Virginia Ifta Tax Forms Printable 2015

What is the Virginia IFTA Tax Forms Printable

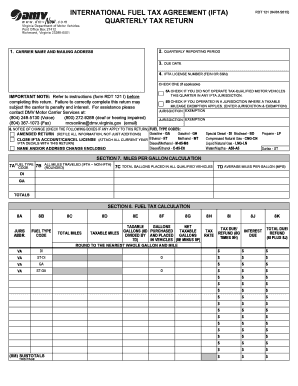

The Virginia IFTA tax forms printable are essential documents used by interstate motor carriers to report fuel usage and calculate the International Fuel Tax Agreement (IFTA) tax owed to various jurisdictions. These forms facilitate compliance with state and federal regulations, ensuring that carriers pay their fair share of fuel taxes based on the miles driven in each state. The forms are specifically designed for Virginia-based carriers and must be completed accurately to avoid penalties.

Steps to Complete the Virginia IFTA Tax Forms Printable

Completing the Virginia IFTA tax forms involves several important steps to ensure accuracy and compliance. First, gather all necessary records of fuel purchases and mileage traveled in each jurisdiction. Next, fill out the form by entering the total miles driven and the fuel consumed in each state. Be sure to include any credits for fuel purchased in Virginia. After completing the form, review it for accuracy, sign it, and submit it according to the specified guidelines.

Legal Use of the Virginia IFTA Tax Forms Printable

The legal use of the Virginia IFTA tax forms printable is governed by the regulations established under the International Fuel Tax Agreement. These forms must be used by eligible motor carriers to report their fuel consumption and mileage accurately. Failure to use these forms correctly can lead to legal repercussions, including fines and penalties. It is crucial to adhere to all instructions and requirements outlined by the Virginia Department of Motor Vehicles when completing and submitting these forms.

Filing Deadlines / Important Dates

Filing deadlines for the Virginia IFTA tax forms are typically set quarterly. Carriers must submit their reports by the last day of the month following the end of each quarter. For example, the first quarter ends on March 31, and the report is due by April 30. It is vital to stay informed about these deadlines to avoid late fees and penalties. Keeping a calendar with these important dates can help ensure timely submission.

Form Submission Methods

The Virginia IFTA tax forms can be submitted through various methods, including online, by mail, or in person. Online submission is often the most efficient way, allowing for immediate processing. If choosing to submit by mail, ensure that the forms are sent to the correct address and allow sufficient time for delivery. In-person submissions can be made at designated offices, providing an opportunity to ask questions if needed.

Penalties for Non-Compliance

Non-compliance with the Virginia IFTA tax requirements can result in significant penalties. These may include late fees, interest on unpaid taxes, and potential legal action. It is essential for carriers to understand the importance of timely and accurate reporting to avoid these consequences. Regularly reviewing compliance requirements and maintaining accurate records can help mitigate the risk of non-compliance.

Quick guide on how to complete virginia ifta tax forms printable

Complete Virginia Ifta Tax Forms Printable seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and eSign your documents quickly and efficiently. Handle Virginia Ifta Tax Forms Printable on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to edit and eSign Virginia Ifta Tax Forms Printable effortlessly

- Obtain Virginia Ifta Tax Forms Printable and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Virginia Ifta Tax Forms Printable and ensure outstanding communication at every stage of the form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct virginia ifta tax forms printable

Create this form in 5 minutes!

How to create an eSignature for the virginia ifta tax forms printable

The way to make an eSignature for your PDF file online

The way to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The way to make an electronic signature from your mobile device

The way to make an electronic signature for a PDF file on iOS

The way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is IFTA and why is it important?

IFTA, or the International Fuel Tax Agreement, simplifies the reporting of fuel use by motor carriers operating in multiple jurisdictions. Understanding IFTA is crucial for ensuring compliance with tax regulations and avoiding penalties. Using airSlate SignNow can help streamline your IFTA documentation process, making it easier to manage your reports.

-

How can airSlate SignNow help with IFTA reporting?

airSlate SignNow provides an efficient way to eSign and send documents related to IFTA reporting. With its user-friendly interface, you can quickly gather signatures on your IFTA documents, ensuring timely submissions. This minimizes errors and helps maintain compliance with regulatory requirements.

-

What are the pricing options for using airSlate SignNow for IFTA documents?

airSlate SignNow offers various pricing plans tailored to meet the needs of businesses handling IFTA-related documentation. You can choose from options that range from basic to advanced features, ensuring you find a cost-effective solution. The transparent pricing ensures no hidden fees, making it easier to budget for your IFTA requirements.

-

Can I integrate airSlate SignNow with other tools for IFTA management?

Yes, airSlate SignNow integrates seamlessly with various applications that help manage IFTA records and reporting. This connectivity allows you to streamline your workflow by combining the eSigning capabilities of SignNow with data management tools. Integration enhances overall efficiency while dealing with your IFTA processes.

-

How secure is airSlate SignNow for handling IFTA documents?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive IFTA documents. The platform employs advanced encryption protocols to protect your data during transmission and storage. This ensures that your IFTA-related information remains confidential and secure.

-

Can I use airSlate SignNow on mobile devices for IFTA documentation?

Absolutely! airSlate SignNow is mobile-friendly, allowing you to manage your IFTA documents from anywhere. Whether you are on the road or at a client meeting, you can access and eSign your IFTA reports via mobile devices. This flexibility can enhance productivity and efficiency in your operations.

-

What benefits does airSlate SignNow provide for businesses handling IFTA?

By using airSlate SignNow for IFTA processes, businesses benefit from improved efficiency, cost-effectiveness, and enhanced compliance. The platform simplifies the documentation process, reducing turnaround times while minimizing the risk of errors. This results in a streamlined workflow, allowing you to focus more on your core business operations.

Get more for Virginia Ifta Tax Forms Printable

Find out other Virginia Ifta Tax Forms Printable

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation