Nr303 2013-2026

What is the NR303?

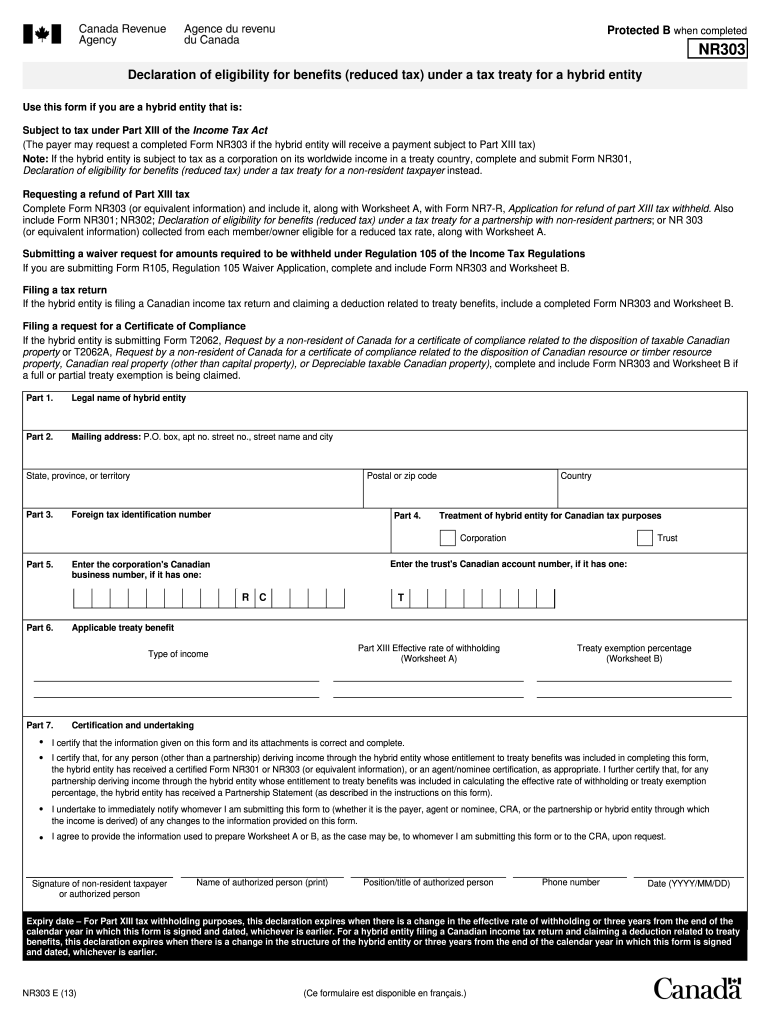

The NR303 form is a Canadian tax document used for reporting income earned by non-residents of Canada. It is essential for individuals and entities that have received income from Canadian sources but do not reside in the country. This form helps ensure compliance with Canadian tax laws and allows the Canada Revenue Agency (CRA) to assess the appropriate tax obligations for non-residents.

How to use the NR303

To effectively use the NR303 form, individuals must first determine their eligibility as non-residents earning income in Canada. The form requires detailed information about the income sources, such as employment, rental, or investment income. After gathering the necessary information, individuals can fill out the form accurately to reflect their income and claim any applicable deductions or credits. It is crucial to ensure all sections are completed to avoid delays in processing.

Steps to complete the NR303

Completing the NR303 form involves several key steps:

- Gather all relevant income documentation, including T4 slips or other income statements.

- Provide personal information, including your name, address, and tax identification number.

- Detail your income sources and amounts earned during the tax year.

- Claim any deductions or credits for which you are eligible.

- Review the form for accuracy before submission.

Legal use of the NR303

The NR303 form must be used in accordance with Canadian tax laws. It is legally binding and must be submitted to the CRA by the specified deadlines. Non-compliance can lead to penalties or interest charges. It is essential for non-residents to understand their tax obligations and ensure that the form is filled out correctly to avoid legal repercussions.

Required Documents

When completing the NR303 form, certain documents are necessary to support the information provided. These may include:

- Income statements (e.g., T4 slips, rental agreements).

- Proof of residency status in your home country.

- Any relevant tax treaties that may affect your tax obligations.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the NR303 form to avoid penalties. Generally, non-residents must submit their forms by April 30 of the year following the tax year in question. However, specific deadlines may vary based on individual circumstances, so it is advisable to check the CRA guidelines for the most accurate information.

Quick guide on how to complete nr303

Complete Nr303 seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers a fantastic eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without interruptions. Handle Nr303 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

The easiest way to modify and electronically sign Nr303 effortlessly

- Locate Nr303 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or obfuscate sensitive information using tools that airSlate SignNow offers specifically for that task.

- Create your electronic signature with the Sign tool, which only takes seconds and carries the same legal authority as a traditional wet signature.

- Review all the details and click on the Done button to save your changes.

- Select how you prefer to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Nr303 and guarantee exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nr303

Create this form in 5 minutes!

How to create an eSignature for the nr303

How to create an eSignature for your PDF document in the online mode

How to create an eSignature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature from your mobile device

How to generate an electronic signature for a PDF document on iOS devices

How to generate an eSignature for a PDF file on Android devices

People also ask

-

What is the NR303 form?

The NR303 form is a specific document often required for tax purposes by non-resident individuals. It provides important information that helps determine your tax obligations while engaging in real estate transactions or certain income sources in the U.S. Using airSlate SignNow, you can easily complete and eSign the NR303 form securely.

-

How does airSlate SignNow simplify the NR303 form signing process?

airSlate SignNow streamlines the signing process for the NR303 form by allowing users to fill out and eSign documents electronically from anywhere. Our platform reduces paperwork and eliminates the hassle of physical signatures, making it easier to manage important documents quickly and efficiently.

-

Is airSlate SignNow a cost-effective solution for managing the NR303 form?

Yes, airSlate SignNow offers competitive pricing plans that cater to both individuals and businesses looking to manage documents like the NR303 form effectively. Our subscription options are designed to fit various budgets, ensuring you can handle your eSigning needs without breaking the bank.

-

What features does airSlate SignNow offer for the NR303 form?

airSlate SignNow provides various features designed to enhance the signing experience for the NR303 form, including template creation, customizable fields, and secure cloud storage. Additionally, our platform supports tracking and notifications, ensuring you stay informed throughout the signing process.

-

Can I integrate airSlate SignNow with other software to manage the NR303 form?

Absolutely! airSlate SignNow can seamlessly integrate with various software solutions such as CRM systems and document management tools, allowing you to automate workflows involving the NR303 form. This integration capability enhances your productivity by connecting different platforms.

-

What are the benefits of using airSlate SignNow for the NR303 form?

Using airSlate SignNow for the NR303 form enhances efficiency, reduces turnaround time, and minimizes the risk of errors in document handling. Our user-friendly platform makes it simple for users to manage their eSigning needs while maintaining compliance with legal and regulatory standards.

-

Is airSlate SignNow secure for handling the NR303 form?

Yes, airSlate SignNow prioritizes security through advanced encryption protocols, ensuring that your NR303 form and all sensitive data remain protected. Our compliance with industry standards safeguards your information and guarantees safe eSigning experiences.

Get more for Nr303

Find out other Nr303

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)