Pr3 Form

What is the Pr3 Form

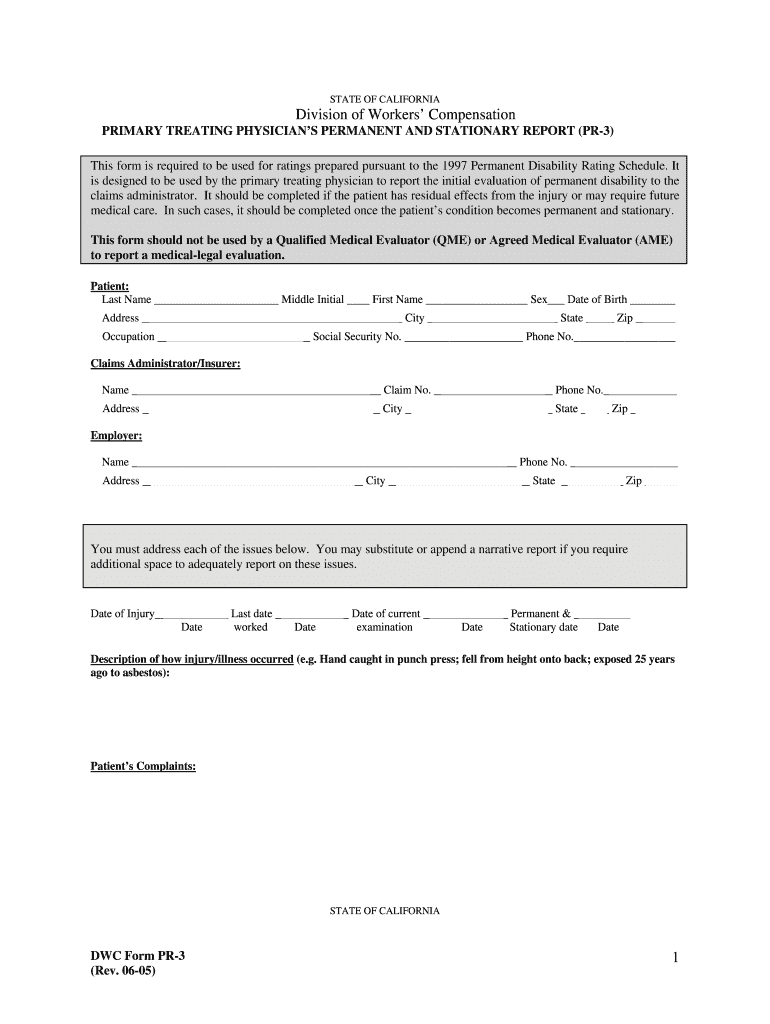

The Pr3 form, also known as the Primary Treating Physician's Permanent and Stationary Report, is a crucial document used in the workers' compensation process in California. It serves as a formal report from the primary treating physician regarding a patient's medical condition and the extent of their disability. This form is essential for determining the injured worker's eligibility for benefits and the appropriate compensation for their medical treatment and rehabilitation.

How to use the Pr3 Form

Using the Pr3 form involves several steps that ensure accurate reporting of an injured worker's medical status. The physician must complete the form with detailed information about the patient's diagnosis, treatment history, and current condition. It is important to provide clear and concise information to facilitate the claims process. Once completed, the form should be submitted to the appropriate workers' compensation claims administrator to initiate the next steps in the benefits process.

Steps to complete the Pr3 Form

Completing the Pr3 form requires careful attention to detail. Here are the steps to follow:

- Gather all relevant medical records and information about the patient.

- Fill in the patient's personal information, including name, date of birth, and claim number.

- Provide a detailed medical history, including diagnosis and treatment received.

- Assess the patient's current condition and indicate whether they are permanent and stationary.

- Sign and date the form, ensuring that all information is accurate and complete.

Legal use of the Pr3 Form

The Pr3 form is legally recognized in California as part of the workers' compensation process. For the form to be valid, it must be completed by a licensed physician who is treating the injured worker. The information provided in the form can be used in legal proceedings to establish the extent of the worker's injuries and the necessary compensation. It is essential that the form complies with all relevant regulations to ensure its acceptance by the claims administrator and potential legal entities.

State-specific rules for the Pr3 Form

In California, the Pr3 form is governed by specific state regulations that dictate its use in the workers' compensation system. These rules outline who is qualified to complete the form, the required content, and the submission process. It is important for physicians and injured workers to be aware of these regulations to ensure compliance and avoid delays in the claims process.

Examples of using the Pr3 Form

The Pr3 form is commonly used in various scenarios within the workers' compensation framework. For instance, if an employee sustains a workplace injury and undergoes treatment, the physician may use the Pr3 form to report the patient's recovery status. This report can influence decisions regarding ongoing medical care and the worker's ability to return to work. Additionally, the form may be referenced in disputes regarding the adequacy of treatment or the determination of permanent disability benefits.

Quick guide on how to complete california workers compensation pr3 editable form

Effortlessly prepare Pr3 Form on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Pr3 Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

Edit and electronically sign Pr3 Form with ease

- Obtain Pr3 Form and then click Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize important sections of your documents or redact sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred method to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or errors that necessitate creating new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Pr3 Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Do un-contracted workers have to fill out IRS W4 form?

I have no idea what an “un-contracted worker” is. I am not familiar with that term.Employees working in the U.S. complete a Form W-4.Independent contractors in the U.S. do not. Instead, they usually complete a Form W-9.If unclear on the difference between an employee or an independent contractor, see Independent Contractor Self Employed or Employee

-

I received Worker's Compensation in 2015, how could I find out how much I received in payments for filling out the FAFSA?

US workers compensation insurance carriers, third party claims administrators and self insureds all keep detailed records on how much they have paid on a given claim. It is broken down into medical payments and indemnity payments and claim expenses.For FAFSA's purposes , you want the indemnity payments which consists of lost time benefits and any settlement or award for your wage loss or disability.If you received a settlement or an award that was paid in a lump sum, it may have been a blend of medical and indemnity which makes it harder to break into accurate components. If there was a settlement, the document itself may recite how much was allocated to disability , disputed lost time, etc.Usually when a person has a lawyer, the carrier will not ( is ethically prohibited , actually) from talking directly to the claimant. However, for administrative things, the claim adjuster should be willing to give you the information needed. If the case is being litigated, your lawyers office needs to make the call. Regardless, it is simple and easy to retrieve on the carrier's end.There will not be a 1099 or W2. Also, worker's compensation benefits are not considered income under the Internal Revenue Code, so look carefully at the way FAFSA asks the question- you may not need this after all.

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

I started teaching piano lessons this year, how do I pay quarterly taxes in California? What form should I fill out?

Go to https://www.irs.gov/pub/irs-pdf/... You will file a form 1040ES each quarter. The website will tell you the due dates for each quarterly payment. Get a similar form from your state tax board website if you pay state taxes.Note: If this is your first year filing, ever, then you can get away without sending in estimated payments because you owe the LESSER of what you owe this year or last year. Having been self-employed most of my life, I always filed quarterly estimated taxes, using the amount I had owed the year before, because I had to to avoid fines, and because I didn't want to get to April of the next year and not have the money. As for the amount you should pay to the IRS and your state, you might be able to figure this out using worksheets available on the IRS and state websites. If you chose to deal in cash and not report it, that's your business. Your students are not going to send you a 1099 at the end of the year. But if you teach at an institution which pays you more than a few thousand dollars a year, they WILL file a 1099 stating how much they paid you in miscellaneous income, with the IRS and state.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

Is it legal for a doctor to charge fifty dollars to fill out the one page ca20 form workers comp requires?

Almost certainly. This is not covered under the costs of medical care. If it takes him only 10 minutes to do so that physician is being underpaid. If it is 5 minutes it might be close. Doctor’s time is expensive because of high overhead. The front desk person, the nurse, the building, the utilities, the malpractice insurance. Most physicians have overhead of over $200 an hour.

Create this form in 5 minutes!

How to create an eSignature for the california workers compensation pr3 editable form

How to generate an eSignature for the California Workers Compensation Pr3 Editable Form online

How to create an electronic signature for your California Workers Compensation Pr3 Editable Form in Google Chrome

How to create an electronic signature for signing the California Workers Compensation Pr3 Editable Form in Gmail

How to make an eSignature for the California Workers Compensation Pr3 Editable Form from your mobile device

How to create an eSignature for the California Workers Compensation Pr3 Editable Form on iOS devices

How to create an electronic signature for the California Workers Compensation Pr3 Editable Form on Android

People also ask

-

What is a Pr3 Form and how can airSlate SignNow help?

The Pr3 Form is a crucial document for various administrative processes, and airSlate SignNow simplifies its handling. With our platform, you can easily prepare, send, and eSign Pr3 Forms securely and efficiently. This streamlines workflows, reduces paper clutter, and enhances compliance.

-

Is there a cost associated with using the Pr3 Form through airSlate SignNow?

Yes, airSlate SignNow offers competitive pricing plans that include features for managing Pr3 Forms. Depending on your team's needs, you can choose from various subscription tiers that provide access to all the necessary tools for effective document management. We provide a cost-effective solution that maximizes your productivity.

-

Can I integrate the Pr3 Form with other software applications?

Absolutely! airSlate SignNow allows seamless integrations with various software applications, making it easy to manage Pr3 Forms alongside your existing systems. Whether you're using CRM, project management tools, or cloud storage solutions, our platform ensures that your Pr3 Forms fit smoothly into your workflow.

-

What are the key features for managing the Pr3 Form in airSlate SignNow?

airSlate SignNow offers a range of features specifically designed for managing the Pr3 Form, such as template creation, advanced eSigning options, and automated reminders. You can also track document status in real-time, ensuring that your Pr3 Forms are processed promptly and efficiently.

-

How do I ensure the security of my Pr3 Form when using airSlate SignNow?

Your Pr3 Form's security is our top priority at airSlate SignNow. We implement industry-standard encryption, secure access protocols, and compliance with regulations to protect your sensitive information. You can confidently send and eSign Pr3 Forms knowing that they are safeguarded against unauthorized access.

-

What benefits does airSlate SignNow provide for businesses using the Pr3 Form?

Using the Pr3 Form with airSlate SignNow delivers numerous benefits, including increased efficiency, reduced turnaround times, and enhanced accuracy. Our platform helps eliminate errors commonly associated with paper forms, allowing your business to focus on growth and customer satisfaction.

-

Can I track the status of my Pr3 Form in airSlate SignNow?

Yes, airSlate SignNow provides comprehensive tracking features for your Pr3 Form. You can monitor its progress, see who has viewed it, and receive notifications when it has been signed. This transparency helps you manage workflows more effectively.

Get more for Pr3 Form

Find out other Pr3 Form

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation