it 2663 Form 2020

What is the IT-2663 Form

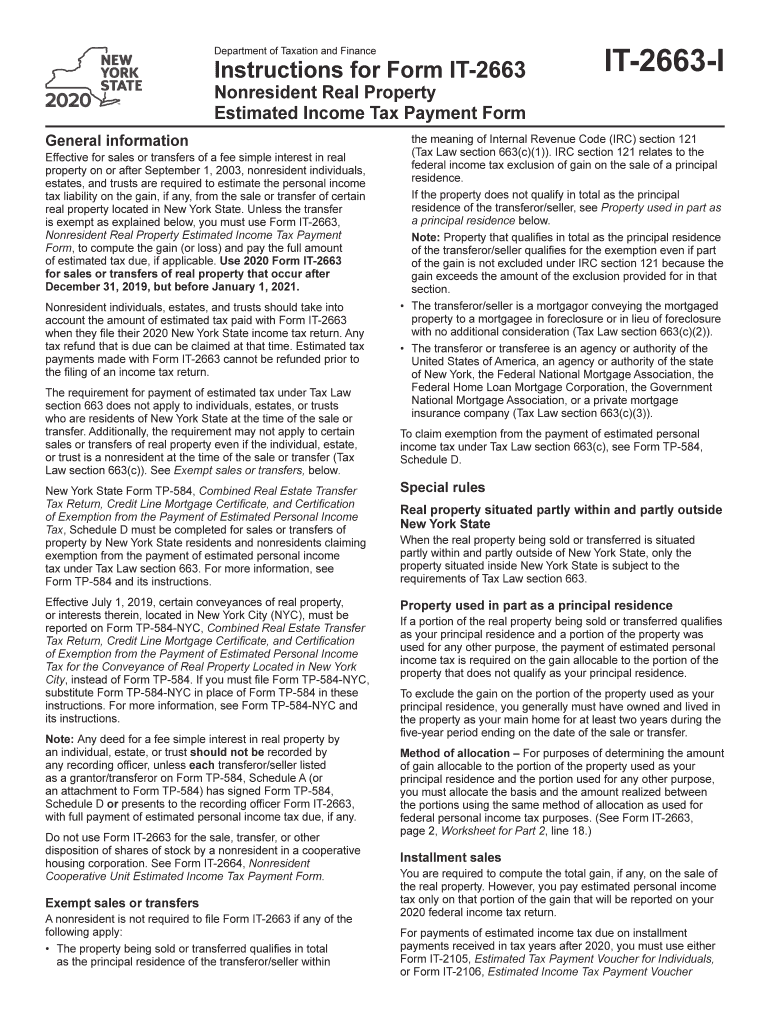

The IT-2663 form, also known as the New York State Non-Resident Real Property Estimated Income Tax Payment Form, is primarily used by non-residents of New York who are selling real property located within the state. This form allows these individuals to estimate and pay their income tax obligations related to the sale of real estate. It is essential for ensuring compliance with New York tax laws and helps facilitate the proper reporting of income generated from property transactions.

Steps to Complete the IT-2663 Form

Completing the IT-2663 form involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information, including details about the property being sold, the sale price, and any applicable deductions. Follow these steps:

- Provide your personal information, including name, address, and Social Security number.

- Enter the details of the property transaction, including the date of sale and the property's location.

- Calculate the estimated income tax based on the sale price and any deductions you qualify for.

- Sign and date the form to certify that the information provided is accurate.

How to Obtain the IT-2663 Form

The IT-2663 form can be obtained directly from the New York State Department of Taxation and Finance website. It is available as a downloadable PDF, which can be printed and filled out manually. Additionally, tax professionals and certain financial institutions may provide copies of the form as part of their services.

Legal Use of the IT-2663 Form

The IT-2663 form is legally binding when completed correctly and submitted to the New York State tax authorities. It is important to ensure that all information is accurate and that the form is submitted by the required deadlines to avoid penalties. Compliance with state tax laws is crucial, and using this form properly helps fulfill tax obligations related to real property sales.

Filing Deadlines / Important Dates

When dealing with the IT-2663 form, it is vital to be aware of the filing deadlines. Generally, the estimated tax payment must be submitted by the date of the property sale or within a specified timeframe thereafter. It is advisable to check the New York State Department of Taxation and Finance for the most current deadlines to ensure timely submission and avoid any potential penalties.

Required Documents

To complete the IT-2663 form accurately, certain documents may be required. These include:

- Proof of property ownership, such as a deed.

- Sales agreement or contract detailing the sale terms.

- Any documentation related to deductions or exemptions you plan to claim.

Having these documents on hand will facilitate a smoother completion process and help ensure compliance with tax regulations.

Quick guide on how to complete form it 2663 i2020instructions for form it 2663nonresident real

Effortlessly Complete It 2663 Form on Any Gadget

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed papers, allowing you to obtain the correct document and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly and without issues. Manage It 2663 Form across any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The Easiest Way to Modify and eSign It 2663 Form with Ease

- Locate It 2663 Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Generate your electronic signature with the Sign feature, which takes only seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to store your changes.

- Select your preferred method for sharing your document: via email, SMS, an invite link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any chosen device. Edit and eSign It 2663 Form to ensure outstanding communication at every step of the document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 2663 i2020instructions for form it 2663nonresident real

Create this form in 5 minutes!

How to create an eSignature for the form it 2663 i2020instructions for form it 2663nonresident real

How to make an electronic signature for your Form It 2663 I2020instructions For Form It 2663nonresident Real in the online mode

How to make an eSignature for the Form It 2663 I2020instructions For Form It 2663nonresident Real in Google Chrome

How to create an electronic signature for putting it on the Form It 2663 I2020instructions For Form It 2663nonresident Real in Gmail

How to create an electronic signature for the Form It 2663 I2020instructions For Form It 2663nonresident Real right from your mobile device

How to generate an eSignature for the Form It 2663 I2020instructions For Form It 2663nonresident Real on iOS devices

How to create an eSignature for the Form It 2663 I2020instructions For Form It 2663nonresident Real on Android OS

People also ask

-

What is the process for how do I complete it 2663 form for New York State using airSlate SignNow?

To complete the 2663 form for New York State using airSlate SignNow, start by uploading your form to our platform. Then, you can easily fill out necessary fields and electronically sign it. Finally, send it directly to the relevant parties with just a few clicks, making the process quick and efficient.

-

Are there any costs associated with completing it 2663 form for New York State on airSlate SignNow?

airSlate SignNow offers a variety of pricing plans, including a free trial that allows you to explore its features, including completing 2663 forms for New York State. Depending on your needs, affordable monthly subscriptions are available with added benefits. This makes it a cost-effective solution for managing your document processes.

-

What features does airSlate SignNow offer to assist with the 2663 form for New York State?

airSlate SignNow provides intuitive features such as drag-and-drop document uploading, customizable templates for the 2663 form, and secure eSignature capabilities. Additionally, you can track the status of your documents in real-time, ensuring you never miss a deadline while completing the 2663 form for New York State.

-

Can I integrate airSlate SignNow with other applications to manage my 2663 form for New York State?

Yes, airSlate SignNow integrates seamlessly with many popular applications such as Google Drive, Dropbox, and CRM systems. This allows you to streamline your workflow, easily access your documents, and ensure that your process of completing the 2663 form for New York State is efficient and cohesive.

-

How secure is the process of completing the 2663 form for New York State on airSlate SignNow?

Security is a priority at airSlate SignNow. We use industry-leading encryption methods to keep your documents safe while you complete the 2663 form for New York State. Your sensitive information remains protected through secure access and authentication protocols.

-

Is there customer support available if I have trouble completing my 2663 form for New York State?

Absolutely! airSlate SignNow offers dedicated customer support to assist you with any issues while completing the 2663 form for New York State. You can signNow our support team via live chat, email, or phone to get the help you need quickly.

-

Can I save my progress when completing the 2663 form for New York State?

Yes, airSlate SignNow allows you to save your progress at any point while completing the 2663 form for New York State. This feature ensures that you can pause and return to your form whenever it’s convenient, avoiding the need to start over and making the process more flexible.

Get more for It 2663 Form

Find out other It 2663 Form

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple