Ft 937 2018-2026

What is the Ft 937

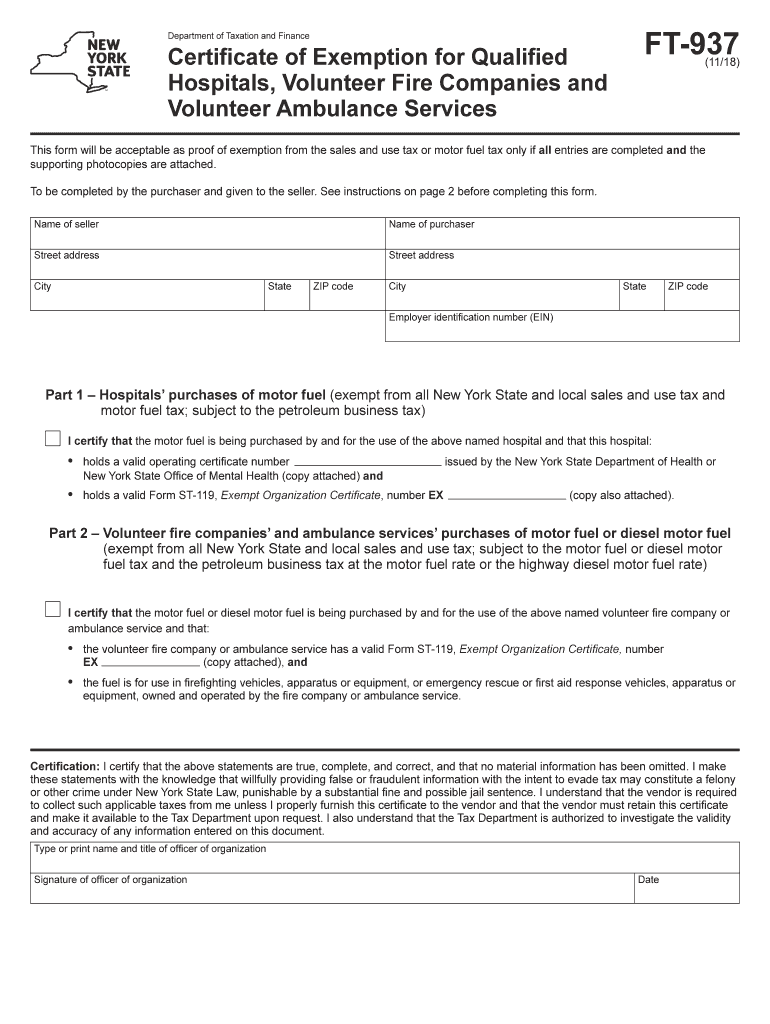

The Ft 937 form, commonly referred to as the New York FT Fire, is a tax form used in New York State to claim exemptions related to fire and ambulance services. This form is essential for organizations that qualify for specific tax benefits under state law. It allows eligible entities to provide documentation to support their exemption claims, ensuring compliance with local taxation regulations.

How to use the Ft 937

Using the Ft 937 form involves several steps to ensure accuracy and compliance. First, gather all necessary documentation that supports your exemption claim. This may include proof of your organization’s status, such as nonprofit designation or other relevant certifications. Next, complete the form by filling in the required fields accurately. Once completed, submit the form to the appropriate tax authority as specified by New York State guidelines.

Steps to complete the Ft 937

Completing the Ft 937 involves a systematic approach:

- Review the eligibility criteria for the exemption.

- Collect supporting documents that validate your claim.

- Fill out the Ft 937 form, ensuring all information is accurate.

- Double-check the form for any errors or omissions.

- Submit the completed form to the designated tax authority.

Legal use of the Ft 937

The legal use of the Ft 937 form is governed by New York State tax laws. To be considered valid, the form must be completed in accordance with state regulations and submitted within the specified deadlines. Proper use of the form ensures that organizations can claim their rightful exemptions without facing penalties or legal issues.

Eligibility Criteria

Eligibility for using the Ft 937 form is typically limited to specific organizations, such as volunteer fire departments, ambulance services, and other nonprofit entities that provide emergency services. To qualify, organizations must demonstrate their operational status and compliance with relevant state laws. It is crucial to review the specific criteria set forth by the New York State Department of Taxation and Finance to ensure eligibility.

Required Documents

When completing the Ft 937 form, certain documents are required to substantiate your claim. These may include:

- Proof of nonprofit status, such as IRS determination letters.

- Documentation of services provided by the organization.

- Financial statements that reflect the organization’s operations.

- Any other relevant certifications or licenses.

Form Submission Methods

The Ft 937 form can be submitted through various methods, depending on the preferences of the submitting organization. Options typically include:

- Online submission through the New York State Department of Taxation and Finance portal.

- Mailing the completed form to the appropriate tax office.

- In-person submission at designated tax offices.

Quick guide on how to complete ft 937

Easily Prepare Ft 937 on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow provides all the resources necessary to create, alter, and eSign your documents swiftly and efficiently. Manage Ft 937 on any device with airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

The Most Efficient Way to Alter and eSign Ft 937 Effortlessly

- Locate Ft 937 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize key sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your updates.

- Choose how you wish to send your form: via email, text message (SMS), invite link, or download it to your computer.

No more worries about lost or misfiled documents, cumbersome form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Ft 937 while ensuring effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ft 937

Create this form in 5 minutes!

How to create an eSignature for the ft 937

How to create an electronic signature for a PDF file online

How to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The way to create an eSignature right from your mobile device

How to create an eSignature for a PDF file on iOS

The way to create an eSignature for a PDF on Android devices

People also ask

-

What is the NY FT exemption qualified search?

The NY FT exemption qualified search is a process that helps businesses determine their eligibility for specific tax exemptions in New York. This search is crucial for organizations looking to optimize their financial responsibilities while remaining compliant with state regulations. Utilizing the right tools, like airSlate SignNow, can streamline this process signNowly.

-

How does airSlate SignNow support the NY FT exemption qualified search?

airSlate SignNow provides businesses with a seamless platform to send and eSign documents required for the NY FT exemption qualified search. With its intuitive interface, users can quickly execute necessary agreements and facilitate compliance with state requirements. This efficiency translates to saved time and reduced stress during the exemption process.

-

What are the pricing options for airSlate SignNow related to the NY FT exemption qualified search?

airSlate SignNow offers flexible pricing plans tailored to different business needs, ensuring that organizations can affordably manage their NY FT exemption qualified search. By choosing the right plan, businesses can gain access to essential features that help simplify their document handling and eSigning processes. Visit our pricing page to find a plan that suits your requirements.

-

What features does airSlate SignNow offer for document management during the NY FT exemption qualified search?

airSlate SignNow includes features like customizable templates, real-time tracking, and cloud storage to enhance document management for the NY FT exemption qualified search. These functionalities help businesses maintain organized records while facilitating quick access to important documents. Overall, these features contribute to a more efficient workflow.

-

How can airSlate SignNow benefit businesses in managing NY FT exemption qualified searches?

By utilizing airSlate SignNow, businesses can streamline their document processes for NY FT exemption qualified searches, resulting in increased efficiency and accuracy. The platform allows for quicker turnaround times on eSigning documents, which is essential for meeting tax deadlines. Furthermore, the cost-effective solution helps organizations save money while optimizing their exemption eligibility.

-

Does airSlate SignNow integrate with other software for the NY FT exemption qualified search?

Yes, airSlate SignNow integrates seamlessly with various popular software solutions, enhancing the overall experience during the NY FT exemption qualified search. These integrations allow businesses to connect their existing tools for a more cohesive workflow. Users can effectively manage their documentation processes without needing to switch between multiple applications.

-

Is airSlate SignNow secure for processing documents related to the NY FT exemption qualified search?

Absolutely, airSlate SignNow prioritizes security when it comes to processing documents related to the NY FT exemption qualified search. The platform employs industry-standard encryption and complies with regulatory requirements to protect sensitive information. Businesses can sign documents with confidence, knowing their data is safeguarded.

Get more for Ft 937

- I 9 form

- Tax formsri department of labor ampamp training ri gov

- Form or lb 50 notice of property and certification of intent to impose a tax fee assessment or charge on property local budget

- Form il 2210 instructions illinois department of revenue

- Page 1 forms ok gov oklahoma digital prairie

- Oklahoma property tax updates form

- Form 952 manufactured home personal property exemption

Find out other Ft 937

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors