Iht Form D32 2014-2026

What is the IHT Form D32

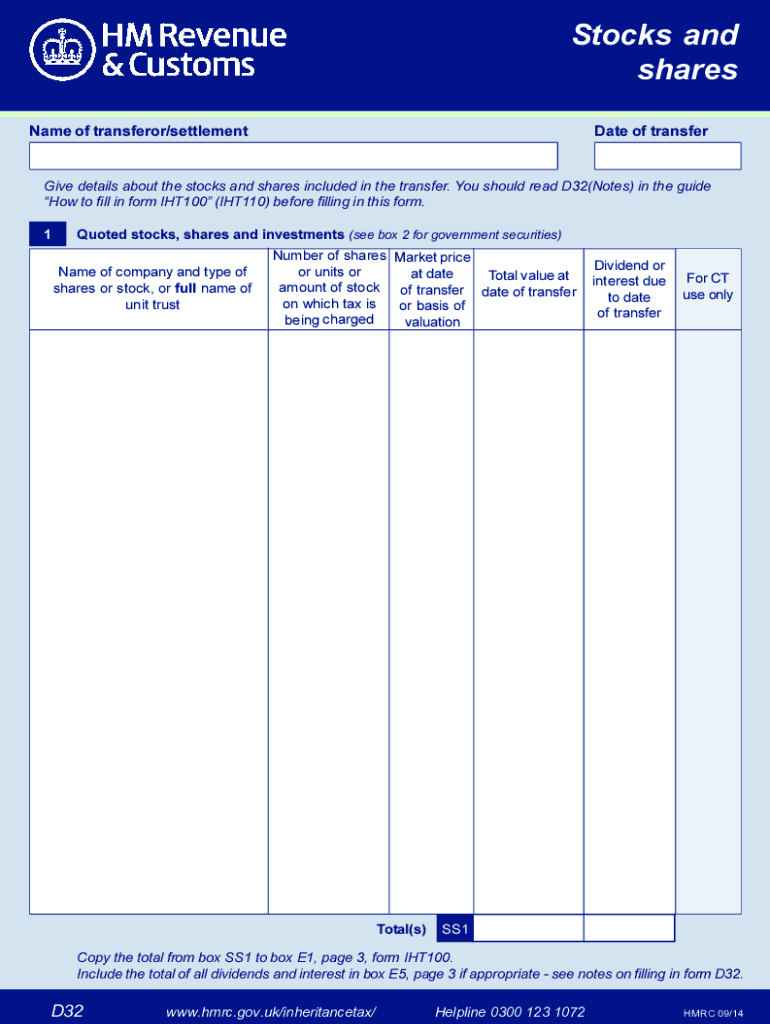

The IHT Form D32 is a key document used in the United Kingdom for reporting certain types of inheritance tax (IHT) liabilities. Specifically, it is utilized when dealing with the transfer of assets, particularly stocks and shares, upon the death of an individual. This form helps ensure that the appropriate taxes are calculated and reported to HM Revenue and Customs (HMRC). Understanding the purpose and requirements of the IHT Form D32 is essential for individuals managing estate affairs, as it plays a crucial role in the tax compliance process.

How to Use the IHT Form D32

Using the IHT Form D32 involves several steps to ensure accurate completion and submission. First, gather all necessary information regarding the deceased's estate, including details about the stocks and shares involved. Next, fill out the form with precise information, ensuring that all sections are completed as required. It is important to include the correct values for the assets and any applicable exemptions. Once the form is completed, it can be submitted to HMRC either online or by mail, depending on the preferred method of filing. Ensuring accuracy and compliance with guidelines is vital to avoid any potential penalties.

Steps to Complete the IHT Form D32

Completing the IHT Form D32 requires careful attention to detail. Here are the essential steps:

- Gather relevant documentation, including the death certificate and details of the deceased's estate.

- Identify all stocks and shares that need to be reported, including their market values at the date of death.

- Fill out the form accurately, providing all required information in the designated sections.

- Review the completed form for any errors or omissions before submission.

- Submit the form to HMRC, ensuring it is done within the specified deadlines to avoid penalties.

Legal Use of the IHT Form D32

The legal use of the IHT Form D32 is governed by inheritance tax regulations in the UK. This form must be completed accurately to ensure compliance with tax laws. It serves as a formal declaration of the value of the deceased's assets, which are subject to inheritance tax. Failure to submit the form correctly can lead to legal repercussions, including fines or additional tax liabilities. Therefore, understanding the legal framework surrounding the IHT Form D32 is crucial for executors and administrators of estates.

Required Documents for the IHT Form D32

When completing the IHT Form D32, certain documents are required to support the information provided. These typically include:

- The death certificate of the deceased.

- Valuations of stocks and shares held by the deceased.

- Any relevant financial statements or documentation related to the estate.

- Proof of identity for the executor or administrator handling the estate.

Having these documents readily available will facilitate the completion of the form and ensure compliance with HMRC requirements.

Form Submission Methods

The IHT Form D32 can be submitted to HMRC through various methods. These include:

- Online submission via the HMRC website, which is often the fastest method.

- Mailing a physical copy of the completed form to the appropriate HMRC office.

- In-person submission, if necessary, at designated HMRC locations.

Choosing the right submission method can help streamline the process and ensure timely compliance with tax obligations.

Quick guide on how to complete iht form d32

Accomplish Iht Form D32 seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a superb eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Iht Form D32 on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-related task today.

Ways to modify and electronically sign Iht Form D32 effortlessly

- Find Iht Form D32 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that function.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for submitting your form, either via email, SMS, or invite link, or download it to your computer.

Eliminate the chances of lost or misfiled documents, exhausting form searches, or errors requiring new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Alter and electronically sign Iht Form D32 and ensure excellent communication at any phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct iht form d32

Create this form in 5 minutes!

How to create an eSignature for the iht form d32

The way to make an electronic signature for a PDF file online

The way to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature from your mobile device

The way to generate an eSignature for a PDF file on iOS

The best way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is ihtd32 and how does it relate to airSlate SignNow?

The ihtd32 is a unique identifier for our advanced document signing features within airSlate SignNow. This keyword helps you recognize our cutting-edge tools designed to streamline eSigning processes. By leveraging ihtd32, users can enhance their workflow efficiency seamlessly.

-

What pricing plans are available for airSlate SignNow?

airSlate SignNow offers competitive pricing options tailored to suit various business needs at different scales. Our plans are economical while providing access to the advanced features linked with ihtd32. Customers can choose from monthly or annual subscriptions to find the best fit.

-

What features does airSlate SignNow offer that incorporate ihtd32?

airSlate SignNow provides a comprehensive suite of features, including eSignature solutions, document templates, and secure storage, all harnessing the capabilities of ihtd32. These features are designed to improve document workflow efficiency and protect your sensitive information.

-

How can I benefit from using airSlate SignNow’s ihtd32 technology?

Utilizing airSlate SignNow with ihtd32 technology provides numerous benefits, such as increased speed and efficiency in document signing and management. It enhances collaboration among teams and clients, making it easier to finalize important documents quickly and securely.

-

Can airSlate SignNow integrate with other software platforms?

Yes, airSlate SignNow integrates seamlessly with a wide range of software platforms, making it an ideal choice for businesses looking to streamline operations. By utilizing ihtd32 integrations, you can connect with CRM systems, cloud storage, and more, ensuring a cohesive workflow.

-

Is airSlate SignNow mobile-friendly?

Absolutely! airSlate SignNow is designed with mobility in mind, allowing users to access the ihtd32 features on-the-go via our mobile app. This ensures you can manage and sign documents from any location, enhancing productivity and convenience.

-

What kind of customer support is available for airSlate SignNow users?

Our dedicated customer support team is always ready to assist you with any queries related to airSlate SignNow and its ihtd32 features. We offer various support channels, including live chat, email, and extensive documentation to ensure you can maximize your experience.

Get more for Iht Form D32

Find out other Iht Form D32

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors