Iht D32 2005

What is the IHT D32?

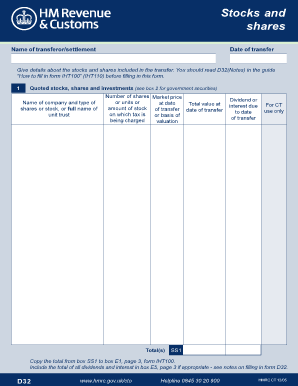

The IHT D32 form, also known as the IHT100 D32, is a document used in the United States for reporting the value of an estate for inheritance tax purposes. This form is essential for individuals who are managing the estate of a deceased person and need to provide detailed information about the assets, liabilities, and beneficiaries involved. The IHT D32 helps the tax authorities assess the tax obligations of the estate, ensuring compliance with federal and state regulations.

How to use the IHT D32

Using the IHT D32 form involves several steps to ensure accurate completion. First, gather all necessary financial documents related to the deceased's estate, including bank statements, property deeds, and investment records. Next, fill out the form with detailed information about the estate's assets and liabilities. It is crucial to be thorough and precise, as any discrepancies can lead to delays or penalties. Finally, submit the completed form to the appropriate tax authority, either electronically or by mail, depending on your preference and the requirements of your jurisdiction.

Steps to complete the IHT D32

Completing the IHT D32 form requires careful attention to detail. Follow these steps:

- Collect all relevant documents that detail the deceased's financial situation.

- Fill in the personal information of the deceased, including full name, date of birth, and date of death.

- List all assets, including real estate, bank accounts, and investments, along with their estimated values.

- Document any liabilities, such as debts or outstanding loans, that need to be settled from the estate.

- Provide information about the beneficiaries and how the assets will be distributed.

- Review the completed form for accuracy before submission.

Legal use of the IHT D32

The legal use of the IHT D32 form is governed by U.S. tax laws, which require accurate reporting of an estate's value for inheritance tax purposes. To ensure that the form is legally binding, it must be completed in accordance with the guidelines set forth by the Internal Revenue Service (IRS) and any relevant state tax authorities. Utilizing a reliable eSignature platform, such as signNow, can help validate the form's authenticity and ensure compliance with legal requirements.

Required Documents

Before completing the IHT D32 form, gather the following required documents:

- Death certificate of the deceased.

- Financial statements, including bank and investment account details.

- Property deeds and valuations of real estate owned by the deceased.

- Documentation of any outstanding debts or liabilities.

- Information regarding beneficiaries and their respective shares of the estate.

Form Submission Methods

The IHT D32 form can be submitted through various methods, depending on the preferences of the executor and the requirements of the tax authority. Common submission methods include:

- Online: Many jurisdictions allow electronic submission through secure portals.

- Mail: The completed form can be printed and sent via postal service to the appropriate tax office.

- In-Person: Some individuals may choose to submit the form in person at a local tax office for immediate confirmation.

Quick guide on how to complete iht d32

Complete Iht D32 seamlessly on any device

Managing documents online has gained traction among companies and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents swiftly without holdups. Handle Iht D32 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign Iht D32 effortlessly

- Locate Iht D32 and then click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Select important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and then click on the Done button to save your changes.

- Decide how you want to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that necessitate reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Iht D32 and assure excellent communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct iht d32

Create this form in 5 minutes!

How to create an eSignature for the iht d32

The way to make an electronic signature for a PDF online

The way to make an electronic signature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The best way to generate an electronic signature from your smartphone

The way to generate an eSignature for a PDF on iOS

The best way to generate an electronic signature for a PDF file on Android

People also ask

-

What is the iht d32 form and why would I need it?

The iht d32 form is a crucial document for those managing the inheritance tax declaration process in the UK. It helps individuals communicate the details of their estate to HM Revenue and Customs. Completing the iht d32 form accurately can streamline the probate process, ensuring a smoother inheritance journey.

-

How can airSlate SignNow help me with my iht d32 form?

airSlate SignNow provides an efficient platform for sending and eSigning your iht d32 form securely. With features like customizable templates and automatic reminders, you can manage the process more effectively. This ensures that your documents are signed and sent on time, reducing the stress of paperwork.

-

Are there any costs associated with using airSlate SignNow for the iht d32 form?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different users. You can choose a plan that fits your budget while still gaining access to powerful features for managing your iht d32 form. Explore our pricing options to find the right fit for your document signing needs.

-

What features does airSlate SignNow offer for signing the iht d32 form?

AirSlate SignNow offers a range of features ideal for managing the iht d32 form, including mobile signing, secure cloud storage, and real-time notifications. These tools enhance your ability to track the signing process and keep all documents organized. Additionally, templates can be created for repeated use of the iht d32 form.

-

Can I integrate airSlate SignNow with other applications for the iht d32 form?

Absolutely! airSlate SignNow provides integrations with various applications such as Google Drive, Salesforce, and Microsoft Office. This means you can seamlessly incorporate the iht d32 form into your existing workflows, making it even easier to manage your document processes.

-

Is using airSlate SignNow safe for managing my iht d32 form?

Yes, using airSlate SignNow for your iht d32 form is safe. The platform employs robust security measures, including encryption and secure access controls, to protect your sensitive information. You can confidently send and sign your documents without worrying about data bsignNowes.

-

How can I ensure my iht d32 form is completed correctly?

To ensure your iht d32 form is completed correctly, it’s essential to double-check all entries and consult resources or professionals as needed. airSlate SignNow provides helpful prompts and templates that guide you through the signing process. Utilizing our platform can reduce the chances of errors, making completion simpler.

Get more for Iht D32

- Western reserve life insurance change of beneficiary form

- Okaloosa county hardship form

- Real estate addendum ohio form

- Desktop appraisal form

- Mortgage assistance application form 710 wvhdf

- Wells fargo secured credit card form

- Rma form template

- Admissions amp registration important contact information

Find out other Iht D32

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document