Sa100 Form 2020

What is the Sa100 Form

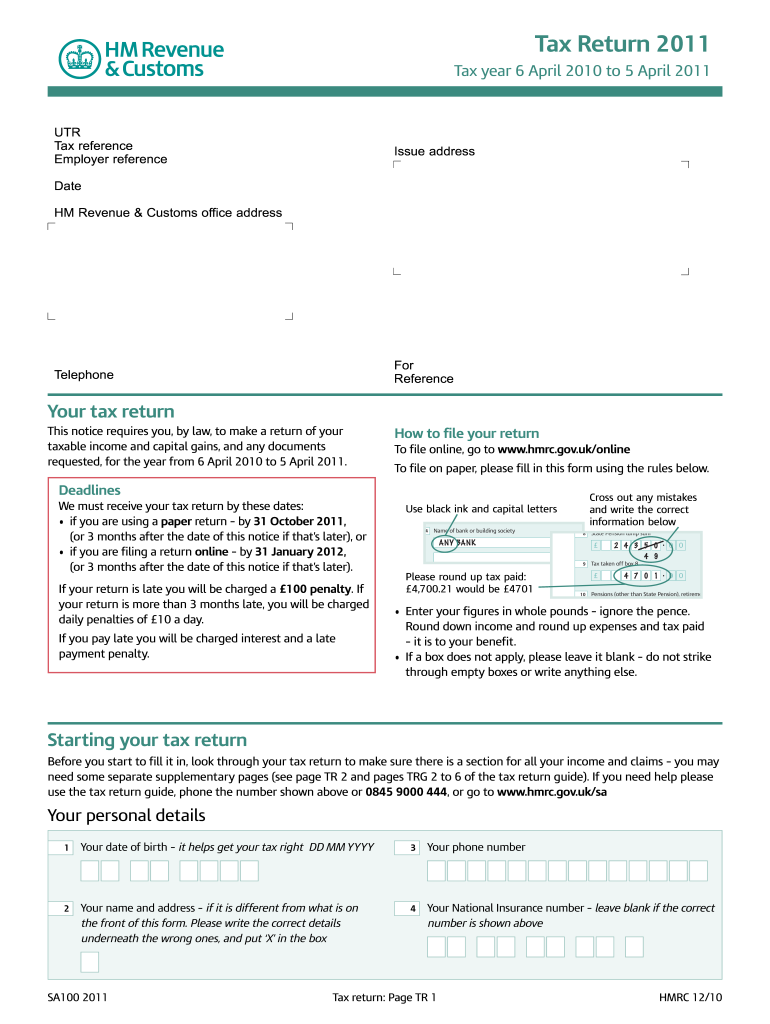

The Sa100 Form is a crucial document used for self-assessment tax returns in the United Kingdom. It is primarily designed for individuals who have income that is not taxed at source, such as self-employed earnings, rental income, or investment returns. Completing the Sa100 Form allows taxpayers to report their income to HM Revenue and Customs (HMRC) and calculate their tax liability. This form is essential for ensuring compliance with tax regulations and avoiding penalties.

How to use the Sa100 Form

Using the Sa100 Form involves several steps to ensure accurate reporting of income and expenses. Taxpayers should begin by gathering all necessary financial documents, including records of income, expenses, and any relevant tax reliefs. Next, they should carefully fill out each section of the form, providing detailed information about their income sources and allowable deductions. Once completed, the form can be submitted electronically or via mail to HMRC, depending on the taxpayer's preference.

Steps to complete the Sa100 Form

Completing the Sa100 Form requires careful attention to detail. Follow these steps for a successful submission:

- Gather documentation: Collect all relevant financial records, including bank statements, invoices, and receipts.

- Fill in personal details: Provide your name, address, and National Insurance number at the top of the form.

- Report income: Accurately list all sources of income, including self-employment, rental income, and dividends.

- Claim expenses: Include any allowable expenses that can reduce your taxable income, such as business expenses or charitable donations.

- Calculate tax owed: Use the provided sections to determine your tax liability based on your reported income.

- Review and submit: Double-check all entries for accuracy before submitting the form to HMRC.

Legal use of the Sa100 Form

The Sa100 Form is legally binding when completed accurately and submitted within the specified deadlines. It is essential for taxpayers to ensure that all information provided is truthful and complete, as inaccuracies can lead to penalties or legal repercussions. By using the Sa100 Form, individuals fulfill their legal obligations to report income and pay taxes owed to HMRC.

Filing Deadlines / Important Dates

Filing deadlines for the Sa100 Form are critical for compliance. Typically, the deadline for submitting the form online is January 31 of the year following the tax year. For paper submissions, the deadline is usually October 31. It is essential for taxpayers to be aware of these dates to avoid late filing penalties and ensure timely processing of their tax returns.

Required Documents

To complete the Sa100 Form accurately, taxpayers should have the following documents ready:

- Income statements: Records of all income sources, including self-employment earnings and rental income.

- Expense receipts: Documentation for any allowable expenses that can be claimed.

- National Insurance number: This is necessary for identification purposes.

- Previous tax returns: Having past returns can help ensure consistency and accuracy in reporting.

Quick guide on how to complete sa100 form

Prepare Sa100 Form effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can easily find the suitable form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without any delays. Handle Sa100 Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Sa100 Form effortlessly

- Find Sa100 Form and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize essential sections of your documents or obscure sensitive details with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just a few seconds and holds the same legal validity as a conventional pen-on-paper signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow manages all your document administration needs in just a few clicks from any device of your preference. Modify and eSign Sa100 Form and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sa100 form

Create this form in 5 minutes!

How to create an eSignature for the sa100 form

The best way to generate an eSignature for a PDF document in the online mode

The best way to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The way to create an eSignature from your mobile device

How to create an eSignature for a PDF document on iOS devices

The way to create an eSignature for a PDF file on Android devices

People also ask

-

What is an Sa100 Form?

The Sa100 Form is a tax return form used by self-employed individuals in the UK to report their income to HM Revenue and Customs. It includes information about your earnings, expenses, and tax owed, making it essential for accurate tax reporting.

-

How can airSlate SignNow assist with the Sa100 Form?

airSlate SignNow offers a seamless electronic signing process, allowing users to easily fill out and eSign their Sa100 Form. This efficient digital solution ensures that all necessary signatures are obtained securely, streamlining the submission process.

-

Is there a cost associated with using airSlate SignNow for the Sa100 Form?

Yes, airSlate SignNow offers various pricing plans designed to fit different business needs. You can select a plan that best suits your requirements for sending and managing documents like the Sa100 Form.

-

What are the features of airSlate SignNow for managing the Sa100 Form?

With airSlate SignNow, you can upload, edit, and share your Sa100 Form with ease. The platform provides templates, in-document comments, and real-time tracking to ensure a smooth signing experience.

-

What are the benefits of using airSlate SignNow for the Sa100 Form?

Using airSlate SignNow for your Sa100 Form offers benefits like improved efficiency, reduced paper usage, and increased security for sensitive information. You'll also enjoy the convenience of electronic signing from anywhere, enhancing your workflow.

-

Can airSlate SignNow integrate with accounting software for the Sa100 Form?

Yes, airSlate SignNow integrates with various accounting software solutions, helping you manage your Sa100 Form alongside your financial records. This integration simplifies the tax preparation process and enhances collaboration with your accountant.

-

How secure is airSlate SignNow for handling the Sa100 Form?

airSlate SignNow prioritizes security, utilizing advanced encryption protocols to protect your data while handling your Sa100 Form. Your documents are stored securely, ensuring that only authorized users have access.

Get more for Sa100 Form

Find out other Sa100 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors