Cigna Voluntary Term Life Insurance Enrollment Form

What is the Cigna Voluntary Term Life Insurance Enrollment Form

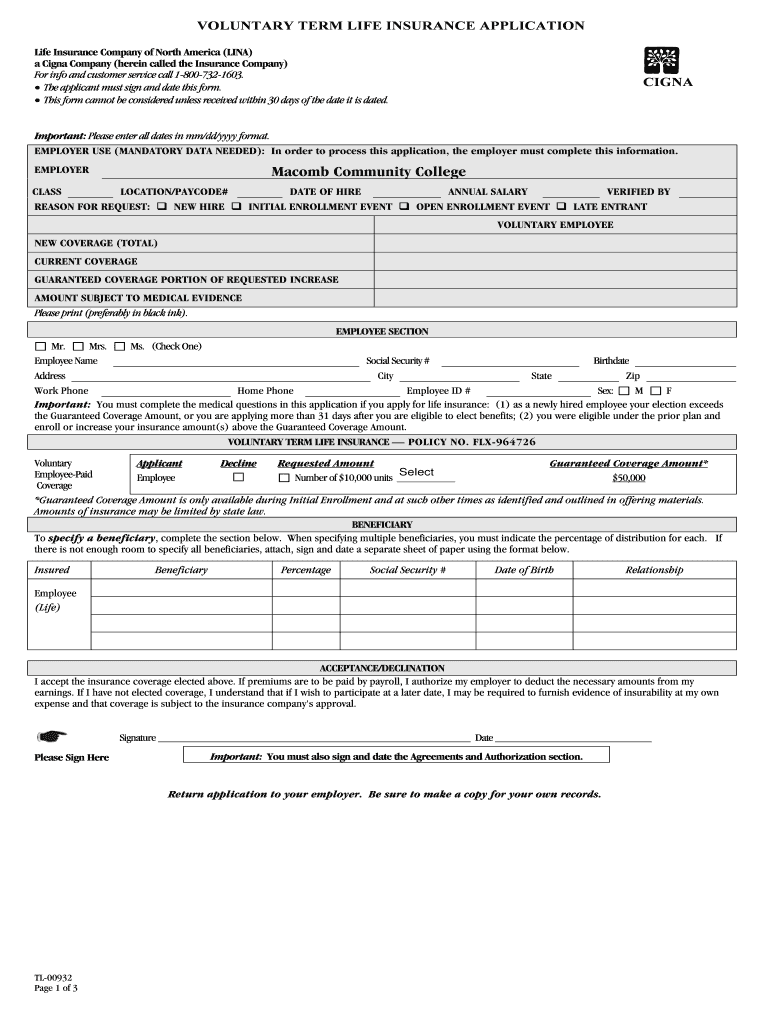

The Cigna voluntary term life insurance enrollment form is a crucial document for individuals seeking to enroll in a term life insurance policy offered by Cigna. This form allows applicants to provide necessary personal information, select coverage amounts, and designate beneficiaries. It is designed to facilitate the process of obtaining life insurance coverage, ensuring that individuals can secure financial protection for their loved ones in the event of their passing.

Steps to complete the Cigna Voluntary Term Life Insurance Enrollment Form

Completing the Cigna voluntary term life insurance enrollment form involves several key steps:

- Gather personal information, including your full name, address, date of birth, and Social Security number.

- Determine the coverage amount you wish to apply for, considering your financial needs and those of your beneficiaries.

- Designate one or more beneficiaries who will receive the insurance payout in the event of your death.

- Review any health questions included in the form, as your answers may impact your eligibility and premium rates.

- Sign and date the form to affirm that the information provided is accurate and complete.

Legal use of the Cigna Voluntary Term Life Insurance Enrollment Form

The legal use of the Cigna voluntary term life insurance enrollment form requires compliance with specific regulations governing electronic signatures and documentation. To ensure the form is legally binding, it must meet the standards set by the ESIGN Act and UETA, which validate electronic signatures and records. When using digital tools for completion, it is essential to select a platform that provides secure eSignature capabilities and maintains compliance with these legal frameworks.

How to obtain the Cigna Voluntary Term Life Insurance Enrollment Form

The Cigna voluntary term life insurance enrollment form can be obtained through various channels. Individuals can access the form directly from Cigna's official website or request a physical copy from their employer if the insurance is offered as part of an employee benefits package. Additionally, insurance agents or brokers can provide the form and assist with the enrollment process.

Key elements of the Cigna Voluntary Term Life Insurance Enrollment Form

Several key elements are essential to the Cigna voluntary term life insurance enrollment form:

- Personal Information: Basic details such as name, address, and date of birth.

- Coverage Amount: Selection of the desired insurance coverage level.

- Beneficiary Designation: Information on who will receive the benefits.

- Health Questionnaire: Questions regarding medical history that may affect eligibility.

- Signature: A declaration affirming the accuracy of the information provided.

Eligibility Criteria

To qualify for coverage through the Cigna voluntary term life insurance enrollment form, applicants typically must meet specific eligibility criteria. These may include age limits, residency requirements, and health status. Generally, individuals between the ages of eighteen and sixty-five are eligible to apply. Additionally, applicants may need to provide information about their health history, which can influence their acceptance and premium rates.

Quick guide on how to complete cigna voluntary term life insurance enrollment form

Complete Cigna Voluntary Term Life Insurance Enrollment Form seamlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the right form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Cigna Voluntary Term Life Insurance Enrollment Form on any device with the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The simplest way to alter and eSign Cigna Voluntary Term Life Insurance Enrollment Form effortlessly

- Obtain Cigna Voluntary Term Life Insurance Enrollment Form and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Mark relevant sections of your documents or conceal sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Modify and eSign Cigna Voluntary Term Life Insurance Enrollment Form and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cigna voluntary term life insurance enrollment form

The best way to generate an eSignature for your PDF document online

The best way to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to create an electronic signature right from your smart phone

How to create an electronic signature for a PDF document on iOS

How to create an electronic signature for a PDF on Android OS

People also ask

-

What is voluntary term life insurance?

Voluntary term life insurance is a type of insurance coverage that provides financial protection for your loved ones in the event of your passing. It is typically offered by employers as an optional benefit, allowing employees to choose the coverage that best fits their needs. This insurance offers a fixed benefit amount that can help replace lost income or cover expenses.

-

How does voluntary term life insurance work?

Voluntary term life insurance provides a death benefit to your designated beneficiaries when you pass away during the policy term. You select the coverage amount and the term length, paying premiums regularly for that coverage. If you outlive the term, the policy expires, but you may have options to convert it into a permanent policy.

-

What are the benefits of enrolling in voluntary term life insurance?

Enrolling in voluntary term life insurance can provide peace of mind, knowing your loved ones will have financial support if the unexpected occurs. Additionally, it typically offers affordable premiums and can be tailored to individual needs, making it a flexible option for protecting family finances and planning for the future.

-

Is voluntary term life insurance expensive?

The cost of voluntary term life insurance varies based on age, health, and coverage amount. However, it is generally more affordable than other types of life insurance due to its temporary nature and straightforward structure. Employers often subsidize costs, making it a cost-effective choice for employees seeking financial security.

-

Can I customize my voluntary term life insurance policy?

Yes, many voluntary term life insurance policies offer customization options such as choosing your coverage amount, term length, and additional riders. This flexibility allows you to tailor the policy to meet your specific needs and financial goals. Always consult with your employer or insurance advisor to review available options.

-

How do I enroll in voluntary term life insurance through my employer?

To enroll in voluntary term life insurance, you should contact your HR department or benefits coordinator during the open enrollment period. They will provide you with the necessary information and guidance on how to select coverage and complete the enrollment process. Ensure you review your options carefully to make an informed decision.

-

Are there any exclusions in voluntary term life insurance policies?

Yes, voluntary term life insurance policies may have specific exclusions, such as suicide within the first two years or deaths resulting from illegal activities. Review the policy terms and conditions closely to understand what is covered and any limitations in coverage. This will help you make the best choice for your personal situation.

Get more for Cigna Voluntary Term Life Insurance Enrollment Form

Find out other Cigna Voluntary Term Life Insurance Enrollment Form

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship