Wells Fargo Check Template Form

What is the Wells Fargo Check Template

The Wells Fargo check template is a standardized document used for issuing checks through Wells Fargo Bank. It serves as a convenient tool for individuals and businesses to create checks that comply with banking standards. This template can be utilized for various types of transactions, including personal payments, business expenses, and more. By using the template, users can ensure that their checks include all necessary information, such as the payee's name, amount, and signature line.

How to use the Wells Fargo Check Template

Using the Wells Fargo check template is straightforward. First, download the template in a compatible format, such as PDF or Word. Once downloaded, open the file and fill in the required fields, including the date, payee name, and amount. Ensure that you include your signature in the designated area. After completing the check, review it for accuracy before printing. This helps prevent any errors that could delay transactions.

Steps to complete the Wells Fargo Check Template

Completing the Wells Fargo check template involves several key steps:

- Download the template from a reliable source.

- Open the file in a compatible application.

- Fill in the date, payee name, and amount in both numerical and written forms.

- Add your signature to authorize the check.

- Review all entries for accuracy.

- Print the completed check on appropriate check paper.

Legal use of the Wells Fargo Check Template

The Wells Fargo check template is legally binding when filled out correctly and used in accordance with banking regulations. To ensure its legality, users must follow specific guidelines, such as providing accurate information and obtaining the necessary signatures. Additionally, it is important to comply with federal and state laws regarding check issuance. This includes understanding the implications of issuing a check with insufficient funds, which can lead to legal consequences.

Key elements of the Wells Fargo Check Template

Several key elements must be included in the Wells Fargo check template to ensure its validity:

- The name and address of the account holder.

- The date of issuance.

- The payee's name.

- The amount to be paid, written in both numerical and word formats.

- The signature of the account holder.

- The routing and account numbers, which are essential for processing the check.

Examples of using the Wells Fargo Check Template

The Wells Fargo check template can be used in various scenarios, including:

- Paying bills, such as utilities or rent.

- Making purchases for business expenses.

- Issuing refunds to customers.

- Transferring funds between accounts.

Quick guide on how to complete wells fargo starter kit checks form

Learn how to effortlessly complete the Wells Fargo Check Template with this simple tutorial

Submitting and signNowing forms digitally is becoming more popular and is the preferred option for many users. It offers various advantages over conventional printed documents, including ease of use, time savings, enhanced precision, and security.

With tools like airSlate SignNow, you can find, modify, sign, enhance and share your Wells Fargo Check Template without the hassle of constant printing and scanning. Follow this brief guide to initiate and finish your form.

Follow these instructions to obtain and complete Wells Fargo Check Template

- Begin by clicking the Get Form button to access your document in our editor.

- Observe the green label on the left that highlights required fields to ensure they are not missed.

- Utilize our advanced features to comment, modify, sign, secure, and enhance your document.

- Safeguard your file or convert it into a fillable form using the features in the right panel.

- Review the document carefully to spot any errors or inconsistencies.

- Click DONE to complete the editing process.

- Change the name of your form or keep it as is.

- Select the storage option to save your document, send it via USPS, or click the Download Now button to download your file.

If Wells Fargo Check Template is not what you were looking for, you can browse our extensive collection of pre-loaded forms that you can complete with ease. Try our solution today!

Create this form in 5 minutes or less

FAQs

-

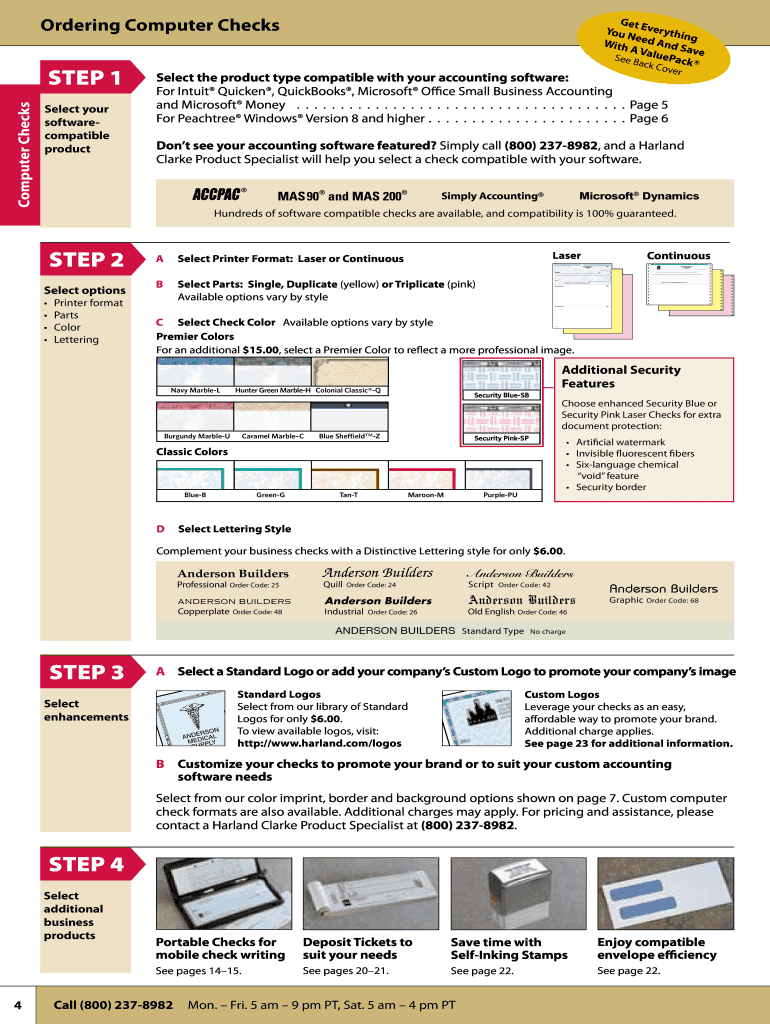

How do you order checks form Wells Fargo?

Simply log into your Wells Fargo online account and hover over “Accounts,” then “Checks & Deposit Tickets.” Or call 1–800-TO-WELLS to speak to a personal banker.

-

How do you order checks from Wells Fargo? Is there a way to order free checks?

You can order checks three different ways. You can either order them online at wellsfargo.com/checks, you can call the customer service number 1 800 869 3557 (1 800 to wells), or you can visit a branch, and one of the bankers inside can order them for you.The amount of checks depends on your account. Some accounts keep them free, but most of the accounts is a charge.The checks come in a green portfolio. We don't mail them in those hefty boxes anymore. They are from Harland Clarke.

-

Is a school ID a valid form to cash a check at Wells Fargo?

My information may be out of date but I’ll share it anyway. The United States passed several anti-money laundry laws after 9–11. One specified the type of identification that financial institutions could use and guidelines to guard against financial crimes. This applies to all institutions, not just Wells Fargo. As a primary source of identification you will need a government issues id, such as a driver’s license, state id, valid military id, or passport. The id must also be current or up to date. They will then require a secondary form of identification which would be something like a credit card, school id, employee id, concealed firearms permit, or any of the primary identifications listed above could also be used. They must also be current if they are date stamped.These will always be required if you are not a bank customer with an account. If you are an account holding customer then bank employees can use their knowledge about your identity as a valid form of id. For example, if you know a customer really well, have checked their identification several times, and are confident they are who they claim to be then you do not need to require a primary and secondary form of identification. This isn’t practiced very often because it puts the employee at risk if the check is fraudulent.

-

How do you make payments to Wells Fargo by check?

If your paying a loan of any kind know matter what bank, the payee is always the name of the bank. On the memo you can write your loan number or whatever description you would like

-

How long does it take for a personal check to get cleared at Wells Fargo bank?

Fast. Depends on where (which bank & what location) the deposit occurs. Many of us remember the days when the physical checks were couriered to the issuing bank. Every night, millions of checks were encoded, sorted, shipped, and cleared between banks. As a college kid in the 70’s (pre-ATM), I knew I could float a check for a couple of days or more before my out-of-town (hometown) bank would get the check written for Cash at the Piggly Wiggly in my college town. If I screwed up the timing, the hometown banker called my dad to cover the check for a day or so. All that work for $20 cash…No longer true. With electronic remote capture (bank imaging systems), the checks (“items”) are moving same day. Often they move instantaneously, but maybe with one day of float. It is tough to enjoy that float time (or kite checks between several banks, if you are really broke). High-value checks (around $5,000 or more) have a little bit of extra handling to make certain the writer has enough money in the issuing account to cover it.Treasury management throughout the US banking system will soon be same-day. You’d need an account at an uber-small credit union in a remote corner of America to pick up a couple of days of float.

-

How long does it take to find out your pre-approval home loan from Wells Fargo?

Wells Fargo issues three types of approval letters. These vary by the level of analysis they perform on the file prior to issuing the letter and therefor the level of certainty the letter provides to the borrower and to potential sellers that the loan financing will come through.The types of letters are -Pre-qualificationGives you an option of your home price range and estimated closing costs based on non-verified information you provided. Doesn’t require a full mortgage applicationCan often be issued same-day through a Loan Officer or an Online ApplicationPre-approvalGives you an estimate of your home price range based on an initial review of your application and limited credit information only. It requires a mortgage application. Doesn’t require you to provide actual documentsTypically issued within two or three daysCredit approvalGives you an estimated loan amount based on an initial underwriter review of your credit and the information you provided. This letter is their highest standard of credit approval. Requires copies of financial documents (e.g. paystubs, tax returns, bank statements, etc.)This is the type of letter you want to obtain prior to making offers on homes as it will make your offer more solid and competitiveTypically issued within five days

Create this form in 5 minutes!

How to create an eSignature for the wells fargo starter kit checks form

How to create an eSignature for the Wells Fargo Starter Kit Checks Form in the online mode

How to make an electronic signature for the Wells Fargo Starter Kit Checks Form in Chrome

How to make an eSignature for signing the Wells Fargo Starter Kit Checks Form in Gmail

How to make an eSignature for the Wells Fargo Starter Kit Checks Form from your smartphone

How to create an eSignature for the Wells Fargo Starter Kit Checks Form on iOS

How to create an eSignature for the Wells Fargo Starter Kit Checks Form on Android

People also ask

-

What is a Wells Fargo blank check?

A Wells Fargo blank check is a type of check that can be used to make payments without needing to fill in a specific dollar amount in advance. It offers flexibility for various transactions, especially for businesses. With airSlate SignNow, you can easily eSign these checks to expedite your payment processes.

-

How can airSlate SignNow help with Wells Fargo blank checks?

airSlate SignNow allows you to electronically sign Wells Fargo blank checks quickly and securely. This ensures that you can efficiently manage your transactions without the hassle of printing and manually signing each check. The platform streamlines the signing process, making it easier for businesses to send and receive payments.

-

Are there any fees associated with using Wells Fargo blank checks?

Using Wells Fargo blank checks may incur certain fees depending on your account type and usage. It's essential to check with Wells Fargo directly to understand their specific fee structure. However, with airSlate SignNow, you can save on costs related to printing and mailing checks, making it a cost-effective solution for your payment needs.

-

What features does airSlate SignNow offer for managing Wells Fargo blank checks?

airSlate SignNow provides features such as template creation, custom branding, and integration with various applications. You can easily store and retrieve your Wells Fargo blank checks within the platform, ensuring you have everything organized. Additionally, the platform supports secure storage and signing of documents, boosting your operational efficiency.

-

Can I integrate airSlate SignNow with my existing accounting software for Wells Fargo blank checks?

Yes, airSlate SignNow offers seamless integrations with many popular accounting software solutions. This allows you to manage your Wells Fargo blank checks more effectively by keeping your financial records synced. Integrating these tools helps automate the payment process and reduces manual data entry errors.

-

What are the benefits of using eSigned Wells Fargo blank checks?

eSigning Wells Fargo blank checks enhances security and speeds up the payment approval process. By using airSlate SignNow, you can eliminate paperwork, reduce the chances of check fraud, and ensure that payments are authorized quickly. This leads to improved cash flow management for your business.

-

Is airSlate SignNow mobile-friendly for managing Wells Fargo blank checks?

Yes, airSlate SignNow is mobile-friendly, allowing you to manage Wells Fargo blank checks on the go. You can sign checks and access your documents from any mobile device, ensuring that you stay productive no matter where you are. This flexibility is ideal for busy professionals and businesses looking to streamline their payment processes.

Get more for Wells Fargo Check Template

Find out other Wells Fargo Check Template

- Electronic signature Alabama Limited Partnership Agreement Online

- Can I Electronic signature Wisconsin Retainer Agreement Template

- Can I Electronic signature Michigan Trademark License Agreement

- Electronic signature Indiana Letter Bankruptcy Inquiry Now

- eSignature Oklahoma Payroll Deduction Authorization Easy

- How To eSignature Texas Payroll Deduction Authorization

- Can I Electronic signature Connecticut Retainer for Attorney

- How Do I Electronic signature Idaho Assignment of License

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast