Wells Fargo Forbearance Form 2012-2026

What is the Wells Fargo Forbearance Form

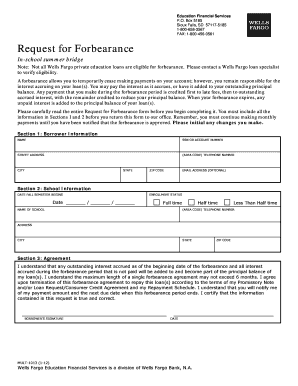

The Wells Fargo forbearance form is a legal document that allows borrowers to temporarily reduce or suspend their mortgage payments due to financial hardship. This form is essential for those seeking assistance from Wells Fargo's mortgage forbearance program, which aims to provide relief during challenging financial times. By submitting this form, borrowers can request a forbearance period that allows them to manage their financial obligations more effectively.

How to use the Wells Fargo Forbearance Form

Using the Wells Fargo forbearance form involves several key steps. First, borrowers must ensure they meet the eligibility criteria for the forbearance program. Next, they should accurately fill out the form, providing necessary personal and financial information to support their request. Once completed, the form can be submitted online or through traditional mail, depending on the borrower's preference. It is crucial to keep a copy of the submitted form for personal records.

Steps to complete the Wells Fargo Forbearance Form

Completing the Wells Fargo forbearance form requires careful attention to detail. Here are the steps to follow:

- Gather necessary documentation, such as income statements and proof of hardship.

- Access the form through Wells Fargo's official website or customer service.

- Fill out the form, ensuring all information is accurate and complete.

- Review the form for any errors or missing information.

- Submit the form via the preferred method, either online or by mail.

Key elements of the Wells Fargo Forbearance Form

The Wells Fargo forbearance form includes several key elements that are important for its validity. These elements typically include:

- Borrower's personal information, such as name, address, and account number.

- A detailed explanation of the financial hardship being experienced.

- The requested duration of the forbearance period.

- Signature of the borrower, affirming the accuracy of the information provided.

Legal use of the Wells Fargo Forbearance Form

The legal use of the Wells Fargo forbearance form hinges on compliance with relevant regulations. For the form to be considered valid, it must be filled out correctly and submitted according to Wells Fargo's guidelines. Additionally, the form must comply with federal and state laws governing mortgage forbearance agreements. Proper documentation and signatures are essential to ensure that the request is legally binding.

Eligibility Criteria

Eligibility for the Wells Fargo forbearance program typically requires borrowers to demonstrate financial hardship. Common criteria include loss of income, medical expenses, or other significant financial challenges. Borrowers must provide supporting documentation to validate their claims, which may include pay stubs, bank statements, or letters from employers. Understanding these criteria is crucial for a successful application.

Quick guide on how to complete wells fargo forbearance form

Finalize Wells Fargo Forbearance Form effortlessly on any gadget

Digital document handling has become increasingly favored by businesses and individuals alike. It offers an excellent environmentally friendly alternative to conventional printed and signed papers, as you can obtain the accurate version and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Wells Fargo Forbearance Form on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest approach to alter and eSign Wells Fargo Forbearance Form with ease

- Obtain Wells Fargo Forbearance Form and then click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or conceal sensitive details with features that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes moments and holds the same legal validity as a traditional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choosing. Modify and eSign Wells Fargo Forbearance Form to ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wells fargo forbearance form

How to generate an electronic signature for a PDF document online

How to generate an electronic signature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The way to generate an electronic signature right from your smart phone

How to make an eSignature for a PDF document on iOS

The way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is Wells Fargo forbearance and how does it work?

Wells Fargo forbearance is a temporary relief program that allows borrowers to pause or reduce their mortgage payments during financial hardship. By entering into forbearance, customers can manage their payments effectively while they stabilize their financial situation. It's important to communicate with Wells Fargo to understand the terms and duration of the forbearance period.

-

How can I apply for Wells Fargo forbearance?

To apply for Wells Fargo forbearance, you can contact Wells Fargo customer service or visit their website for detailed guidelines. You'll need to provide information regarding your financial situation to assess your eligibility. Be prepared to submit necessary documentation to expedite the process.

-

What are the benefits of the Wells Fargo forbearance program?

The primary benefit of the Wells Fargo forbearance program is the immediate relief it offers by temporarily reducing or pausing mortgage payments. This can greatly assist those facing temporary financial difficulties. Additionally, it allows customers the time to arrange finances without the pressure of regular payments.

-

Will I accrue interest during the Wells Fargo forbearance period?

Yes, during the Wells Fargo forbearance period, interest may still accrue on the unpaid balance of your mortgage. It's essential to understand how this may impact your total loan balance once the forbearance ends. You should clarify any questions regarding interest accumulation with Wells Fargo directly.

-

How does Wells Fargo forbearance affect my credit score?

Entering into Wells Fargo forbearance generally should not negatively impact your credit score, provided that you communicate effectively with them and follow the terms of the agreement. It's crucial to ensure that all reported information remains accurate during this period to protect your credit standing. Always confirm this aspect with Wells Fargo to avoid surprises.

-

What options do I have after my Wells Fargo forbearance ends?

After your Wells Fargo forbearance ends, you have several options to manage repayment, including a repayment plan, loan modification, or reinstatement of payments. It’s important to discuss these options with Wells Fargo to find a solution that best fits your financial situation. Staying informed and proactive about your next steps is key to avoiding further financial strain.

-

Is there a fee associated with Wells Fargo forbearance?

Typically, there are no direct fees associated with initiating Wells Fargo forbearance; however, it's essential to inquire about potential costs or fees that may occur as repayment options are discussed later. Always consult with Wells Fargo for complete clarity regarding any associated charges. Understanding financial implications fully can help in making an informed decision.

Get more for Wells Fargo Forbearance Form

- Summons to answer civil complaint hawaii state judiciary form

- Usufruct louisianalouisiana usufruct and right of form

- Texas bar examination form

- The following are not issues on the essay portion questions 1 and 2 of the form

- Rules governing the courts of the state of new jersey form

- This form if

- Request for letter of permission to take courses elsewhere form

- Pdf 8700 12 fl notification form florida department of

Find out other Wells Fargo Forbearance Form

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template