1606410056 PA SCHEDULE D I Pennsylvania Department of Revenue 2020

Understanding the Pennsylvania Schedule D

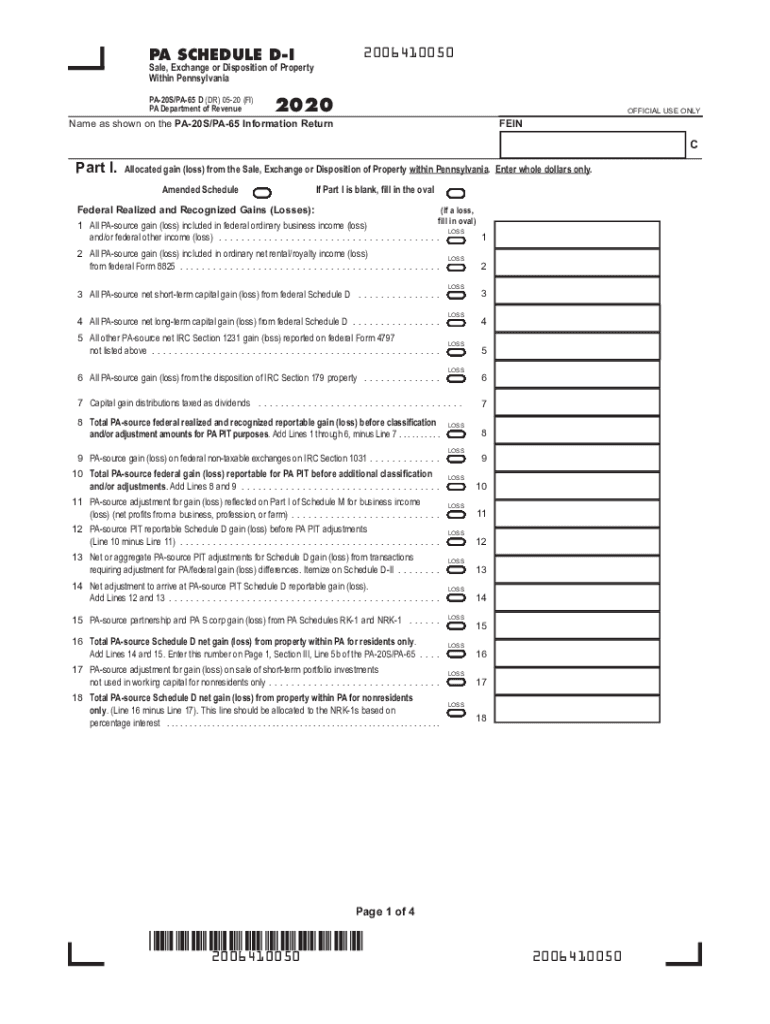

The Pennsylvania Schedule D, also known as the PA 65, is a tax form used by residents of Pennsylvania to report capital gains and losses from the sale of assets. This form is essential for individuals and entities that have engaged in transactions involving stocks, bonds, real estate, or other capital assets. Proper completion of the PA Schedule D ensures compliance with state tax laws and accurate reporting of financial activities.

Steps to Complete the Pennsylvania Schedule D

Filling out the Pennsylvania Schedule D involves several key steps:

- Gather necessary documentation, including records of asset purchases and sales.

- Calculate total capital gains and losses from each transaction.

- Complete the relevant sections of the form, detailing each transaction.

- Ensure all calculations are accurate and reflect the correct amounts.

- Review the completed form for any errors before submission.

Legal Use of the Pennsylvania Schedule D

The Pennsylvania Schedule D is legally binding when completed accurately and submitted in accordance with state regulations. It is crucial that taxpayers understand the legal implications of reporting capital gains and losses, as inaccuracies can lead to penalties or audits. The form must be filed by the appropriate deadline to avoid additional fees.

Filing Deadlines and Important Dates

Taxpayers should be aware of the filing deadlines for the Pennsylvania Schedule D. Typically, the form is due on April 15 for individuals, coinciding with federal tax deadlines. Extensions may be available, but it is important to check with the Pennsylvania Department of Revenue for specific guidelines regarding extensions and late filings.

Required Documents for the Pennsylvania Schedule D

To complete the Pennsylvania Schedule D, taxpayers need to gather several documents, including:

- Transaction records for all capital asset sales.

- Purchase receipts and documentation for assets sold.

- Any prior year Schedule D forms, if applicable.

- Statements from brokers or financial institutions detailing transactions.

Examples of Using the Pennsylvania Schedule D

Common scenarios where the Pennsylvania Schedule D is necessary include:

- Selling stocks or bonds at a profit or loss.

- Transferring real estate property and reporting gains or losses.

- Exchanging assets that result in a capital gain or loss.

Penalties for Non-Compliance with the Pennsylvania Schedule D

Failure to file the Pennsylvania Schedule D or inaccuracies in reporting can result in significant penalties. Taxpayers may face fines, interest on unpaid taxes, and potential audits. It is essential to ensure that the form is filled out correctly and submitted on time to avoid these consequences.

Quick guide on how to complete 1606410056 pa schedule d i pennsylvania department of revenue

Complete 1606410056 PA SCHEDULE D I Pennsylvania Department Of Revenue effortlessly on any device

Web-based document management has become favored by both businesses and individuals. It serves as an ideal green alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the features needed to create, modify, and eSign your documents quickly without delays. Handle 1606410056 PA SCHEDULE D I Pennsylvania Department Of Revenue on any system with airSlate SignNow Android or iOS applications and enhance any document-centric task today.

How to alter and eSign 1606410056 PA SCHEDULE D I Pennsylvania Department Of Revenue effortlessly

- Find 1606410056 PA SCHEDULE D I Pennsylvania Department Of Revenue and click on Get Form to begin.

- Utilize the features we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure confidential information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Alter and eSign 1606410056 PA SCHEDULE D I Pennsylvania Department Of Revenue and ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1606410056 pa schedule d i pennsylvania department of revenue

Create this form in 5 minutes!

How to create an eSignature for the 1606410056 pa schedule d i pennsylvania department of revenue

The way to generate an eSignature for your PDF in the online mode

The way to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature straight from your smart phone

The way to create an electronic signature for a PDF on iOS devices

How to generate an eSignature for a PDF document on Android OS

People also ask

-

What is Pennsylvania 65 and how does it relate to airSlate SignNow?

Pennsylvania 65 refers to a specific legal requirement for document management in the state. AirSlate SignNow helps businesses comply with Pennsylvania 65 by providing a secure platform for sending and eSigning documents, ensuring legal adherence while streamlining operations.

-

How much does airSlate SignNow cost for businesses operating under Pennsylvania 65?

AirSlate SignNow offers flexible pricing plans suitable for businesses navigating Pennsylvania 65 regulations. Pricing varies based on the selected features and number of users, but the solution remains cost-effective for companies in Pennsylvania.

-

What features does airSlate SignNow provide for compliance with Pennsylvania 65?

AirSlate SignNow includes features such as customizable templates, audit trails, and secure storage that assist in meeting Pennsylvania 65 compliance requirements. These tools ensure that documents are properly managed, signed, and stored according to state guidelines.

-

How can airSlate SignNow benefit businesses in Pennsylvania?

Businesses utilizing airSlate SignNow can experience enhanced efficiency when managing documents under Pennsylvania 65. By automating the eSigning process, companies can reduce turnaround times, minimize paperwork, and improve overall productivity.

-

Does airSlate SignNow integrate with other tools used by Pennsylvania businesses?

Yes, airSlate SignNow offers integration with numerous third-party applications that are essential for Pennsylvania businesses. Whether it's CRM systems, project management tools, or other software, these integrations help streamline document workflow and enhance collaboration.

-

Is airSlate SignNow user-friendly for those unfamiliar with Pennsylvania 65 regulations?

Absolutely! AirSlate SignNow is designed with user-friendliness in mind, ensuring that even those unfamiliar with Pennsylvania 65 regulations can navigate the platform with ease. The intuitive interface simplifies document management, making it accessible for all users.

-

Can airSlate SignNow handle high volumes of documents required by Pennsylvania 65?

Yes, airSlate SignNow is equipped to manage high volumes of documents required by Pennsylvania 65 without compromising performance. The platform is scalable, ensuring it can grow with your business's needs as document demands increase.

Get more for 1606410056 PA SCHEDULE D I Pennsylvania Department Of Revenue

Find out other 1606410056 PA SCHEDULE D I Pennsylvania Department Of Revenue

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free