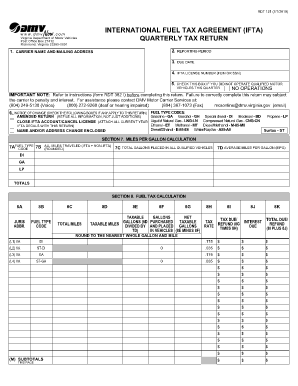

Rdt 121 2021-2026

What is the IFTA Quarters?

The International Fuel Tax Agreement (IFTA) is an agreement among U.S. states and Canadian provinces to simplify the reporting of fuel use by motor carriers that operate in multiple jurisdictions. IFTA quarters refer to the specific quarterly periods during which carriers must report their fuel use and pay taxes accordingly. These quarters are typically aligned with the calendar year, consisting of four reporting periods: January to March, April to June, July to September, and October to December. Each quarter requires carriers to file an IFTA tax return detailing their fuel consumption and miles traveled in each jurisdiction.

Steps to Complete the IFTA Quarters

Completing the IFTA quarters involves several key steps that ensure compliance with reporting requirements. First, gather all necessary records of fuel purchases and mileage traveled in each jurisdiction. This includes receipts, fuel logs, and any other documentation that supports your fuel usage claims. Next, calculate the total gallons of fuel purchased and the total miles driven in each state or province. After compiling this data, you can fill out the IFTA tax return, which typically includes sections for reporting fuel consumption, mileage, and tax owed. Finally, submit the completed return by the specified deadline to avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for IFTA quarters are crucial for maintaining compliance and avoiding penalties. Generally, the due date for filing quarterly IFTA returns is the last day of the month following the end of each quarter. For example, returns for the first quarter (January to March) are due by April 30. It is essential to be aware of these deadlines to ensure timely submission. Additionally, some jurisdictions may have specific rules regarding late filings or extensions, so checking with your local tax authority is advisable.

Legal Use of the IFTA Quarters

The legal use of IFTA quarters is governed by the regulations set forth in the IFTA agreement. Carriers are required to accurately report fuel consumption and mileage to ensure fair taxation across jurisdictions. Failure to comply with these regulations can result in penalties, including fines and potential audits. It is important for carriers to maintain accurate records and understand their obligations under IFTA to avoid legal issues. Compliance with IFTA not only supports fair tax distribution but also simplifies the reporting process for carriers operating in multiple states.

Required Documents

To complete the IFTA quarters, several documents are essential. Carriers should maintain detailed records of their fuel purchases, including receipts that indicate the date, location, and amount of fuel purchased. Additionally, mileage logs that track the distance traveled in each jurisdiction are necessary. These documents serve as the foundation for the calculations needed to complete the IFTA tax return. Keeping accurate and organized records will facilitate the filing process and support compliance with IFTA regulations.

Penalties for Non-Compliance

Non-compliance with IFTA reporting requirements can lead to significant penalties for carriers. These penalties may include monetary fines, interest on unpaid taxes, and even the suspension of IFTA credentials. The severity of penalties often depends on the nature of the non-compliance, such as failure to file on time or inaccuracies in reporting. It is crucial for carriers to understand these consequences and take proactive steps to ensure timely and accurate filings to avoid financial repercussions.

Quick guide on how to complete rdt 121

Complete Rdt 121 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can access the required format and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents rapidly without delays. Manage Rdt 121 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Rdt 121 with ease

- Locate Rdt 121 and select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight relevant portions of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your updates.

- Select how you prefer to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, cumbersome form searches, or errors that require printing new document copies. airSlate SignNow meets your needs in document management with just a few clicks from any device you choose. Edit and eSign Rdt 121 and guarantee outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct rdt 121

Create this form in 5 minutes!

How to create an eSignature for the rdt 121

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are IFTA quarters, and why are they important?

IFTA quarters refer to the quarterly reporting periods under the International Fuel Tax Agreement (IFTA), which simplifies fuel tax reporting for trucking companies operating across multiple states. It's important for businesses to accurately track their fuel usage and miles traveled in each jurisdiction to ensure compliance and avoid penalties. Understanding IFTA quarters helps streamline the reporting process and ensures that businesses can stay up-to-date with their fuel tax obligations.

-

How does airSlate SignNow assist with IFTA quarter filings?

AirSlate SignNow offers a user-friendly platform that allows businesses to automate and manage their IFTA quarter documents efficiently. By using our eSignature capabilities, businesses can quickly obtain necessary approvals and ensure that their IFTA quarter filings are submitted accurately and on time. This not only saves time but also reduces the risk of errors in the reporting process.

-

What features does airSlate SignNow provide for managing IFTA quarters?

AirSlate SignNow includes features like customizable templates for IFTA filings, real-time tracking of document status, and secure cloud storage for all your IFTA quarter-related documents. These features enhance organization and accessibility, making it easier for trucking companies to manage their IFTA compliance needs. Additionally, the platform's ease of use helps streamline the process of completing and signing necessary paperwork.

-

Is there a cost associated with using airSlate SignNow for IFTA quarters?

Yes, airSlate SignNow offers multiple pricing plans to cater to the needs of different businesses, including options that are budget-friendly for smaller companies dealing with IFTA quarters. Each plan provides access to essential features, ensuring that users can manage their IFTA documentation without compromising quality or service. To find a plan that suits your needs, please visit our pricing page.

-

Can I integrate airSlate SignNow with my existing software for IFTA management?

Absolutely! AirSlate SignNow provides integration options with various software systems commonly used for managing IFTA quarters and trucking operations. This allows for seamless data transfer and workflow management, enhancing efficiency and reducing the risk of manual entry errors. Check our integrations page for a list of compatible applications.

-

What are the benefits of using airSlate SignNow for IFTA quarter compliance?

Using airSlate SignNow for IFTA quarter compliance brings several benefits, including increased accuracy in reporting, faster document turnaround times, and improved document security. Our platform also minimizes the paperwork burden by digitizing your forms and leveraging eSignatures. As a result, you can focus more on your core business operations while maintaining compliance with IFTA regulations.

-

How do I get started with airSlate SignNow for my IFTA quarters?

Getting started with airSlate SignNow for your IFTA quarters is easy! Simply sign up for an account on our website, and you’ll have access to our comprehensive features for document management and eSigning. From there, you can begin creating templates for your IFTA filings and invite team members to collaborate in real-time. Our support team is also available to help you with the onboarding process.

Get more for Rdt 121

- Application for special permit for social affair sa nj form

- Notice of change in terms of tenancy pdf 81416550 form

- It 237 instructions form

- Promissory note sample form

- Vdss forms 032 05 0602 00 eng

- Form 100x amended corporation franchise or income tax return

- Shared space agreement template form

- Shared service agreement template form

Find out other Rdt 121

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast

- Can I Sign Virginia Business Letter Template

- Can I Sign Ohio Startup Costs Budget Worksheet

- How Do I Sign Maryland 12 Month Sales Forecast

- How Do I Sign Maine Profit and Loss Statement

- How To Sign Wisconsin Operational Budget Template