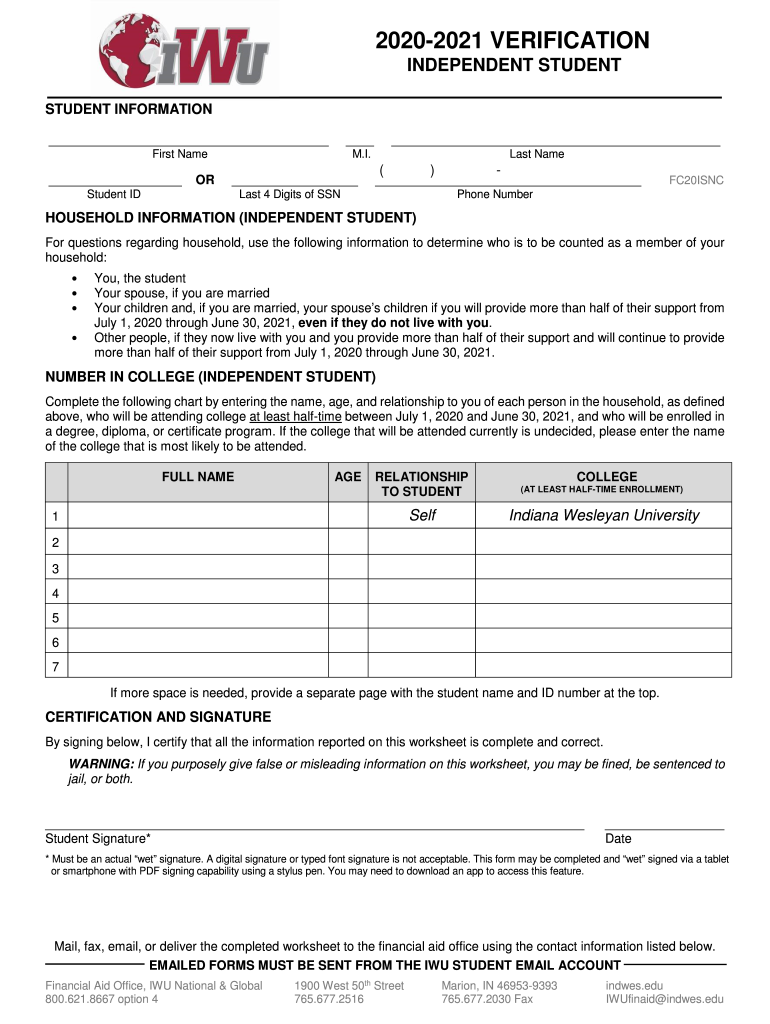

HOUSEHOLD INFORMATION INDEPENDENT STUDENT 2020-2026

What is the household information independent student?

The household information independent student refers to the data that an independent student must provide when completing the Free Application for Federal Student Aid (FAFSA). This information typically includes details about the student's income, assets, and household size. Understanding this section is crucial for determining eligibility for financial aid, as independent students are assessed differently than dependent students. Independent status may arise from various circumstances, such as being over a certain age, being married, or having dependents of one’s own.

How to use the household information independent student

To effectively use the household information independent student section on the FAFSA, start by gathering all necessary financial documents. This includes tax returns, W-2 forms, and any records of untaxed income. When filling out the FAFSA, accurately report your income and the number of people in your household, including yourself and any dependents. This information directly affects the calculation of your Expected Family Contribution (EFC), which determines your eligibility for various financial aid programs.

Steps to complete the household information independent student

Completing the household information independent student section involves several key steps:

- Gather necessary financial documents, including tax returns and proof of income.

- Access the FAFSA form online or through a paper application.

- Indicate your independent status by answering the relevant questions accurately.

- Provide detailed information about your income and assets.

- List the number of individuals in your household, including yourself and any dependents.

- Review all entries for accuracy before submission.

Legal use of the household information independent student

The legal use of the household information independent student is governed by federal regulations that dictate how financial aid is assessed. It is essential to provide truthful and accurate information, as any discrepancies can lead to penalties, including loss of financial aid eligibility. The FAFSA form is a legal document, and by signing it, you affirm that the information provided is complete and accurate to the best of your knowledge.

Eligibility criteria

Eligibility for independent student status on the FAFSA is determined by specific criteria set by the U.S. Department of Education. Generally, you may qualify as an independent student if you meet one or more of the following conditions:

- You are at least twenty-four years old.

- You are married.

- You have dependents who receive more than half of their support from you.

- You are a veteran of the U.S. Armed Forces.

- You are an orphan or ward of the court.

Required documents

When completing the household information independent student section of the FAFSA, several documents are required to ensure accurate reporting. These typically include:

- Federal tax returns from the previous year.

- W-2 forms from employers.

- Records of untaxed income, such as child support or disability payments.

- Bank statements and investment records.

Quick guide on how to complete household information independent student

Complete HOUSEHOLD INFORMATION INDEPENDENT STUDENT effortlessly on any device

Digital document management has gained traction among companies and individuals alike. It offers an ideal sustainable alternative to traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage HOUSEHOLD INFORMATION INDEPENDENT STUDENT on any device using airSlate SignNow Android or iOS applications and enhance any document-related activity today.

The simplest way to modify and electronically sign HOUSEHOLD INFORMATION INDEPENDENT STUDENT without hassle

- Locate HOUSEHOLD INFORMATION INDEPENDENT STUDENT and then click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to preserve your changes.

- Decide how you wish to share your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign HOUSEHOLD INFORMATION INDEPENDENT STUDENT and guarantee outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct household information independent student

Create this form in 5 minutes!

How to create an eSignature for the household information independent student

The way to create an eSignature for a PDF file online

The way to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature from your mobile device

The best way to generate an eSignature for a PDF file on iOS

The best way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is the fafsa independent loophole?

The fafsa independent loophole refers to specific circumstances that allow certain students to file for financial aid independently from their parents. This can signNowly increase the amount of federal aid received, as the income reported may be lower. Understanding how to leverage this loophole can be crucial for maximizing financial support.

-

How can airSlate SignNow help with documents related to the fafsa independent loophole?

AirSlate SignNow provides a seamless way to send, sign, and manage documents required for applying for financial aid through the fafsa independent loophole. With our easy-to-use platform, you can ensure that all necessary forms are completed and submitted accurately and on time, maximizing your chances of securing aid.

-

What are the pricing options for using airSlate SignNow?

AirSlate SignNow offers various pricing plans suitable for individuals and businesses alike. By choosing the right plan, you can access features that support your needs, including document signing and management related to the fafsa independent loophole. Competitive pricing ensures you get great value for your investment.

-

What features does airSlate SignNow offer for users interested in the fafsa independent loophole?

Our platform includes key features such as customizable templates, easy document sharing, and a secure eSignature process. These features make it easier for users navigating the fafsa independent loophole to prepare and submit their financial aid applications efficiently and securely.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow offers integrations with a variety of popular applications and platforms, making it easier to manage your financial aid documents. This compatibility is especially useful for those utilizing the fafsa independent loophole, as it allows for streamlined workflows and better organization of relevant documents.

-

What are the benefits of using airSlate SignNow for financial aid applications?

Using airSlate SignNow simplifies the process of completing and submitting financial aid applications, particularly for those utilizing the fafsa independent loophole. Our platform enhances efficiency, reduces errors, and ensures secure document handling, which can lead to better financial aid outcomes for students.

-

Can I track my documents with airSlate SignNow?

Absolutely! AirSlate SignNow allows you to track the status of your documents in real-time. This feature is particularly beneficial for users navigating the fafsa independent loophole as it ensures that all necessary paperwork is submitted and processed promptly.

Get more for HOUSEHOLD INFORMATION INDEPENDENT STUDENT

- Pdf downloadable form rev 1196 2016

- Employer withholding information guide rev 415 scorecpaorg

- Per capita ampamp occupational assessment taxes faqberkheimer form

- Print form city of philadelphia 2008 business privilege tax ez due date april 15 2009 0 1 0 8 2008 bpt ez for business

- Harrisburg pa 17128 0501 form

- Fillable pa 40 form

- Pa rent certificate application 2016 pa1000 rc form

- 2016 schedule pa 41x amended pa fiduciary income tax schedule pa 41x formspublications

Find out other HOUSEHOLD INFORMATION INDEPENDENT STUDENT

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF