Delaware Monthly Withholding Form FILE MONTHLY RETURNS for the YEAR Use the Form below If You Are Required to File and Pay Your 2020

What is the Delaware Monthly Withholding Form?

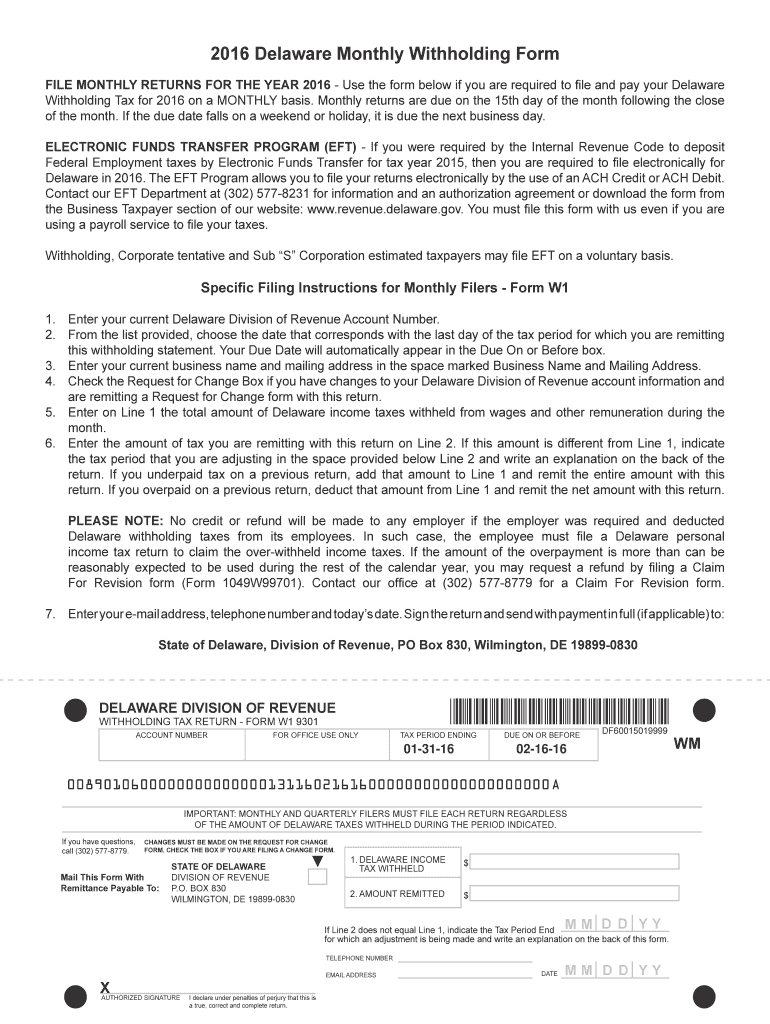

The Delaware Monthly Withholding Form is a tax document required for employers to report and pay withholding taxes on a monthly basis. This form is essential for businesses that have employees working in Delaware and are obligated to withhold state income tax from their employees' wages. By filing this form, employers ensure compliance with Delaware tax laws and contribute to the state's revenue system. The form must be accurately completed and submitted to the Delaware Division of Revenue to avoid penalties and maintain good standing with state tax authorities.

Steps to Complete the Delaware Monthly Withholding Form

Completing the Delaware Monthly Withholding Form involves several key steps:

- Gather all necessary employee wage information, including the total wages paid and the amount withheld for state income tax.

- Access the form through the Delaware Division of Revenue's website or a trusted digital document service.

- Fill in the required fields, ensuring all information is accurate and up to date.

- Review the completed form for any errors or omissions before submission.

- Submit the form by the designated deadline, either electronically or by mail, as per state guidelines.

Legal Use of the Delaware Monthly Withholding Form

The Delaware Monthly Withholding Form is legally binding when completed and submitted in accordance with state regulations. To ensure its validity, employers must adhere to the guidelines set forth by the Delaware Division of Revenue. This includes maintaining accurate records of employee wages and withholding amounts, as well as submitting the form by the required deadlines. Failure to comply with these legal requirements can result in penalties, including fines and interest on unpaid taxes.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines associated with the Delaware Monthly Withholding Form. Typically, the form is due by the last day of the month following the month in which the wages were paid. For example, if wages are paid in January, the form must be submitted by the end of February. It is crucial for employers to stay informed about any changes to these deadlines to avoid late fees and ensure timely compliance with state tax laws.

Required Documents

To complete the Delaware Monthly Withholding Form, employers need to gather specific documents and information, including:

- Employee payroll records detailing wages and withholding amounts.

- Previous monthly withholding forms for reference, if applicable.

- Any relevant tax identification numbers, such as the employer's federal EIN and state withholding account number.

Form Submission Methods

The Delaware Monthly Withholding Form can be submitted through various methods, including:

- Online submission via the Delaware Division of Revenue's e-filing system, which is often the most efficient method.

- Mailing a paper version of the form to the appropriate state tax office.

- In-person delivery at designated state revenue offices, if preferred.

Penalties for Non-Compliance

Employers who fail to file the Delaware Monthly Withholding Form on time or who submit inaccurate information may face significant penalties. These can include:

- Fines for late filing or underpayment of withheld taxes.

- Interest on any unpaid tax amounts, which can accumulate over time.

- Potential legal action from state tax authorities for continued non-compliance.

Quick guide on how to complete 2016 delaware monthly withholding form file monthly returns for the year 2016 use the form below if you are required to file

Complete Delaware Monthly Withholding Form FILE MONTHLY RETURNS FOR THE YEAR Use The Form Below If You Are Required To File And Pay Your seamlessly on any device

Online document management has become increasingly popular among organizations and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Delaware Monthly Withholding Form FILE MONTHLY RETURNS FOR THE YEAR Use The Form Below If You Are Required To File And Pay Your on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented task today.

How to modify and electronically sign Delaware Monthly Withholding Form FILE MONTHLY RETURNS FOR THE YEAR Use The Form Below If You Are Required To File And Pay Your effortlessly

- Find Delaware Monthly Withholding Form FILE MONTHLY RETURNS FOR THE YEAR Use The Form Below If You Are Required To File And Pay Your and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize signNow sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes moments and carries the same legal validity as a conventional ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Delaware Monthly Withholding Form FILE MONTHLY RETURNS FOR THE YEAR Use The Form Below If You Are Required To File And Pay Your to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 delaware monthly withholding form file monthly returns for the year 2016 use the form below if you are required to file

Create this form in 5 minutes!

How to create an eSignature for the 2016 delaware monthly withholding form file monthly returns for the year 2016 use the form below if you are required to file

The best way to create an eSignature for your PDF in the online mode

The best way to create an eSignature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

How to make an eSignature right from your smart phone

The way to generate an electronic signature for a PDF on iOS devices

How to make an eSignature for a PDF on Android OS

People also ask

-

What is the Delaware Monthly Withholding Form?

The Delaware Monthly Withholding Form is a crucial document for businesses that are required to file and pay their Delaware withholding tax on a monthly basis. Using this form ensures compliance with state tax laws and simplifies the tax filing process. If you need to file monthly returns for the year, this form is essential for maintaining organized records.

-

How do I complete the Delaware Monthly Withholding Form?

To complete the Delaware Monthly Withholding Form, input your business information, the total amount of withholding tax collected, and any other required details. Follow the instructions provided to ensure accuracy. If you are required to file and pay your Delaware withholding tax on a monthly basis, using the form correctly is vital for compliance.

-

What happens if I miss the filing deadline for the Delaware Monthly Withholding Form?

Missing the filing deadline for the Delaware Monthly Withholding Form may result in penalties and interest on unpaid taxes. It is important to file this form on time if you are required to file and pay your Delaware withholding tax on a monthly basis. Ensure timely submissions to avoid complications.

-

Can airSlate SignNow help with filing the Delaware Monthly Withholding Form?

Yes, airSlate SignNow is designed to empower businesses to send, sign, and manage documents effectively, including the Delaware Monthly Withholding Form. Our platform simplifies the process of preparing and submitting the form, allowing you to focus on your business operations. Streamline your filing by using our cost-effective solution.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers numerous features for tax document management, including e-signature capabilities, document storage, and workflow automation. These features assist in preparing and submitting your Delaware Monthly Withholding Form efficiently. Our solution is designed for businesses needing to file and pay their Delaware withholding tax on a monthly basis.

-

Is there a cost associated with using airSlate SignNow for filing tax forms?

airSlate SignNow offers competitive pricing for businesses looking to manage their documentation needs, including the filing of tax forms like the Delaware Monthly Withholding Form. We provide various plans to suit different business sizes and requirements. Explore our pricing options to find a custom fit that allows you to file monthly returns for the year.

-

Can I integrate airSlate SignNow with other software for tax filing?

Absolutely! airSlate SignNow integrates with various accounting and tax software solutions to streamline your filing process. This is especially beneficial for businesses that need to handle the Delaware Monthly Withholding Form and other tax-related documents efficiently. Integrate seamlessly for an optimized workflow.

Get more for Delaware Monthly Withholding Form FILE MONTHLY RETURNS FOR THE YEAR Use The Form Below If You Are Required To File And Pay Your

- Name jane smith dob 2251975 tn form

- Ph 3343 form

- Active member change of beneficiary treasury tn form

- 11 to 15 year visit tnaap form

- Other source health insurance information child support office portal cs oag state tx

- Texas certification form

- Texas declaration of informal marriage form 2008

- Supporter statement form

Find out other Delaware Monthly Withholding Form FILE MONTHLY RETURNS FOR THE YEAR Use The Form Below If You Are Required To File And Pay Your

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document