Printable Employer Payg Summary 2017-2026

What is the Printable Employer Payg Summary

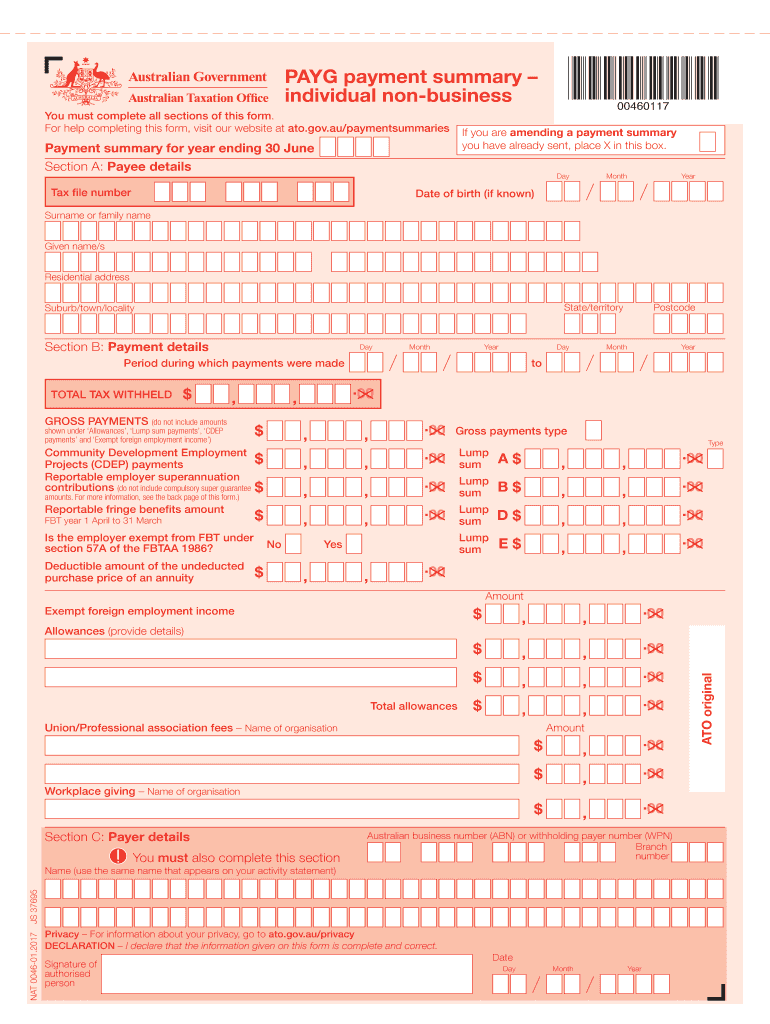

The Printable Employer Payg Summary, also known as the summary 0046, is a crucial document for individuals in the United States who receive payments from their employers. It serves as a summary of the income earned and the taxes withheld during a specific financial year. This document is essential for tax reporting and compliance, providing a clear overview of an employee's earnings and the tax contributions made on their behalf. The payg summary individual form is typically issued by employers at the end of the tax year, ensuring that employees have accurate information for their personal tax filings.

Key Elements of the Printable Employer Payg Summary

The payg payment summary individual includes several key elements that are vital for accurate tax reporting. These elements typically consist of:

- Employee Information: This includes the employee's name, address, and Social Security number.

- Employer Information: Details about the employer, including the name and Employer Identification Number (EIN).

- Total Income: The total amount earned by the employee during the year.

- Tax Withheld: The total amount of federal, state, and local taxes withheld from the employee's earnings.

- Other Deductions: Any additional deductions that may apply, such as retirement contributions or health insurance premiums.

Steps to Complete the Printable Employer Payg Summary

Completing the payg payment summary individual is a straightforward process that involves several steps. Here is how to properly fill out the form:

- Gather Information: Collect all necessary information, including your income details and tax withholding amounts.

- Fill Out Employee Details: Enter your personal information accurately, ensuring that your name and Social Security number are correct.

- Input Employer Information: Provide the name and EIN of your employer as required on the form.

- Report Earnings: Clearly state the total income earned during the year and any applicable deductions.

- Review for Accuracy: Double-check all entries to ensure there are no mistakes before submitting the form.

Legal Use of the Printable Employer Payg Summary

The payg summary individual form is legally recognized for tax purposes in the United States. It must be completed accurately to comply with IRS regulations. Employers are required to provide this summary to their employees, and employees must use it when filing their annual tax returns. Failing to provide accurate information on this form can lead to discrepancies in tax filings, potentially resulting in penalties or audits.

How to Obtain the Printable Employer Payg Summary

To obtain the payg payment summary individual, employees should contact their employer directly. Employers are responsible for issuing this document at the end of the tax year. In some cases, employers may provide a digital version of the summary, which can be printed for personal records. If an employee does not receive their summary, they should reach out to their payroll department to request a copy.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the payg summary individual. Typically, employers must provide this summary to employees by January thirty-first of the following year. Employees should ensure they have received their summary by this date to allow sufficient time for tax preparation and filing. The deadline for submitting personal tax returns is usually April fifteenth, making it essential to have the payg summary on hand for accurate reporting.

Quick guide on how to complete printable employer payg summary

Complete Printable Employer Payg Summary effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Printable Employer Payg Summary on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to modify and eSign Printable Employer Payg Summary without hassle

- Obtain Printable Employer Payg Summary and select Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or conceal sensitive details using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the information and click on the Done button to save your modifications.

- Select how you wish to submit your form, whether by email, SMS, invite link, or by downloading it to your computer.

Eliminate the issues of lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Printable Employer Payg Summary and ensure effective communication at every step of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct printable employer payg summary

Create this form in 5 minutes!

How to create an eSignature for the printable employer payg summary

The way to create an electronic signature for a PDF in the online mode

The way to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature right from your smart phone

The best way to create an eSignature for a PDF on iOS devices

The best way to make an eSignature for a PDF on Android OS

People also ask

-

What is a PAYG payment summary individual?

A PAYG payment summary individual is an official document provided to employees and contractors in Australia that summarizes their income and tax withheld for a financial year. Using airSlate SignNow, you can easily create and send these summaries electronically, ensuring compliance and convenience. This tool streamlines the process, making it faster and more efficient.

-

How does airSlate SignNow help with generating PAYG payment summaries?

With airSlate SignNow, you can generate PAYG payment summaries individually by entering essential details and customizing the document as needed. The platform simplifies the workflow, allowing businesses to send and eSign these payments securely. By using our solution, you can improve accuracy and reduce the amount of time spent on administrative tasks.

-

What are the pricing options for using airSlate SignNow for PAYG payment summaries?

airSlate SignNow offers various pricing plans that cater to different business sizes and needs, including plans that enhance features specific to PAYG payment summary individual. This flexibility allows you to choose a subscription that aligns with your budget while ensuring access to essential tools. Check our pricing page for detailed information on what each plan includes.

-

Can I integrate airSlate SignNow with other software for PAYG payment summaries?

Yes, airSlate SignNow seamlessly integrates with various accounting and business management software, making it easy to manage your PAYG payment summary individual alongside other financial documents. Integration helps streamline your workflow and ensures that all your systems are synchronized. This versatility enhances efficiency in document management and compliance.

-

What are the key features of airSlate SignNow for managing PAYG payment summaries?

Key features of airSlate SignNow for managing PAYG payment summaries include electronic signatures, real-time tracking, and customizable templates. These features ensure that your documents are securely signed and processed quickly, enhancing your overall efficiency. Additionally, the user-friendly interface makes it easy for all team members to adopt this solution.

-

How can airSlate SignNow benefit my business when handling PAYG payment summaries?

Using airSlate SignNow can benefit your business by reducing paperwork and streamlining the distribution of PAYG payment summary individual to your employees and contractors. It ensures timely delivery of documents and minimizes the risk of errors. This efficiency helps maintain good relationships with your team while keeping your compliance intact.

-

Is airSlate SignNow secure for handling sensitive information in PAYG payment summaries?

Absolutely, airSlate SignNow prioritizes security by employing advanced encryption and secure access controls, making it a safe choice for handling sensitive information related to PAYG payment summary individual. Our platform complies with industry standards to protect your data from unauthorized access. You can trust that your documents remain confidential and secure during the entire process.

Get more for Printable Employer Payg Summary

- State of georgia vessel registration application long county form

- Form application biometric

- Auburn registrar diploma replacement form

- Promising practices for child abuse prevention councils in california cirinc form

- Agreed divorce retainer agreement family law and divorce form

- Repossession assignment forms

- One form required for each overnight participant individual release

- Repossession hold harmless form

Find out other Printable Employer Payg Summary

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors