Nrcs Cpa 1236 Form 2010

What is the NRCS CPA-1236 Form

The NRCS CPA-1236 form is a crucial document used within the United States for conservation program applications. Specifically, it is utilized by landowners and producers who wish to apply for financial assistance from the Natural Resources Conservation Service (NRCS). This form helps facilitate the assessment of conservation practices that can be implemented on agricultural land to improve environmental quality and sustainability. By completing the CPA-1236, applicants provide essential information regarding their land and the conservation measures they intend to adopt.

How to Use the NRCS CPA-1236 Form

Using the NRCS CPA-1236 form involves several steps to ensure proper completion and submission. First, gather all necessary information about your land and the conservation practices you wish to implement. Next, carefully fill out the form, ensuring that all sections are completed accurately. It is important to provide detailed descriptions of the conservation practices and any relevant land management information. Once completed, submit the form to your local NRCS office, either electronically or by mail, depending on your preference and the office's submission guidelines.

Steps to Complete the NRCS CPA-1236 Form

Completing the NRCS CPA-1236 form requires attention to detail. Follow these steps for a successful submission:

- Review the form thoroughly to understand all required sections.

- Gather relevant documentation, such as land ownership details and previous conservation practices.

- Fill out the form, ensuring all information is accurate and complete.

- Double-check your entries for any errors or omissions.

- Submit the completed form to your local NRCS office, adhering to their submission guidelines.

Legal Use of the NRCS CPA-1236 Form

The NRCS CPA-1236 form holds legal significance as it serves as a formal application for federal financial assistance. When completed and submitted correctly, it initiates a legal process for obtaining support for conservation practices. It is essential that applicants understand the legal implications of the information provided, as inaccuracies or misrepresentations can lead to penalties or denial of assistance. Compliance with all applicable regulations is crucial to ensure the validity of the application.

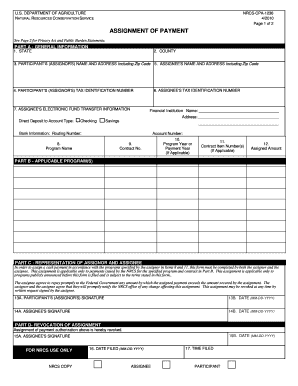

Key Elements of the NRCS CPA-1236 Form

Several key elements must be included in the NRCS CPA-1236 form to ensure its effectiveness:

- Applicant Information: Personal details of the landowner or producer applying for assistance.

- Land Description: Information about the land, including location, size, and current use.

- Conservation Practices: Detailed descriptions of the proposed conservation practices and their expected benefits.

- Signature: The applicant's signature is required to validate the submission.

Form Submission Methods

The NRCS CPA-1236 form can be submitted through various methods, providing flexibility for applicants. Options include:

- Online Submission: Many local NRCS offices accept electronic submissions through their designated platforms.

- Mail: Applicants can print the completed form and send it via postal service to their local NRCS office.

- In-Person Submission: Some applicants may prefer to deliver the form directly to their local NRCS office for immediate processing.

Quick guide on how to complete nrcs cpa 1236 form

Effortlessly Prepare Nrcs Cpa 1236 Form on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any delays. Manage Nrcs Cpa 1236 Form on any device with the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to Modify and eSign Nrcs Cpa 1236 Form with Ease

- Obtain Nrcs Cpa 1236 Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the document or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Verify the information and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Nrcs Cpa 1236 Form to ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nrcs cpa 1236 form

Create this form in 5 minutes!

How to create an eSignature for the nrcs cpa 1236 form

The way to create an eSignature for a PDF file online

The way to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The way to make an electronic signature from your mobile device

The best way to generate an eSignature for a PDF file on iOS

The way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is the nrcs cpa 1236 form and why is it important?

The nrcs cpa 1236 form is a key document used in Natural Resources Conservation Service programs, crucial for ensuring compliance and eligibility for conservation-related assistance. Understanding this form helps you navigate regulations effectively and maximize your funding opportunities.

-

How can airSlate SignNow simplify the process of filling out the nrcs cpa 1236 form?

airSlate SignNow provides a user-friendly platform that allows you to easily fill out and eSign the nrcs cpa 1236 form digitally. This streamlines the submission process, reduces paperwork, and ensures that your documents are securely stored and readily accessible.

-

What are the pricing options for using airSlate SignNow for the nrcs cpa 1236 form?

AirSlate SignNow offers competitive pricing plans that cater to various needs, whether you're an individual or a business looking to manage the nrcs cpa 1236 form effectively. You can start with a free trial to experience the platform before committing to a subscription.

-

What features does airSlate SignNow offer for managing the nrcs cpa 1236 form?

With airSlate SignNow, you get features like customizable templates, secure storage, real-time tracking, and automated reminders for the nrcs cpa 1236 form. These functionalities help enhance efficiency, ensuring that all your documents are processed smoothly.

-

Is it easy to integrate airSlate SignNow with other tools when handling the nrcs cpa 1236 form?

Yes, airSlate SignNow offers seamless integrations with various applications and services, making it easy to manage the nrcs cpa 1236 form within your existing workflow. This flexibility allows you to connect tools like CRM systems and cloud storage for enhanced productivity.

-

What are the benefits of eSigning the nrcs cpa 1236 form using airSlate SignNow?

eSigning the nrcs cpa 1236 form with airSlate SignNow enhances speed and efficiency in your document management. It eliminates the need for printing and scanning, ensuring that you can complete transactions swiftly while maintaining legal compliance and security.

-

Can I track the status of my nrcs cpa 1236 form when using airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking features that allow you to monitor the status of your nrcs cpa 1236 form. You can receive notifications when documents are viewed, signed, or completed, giving you full visibility throughout the process.

Get more for Nrcs Cpa 1236 Form

- Educational improvement grant application new brunswick form

- Employment application form borang permohonan jawatan

- Chfskygovdmsprovenrrevalidation 2018 2019 form

- V756 2018 2019 form

- Welcome to the peccole plaza clinic dignityhealth form

- Seller survey keller williams realty form

- Limited liability company authorization resolution form

- Illinois state police form

Find out other Nrcs Cpa 1236 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors