538 Form 2018

What is the 538 Form

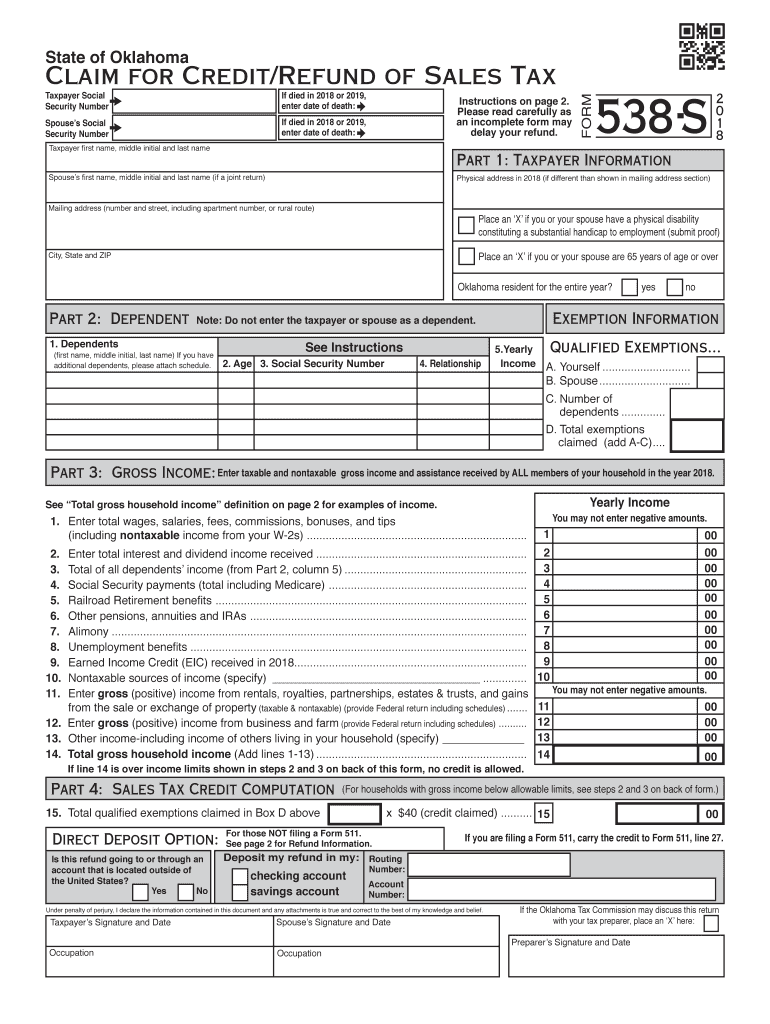

The 538 form, also known as the Oklahoma 538, is a tax document used by residents of Oklahoma to report various tax credits and refunds. This form is specifically designed for individuals seeking to claim the Oklahoma refund tax. It is essential for ensuring compliance with state tax regulations and for accurately calculating any potential refunds owed to taxpayers. Understanding the purpose and requirements of the 538 form is crucial for effective tax reporting.

Steps to complete the 538 Form

Completing the 538 form involves several key steps to ensure accuracy and compliance. Here’s a straightforward process to follow:

- Gather necessary documents, including income statements and previous tax returns.

- Fill out personal information, such as your name, address, and Social Security number.

- Report your income and any applicable deductions as required by the form.

- Calculate your tax credits and refunds based on the guidelines provided.

- Review the completed form for any errors or omissions.

- Sign and date the form before submission.

Legal use of the 538 Form

The 538 form is legally recognized by the Oklahoma Tax Commission, making it a valid document for claiming tax refunds. It is important to ensure that all information provided is accurate and truthful, as any discrepancies can lead to penalties or delays in processing. Utilizing the form in accordance with state laws helps protect taxpayers' rights and ensures compliance with tax obligations.

Filing Deadlines / Important Dates

Timely submission of the 538 form is crucial for taxpayers. The filing deadline typically aligns with the federal tax return deadline, which is usually April 15. However, it's important to verify specific dates for the current tax year, as they may vary. Filing on time helps avoid penalties and ensures that taxpayers receive any refunds promptly.

Form Submission Methods

The 538 form can be submitted through various methods to accommodate different preferences. Taxpayers can choose to file online using authorized e-filing services, which often provide a more streamlined process. Alternatively, the form can be mailed directly to the Oklahoma Tax Commission or submitted in person at designated locations. Each method has its own processing times and requirements, so it is advisable to choose the one that best suits your needs.

Required Documents

When completing the 538 form, certain documents are necessary to support your claims. These may include:

- W-2 forms from employers

- 1099 forms for other income sources

- Documentation for any tax credits being claimed

- Previous year’s tax return for reference

Having these documents ready will facilitate a smoother filing process and help ensure that all information is accurate.

Eligibility Criteria

To successfully file the 538 form, taxpayers must meet specific eligibility criteria. Generally, this includes being a resident of Oklahoma and having income that qualifies for the state refund tax. Additionally, individuals must ensure they are claiming the correct credits and that their income falls within the specified limits set by the Oklahoma Tax Commission. Understanding these criteria is essential for a successful filing.

Quick guide on how to complete physical address in 2018 if different than shown in mailing address section

Your assistance manual on how to prepare your 538 Form

If you’re curious about how to finalize and submit your 538 Form, here are a few straightforward guidelines to simplify your tax submission process.

To begin, you simply need to create your airSlate SignNow account to change how you manage documents online. airSlate SignNow is an extremely user-friendly and robust document solution that allows you to modify, draft, and finalize your tax forms effortlessly. With its editor, you can alternate between text, check boxes, and eSignatures and revisit to amend responses as necessary. Streamline your tax handling with advanced PDF editing, eSigning, and easy sharing.

Follow the instructions below to complete your 538 Form in just a few minutes:

- Establish your account and start working on PDFs within moments.

- Utilize our directory to access any IRS tax form; browse through versions and schedules.

- Click Get form to open your 538 Form in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Use the Sign Tool to insert your legally-valid eSignature (if required).

- Review your document and rectify any mistakes.

- Save changes, print your copy, submit it to your intended recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Note that submitting in paper form can increase error rates and delay refunds. Naturally, before e-filing your taxes, verify the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct physical address in 2018 if different than shown in mailing address section

FAQs

-

How do I build an automatic script to visit a mailbox URL, fill out the form and log in, and get a link address in the email (any OS system)?

Here is a good place to start with checking email with VB since that is a topic you put it under.Retrieve Email and Parse Email in VB.NET - Tutorial

-

What should I do if I have a different address on my Aadhar card than the one I filled in DU form as both current and permanent?

I guess DU will not accept your application. Check with DU will allow you to change the address

-

I had filed form 843 for refund of wrongly withheld Social Security taxes and Medicare taxes about 6 months back. I just realised that I mistakenly filled the wrong address in the column "Name and address shown on return if different from above". What should I do? Is that causing a delay in my refund?

You might want to contact them with a follow up letter, but, that isn't delay...843's can take quite a long time to get processed...I have some take 18 months.

-

How do I fill out a Form 10BA if I lived in two rented homes during the previous year as per the rent agreement? Which address and landlord should I mention in the form?

you should fill out the FORM 10BA, with detail of the rented house, for which you are paying more rent than other.To claim Section 80GG deduction, the following conditions must be fulfilled by the taxpayer:HRA Not Received from Employer:- The taxpayer must not have received any house rent allowance (HRA) from the employer.Not a Home Owner:- The taxpayer or spouse or minor child must not own a house property. In case of a Hindu Undivided Family (HUF), the HUF must not own a house property where the taxpayer resides.Form 10BA Declaration:- The taxpayer must file a declaration in Form 10BA that he/she has taken a residence on rent in the previous year and that he/she has no other residence.format of form-10BA:-https://www.webtel.in/Image/Form...Amount of Deduction under Section 80GG:-Maximum deduction under Section 80GG is capped at Rs.60,000. Normally, the deduction under Section 80GG is the lower of the following three amounts :-25% of Adjusted Total IncomeRent Paid minus 10% of Adjusted Total IncomeRs.5000 per Month

Create this form in 5 minutes!

How to create an eSignature for the physical address in 2018 if different than shown in mailing address section

How to create an eSignature for your Physical Address In 2018 If Different Than Shown In Mailing Address Section in the online mode

How to generate an electronic signature for your Physical Address In 2018 If Different Than Shown In Mailing Address Section in Google Chrome

How to make an electronic signature for putting it on the Physical Address In 2018 If Different Than Shown In Mailing Address Section in Gmail

How to create an electronic signature for the Physical Address In 2018 If Different Than Shown In Mailing Address Section from your smart phone

How to make an electronic signature for the Physical Address In 2018 If Different Than Shown In Mailing Address Section on iOS devices

How to generate an electronic signature for the Physical Address In 2018 If Different Than Shown In Mailing Address Section on Android OS

People also ask

-

What is the process for obtaining an ok refund tax with airSlate SignNow?

To obtain an ok refund tax with airSlate SignNow, you can streamline your document signing process. Simply upload your tax-related documents, send them for eSignature, and once signed, you can quickly submit your tax refund request. Our platform ensures a secure and efficient way to manage your tax documents.

-

How does airSlate SignNow ensure compliance for ok refund tax documents?

airSlate SignNow is designed with security and compliance in mind, ensuring that your ok refund tax documents meet all necessary regulations. We offer encryption and authentication features, so you can confidently sign and send your tax documents without worrying about their legality. Compliance is key, and our platform supports it fully.

-

Is airSlate SignNow cost-effective for managing ok refund tax?

Yes, airSlate SignNow provides an affordable solution for managing ok refund tax and other document-related tasks. Our pricing plans are designed to cater to businesses of all sizes, allowing you to save money while effectively managing your tax documents. Investing in our platform means investing in hassle-free eSigning capabilities.

-

What integrations does airSlate SignNow offer for tax document management?

airSlate SignNow integrates seamlessly with various accounting and tax software solutions, making it easier to manage your ok refund tax documents. These integrations ensure you can send, track, and manage your documents directly within the tools you already use. Improve your productivity with our effective integration options.

-

Can airSlate SignNow help speed up the process of receiving an ok refund tax?

Absolutely! airSlate SignNow accelerates the process of signing necessary documents for your ok refund tax. By allowing for real-time eSignatures, you can reduce downtime and expedite your tax refund submissions. Fast document processing ensures quicker results for tax-related tasks.

-

What features does airSlate SignNow offer for managing tax-related documents?

airSlate SignNow boasts a variety of features that simplify the management of tax-related documents, including templates, reminders, and real-time tracking. By using these features for your ok refund tax documents, you can save time and ensure you never miss important deadlines. Efficiency is built into our platform.

-

Is it easy to learn how to use airSlate SignNow for ok refund tax purposes?

Yes, airSlate SignNow is user-friendly and intuitive, making it easy to learn how to use for your ok refund tax needs. Our comprehensive support resources, including tutorials and customer service, are available to help you get started quickly. Efficient use of our platform leads to quick turnaround on your tax documents.

Get more for 538 Form

- The mysterious benedict society pdf form

- Mewp pre use inspection checklist form

- Oil disposal log sheet form

- Members data amendment form

- Qualified plan beneficiary designation fidelity investments bowdoin form

- Nh district division rule 1 3d form

- Tenant release form 24359812

- Film investment contract template form

Find out other 538 Form

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form