Ohio it 1040 2019

What is the Ohio IT 1040?

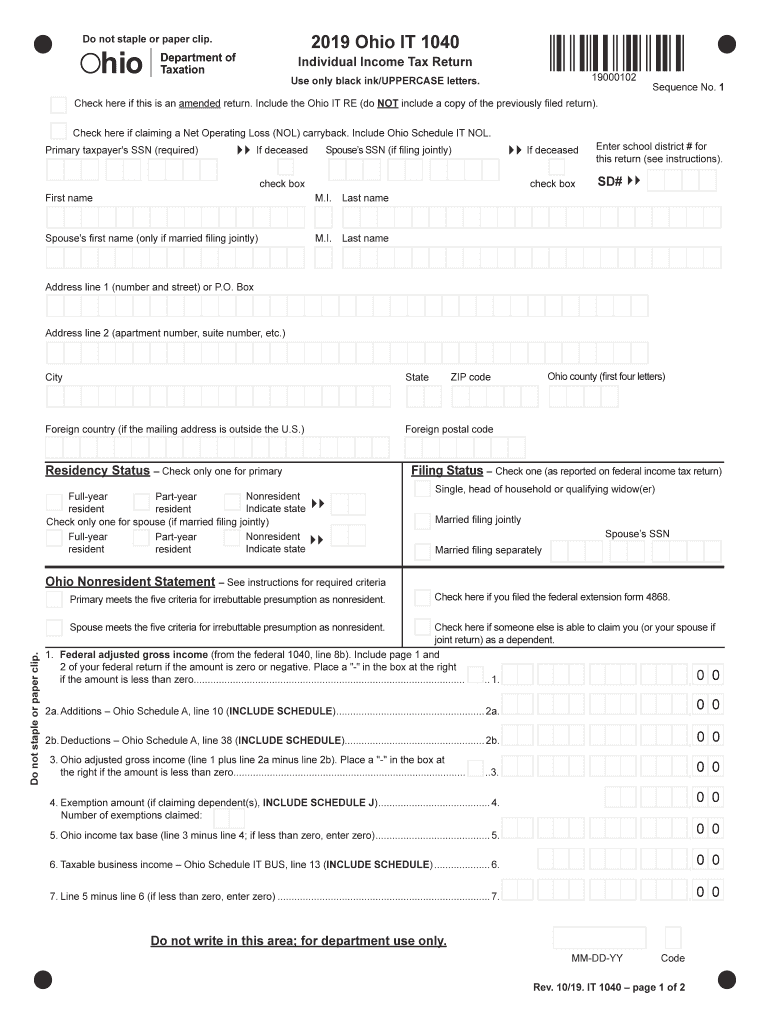

The Ohio IT 1040 is the state's individual income tax return form used by residents to report their income and calculate their tax liability. This form is essential for individuals who earn income in Ohio and need to comply with state tax regulations. It captures various types of income, including wages, salaries, and interest, and allows taxpayers to claim deductions and credits applicable to their situation. Understanding the Ohio IT 1040 is crucial for ensuring accurate reporting and compliance with state tax laws.

Steps to Complete the Ohio IT 1040

Completing the Ohio IT 1040 involves several steps to ensure accuracy and compliance. Start by gathering all necessary documents, such as W-2s and 1099s, which detail your income. Next, fill out the form with your personal information, including your Social Security number and filing status. Report all sources of income and apply any eligible deductions or credits. After completing the form, review it carefully for any errors before submitting it. Finally, choose your submission method: online, by mail, or in person, ensuring that you meet the filing deadline.

How to Obtain the Ohio IT 1040

The Ohio IT 1040 form can be easily obtained through the Ohio Department of Taxation website. You can download a printable version of the form in PDF format. Additionally, many tax preparation software programs include the Ohio IT 1040, allowing for electronic completion and submission. If you prefer a physical copy, you may also visit local tax offices or libraries that provide tax forms. Ensuring you have the correct version for the tax year is important for accurate filing.

Legal Use of the Ohio IT 1040

The Ohio IT 1040 is legally binding when completed and submitted according to state regulations. To ensure its validity, all required fields must be filled out accurately, and the form must be signed by the taxpayer. Electronic submissions are recognized as legally valid under the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). It is important to retain a copy of the submitted form and any supporting documentation for your records.

Filing Deadlines / Important Dates

Filing deadlines for the Ohio IT 1040 typically align with the federal tax deadlines. For most taxpayers, the deadline to file is April 15 of the following year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers should also be aware of any extensions they may qualify for, which can provide additional time to file their returns. Keeping track of these important dates is essential to avoid penalties and interest on unpaid taxes.

Required Documents

When preparing to file the Ohio IT 1040, certain documents are necessary to ensure accurate reporting. These include:

- W-2 forms from employers detailing wages and tax withheld

- 1099 forms for any freelance or contract work

- Documentation for any additional income sources

- Records of deductions and credits, such as receipts for charitable contributions or medical expenses

- Previous year's tax return for reference

Having these documents organized will streamline the completion process and help ensure compliance with state tax laws.

Quick guide on how to complete complete and file an ohio income tax amendment online

Effortlessly Prepare Ohio It 1040 on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a perfect environmentally friendly substitute for traditional printed and signed documents, allowing you to easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly, without any hold-ups. Manage Ohio It 1040 on any device using the airSlate SignNow apps for Android or iOS, and simplify any document-related tasks today.

The Simplest Method to Edit and eSign Ohio It 1040 Effortlessly

- Find Ohio It 1040 and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or mask sensitive information with the tools specifically designed for this purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to finalize your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any chosen device. Edit and eSign Ohio It 1040 to ensure excellent communication at every step of your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct complete and file an ohio income tax amendment online

Create this form in 5 minutes!

How to create an eSignature for the complete and file an ohio income tax amendment online

How to generate an electronic signature for your Complete And File An Ohio Income Tax Amendment Online online

How to create an electronic signature for the Complete And File An Ohio Income Tax Amendment Online in Chrome

How to generate an electronic signature for signing the Complete And File An Ohio Income Tax Amendment Online in Gmail

How to make an electronic signature for the Complete And File An Ohio Income Tax Amendment Online from your mobile device

How to create an eSignature for the Complete And File An Ohio Income Tax Amendment Online on iOS

How to make an electronic signature for the Complete And File An Ohio Income Tax Amendment Online on Android devices

People also ask

-

What is the ohio it 1040 2018 form?

The ohio it 1040 2018 form is used by residents of Ohio to file their state income taxes. It includes crucial information such as income, deductions, and credits specific to the 2018 tax year. Completing this form accurately ensures compliance and helps in receiving potential refunds.

-

How can airSlate SignNow help with ohio it 1040 2018 filings?

airSlate SignNow streamlines the process of completing and eSigning the ohio it 1040 2018 form. With our platform, you can easily upload, send, and sign documents without the hassle of paper forms. This efficiency can save you time and reduce potential filing errors.

-

What are the pricing options for using airSlate SignNow for ohio it 1040 2018?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Each plan includes essential features for sending and eSigning documents, including the necessary functionalities for ohio it 1040 2018 filings. We also provide a free trial to explore our services with no commitment.

-

Are there integrations available for airSlate SignNow when filing ohio it 1040 2018?

Yes, airSlate SignNow integrates seamlessly with various applications and tools that many businesses already use. This means you can enhance your workflow by connecting to CRM systems, cloud storage, and accounting software, making handling the ohio it 1040 2018 form even more efficient.

-

What features does airSlate SignNow offer that benefit ohio it 1040 2018 filers?

airSlate SignNow provides features such as customizable templates, real-time tracking, and secure storage to benefit those filing the ohio it 1040 2018 form. These features help ensure that all necessary documentation is easily accessible and securely stored throughout the filing process.

-

How secure is airSlate SignNow when handling ohio it 1040 2018 documents?

Security is a top priority for airSlate SignNow. Our platform uses encryption and secure cloud storage to protect your sensitive data, including the ohio it 1040 2018 documents. You can confidently eSign and share your tax documents without worrying about unauthorized access.

-

Can I use airSlate SignNow for multiple years of ohio it 1040 filings?

Absolutely! airSlate SignNow allows you to manage and eSign documents for multiple years, including the ohio it 1040 2018 filings. This capability is beneficial for individuals or businesses that need to keep track of their tax filings across several years seamlessly.

Get more for Ohio It 1040

- Ocfs 6001 pdf form

- Lic 702 1999 form

- Nh statement form

- Physical assessment form seating matters

- System character sheet form

- Bed bug inspection report master pest control form

- Appointment of agent to control disposition form aldine funeral

- Cumulative standardized review spelling test grade 3 lessons 18 svusd form

Find out other Ohio It 1040

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free