Tax Return Use Form SA100 to File a Tax Return, Report Your Income and to Claim Tax Reliefs and Any Repayment Due You'll Ne 2024-2026

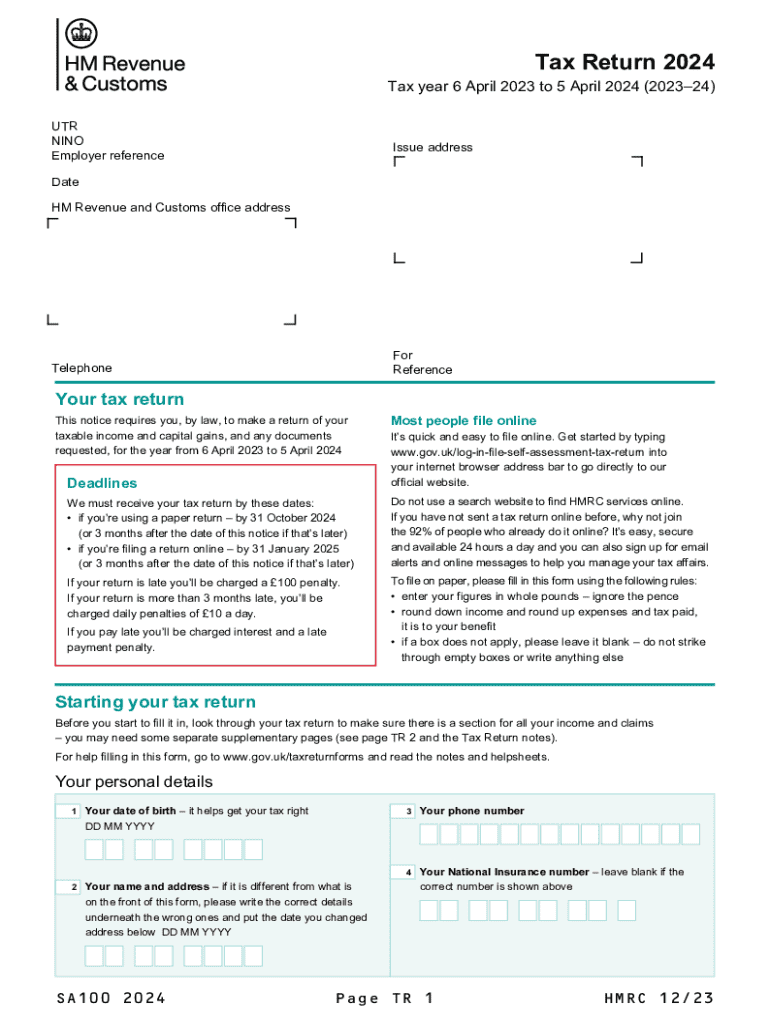

Understanding the Self Assessment Tax Return Form

The self assessment tax return form, commonly known as the SA100, is a crucial document for individuals in the United States who need to report their income and calculate their tax liability. This form is particularly important for self-employed individuals, freelancers, and those with additional income sources outside of traditional employment. By accurately completing the SA100, taxpayers can ensure compliance with IRS regulations and potentially claim tax reliefs or refunds.

Steps to Complete the Self Assessment Tax Return Form

Filling out the self assessment tax return form involves several key steps:

- Gather necessary documents, including income statements, receipts for expenses, and any other relevant financial records.

- Download the SA100 form from the IRS website or obtain a physical copy.

- Begin by entering personal information, such as your name, address, and Social Security number.

- Report your income sources, including wages, self-employment income, and any other earnings.

- Calculate your allowable expenses and deductions to determine your taxable income.

- Complete the appropriate sections for tax reliefs or repayments if applicable.

- Review the form for accuracy before submission.

Required Documents for Filing

To successfully complete the self assessment tax return form, you will need to gather several important documents:

- W-2 forms from employers for wage income.

- 1099 forms for freelance or contract work.

- Receipts for deductible expenses, such as business-related costs.

- Records of any other income, such as rental or investment income.

Form Submission Methods

The self assessment tax return form can be submitted through various methods, allowing for flexibility based on individual preferences:

- Online submission through the IRS e-file system, which is fast and secure.

- Mailing a printed copy of the completed form to the designated IRS address.

- In-person submission at local IRS offices, though this option may require an appointment.

Filing Deadlines and Important Dates

Staying aware of filing deadlines is essential to avoid penalties. The typical deadline for submitting the self assessment tax return form is April 15 of the following year. However, extensions may be available in certain circumstances. It is advisable to check the IRS website for any updates or changes to deadlines.

Penalties for Non-Compliance

Failing to file the self assessment tax return form on time can result in significant penalties. These may include:

- Late filing fees, which can accumulate over time.

- Interest on any unpaid taxes, increasing the overall amount owed.

- Potential legal actions for continued non-compliance, including liens or levies on personal property.

Quick guide on how to complete tax return use form sa100 to file a tax return report your income and to claim tax reliefs and any repayment due youll need 733402847

Complete Tax Return Use Form SA100 To File A Tax Return, Report Your Income And To Claim Tax Reliefs And Any Repayment Due You'll Ne effortlessly on any device

Digital document management has gained popularity among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and save it securely online. airSlate SignNow equips you with all the functionalities required to create, edit, and electronically sign your documents quickly and without interruptions. Handle Tax Return Use Form SA100 To File A Tax Return, Report Your Income And To Claim Tax Reliefs And Any Repayment Due You'll Ne on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign Tax Return Use Form SA100 To File A Tax Return, Report Your Income And To Claim Tax Reliefs And Any Repayment Due You'll Ne easily

- Obtain Tax Return Use Form SA100 To File A Tax Return, Report Your Income And To Claim Tax Reliefs And Any Repayment Due You'll Ne and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of your documents or redact sensitive data using features that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form retrieval, or errors necessitating the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device. Edit and eSign Tax Return Use Form SA100 To File A Tax Return, Report Your Income And To Claim Tax Reliefs And Any Repayment Due You'll Ne and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax return use form sa100 to file a tax return report your income and to claim tax reliefs and any repayment due youll need 733402847

Create this form in 5 minutes!

How to create an eSignature for the tax return use form sa100 to file a tax return report your income and to claim tax reliefs and any repayment due youll need 733402847

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a self assessment tax return form?

A self assessment tax return form is a document that individuals in the UK use to report their income and calculate their tax obligations. It is essential for those who are self-employed or have additional income sources. Completing this form accurately ensures compliance with tax regulations and helps avoid penalties.

-

How can airSlate SignNow help with my self assessment tax return form?

airSlate SignNow simplifies the process of completing and submitting your self assessment tax return form by allowing you to eSign documents securely and efficiently. Our platform streamlines document management, making it easier to gather necessary information and submit your tax return on time. This saves you time and reduces the stress associated with tax season.

-

What are the pricing options for using airSlate SignNow for my self assessment tax return form?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, including options for individuals and teams. You can choose a plan that best fits your budget while ensuring you have access to all the necessary features for managing your self assessment tax return form. Visit our pricing page for detailed information on each plan.

-

Are there any features specifically designed for self assessment tax return forms?

Yes, airSlate SignNow includes features tailored for managing self assessment tax return forms, such as customizable templates, automated reminders, and secure eSigning capabilities. These features help you efficiently complete your tax return while ensuring that all necessary documents are properly signed and stored. This enhances your overall tax filing experience.

-

Can I integrate airSlate SignNow with other accounting software for my self assessment tax return form?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, allowing you to streamline the process of preparing your self assessment tax return form. By connecting your tools, you can easily import data, manage documents, and ensure that your tax return is accurate and complete. Check our integrations page for a list of compatible software.

-

What are the benefits of using airSlate SignNow for my self assessment tax return form?

Using airSlate SignNow for your self assessment tax return form offers numerous benefits, including enhanced efficiency, improved accuracy, and secure document handling. Our platform allows you to manage your tax documents in one place, reducing the risk of errors and ensuring timely submissions. Additionally, the eSigning feature speeds up the process, making tax season less stressful.

-

Is airSlate SignNow secure for handling my self assessment tax return form?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your self assessment tax return form and other sensitive documents are protected. We utilize advanced encryption and secure storage solutions to safeguard your information. You can trust that your data is safe while using our platform for your tax-related needs.

Get more for Tax Return Use Form SA100 To File A Tax Return, Report Your Income And To Claim Tax Reliefs And Any Repayment Due You'll Ne

Find out other Tax Return Use Form SA100 To File A Tax Return, Report Your Income And To Claim Tax Reliefs And Any Repayment Due You'll Ne

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now