Small Business ExemptionRevenue NSW Form

What is the Small Business Exemption?

The Small Business Exemption is a provision offered by Revenue NSW that allows eligible small businesses to apply for an exemption from stamp duty on certain transactions. This exemption is designed to support small businesses by reducing their financial burden when engaging in activities such as purchasing property or transferring ownership. Understanding the criteria for eligibility is essential for businesses seeking to benefit from this exemption.

Eligibility Criteria for the Small Business Exemption

To qualify for the Small Business Exemption, businesses must meet specific criteria set forth by Revenue NSW. Generally, the following conditions apply:

- The business must be classified as a small business under the relevant guidelines.

- The total taxable turnover of the business must not exceed a certain threshold, which is updated periodically.

- The exemption typically applies to specific types of transactions, such as property purchases or transfers.

It is crucial for businesses to review these criteria carefully to ensure they meet all requirements before applying.

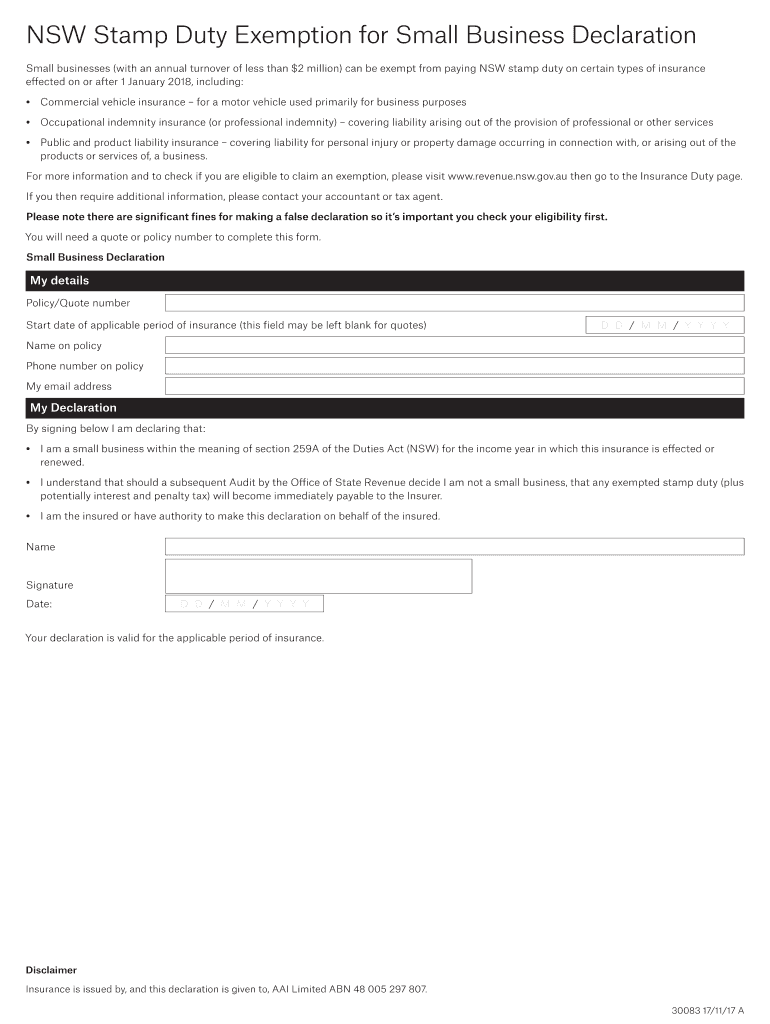

Steps to Complete the Small Business Exemption Declaration

Filling out the Small Business Exemption Declaration involves several steps to ensure accuracy and compliance. Here’s a straightforward process to follow:

- Gather all necessary documentation, including proof of business size and turnover.

- Access the Small Business Exemption Declaration form through the appropriate channels.

- Complete the form by providing accurate information regarding your business and the transaction.

- Review the form for any errors or omissions before submission.

- Submit the completed form as directed, either online or via mail.

Following these steps will help streamline the application process and increase the likelihood of approval.

Required Documents for the Small Business Exemption

When applying for the Small Business Exemption, certain documents are typically required to substantiate your application. These may include:

- Proof of business registration and structure, such as an LLC or corporation documents.

- Financial statements or tax returns demonstrating the business's turnover.

- Any relevant contracts or agreements related to the transaction.

Having these documents ready will facilitate a smoother application process and help ensure compliance with Revenue NSW requirements.

Legal Use of the Small Business Exemption

The Small Business Exemption must be used in accordance with the laws and regulations established by Revenue NSW. Misuse of the exemption, such as providing false information or failing to meet eligibility criteria, can result in penalties. It is important for businesses to understand the legal implications of their application and to ensure that all information provided is truthful and accurate.

Form Submission Methods

Businesses can submit the Small Business Exemption Declaration through various methods, ensuring flexibility and convenience. The available submission methods typically include:

- Online submission through the Revenue NSW website, which is often the fastest option.

- Mailing the completed form to the designated Revenue NSW office.

- In-person submission at a local Revenue NSW office, if applicable.

Choosing the appropriate submission method can help expedite the processing of your application.

Quick guide on how to complete small business exemptionrevenue nsw

Complete Small Business ExemptionRevenue NSW effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Handle Small Business ExemptionRevenue NSW on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Small Business ExemptionRevenue NSW without hassle

- Find Small Business ExemptionRevenue NSW and then click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Mark relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and then click on the Done button to save your modifications.

- Select how you prefer to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Modify and eSign Small Business ExemptionRevenue NSW and ensure exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the small business exemptionrevenue nsw

The way to make an electronic signature for your PDF in the online mode

The way to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to make an eSignature right from your smart phone

The way to generate an electronic signature for a PDF on iOS devices

The best way to make an eSignature for a PDF on Android OS

People also ask

-

What is a duty exemption declaration?

A duty exemption declaration is a formal document that allows businesses to claim exemptions from certain duties or tariffs on imported goods. This declaration is essential for companies looking to reduce costs and streamline their import processes. By properly utilizing a duty exemption declaration, businesses can enhance their cash flow and avoid unnecessary expenses.

-

How can airSlate SignNow help with duty exemption declarations?

airSlate SignNow simplifies the process of creating and managing duty exemption declarations by providing easy-to-use templates and eSignature capabilities. This enables users to prepare documents quickly and securely while ensuring compliance with legal requirements. With airSlate SignNow, businesses can efficiently handle their duty exemption declarations and other important documents.

-

Is there a fee associated with creating duty exemption declarations using airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses. Users can choose a plan that best accommodates their requirements for creating duty exemption declarations and other document processes. Pricing is competitive and designed to provide value to businesses seeking cost-effective solutions.

-

What features does airSlate SignNow offer for managing duty exemption declarations?

airSlate SignNow includes features such as customizable templates, eSigning, and document tracking, which are crucial for managing duty exemption declarations. Users can easily create and send documents, track their status, and ensure timely signatures from multiple parties. These features streamline the workflow and enhance efficiency in handling duty exemption declarations.

-

Can I integrate airSlate SignNow with other software for duty exemption declarations?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing users to connect their document workflows seamlessly. These integrations can enhance the process of managing duty exemption declarations by ensuring that all relevant information is accessible and up-to-date across platforms.

-

What are the benefits of using airSlate SignNow for duty exemption declarations?

Using airSlate SignNow for duty exemption declarations provides numerous benefits, including improved efficiency, reduced processing times, and increased accuracy. Moreover, the platform's user-friendly interface and robust security features ensure that sensitive business documents are handled safely. Ultimately, businesses can save time and resources while ensuring compliance with import regulations.

-

How secure is airSlate SignNow when handling duty exemption declarations?

airSlate SignNow takes security seriously, implementing top-level encryption and compliance measures to protect your duty exemption declarations and other sensitive documents. With secure storage and access controls, businesses can trust that their information remains safe and confidential. This commitment to security allows users to focus on their business without worrying about data bsignNowes.

Get more for Small Business ExemptionRevenue NSW

Find out other Small Business ExemptionRevenue NSW

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now