsylvania 65 plan from airSlate SignNow provides a comprehensive eSigning solution tailored for businesses in Pennsylvania. This plan not only facilitates document signing but also ensures compliance with state regulations, making it a reliable choice for local businesses.

-

How much does the Pennsylvania 65 plan cost?

The pricing for the Pennsylvania 65 plan is competitive and designed to cater to various business needs. By offering flexible pricing structures, airSlate SignNow ensures that organizations can benefit from eSigning services without breaking the bank.

-

What features are included in the Pennsylvania 65 offering?

The Pennsylvania 65 plan includes features such as document templates, real-time tracking, and secure cloud storage. These tools enhance the signing experience while ensuring the safety and integrity of your documents.

-

How can businesses benefit from using the Pennsylvania 65 plan?

Businesses using the Pennsylvania 65 plan can streamline their document workflows, reduce turnaround times, and eliminate paper waste. This efficiency leads to increased productivity and reliability, making it a beneficial choice for any organization.

-

Does airSlate SignNow's Pennsylvania 65 plan integrate with other software?

Yes, the Pennsylvania 65 plan supports various integrations with popular software such as CRM systems and project management tools. This allows businesses to seamlessly incorporate eSigning into their existing workflows and enhance overall productivity.

-

Is the Pennsylvania 65 plan suitable for small businesses?

Absolutely! The Pennsylvania 65 plan by airSlate SignNow is particularly well-suited for small businesses looking for an affordable eSigning solution. Its user-friendly interface and cost-effective pricing make it easy for small teams to manage their document signing needs efficiently.

-

What types of documents can be signed using Pennsylvania 65?

The Pennsylvania 65 plan supports a variety of document types, including contracts, agreements, and consent forms. Businesses can easily upload any document they need to be signed, ensuring a versatile eSigning experience.

Get more for Pennsylvania 65

- Procedure to get transcripts from the university of ilorin form

- Huber application winnebago county co winnebago wi form

- Form 13 502f4 capital markets participation fee calculation ontario osc gov on

- Rules and policies form 13 502f4 capital markets participation fee calculation general instructions 1 osc gov on

- Application for nacdlamp39s capital voir dire training seminar schr form

- Participation letter and form fulton county schools

- Georgia spca foster application form

- Physical form for gwinnett county

Find out other Pennsylvania 65

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure