Cib Forms Nyc 2019

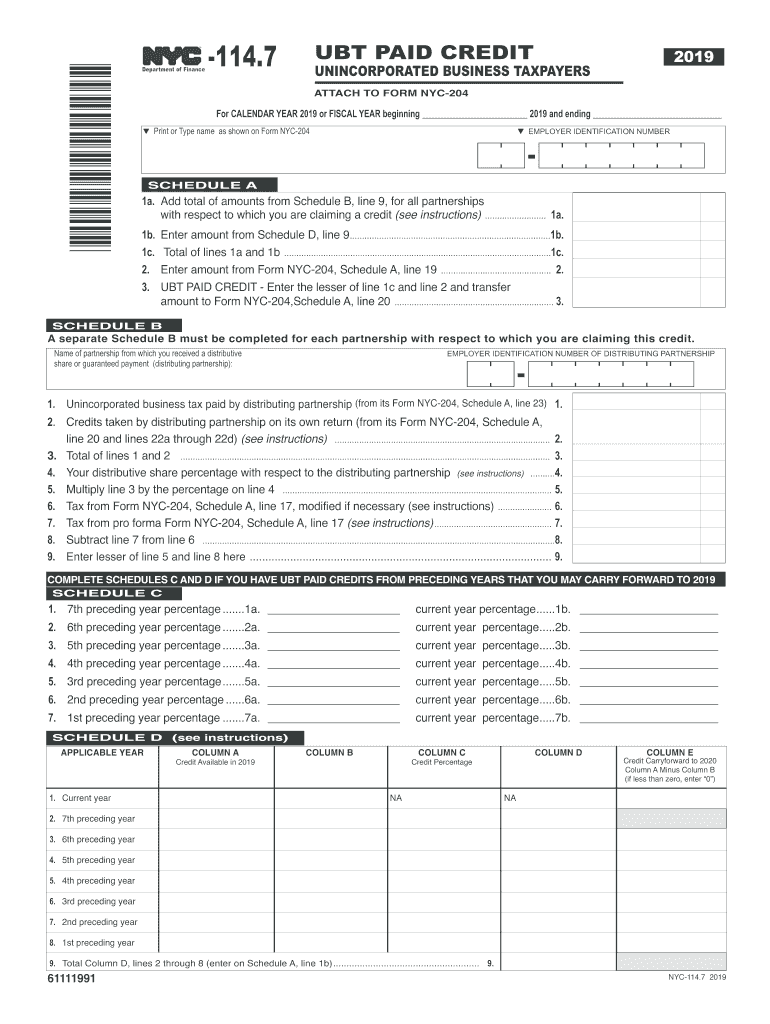

What is the NYC 114-7 Form?

The NYC 114-7 form, also known as the Unincorporated Business Tax (UBT) form, is a tax document required for businesses operating in New York City that are not incorporated. This form is utilized to report income and calculate the tax owed to the city. It is essential for sole proprietors and partnerships to ensure compliance with local tax regulations. The NYC 114-7 instructions for 2022 provide detailed guidance on how to accurately fill out and submit this form.

Steps to Complete the NYC 114-7 Form

Filling out the NYC 114-7 form involves several key steps:

- Gather necessary financial documents, including income statements and expense records.

- Fill out the identification section with your business name, address, and tax identification number.

- Report your gross income and allowable deductions as specified in the instructions.

- Calculate your tax liability based on the provided tax rates.

- Review the form for accuracy before submission.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the NYC 114-7 form. Typically, the form is due on the fifteenth day of the fourth month following the end of your tax year. For most businesses operating on a calendar year, this means the deadline is April 15. Late submissions may incur penalties, so timely filing is essential.

Required Documents for NYC 114-7 Submission

When completing the NYC 114-7 form, certain documents are required to support your reported income and deductions. These include:

- Financial statements, such as profit and loss statements.

- Receipts for deductible business expenses.

- Any prior year tax returns that might provide context for your current filing.

Penalties for Non-Compliance

Failing to file the NYC 114-7 form on time or submitting inaccurate information can result in significant penalties. Common consequences include:

- Late filing penalties, which can be a percentage of the tax due.

- Interest on unpaid taxes, accruing from the original due date.

- Potential audits or additional scrutiny from tax authorities.

Digital vs. Paper Version of the NYC 114-7 Form

The NYC 114-7 form can be submitted either digitally or via paper. The digital submission process is often faster and allows for immediate confirmation of receipt. However, some taxpayers may prefer the traditional paper method. Regardless of the method chosen, ensuring that all information is accurate and complete is essential for compliance.

Quick guide on how to complete t print or type name as shown on form nyc 204

Accomplish Cib Forms Nyc effortlessly on any device

Digital document management has gained significance among corporations and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, as you can access the necessary form and securely keep it online. airSlate SignNow equips you with all the resources needed to create, adjust, and eSign your documents promptly without delays. Manage Cib Forms Nyc on any device with airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to adjust and eSign Cib Forms Nyc without difficulty

- Find Cib Forms Nyc and then click Obtain Form to begin.

- Utilize the functions we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow has specifically designed for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Finished button to save your modifications.

- Choose how you would like to share your form, via email, SMS, or a shareable link, or download it to your computer.

Put aside concerns about lost or misfiled documents, tedious form searching, or errors that necessitate creating new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Cib Forms Nyc and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct t print or type name as shown on form nyc 204

Create this form in 5 minutes!

How to create an eSignature for the t print or type name as shown on form nyc 204

How to make an electronic signature for your T Print Or Type Name As Shown On Form Nyc 204 in the online mode

How to make an eSignature for the T Print Or Type Name As Shown On Form Nyc 204 in Google Chrome

How to make an electronic signature for putting it on the T Print Or Type Name As Shown On Form Nyc 204 in Gmail

How to create an eSignature for the T Print Or Type Name As Shown On Form Nyc 204 straight from your smart phone

How to create an eSignature for the T Print Or Type Name As Shown On Form Nyc 204 on iOS devices

How to make an eSignature for the T Print Or Type Name As Shown On Form Nyc 204 on Android devices

People also ask

-

What are the NYC 114 7 instructions 2022 for eSigning documents?

The NYC 114 7 instructions 2022 provide essential guidelines for electronically signing documents in New York City. These instructions ensure that eSignatures comply with regulatory requirements, making airSlate SignNow an ideal platform to facilitate such compliant signing processes.

-

How does airSlate SignNow help with NYC 114 7 instructions 2022?

airSlate SignNow streamlines the eSigning process, ensuring that all documents adhere to NYC 114 7 instructions 2022. Our platform offers features like secure storage and detailed audit trails, which enhance compliance and provide peace of mind for users.

-

What features does airSlate SignNow offer for NYC 114 7 instructions 2022?

Key features include customizable templates, secure eSignature options, and integration capabilities with popular applications. With airSlate SignNow, businesses can easily create, send, and manage documents in accordance with NYC 114 7 instructions 2022.

-

Is airSlate SignNow cost-effective for businesses needing NYC 114 7 instructions 2022?

Yes, airSlate SignNow offers a variety of pricing plans that cater to businesses of all sizes, making it a cost-effective solution for those needing NYC 114 7 instructions 2022 compliance. Our pricing reflects the value of simplifying your eSigning processes without compromising on functionality.

-

Can I integrate airSlate SignNow with other applications while using NYC 114 7 instructions 2022?

Absolutely! airSlate SignNow allows seamless integration with other platforms and applications, such as CRM systems and cloud storage services. This feature ensures that you can manage your documents while staying compliant with NYC 114 7 instructions 2022 without hassle.

-

What are the benefits of using airSlate SignNow for NYC 114 7 instructions 2022?

Using airSlate SignNow ensures that your eSigning needs are met efficiently while complying with NYC 114 7 instructions 2022. Benefits include reduced turnaround time for documents, enhanced security, and the ability to track the signing process in real-time.

-

Does airSlate SignNow support mobile access for NYC 114 7 instructions 2022?

Yes, airSlate SignNow is fully optimized for mobile, allowing users to eSign documents on-the-go while complying with NYC 114 7 instructions 2022. This flexibility makes it easy for businesses to manage their eSigning needs from anywhere.

Get more for Cib Forms Nyc

- Ages and stages questionnaire form

- Greccio housing application form

- Nachweis der personlichen arbeitsbemuhungen form

- Dhr cdc 739 2006 2019 form

- Starbucks order form

- Kandiyohi power charitable trust 8605 47th street ne form

- Stress indicators questionnaire nbanh form

- Application_csx1_4pages 4pdf nassau county civil service commission application for employment form

Find out other Cib Forms Nyc

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form