Formscc544 2005

What is the Formscc544

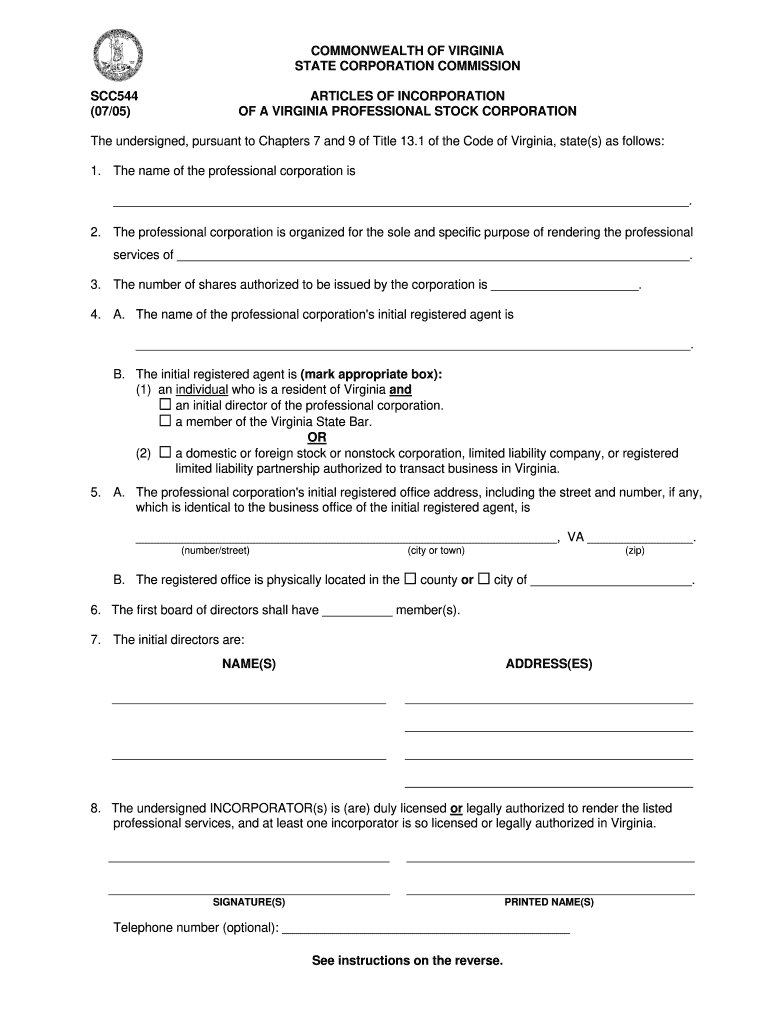

The Formscc544 is a specific document used primarily for tax-related purposes in the United States. It serves as a formal request for certain tax exemptions or deductions. Understanding the purpose of this form is crucial for individuals and businesses aiming to comply with IRS regulations. The form is particularly relevant for those who may qualify for specific tax benefits, ensuring they can properly document their eligibility.

How to use the Formscc544

Using the Formscc544 involves several straightforward steps. First, gather all necessary information, including personal details and relevant financial data. Next, complete the form accurately, ensuring that all sections are filled out according to IRS guidelines. Once completed, the form can be submitted electronically or via traditional mail, depending on the specific requirements outlined by the IRS. It's essential to review the form for accuracy before submission to avoid delays or issues with processing.

Steps to complete the Formscc544

Completing the Formscc544 requires careful attention to detail. Follow these steps:

- Gather required documents, such as income statements and identification.

- Fill out personal information, including your name, address, and Social Security number.

- Provide any relevant financial details that support your claim for tax exemptions.

- Review the form for accuracy and completeness.

- Submit the form according to IRS guidelines, either online or by mail.

Legal use of the Formscc544

The legal use of the Formscc544 is governed by IRS regulations. To ensure compliance, it is vital that the form is filled out truthfully and accurately. Misrepresentation or errors can lead to penalties or denial of tax benefits. The form must be submitted within the designated time frames to be considered valid. Understanding the legal implications of using this form helps individuals and businesses navigate the tax landscape effectively.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the Formscc544. These guidelines include detailed instructions on what information is required and how to properly format the form. It is essential to consult the latest IRS publications or the official IRS website to ensure compliance with any updates or changes to the form's requirements. Adhering to these guidelines helps prevent common mistakes that could delay processing or result in penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Formscc544 are critical to ensure timely processing and compliance with tax regulations. Typically, the form must be submitted by specific dates outlined by the IRS, often coinciding with the annual tax filing season. It is advisable to mark these dates on your calendar and prepare the form in advance to avoid last-minute issues. Staying aware of these deadlines helps individuals and businesses maintain their tax obligations without unnecessary stress.

Quick guide on how to complete formscc544

Effortlessly Prepare Formscc544 on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal sustainable alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Manage Formscc544 on any device with the airSlate SignNow applications for Android or iOS, and streamline any document-related process today.

The Easiest Method to Modify and Electronically Sign Formscc544 Without Hassle

- Obtain Formscc544 and click Get Form to begin.

- Utilize the features we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive data using the tools specifically provided by airSlate SignNow for this purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal status as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method for sharing your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and electronically sign Formscc544, ensuring effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct formscc544

Create this form in 5 minutes!

How to create an eSignature for the formscc544

The best way to generate an eSignature for your PDF file online

The best way to generate an eSignature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The best way to create an eSignature straight from your mobile device

How to create an electronic signature for a PDF file on iOS

The best way to create an eSignature for a PDF document on Android devices

People also ask

-

What is formscc544 and how can it benefit my business?

Formscc544 refers to a specific form used in various business transactions. By utilizing formscc544 within airSlate SignNow, businesses can streamline their document signing process, ensuring compliance and efficiency. This allows teams to work faster and stay organized, ultimately improving productivity.

-

How much does it cost to use formscc544 with airSlate SignNow?

The pricing for using formscc544 with airSlate SignNow varies depending on the plan you select. Each plan offers different features and limits, allowing businesses to choose one that fits their needs and budget. Most plans include unlimited access to formscc544, making it a cost-effective choice for document management.

-

Can I customize formscc544 for my specific business needs?

Yes, airSlate SignNow allows you to customize formscc544 according to your business requirements. You can add fields, include branding elements, and modify the layout to ensure it meets your specific processes. This flexibility enhances usability and compliance with your unique document workflows.

-

What integrations are available for formscc544 with airSlate SignNow?

AirSlate SignNow offers various integrations that allow formscc544 to connect seamlessly with other software your business uses. Popular integrations include CRM systems, cloud storage services, and project management tools. These integrations enhance the functionality of formscc544 and streamline your overall operations.

-

Is it possible to track the status of formscc544 once sent out for signing?

Absolutely! With airSlate SignNow, you can easily track the status of formscc544 sent for eSignature. The platform provides notifications and updates, so you know when a recipient has opened and signed the document, helping you keep your workflow organized and timely.

-

How secure is the information within formscc544 when using airSlate SignNow?

AirSlate SignNow prioritizes the security of your documents, including formscc544. The platform employs advanced encryption methods and complies with international security standards to protect sensitive information. You can trust that your documents are safe and secure throughout the entire signing process.

-

Can I access formscc544 on mobile devices?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to access formscc544 anytime, anywhere. Whether you’re in the office or on the go, you can send, sign, and manage documents with ease on your smartphone or tablet.

Get more for Formscc544

Find out other Formscc544

- eSignature Mississippi Demand for Extension of Payment Date Secure

- Can I eSign Oklahoma Online Donation Form

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity