Illinois Certification for Exemption from E Filing Form

What is the Illinois Certification For Exemption From E Filing

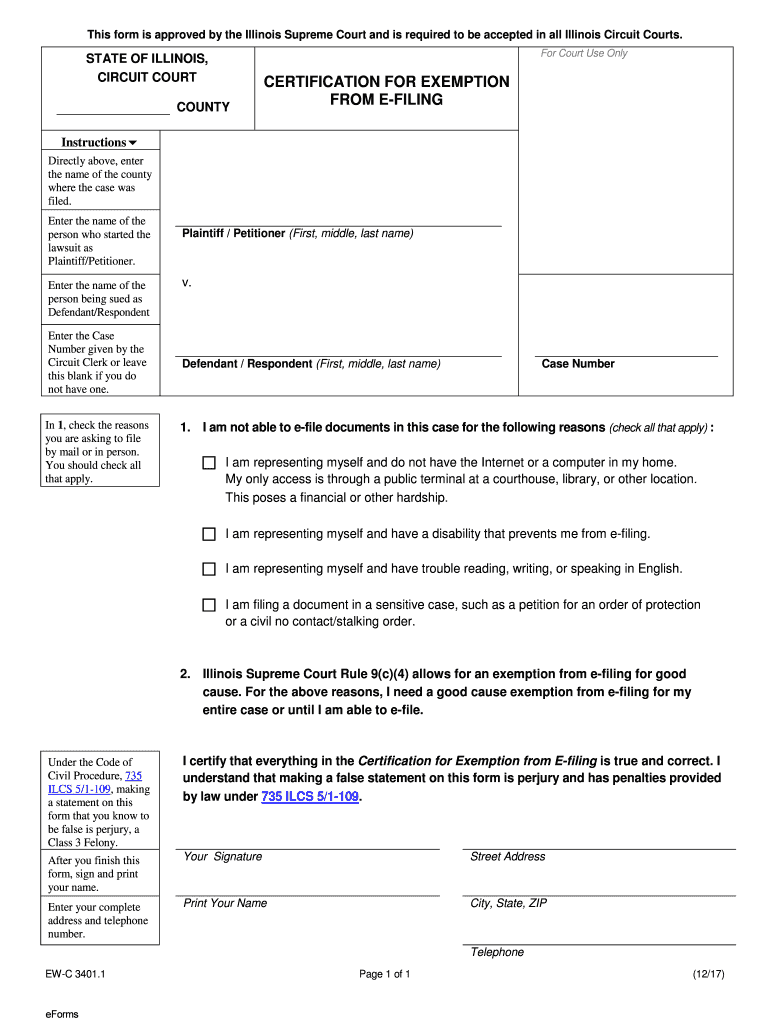

The Illinois Certification For Exemption From E Filing is a formal document that allows certain taxpayers to be exempt from the requirement of electronically filing their tax returns. This certification is particularly relevant for individuals and businesses that may face challenges in meeting e-filing requirements due to specific circumstances. Understanding the criteria for exemption is essential for ensuring compliance with Illinois tax regulations.

How to Use the Illinois Certification For Exemption From E Filing

To use the Illinois Certification For Exemption From E Filing, taxpayers must first determine their eligibility based on the criteria outlined by the Illinois Department of Revenue. Once eligibility is confirmed, the form must be completed accurately, providing all required information. After filling out the form, it should be submitted according to the instructions provided, which may include mailing or submitting it in person to the appropriate tax authority.

Steps to Complete the Illinois Certification For Exemption From E Filing

Completing the Illinois Certification For Exemption From E Filing involves several key steps:

- Gather necessary information, including your tax identification number and relevant financial details.

- Download or obtain the certification form from the Illinois Department of Revenue.

- Fill out the form carefully, ensuring all sections are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the completed form as directed, either by mail or in person.

Key Elements of the Illinois Certification For Exemption From E Filing

The key elements of the Illinois Certification For Exemption From E Filing include the taxpayer's identification information, the reason for the exemption, and any supporting documentation required. It is crucial to provide accurate and complete information to avoid delays or issues with the exemption process. Additionally, understanding the specific reasons for exemption can help ensure that the application aligns with the regulations set forth by the state.

Eligibility Criteria

Eligibility for the Illinois Certification For Exemption From E Filing typically includes specific conditions such as age, income level, or particular circumstances that may prevent e-filing. Common examples of eligible taxpayers include those who are elderly, disabled, or have limited access to technology. It is important to review the eligibility criteria carefully to determine if you qualify for this exemption.

Form Submission Methods

The Illinois Certification For Exemption From E Filing can be submitted through various methods. Taxpayers may choose to mail the completed form to the designated address provided by the Illinois Department of Revenue. Alternatively, in-person submission may be available at local tax offices. It is essential to follow the submission guidelines to ensure timely processing of the exemption request.

Legal Use of the Illinois Certification For Exemption From E Filing

The legal use of the Illinois Certification For Exemption From E Filing is governed by state tax laws. This form serves as a formal declaration of a taxpayer's eligibility for exemption from e-filing requirements. Proper use of this certification helps ensure compliance with Illinois tax regulations and protects the taxpayer's rights. Failure to use the form correctly may result in penalties or the denial of the exemption request.

Quick guide on how to complete illinois certification for exemption from e filing

Complete Illinois Certification For Exemption From E Filing with ease on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to access the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without any delays. Handle Illinois Certification For Exemption From E Filing on any device using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to modify and eSign Illinois Certification For Exemption From E Filing effortlessly

- Locate Illinois Certification For Exemption From E Filing and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invite link, or downloading it to your computer.

Forget about lost or misfiled documents, cumbersome form searches, or errors that require new document prints. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Alter and eSign Illinois Certification For Exemption From E Filing to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the illinois certification for exemption from e filing

The way to make an eSignature for your PDF in the online mode

The way to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature from your smart phone

The way to make an electronic signature for a PDF on iOS devices

The way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is Illinois Certification For Exemption From E Filing?

The Illinois Certification For Exemption From E Filing is a legal document that allows certain businesses to avoid mandatory electronic filing with the state. This certification can benefit organizations that may not have the resources or technology to comply with e-filing requirements. Understanding this certification is crucial for businesses operating in Illinois.

-

Who qualifies for Illinois Certification For Exemption From E Filing?

Generally, individuals and businesses that have specific limitations due to their circumstances, such as small filing volumes or financial constraints, may qualify for Illinois Certification For Exemption From E Filing. It's essential to check the eligibility criteria set by the Illinois Secretary of State to ensure compliance. Consulting with a professional may also be helpful.

-

How do I apply for Illinois Certification For Exemption From E Filing?

To apply for the Illinois Certification For Exemption From E Filing, you need to complete the designated application form provided by the state's Department of Revenue. This form requires specific information about your business and the reason for exemption. After submission, ensure you keep a copy for your records and check on the processing status.

-

What are the benefits of using airSlate SignNow for Illinois Certification For Exemption From E Filing?

Using airSlate SignNow simplifies the process of managing your Illinois Certification For Exemption From E Filing documents. Our platform ensures secure electronic signing and easy document organization, streamlining your workflow. Additionally, the cost-effective solution can save you time and resources while maintaining compliance with state regulations.

-

Is airSlate SignNow compliant with Illinois Certification For Exemption From E Filing?

Yes, airSlate SignNow is fully compliant with the requirements for Illinois Certification For Exemption From E Filing. Our platform adheres to legal e-signature standards, ensuring that your documents meet state regulations. This compliance gives users peace of mind when handling sensitive legal documents.

-

What integrations does airSlate SignNow offer for managing Illinois Certification For Exemption From E Filing?

airSlate SignNow offers a variety of integrations that enhance the management of Illinois Certification For Exemption From E Filing. It seamlessly connects with popular software such as Google Drive, Salesforce, and Dropbox, allowing you to store and manage documents efficiently. This flexibility improves collaboration and document accessibility.

-

How much does airSlate SignNow cost for businesses seeking Illinois Certification For Exemption From E Filing?

airSlate SignNow offers a range of pricing plans tailored for different business sizes, providing an affordable option for managing your Illinois Certification For Exemption From E Filing. Pricing typically depends on the number of users and features required. Visit our website for detailed pricing information and to find a plan that suits your needs.

Get more for Illinois Certification For Exemption From E Filing

- No administration necessary 2016 2019 form

- Ils prob 48a request for net worth statement and financial records form

- Landlord tenant and michigan courts form

- Uniform child order 2014 2018

- Pc 639 petition for appointment of conservator michigan courts courts mi form

- Mc 315 authorization 2017 2019 form

- Parenting plan missouri 2018 2019 form

- Warrant to satisfy judgment nj judiciary form

Find out other Illinois Certification For Exemption From E Filing

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free