Summary (executive overview)

- U.S. law recognizes e-signatures as legally valid under ESIGN (federal) and UETA (state; New York uses ESRA), removing legal ambiguity for most business agreements.

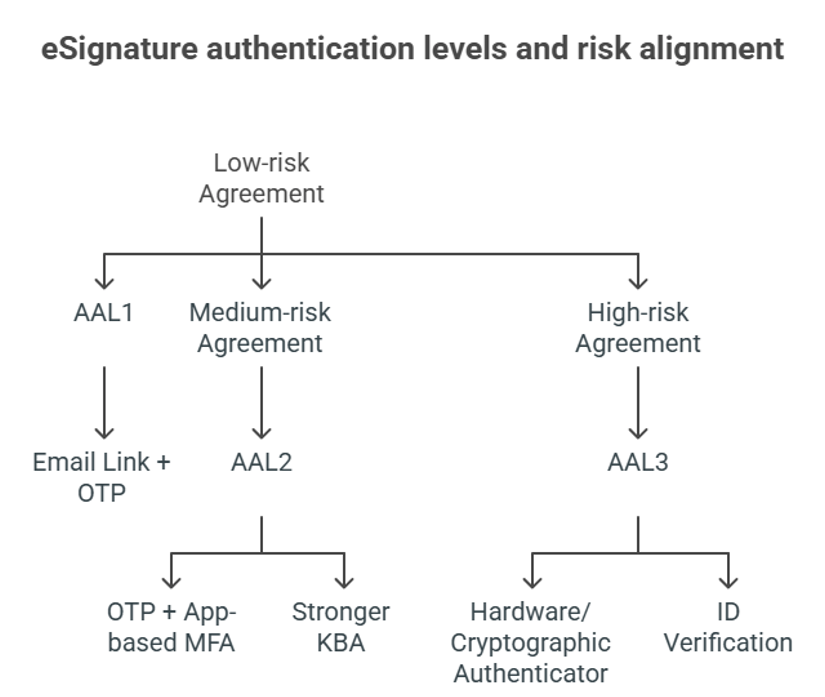

- Security and identity assurance are mature: NIST’s Digital Identity Guidelines define risk-based assurance levels (AAL1-3), informing best practices like MFA and audit trails in e-signature workflows.

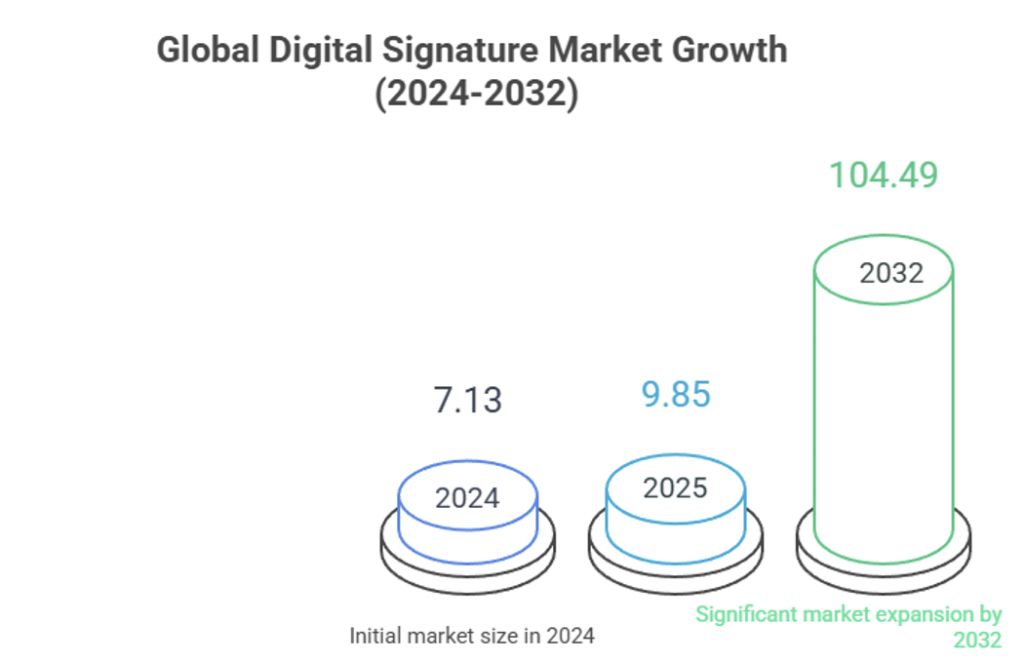

- Market momentum is strong: the U.S. digital-signature market is estimated at $2.14B (2024) with a projected 30.6% CAGR to 2033; globally, analysts project rapid expansion through 2030–2032.

- Regulated uses keep widening: the IRS permanently allows e-signatures on specified forms, signaling durable mainstream acceptance.

- SignNow revolutionizes eSigning for SMB and mid-market teams. The solution helps compress cycle times, cut paper/ops costs, and improve visibility, especially when paired with templates, bulk send, and real-time tracking features.

Introduction

For years, agreements depended on in-person signing, printing, or courier exchanges—delays that slowed hiring, vendor onboarding, and sales cycles. Modern eSignatures eliminate these bottlenecks by enabling users to authenticate intent and finalize agreements digitally with full legal backing in the U.S. (ESIGN and UETA/ESRA) and widely recognized security standards (NIST SP 800-63).

Global adoption is rising quickly as organizations shift to remote work, standardize digital identity controls, and move paper-heavy workflows online.

SignNow serves SMB and mid-market teams that need a simple, affordable platform. The solution combines unlimited users, predictable pricing, and powerful tools: templates, bulk send, and real-time tracking, to scale operations efficiently.

Current state and trends

1. A unified legal and regulatory foundation

ESIGN, UETA, and ESRA provide nationwide legal certainty: electronic signatures and records generally carry the same enforceability as handwritten ink if basic conditions such as consent and record retention are met.

Regulators continue expanding digital acceptance. A major milestone was the IRS’s decision to permanently allow eSignatures for designated forms and compliance interactions—removing one of the largest historical barriers in finance and tax workflows.

Why it matters: Organizations can standardize on eSignatures across departments without creating state-by-state exceptions, except for a few specialized use cases.

2. Security and identity assurance aligned to risk

NIST SP 800-63 outlines identity assurance levels (AAL1–AAL3) that help organizations select the right authentication method for each agreement.

- AAL1: routine, low-risk agreements (e.g., NDAs)

- AAL2: agreements requiring stronger validation (e.g., onboarding forms, financial documents)

- AAL3: high-risk transactions where robust identity proofing and strong authenticators are necessary

E-signature platforms map authentication options: OTP, MFA, audit trails, ID checks, – to these levels so teams can tune security to the sensitivity of each workflow.

3. Market growth signals maturity

Analysts project sustained expansion in both U.S. and global markets through 2032–2033, driven by remote work, compliance modernization, and increasing public-sector adoption.

What this indicates: eSignatures have moved from a convenience to critical business infrastructure, with maturing integrations, expanding feature sets, and lower total cost of ownership for SMBs..

How eSignatures work for agreements (from preparation to evidentiary readiness)

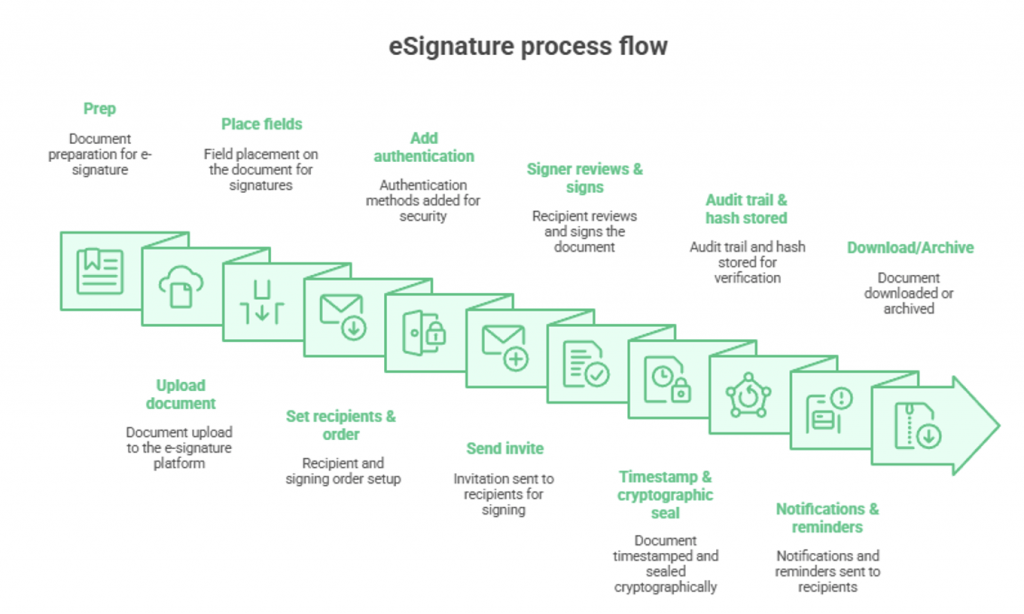

An end-to-end eSignature workflow typically involves:

- Preparing documents with fillable fields and routing rules

- Assigning recipients and authentication requirements

- Digital signing by users across any device

- Applying tamper-evident sealing and generating an audit trail

- Notifying stakeholders and storing final documents securely

U.S. law treats “electronic signature” broadly, while “digital signature” often refers to cryptographic (PKI-backed) methods. Most business workflows rely on legally valid eSignatures with layered authentication and tamper evidence; PKI is available where required.

Adoption dynamics

Several drivers are accelerating eSignature standardization:

- Clear legality eliminates friction in procurement, HR, sales, and compliance workflows.

- Regulatory expansion, led by the IRS, reduces paper-only exceptions.

- Risk-based authentication—increasingly referenced in federal and industry guidelines—encourages organizations to align workflows with NIST assurance levels.

- Operational efficiency demands faster turnaround, mobile-friendly signing, and reliable audit trails.

For SMB and mid-market organizations, the cumulative effect is significant. Templates and bulk-send automate repetitive processes, centralized tracking increases visibility, and consistent audit trails strengthen compliance across distributed teams.

What to evaluate when choosing an eSignature platform

1. Legal & compliance fit

Ensure workflows meet ESIGN/UETA/ESRA requirements and sector-specific guidance. Match authentication strength to risk using the NIST framework. Confirm retention and auditability needs.

2. Security & identity verification

Look for MFA, detailed audit logs (timestamps, emails, IPs), tamper-evident sealing, and data residency controls. High-risk agreements may require ID verification or higher-assurance authenticators.

3. Operational efficiency

Templates, invite links, shared resources, bulk sending, and real-time tracking reduce cycle times and errors—especially in high-volume HR and sales processes.

4. Economics

Transparent pricing and unlimited users support broad rollout without seat-count friction. Flexible volume-based or usage-based pricing ensures alignment with your demand patterns.

5. Integrations

Native connectors to Salesforce, NetSuite, and Microsoft 365, plus APIs and webhooks, ensure visibility and maintain data consistency across systems.

Where SignNow stands:

SignNow aligns directly with these criteria. The platform enables you to maximize the benefits of eSignatures with scalable authentication, granular audit trails, templates, bulk operations for enhanced efficiency, and cost-predictable plans that support unlimited users for SMB and mid-market teams.

Impact on stakeholders

Sales

Shorter turnaround times reduce deal stall risk and increase forecast reliability for sales teams. Consistent compliance reduces negotiation friction with procurement and legal teams.

HR & Operations

Bulk send and templates streamline multi-state onboarding, policy acknowledgements, and seasonal hiring, while audit trails simplify verification and recordkeeping.

IT & Security

Standards-aligned authentication, auditability, and cloud deployment support internal risk programs. SSO simplifies user lifecycle management.

Finance & Tax

Permanent IRS acceptance for designated forms removes paper-based exceptions and supports modernization initiatives in the financial services.

The impact of eSignature implementation is not limited to this list. For example, you can read more about the benefits of eSignature solutions for real estate in one of our previous articles.

Expert forecasts (6–24 months)

Industry experts anticipate:

- Continued growth as more transactions shift online across the private and public sectors

- Increased—but more selective—use of high-assurance options like ID verification or notarization

- Expansion of eSignature use in government-related workflows as agencies follow the IRS’s lead

Organizations will need platforms that can start simple and scale assurance levels as risk, volume, and compliance requirements evolve. SignNow supports this trajectory with flexible authentication, strong auditability, and workflows that adapt to both low- and high-assurance needs.

Case studies (SMB & mid-market, USA)

Bryant & Stratton College (Education)

After early success, the college expanded SignNow internally across departments, citing efficiency improvements and favorable price-to-value compared to competitors.

Funjoin (Operations/Registration)

Adopted SignNow to streamline registration workflows and reduce friction, calling the platform an “invaluable partner” in simplifying operations.

Sales teams (Evotek; Optika Ventures)

Teams used SignNow for NDAs, contracts, and Salesforce-connected workflows, accelerating deal cycles and centralizing records.

These examples reflect common patterns: rapid wins, scalable templating, cross-team adoption after ROI is proven, and integration-driven visibility.

How to evaluate providers for agreement workflows

- Map agreement types to required assurance levels.

- Pilot 3–5 high-volume templates for 30 days and track time-to-sign, decline rates, resends, and mobile completions.

- Model total cost of ownership, including printing, mailing, and administrative handling avoided.

- Confirm integrations (CRM/HRIS/ERP), webhook support, and audit export capabilities.

- Define retention, encryption, admin roles, and incident response expectations.

Conclusion

eSignatures have become essential infrastructure for modern organizations. Regulatory acceptance, identity standards, and strong market growth signal sustained adoption across industries.

For SMB and mid-market teams, the path is straightforward: standardize templates, align authentication to risk, integrate with core systems, and choose pricing that scales with demand.

SignNow delivers this foundation with ease of use, predictable economics, bulk operations, and 24/7 support—helping teams build fast, secure, future-ready agreement workflows.

FAQs

Are eSignatures legal in the U.S.?

Yes. Under ESIGN and state frameworks (UETA/ESRA), electronic signatures and records generally carry full legal weight when requirements such as consent and retention are met.

Do regulators accept eSignatures?

Yes. The IRS permanently authorizes eSignatures for designated forms, and other agencies continue expanding acceptance.

How secure are eSignature platforms?

Security depends on authentication strength, tamper evidence, and audit trails. NIST AAL1–AAL3 provide a blueprint for selecting appropriate authentication per transaction.

Where does SignNow fit?

SignNow is designed for SMB and mid-market teams that need ease of use, transparent pricing, unlimited users, bulk operations, and strong support—ideal for organizations scaling digital agreements.

- Summary (executive overview)

- Introduction

- Current state and trends

- How eSignatures work for agreements (from preparation to evidentiary readiness)

- Adoption dynamics

- What to evaluate when choosing an eSignature platform

- Impact on stakeholders

- Expert forecasts (6–24 months)

- Case studies (SMB & mid-market, USA)

- How to evaluate providers for agreement workflows

- Conclusion

- FAQs