INTERNATIONAL FUEL TAX AGREEMENT IFTA Virginia 2020

What is the International Fuel Tax Agreement (IFTA) in Virginia

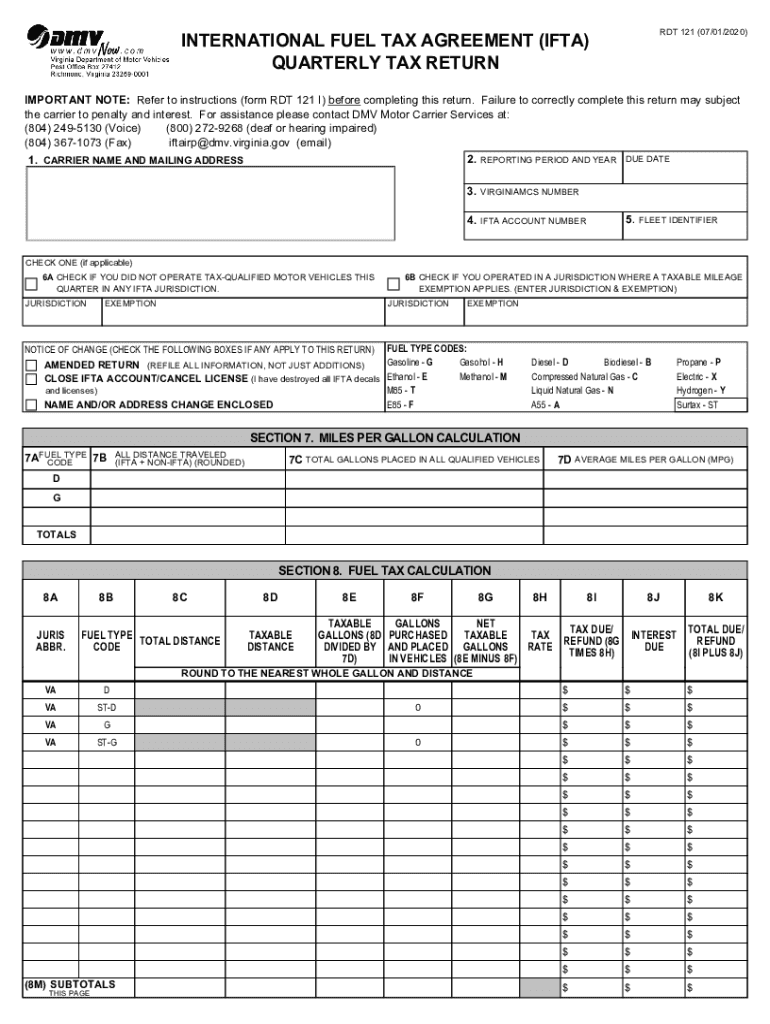

The International Fuel Tax Agreement (IFTA) is a cooperative agreement among U.S. states and Canadian provinces that simplifies the reporting of fuel use by motor carriers operating in multiple jurisdictions. In Virginia, IFTA allows businesses to report fuel taxes on a quarterly basis, streamlining the process for carriers who travel across state lines. This agreement is essential for ensuring that fuel taxes are distributed fairly among the jurisdictions where fuel is consumed.

Steps to Complete the International Fuel Tax Agreement (IFTA) in Virginia

Completing the IFTA in Virginia involves several key steps to ensure compliance and accuracy. First, gather all necessary documentation, including fuel purchase receipts and mileage logs. Next, calculate the total miles traveled in each jurisdiction and the total gallons of fuel purchased. Use this information to complete the IFTA quarterly report form accurately. After filling out the form, review it for any errors before submitting it to the Virginia Department of Motor Vehicles (DMV) by the specified deadline.

Filing Deadlines / Important Dates for IFTA in Virginia

In Virginia, the IFTA filing deadlines are crucial for maintaining compliance. The quarterly reports are due on the last day of the month following the end of each quarter. Specifically, the deadlines are April 30 for the first quarter, July 31 for the second quarter, October 31 for the third quarter, and January 31 for the fourth quarter. It is important to adhere to these deadlines to avoid penalties and ensure timely tax payments.

Legal Use of the International Fuel Tax Agreement (IFTA) in Virginia

The legal use of IFTA in Virginia requires adherence to specific regulations and guidelines set forth by both state and federal authorities. Carriers must maintain accurate records of fuel purchases and mileage to substantiate their IFTA filings. Failure to comply with IFTA regulations can result in penalties, including fines and potential audits. Understanding these legal requirements is essential for businesses operating in multiple jurisdictions.

Required Documents for IFTA in Virginia

To successfully complete the IFTA filing process in Virginia, several documents are required. These include:

- Fuel purchase receipts

- Mileage logs detailing distance traveled in each jurisdiction

- Previous IFTA quarterly reports

- Any relevant correspondence from the Virginia DMV

Having these documents organized and accessible will facilitate a smoother filing process.

Penalties for Non-Compliance with IFTA in Virginia

Non-compliance with IFTA regulations can lead to severe consequences for businesses operating in Virginia. Penalties may include fines, interest on unpaid taxes, and potential audits by state authorities. Additionally, repeated non-compliance can result in the revocation of IFTA credentials, limiting a carrier's ability to operate across state lines. It is crucial for businesses to stay informed about their filing requirements and deadlines to avoid these penalties.

Quick guide on how to complete international fuel tax agreement ifta virginia

Effortlessly prepare INTERNATIONAL FUEL TAX AGREEMENT IFTA Virginia on any device

Digital document management has gained popularity among businesses and individuals. It presents an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Manage INTERNATIONAL FUEL TAX AGREEMENT IFTA Virginia on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to edit and electronically sign INTERNATIONAL FUEL TAX AGREEMENT IFTA Virginia with ease

- Locate INTERNATIONAL FUEL TAX AGREEMENT IFTA Virginia and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and electronically sign INTERNATIONAL FUEL TAX AGREEMENT IFTA Virginia and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct international fuel tax agreement ifta virginia

Create this form in 5 minutes!

How to create an eSignature for the international fuel tax agreement ifta virginia

The way to make an eSignature for your PDF in the online mode

The way to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature from your smart phone

The way to make an electronic signature for a PDF on iOS devices

The way to make an electronic signature for a PDF file on Android OS

People also ask

-

What are IFTA quarters and how do they affect my business?

IFTA quarters refer to the quarterly reporting periods for the International Fuel Tax Agreement. Businesses engaged in interstate travel must file their fuel tax reports during these quarters. Properly managing your IFTA quarters ensures compliance and can help avoid costly penalties, making it vital for your operations.

-

How does airSlate SignNow help with IFTA quarter submissions?

AirSlate SignNow streamlines the process of preparing and submitting IFTA quarter documents. With our eSigning capabilities, you can easily sign and send your tax documents online, ensuring timely and accurate submissions. This helps you focus on your business instead of the paperwork.

-

What are the pricing options for using airSlate SignNow for IFTA quarters?

AirSlate SignNow offers various pricing plans to suit different business needs. Whether you're a small business or a large enterprise, our cost-effective solution supports efficient management of your IFTA quarters at a reasonable price. You can choose a plan based on your expected volume of transactions.

-

Can I integrate airSlate SignNow with my accounting software for IFTA reporting?

Yes, airSlate SignNow offers seamless integrations with numerous accounting platforms. This allows you to efficiently manage your IFTA quarters by automatically transferring data between systems, reducing the risk of errors in your reporting. This integration enhances your overall workflow and efficiency.

-

What benefits does electronic signing provide for IFTA quarter reports?

Electronic signing with airSlate SignNow provides several benefits for IFTA quarter reports, including faster turnaround times, reduced paperwork, and improved organization. By using eSignatures, you can ensure that reports are signed and submitted quickly, meeting your deadlines without the hassle of printing and scanning.

-

How does airSlate SignNow ensure the security of my IFTA quarter documents?

AirSlate SignNow employs advanced security features such as encryption, secure storage, and access controls to protect your IFTA quarter documents. This ensures that sensitive information remains confidential and secure while you manage your tax reporting obligations. Our platform is compliant with industry security standards.

-

Is training available for using airSlate SignNow for IFTA quarters?

Yes, airSlate SignNow provides comprehensive training resources to help users effectively manage their IFTA quarters. Our tutorials, webinars, and customer support ensure you can maximize the use of our platform, enabling you to file your fuel tax reports confidently and efficiently.

Get more for INTERNATIONAL FUEL TAX AGREEMENT IFTA Virginia

- Abstract of offers construction gsagov form

- Abstract of offers construction continuation sheet gsa form

- Omb control number for this collection is 9000 0075 form

- Send only comments relating to our time estimate including suggestions for reducing this burden or any other aspects of this form

- Dd form 1432contract data requirements list form

- You do not need to answer form

- Determination of surplus excess real property gsa form

- Clearance record form

Find out other INTERNATIONAL FUEL TAX AGREEMENT IFTA Virginia

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer