Cap Form 83

What is the Cap Form 83

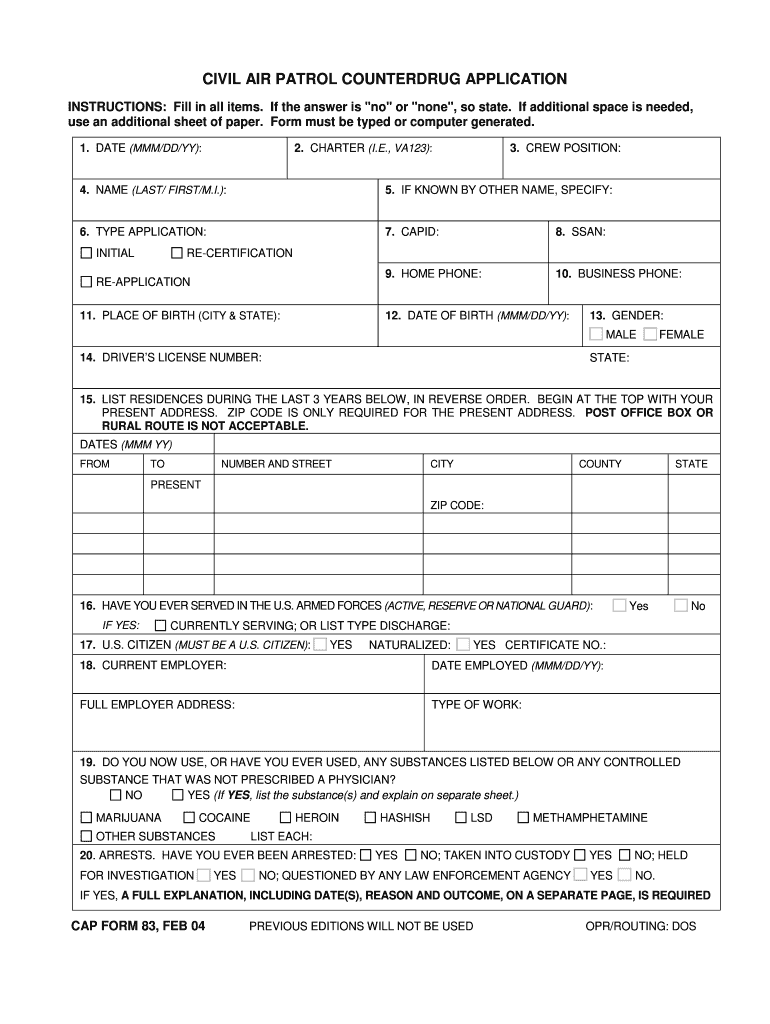

The Cap Form 83, also known as the 83 b election form, is a critical document used in the context of restricted stock and equity compensation. It allows individuals to elect to include the value of restricted stock in their taxable income at the time of grant rather than at the time of vesting. This election can be beneficial for taxpayers as it may result in lower overall tax liability if the stock appreciates in value over time.

How to use the Cap Form 83

Using the Cap Form 83 involves a straightforward process. First, ensure that you meet the eligibility criteria for filing the form. Next, accurately complete the form by providing necessary details such as your name, the description of the property, and the fair market value at the time of the grant. After completing the form, submit it to the IRS within the required timeframe. It is advisable to keep a copy for your records, as it serves as proof of your election.

Steps to complete the Cap Form 83

Completing the Cap Form 83 requires careful attention to detail. Follow these steps:

- Obtain the Cap Form 83 from the IRS or your employer.

- Fill in your personal information, including your name and address.

- Provide details about the restricted stock, including the number of shares and the fair market value at the time of grant.

- Sign and date the form to validate your election.

- Submit the completed form to the IRS and retain a copy for your records.

Legal use of the Cap Form 83

The Cap Form 83 is legally binding when completed and submitted correctly. To ensure its validity, comply with IRS regulations regarding the timing and content of the form. The form must be filed within thirty days of receiving the restricted stock. Failure to adhere to these guidelines may result in penalties or the inability to make the election, which could lead to a higher tax burden.

Key elements of the Cap Form 83

Several key elements must be included in the Cap Form 83 to ensure its effectiveness:

- Taxpayer Information: Full name, address, and taxpayer identification number.

- Property Description: A clear description of the restricted stock.

- Fair Market Value: The fair market value of the stock at the time of grant.

- Signature: A signature to validate the election.

Filing Deadlines / Important Dates

Timeliness is crucial when filing the Cap Form 83. The form must be submitted to the IRS within thirty days of the stock grant date. Missing this deadline can result in the loss of the election, meaning the taxpayer will have to report income at the time of vesting instead, which may lead to a higher tax liability. It is essential to mark your calendar with this important date to ensure compliance.

Quick guide on how to complete cap form 83

Set Up Cap Form 83 Effortlessly on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow provides you with all the resources required to produce, modify, and eSign your documents swiftly without delays. Handle Cap Form 83 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

Steps to Modify and eSign Cap Form 83 with Ease

- Locate Cap Form 83 and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Highlight important sections of the documents or conceal sensitive details with tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Decide how you want to send your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Modify and eSign Cap Form 83 and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cap form 83

The best way to generate an eSignature for your PDF document in the online mode

The best way to generate an eSignature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature right from your mobile device

How to create an electronic signature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF on Android devices

People also ask

-

What is the cap form 83 and how can airSlate SignNow help with it?

The cap form 83 is a document often used in business transactions. airSlate SignNow simplifies the process of sending, signing, and managing this form electronically, ensuring you can complete your transactions efficiently.

-

Is there a cost associated with using airSlate SignNow for the cap form 83?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including those who frequently use the cap form 83. We provide a transparent pricing model that ensures you only pay for the features you need.

-

What are the main features of airSlate SignNow for managing the cap form 83?

Key features of airSlate SignNow include templates for the cap form 83, customizable fields, and robust eSignature capabilities. These features enhance the documentation process, making it faster and more reliable.

-

How does using airSlate SignNow improve the signing process for the cap form 83?

airSlate SignNow provides a user-friendly interface, allowing users to quickly fill out and eSign the cap form 83. This streamlined process saves time and reduces errors compared to traditional methods.

-

Can airSlate SignNow integrate with other software for handling the cap form 83?

Yes, airSlate SignNow integrates with various applications, enhancing your workflow while handling the cap form 83. Popular integrations include CRM systems and cloud storage services, offering seamless document management.

-

What benefits can businesses expect when using airSlate SignNow for the cap form 83?

Businesses can expect increased efficiency, cost savings, and improved accuracy when using airSlate SignNow for the cap form 83. Our solution helps streamline your document workflows, making it easier to get essential signatures promptly.

-

Is airSlate SignNow secure for handling sensitive documents like the cap form 83?

Absolutely! airSlate SignNow employs robust security measures, including encryption and compliance with industry standards. This ensures that your cap form 83 and other sensitive documents are protected at all times.

Get more for Cap Form 83

Find out other Cap Form 83

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors