Council Tax City Westminster Form

What is the Council Tax City Westminster

The Council Tax City Westminster is a local taxation system in the City of Westminster, London, which helps fund local services such as education, transport, and social care. It is charged on residential properties and is calculated based on the estimated value of the property as of April 1, 1991. The tax is typically paid by the residents living in the property, and the amount can vary depending on the property's band, which ranges from A to H.

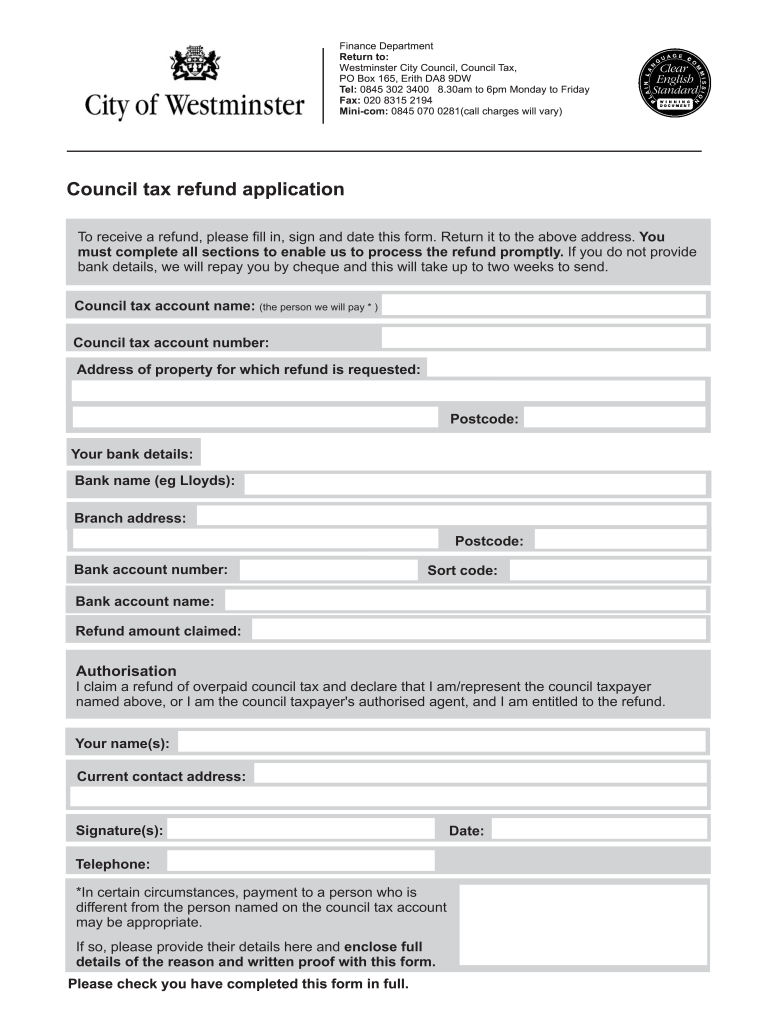

Eligibility Criteria

To be eligible for a council tax refund application, residents must meet specific criteria. Generally, the property must be the applicant's primary residence. Certain exemptions may apply, such as for students, people with severe mental impairments, or those living in care homes. Additionally, if a resident has overpaid their council tax due to changes in circumstances, they may qualify for a refund.

Required Documents

When filling out the council refund application form, applicants need to provide several key documents to support their claim. This may include:

- Proof of identity, such as a driver's license or passport.

- Evidence of residency, like a utility bill or lease agreement.

- Documentation of any changes in circumstances that led to the overpayment.

- Previous council tax statements or payment receipts.

Steps to Complete the Council Tax City Westminster

Completing the council refund application involves several straightforward steps:

- Gather all required documents to support your claim.

- Access the official council refund application form, either online or in paper format.

- Fill out the form with accurate information, ensuring all details align with your supporting documents.

- Submit the application form along with the necessary documentation either online, by mail, or in person at the local council office.

Form Submission Methods

The council refund application can be submitted through various methods to accommodate different preferences. Residents can choose to:

- Submit the application online through the City Westminster's official website.

- Mail the completed application form and supporting documents to the designated council address.

- Visit the local council office and submit the application in person, ensuring that all documents are presented for verification.

Legal Use of the Council Tax City Westminster

The council tax system in Westminster is governed by specific legal frameworks that ensure its compliance and legitimacy. The application process adheres to laws that protect residents' rights and outline the responsibilities of the local council. This includes regulations regarding the assessment of properties, the calculation of tax rates, and the procedures for applying for refunds. Understanding these legal aspects can help residents navigate the council tax system effectively.

Quick guide on how to complete council tax city westminster

Effortlessly prepare Council Tax City Westminster on any device

Digital document administration has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, enabling you to access the right format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Handle Council Tax City Westminster on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to adjust and eSign Council Tax City Westminster with ease

- Obtain Council Tax City Westminster and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize signNow parts of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature with the Sign tool, which only takes moments and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method for sending your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow fulfills all your document management needs within a few clicks from any device of your choice. Transform and eSign Council Tax City Westminster and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the council tax city westminster

The best way to create an eSignature for a PDF file in the online mode

The best way to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature straight from your smartphone

The way to generate an eSignature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF document on Android

People also ask

-

What is a council refund application?

A council refund application is a formal request made to local councils for a rebate or reimbursement of fees, taxes, or charges. Through airSlate SignNow, you can streamline this process by electronically signing and sending your council refund applications, making it quicker and more efficient.

-

How does airSlate SignNow help with council refund applications?

airSlate SignNow simplifies the council refund application process by allowing users to prepare, sign, and send their applications electronically. This eliminates the hassle of paperwork and ensures that your applications are submitted promptly and securely.

-

Is there a fee for using airSlate SignNow for my council refund application?

airSlate SignNow offers competitive pricing plans that cater to different needs, including a free trial for first-time users. Depending on the features you choose, you can find a plan that fits your budget while efficiently managing your council refund application.

-

What features does airSlate SignNow offer for council refund applications?

airSlate SignNow provides features such as customizable templates, real-time tracking, and secure eSigning functionalities to enhance your council refund application process. Users can enjoy a seamless experience without the need for physical documents.

-

Can I integrate airSlate SignNow with other tools for my council refund application?

Yes, airSlate SignNow offers integrations with various applications and platforms, making it easy to link your workflows and manage your council refund application alongside other business processes. Integrating your tools ensures a cohesive experience and simplifies your document management.

-

What are the benefits of using airSlate SignNow for council refund applications?

Using airSlate SignNow for your council refund application offers speed, efficiency, and increased accuracy. By reducing the need for physical paperwork, you save time and minimize errors, ensuring that your applications are processed quickly and correctly.

-

How secure is my data when using airSlate SignNow for council refund applications?

airSlate SignNow prioritizes data security, employing advanced encryption and authentication measures to protect your information. When you submit your council refund application, you can rest assured that your data is safeguarded against unauthorized access.

Get more for Council Tax City Westminster

- Hickory county r 1 schools student enrollment form skylineschools

- Vehicle list form los angeles world airports lawa

- Application abc supply form

- Operatoramp39s manual menzi muck form

- Ethicon medical mission program form

- Form 440 emo

- Commissioning test report category 1 and 2 form 1739

- Seven basic needs of a wife form

Find out other Council Tax City Westminster

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later