Form Pa 65 Find Answers 2022

What is the Form PA 65?

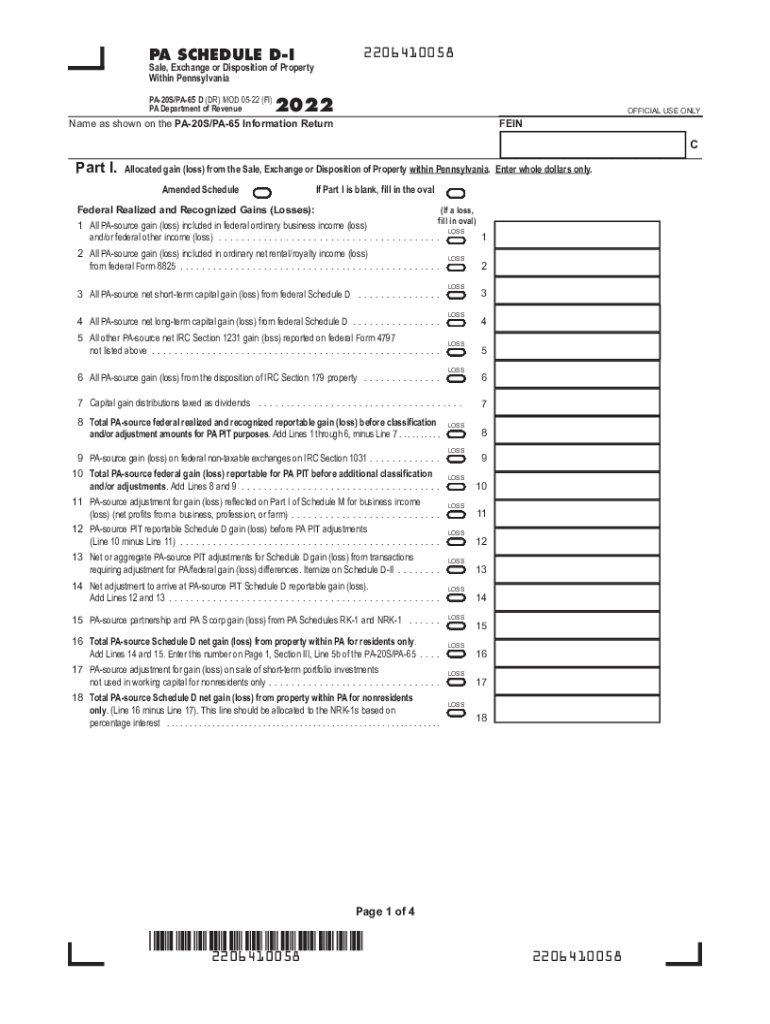

The PA Schedule D is a tax form used by individuals and entities in Pennsylvania to report capital gains and losses from the sale of assets. This form is essential for accurately calculating taxable income and ensuring compliance with state tax regulations. It is particularly relevant for taxpayers who have sold stocks, bonds, or other investments during the tax year. Understanding the purpose and requirements of the PA Schedule D is crucial for effective tax planning and reporting.

How to Use the Form PA 65

Using the PA Schedule D involves several steps to ensure accurate reporting of capital gains and losses. Taxpayers must first gather all relevant documentation, including records of asset purchases and sales. Next, they will fill out the form by entering details such as the date of acquisition, date of sale, and the amounts involved. It is important to categorize gains and losses as either short-term or long-term, as this affects tax rates. Once completed, the form must be submitted along with the Pennsylvania state income tax return.

Steps to Complete the Form PA 65

Completing the PA Schedule D requires careful attention to detail. Here are the key steps:

- Gather all necessary documentation related to asset transactions.

- Determine whether each asset was held for the short term (one year or less) or long term (more than one year).

- List each asset sold during the tax year, including acquisition and sale dates.

- Calculate the gain or loss for each transaction by subtracting the purchase price from the sale price.

- Summarize total short-term and long-term gains and losses on the form.

- Transfer the totals to the appropriate sections of your Pennsylvania state income tax return.

Legal Use of the Form PA 65

The PA Schedule D is legally binding when completed accurately and submitted in accordance with Pennsylvania tax laws. It must be filed by the due date to avoid penalties. The information provided on this form is used by the Pennsylvania Department of Revenue to assess tax liabilities. It is important for taxpayers to ensure that all information is truthful and complete, as discrepancies may lead to audits or legal consequences.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the PA Schedule D to avoid late fees. Typically, the form is due on April 15 of the following year, coinciding with the federal tax filing deadline. However, if April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check for any updates or changes to these dates annually.

Form Submission Methods

The PA Schedule D can be submitted through various methods to accommodate different preferences. Taxpayers may choose to file electronically using approved tax software, which often simplifies the process and reduces the likelihood of errors. Alternatively, the form can be mailed to the Pennsylvania Department of Revenue or submitted in person at designated locations. Each submission method has its own guidelines, so it is important to follow the instructions carefully.

Quick guide on how to complete form pa 65 find answers

Effortlessly Prepare Form Pa 65 Find Answers on Any Gadget

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly replacement for conventional printed and manually signed papers, as you can easily access the right form and securely keep it online. airSlate SignNow supplies you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Handle Form Pa 65 Find Answers on any gadget using airSlate SignNow apps for Android or iOS and enhance any document-related procedure today.

How to Modify and Electronically Sign Form Pa 65 Find Answers with Ease

- Obtain Form Pa 65 Find Answers and click on Get Form to initiate.

- Utilize the tools we offer to fill out your document.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal weight as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your modifications.

- Choose your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Form Pa 65 Find Answers and ensure outstanding communication at every step of the document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form pa 65 find answers

Create this form in 5 minutes!

How to create an eSignature for the form pa 65 find answers

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 65 d form and how is it used?

The 65 d form is a specific document required for various administrative and legal processes. It is often used to signNow transactions and can be signed electronically using platforms like airSlate SignNow. Using the 65 d form ensures compliance with regulations while streamlining the signing process.

-

How does airSlate SignNow facilitate the signing of a 65 d form?

airSlate SignNow provides an intuitive platform that allows users to upload and sign a 65 d form easily. The solution offers features like templates and customizable fields, making it efficient to prepare the document for signatures. With its user-friendly interface, businesses can complete the signing process in minutes.

-

What are the pricing options for using airSlate SignNow to manage 65 d forms?

airSlate SignNow offers a variety of pricing plans to suit different business needs, including options for those who frequently use the 65 d form. These plans are designed to provide cost-effective solutions with flexible billing options. Potential customers can choose a plan based on their volume of documents and specific features required.

-

Can I integrate airSlate SignNow with other applications for processing 65 d forms?

Yes, airSlate SignNow supports integrations with various applications, making it easier to manage the 65 d form alongside other business tools. This interoperability allows businesses to automate workflows, enhancing productivity and ensuring documents are processed efficiently. Popular integrations include CRM systems and project management tools.

-

What are the benefits of using airSlate SignNow for 65 d forms over traditional methods?

Using airSlate SignNow for 65 d forms offers numerous benefits, such as faster processing times and reduced paper usage. The electronic signature feature minimizes delays often encountered with traditional signing methods. Additionally, users can access documents from anywhere, improving collaboration and efficiency.

-

Is it secure to use airSlate SignNow for signing a 65 d form?

Absolutely! airSlate SignNow utilizes advanced security measures, including encryption and secure authentication, to protect your 65 d form and any other sensitive documents. Compliance with industry standards ensures that your data remains safe during the signing process. You'll have peace of mind knowing your information is secure.

-

How can I track the status of my 65 d form with airSlate SignNow?

airSlate SignNow provides real-time tracking capabilities, allowing you to monitor the status of your 65 d form easily. Users can receive notifications when the document is viewed, signed, or completed, helping streamline follow-ups and account for every step in the process. This transparency enhances communication with signers.

Get more for Form Pa 65 Find Answers

- Pacer test worksheet form

- Omcn art 199 manual form

- Bharat gas bill pdf form

- Firearm license application form trinidad

- Basic cheer motions pdf form

- Rental application equal housing opportunity form

- Technical report and resource estimate on the alous copper form

- Aa 1d 2 14 indd reginfo gov reginfo form

Find out other Form Pa 65 Find Answers

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement