Tax Return Use Form SA100 to File a Tax Return, Report Your Income and to Claim Tax Reliefs and Any Repayment Due You'll Ne 2023

Understanding the SA100 Form

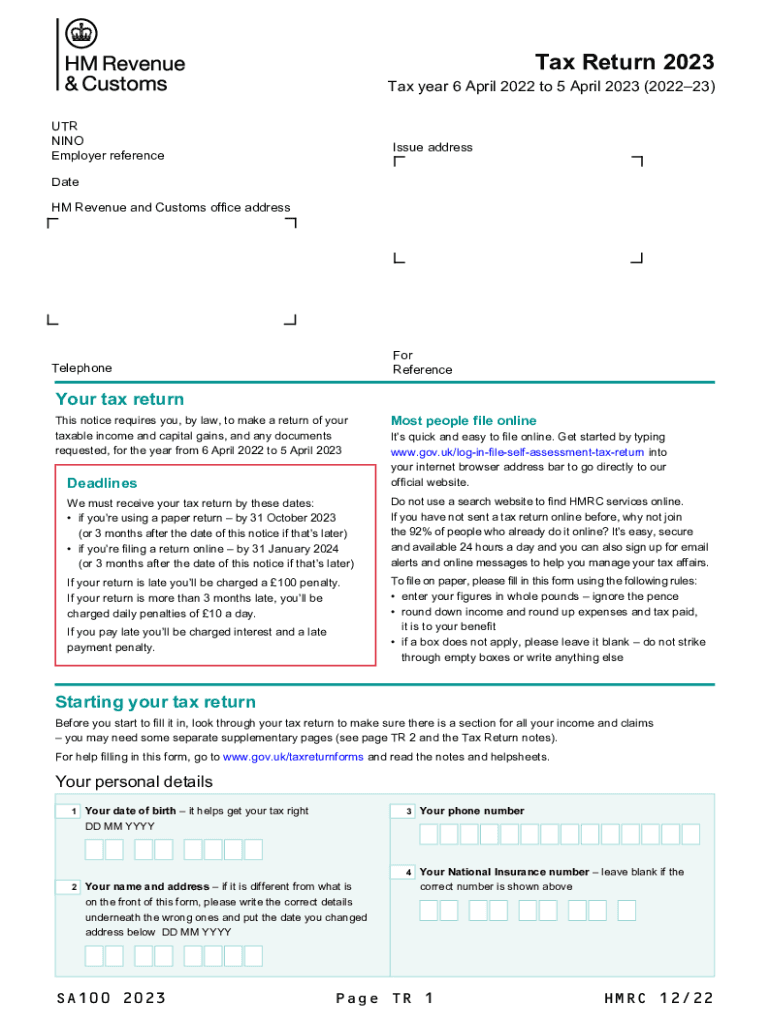

The SA100 form is a self-assessment tax return used by individuals in the United Kingdom to report their income, claim tax reliefs, and determine any repayment due. This form is essential for those who are self-employed, have multiple income sources, or need to report capital gains. Understanding the purpose and requirements of the SA100 form is crucial for ensuring compliance with tax regulations.

When filling out the SA100 form, it is important to gather all necessary documents, including income statements, records of expenses, and any relevant supplementary pages. These documents help provide a complete picture of your financial situation and support your claims for tax reliefs.

Steps to Complete the SA100 Form

Completing the SA100 form involves several key steps to ensure accuracy and compliance. Start by gathering all necessary information related to your income, expenses, and any other relevant financial details. This may include:

- Income from employment, self-employment, or investments

- Records of allowable expenses

- Details of any capital gains

Next, fill out the form accurately, ensuring that all figures are correct and that you include any required supplementary pages for specific types of income. After completing the form, review it thoroughly to check for any errors or omissions. Once satisfied, submit the form by the relevant deadline to avoid penalties.

Legal Use of the SA100 Form

The SA100 form is legally recognized for reporting income and calculating tax liabilities. To ensure its legal standing, it must be completed accurately and submitted in accordance with HMRC guidelines. Compliance with tax laws is critical, as incorrect submissions can lead to penalties or legal issues.

When using the SA100 form, it is essential to maintain accurate records and documentation to support your claims. This not only helps in case of an audit but also ensures that you are meeting your legal obligations as a taxpayer.

Filing Deadlines and Important Dates

Filing deadlines for the SA100 form are crucial for compliance. Typically, the deadline for submitting your self-assessment tax return is January 31st following the end of the tax year. For example, for the tax year ending April 5, 2024, the SA100 must be submitted by January 31, 2025.

It is important to note that late submissions can result in penalties. Therefore, being aware of these deadlines and planning accordingly can help avoid unnecessary fees and ensure timely processing of your tax return.

Required Documents for the SA100 Form

To complete the SA100 form accurately, specific documents are required. These include:

- Payslips or P60s for employment income

- Invoices and receipts for self-employment income

- Bank statements showing interest earned

- Records of any capital gains

Having these documents readily available will streamline the process of filling out the SA100 form and help ensure that all income and expenses are reported correctly.

Examples of Using the SA100 Form

The SA100 form is commonly used in various scenarios, including:

- Self-employed individuals reporting their business income

- Individuals with rental income from property

- Taxpayers claiming relief for expenses related to their job

Understanding these examples can help taxpayers recognize their obligations and the importance of accurately reporting their financial activities through the SA100 form.

Quick guide on how to complete tax return use form sa100 to file a tax return report your income and to claim tax reliefs and any repayment due youll need

Easily Prepare Tax Return Use Form SA100 To File A Tax Return, Report Your Income And To Claim Tax Reliefs And Any Repayment Due You'll Ne on Any Device

The management of online documents has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the essential tools for generating, editing, and eSigning your documents swiftly, without delays. Handle Tax Return Use Form SA100 To File A Tax Return, Report Your Income And To Claim Tax Reliefs And Any Repayment Due You'll Ne on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Edit and eSign Tax Return Use Form SA100 To File A Tax Return, Report Your Income And To Claim Tax Reliefs And Any Repayment Due You'll Ne with Ease

- Locate Tax Return Use Form SA100 To File A Tax Return, Report Your Income And To Claim Tax Reliefs And Any Repayment Due You'll Ne and then click Get Form to begin.

- Take advantage of the tools we provide to complete your document.

- Highlight necessary sections of the documents or obscure sensitive data with features that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Tax Return Use Form SA100 To File A Tax Return, Report Your Income And To Claim Tax Reliefs And Any Repayment Due You'll Ne to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax return use form sa100 to file a tax return report your income and to claim tax reliefs and any repayment due youll need

Create this form in 5 minutes!

How to create an eSignature for the tax return use form sa100 to file a tax return report your income and to claim tax reliefs and any repayment due youll need

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SA100 form 2024?

The SA100 form 2024 is a self-assessment tax return required by HMRC for individuals to report their income and capital gains for the tax year. Completing the SA100 form 2024 accurately is essential for ensuring compliance and avoiding penalties. Using airSlate SignNow can simplify the process by allowing you to eSign and send documents securely.

-

How can airSlate SignNow assist with the SA100 form 2024?

airSlate SignNow streamlines the management of the SA100 form 2024 by providing an easy-to-use platform for eSigning and sending the necessary documents. This not only boosts efficiency but also enhances security, ensuring that your sensitive information is protected while you complete your tax return.

-

Is airSlate SignNow suitable for small businesses needing the SA100 form 2024?

Yes, airSlate SignNow is an ideal solution for small businesses that must complete the SA100 form 2024. With affordable pricing plans and user-friendly features, it enables small businesses to manage their tax forms easily while ensuring compliance with HMRC requirements.

-

What are the pricing options for using airSlate SignNow for the SA100 form 2024?

airSlate SignNow offers various pricing plans to cater to different business needs, making it accessible for anyone needing assistance with the SA100 form 2024. Whether you are an individual freelancer or part of a larger organization, there is a plan that fits your budget and requirements.

-

Can I integrate airSlate SignNow with other software for handling the SA100 form 2024?

Absolutely! airSlate SignNow allows seamless integration with various software applications, enhancing your ability to manage the SA100 form 2024. You can connect with popular accounting software, CRMs, and other tools for a streamlined workflow.

-

What benefits does airSlate SignNow offer for completing the SA100 form 2024?

By using airSlate SignNow for the SA100 form 2024, you gain access to a fast, secure, and efficient way to handle your tax documents. The platform simplifies the eSigning process, provides document tracking features, and ensures compliance with regulatory standards.

-

How do I get started with airSlate SignNow for the SA100 form 2024?

Getting started with airSlate SignNow for the SA100 form 2024 is simple! Just sign up for an account, select the plan that suits your needs, and begin uploading and processing your documents. The intuitive interface will guide you through each step.

Get more for Tax Return Use Form SA100 To File A Tax Return, Report Your Income And To Claim Tax Reliefs And Any Repayment Due You'll Ne

Find out other Tax Return Use Form SA100 To File A Tax Return, Report Your Income And To Claim Tax Reliefs And Any Repayment Due You'll Ne

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement