Hmrc W21 Form

What is the Hmrc W21?

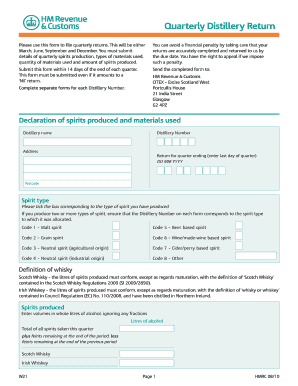

The Hmrc W21 form is a document used in the United Kingdom for reporting specific tax-related information. It is primarily utilized by businesses and individuals to declare certain financial details to Her Majesty's Revenue and Customs (HMRC). This form plays a crucial role in ensuring compliance with tax regulations and helps in the accurate assessment of tax liabilities.

How to Use the Hmrc W21

Using the Hmrc W21 form involves several key steps. First, gather all necessary financial information that needs to be reported. This includes income details, expenses, and any relevant deductions. Next, fill out the form accurately, ensuring that all sections are completed. It is essential to double-check the information for any errors before submission. Once completed, the form can be submitted to HMRC either online or via traditional mail, depending on the preferred method.

Steps to Complete the Hmrc W21

Completing the Hmrc W21 form requires careful attention to detail. Follow these steps for a successful submission:

- Gather all relevant financial documents, including income statements and expense receipts.

- Access the Hmrc W21 form through the official HMRC website or obtain a physical copy.

- Fill in the required fields, ensuring accuracy in all entries.

- Review the completed form for any mistakes or omissions.

- Submit the form to HMRC by the specified deadline, either electronically or by mail.

Legal Use of the Hmrc W21

The legal use of the Hmrc W21 form is governed by tax regulations set forth by HMRC. It is essential that the information provided is truthful and complete, as inaccuracies can lead to penalties or legal repercussions. The form serves as an official record of financial reporting, and proper usage ensures compliance with UK tax laws.

Key Elements of the Hmrc W21

Key elements of the Hmrc W21 form include personal identification details, financial information such as income and expenses, and any applicable deductions. Each section of the form is designed to capture specific data that HMRC requires for tax assessment. Understanding these elements is crucial for accurate reporting and compliance.

Form Submission Methods

The Hmrc W21 form can be submitted through various methods. Individuals and businesses can choose to file the form online via the HMRC portal, which offers a streamlined process. Alternatively, the form can be printed and mailed to HMRC. It is important to select the method that best suits your needs, keeping in mind any submission deadlines.

Filing Deadlines / Important Dates

Filing deadlines for the Hmrc W21 form are critical to avoid penalties. Typically, the form must be submitted by a specific date set by HMRC, which may vary annually. It is advisable to keep track of these dates and ensure timely submission to maintain compliance with tax obligations.

Quick guide on how to complete hmrc w21

Effortlessly Prepare Hmrc W21 on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents promptly without delays. Manage Hmrc W21 on any device using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to Modify and Electronically Sign Hmrc W21 with Ease

- Obtain Hmrc W21 and click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click the Done button to save your modifications.

- Choose how you wish to share your form – via email, text (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or errors that require new document prints. airSlate SignNow caters to all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Hmrc W21 and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the hmrc w21

The way to make an eSignature for a PDF document online

The way to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The best way to make an electronic signature right from your smart phone

The way to make an eSignature for a PDF document on iOS

The best way to make an electronic signature for a PDF on Android OS

People also ask

-

What is a W21 form and why do I need it?

The W21 form is a tax-related document that is essential for reporting certain types of income. Businesses often need to submit the W21 form to ensure compliance with tax regulations. Using airSlate SignNow to manage your W21 form simplifies the process, allowing for secure eSigning and streamlined document handling.

-

How can airSlate SignNow help with my W21 form?

airSlate SignNow provides a user-friendly platform to create, send, and eSign your W21 form effortlessly. With its robust features, you can ensure that all parties can digitally sign the document quickly, reducing paperwork and enhancing efficiency. The platform's tracking capabilities also allow you to monitor the status of your W21 form at any time.

-

Is airSlate SignNow cost-effective for managing W21 forms?

Yes, airSlate SignNow offers a cost-effective solution for businesses needing to manage W21 forms. With flexible pricing plans, you can choose the package that best fits your needs. By reducing paper usage and streamlining the signing process, airSlate SignNow helps you save both time and money.

-

What are the key features of airSlate SignNow related to W21 forms?

airSlate SignNow offers a variety of features tailored for managing W21 forms, including customizable templates, secure eSignature capabilities, and automated workflows. You can easily create a W21 form from scratch or use existing templates to accelerate the process. Additionally, the platform provides real-time notifications and reminders to ensure timely submissions.

-

Can I integrate airSlate SignNow with other applications for W21 forms?

Absolutely! airSlate SignNow supports various integrations, allowing you to connect with other applications you use to handle your W21 forms. Whether it's cloud storage services, CRMs, or accounting software, these integrations create a seamless workflow that enhances productivity and document management.

-

What benefits does airSlate SignNow offer for electronic signing of W21 forms?

Using airSlate SignNow for electronic signing of your W21 forms provides numerous benefits, including enhanced security, reduced turnaround time, and improved accessibility. The platform ensures that signatures are legally binding and stored securely, offering peace of mind. Furthermore, with mobile access, you can sign your W21 form from anywhere at any time.

-

How secure is my W21 form when using airSlate SignNow?

Security is a top priority at airSlate SignNow, especially when it comes to sensitive documents like the W21 form. The platform employs advanced encryption protocols and complies with industry standards to protect your data. You can trust that your W21 form is handled with the utmost confidentiality and security during the signing process.

Get more for Hmrc W21

Find out other Hmrc W21

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF