PERMIT NUMBER 001 NEVADA DEPARTMENT of TAXATION COMBINED SALES and USE TAX RETURN Please Enter Your 10 Digit TID Number Without 2016

Understanding the Permit Number 001 Nevada Department of Taxation Combined Sales and Use Tax Return

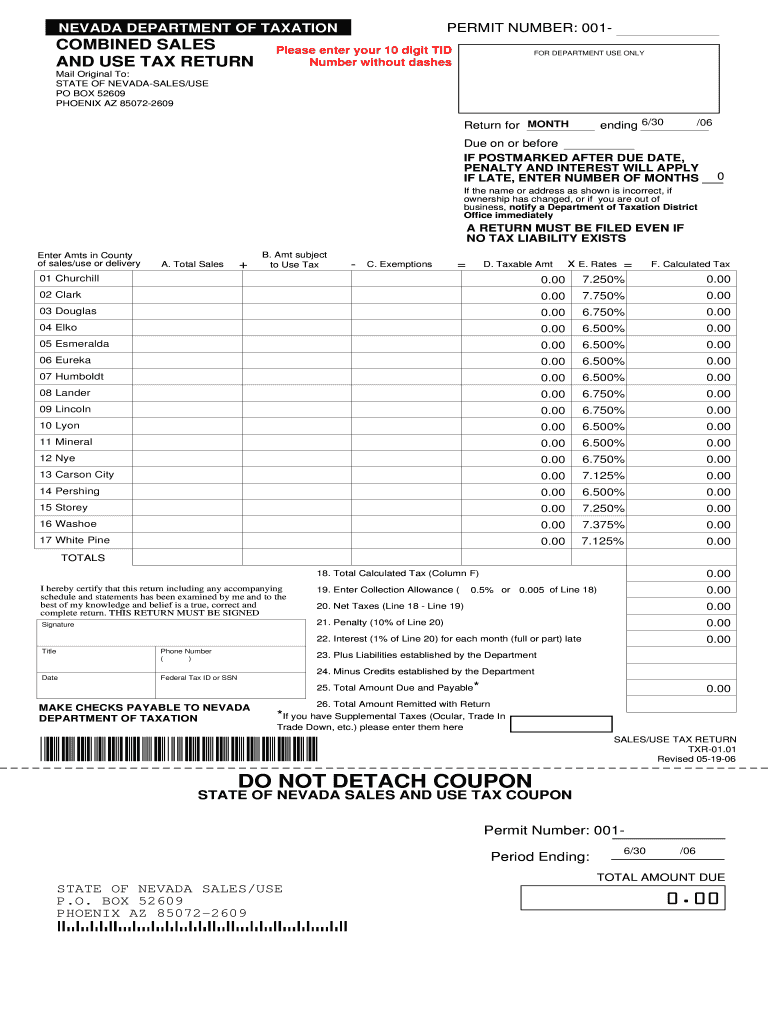

The Permit Number 001 Nevada Department of Taxation Combined Sales and Use Tax Return is a crucial form for businesses operating in Nevada. This form is used to report sales and use tax collected by businesses and is essential for compliance with state tax regulations. The form requires the taxpayer to enter their ten-digit TID number without dashes, ensuring accurate identification of the business entity. The completed form must be mailed to the designated address in Phoenix, Arizona, as specified in the instructions.

Steps to Complete the Permit Number 001 Nevada Department of Taxation Combined Sales and Use Tax Return

Completing the Permit Number 001 form involves several key steps:

- Gather necessary business information, including your ten-digit TID number.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the information for accuracy to avoid potential penalties.

- Sign and date the form where indicated.

- Mail the original form to the address provided: State of Nevada Sales/Use, PO Box 52609, Phoenix, AZ 85.

Legal Use of the Permit Number 001 Nevada Department of Taxation Combined Sales and Use Tax Return

The legal use of the Permit Number 001 form is governed by state tax laws. When properly completed and submitted, this form serves as a legal document that demonstrates compliance with Nevada's sales and use tax requirements. It is important to ensure that all information is truthful and accurate, as providing false information can lead to penalties and legal repercussions.

Obtaining the Permit Number 001 Nevada Department of Taxation Combined Sales and Use Tax Return

To obtain the Permit Number 001 form, businesses can visit the Nevada Department of Taxation's official website or contact their local tax office. The form is typically available for download, allowing for easy access. It is advisable to ensure that you are using the most current version of the form to comply with any recent changes in tax regulations.

State-Specific Rules for the Permit Number 001 Nevada Department of Taxation Combined Sales and Use Tax Return

Each state has specific rules regarding the filing and payment of sales and use taxes. In Nevada, businesses must adhere to the state’s guidelines, which include deadlines for filing the Permit Number 001 form and payment of any taxes due. Familiarizing yourself with these rules is essential to avoid late fees and ensure compliance with state tax laws.

Examples of Using the Permit Number 001 Nevada Department of Taxation Combined Sales and Use Tax Return

Businesses may encounter various scenarios when using the Permit Number 001 form. For instance, a retail store must report sales tax collected from customers on a monthly basis using this form. Similarly, a service provider may need to report use tax on items purchased for business use. Understanding these examples can help businesses better prepare for their tax obligations.

Quick guide on how to complete permit number 001 nevada department of taxation combined sales and use tax return please enter your 10 digit tid number without

Easily Prepare PERMIT NUMBER 001 NEVADA DEPARTMENT OF TAXATION COMBINED SALES AND USE TAX RETURN Please Enter Your 10 Digit TID Number Without on Any Device

Digital document management has become widespread among businesses and individuals. It offers a perfect environmentally-friendly option to traditional printed and signed documents, allowing you to find the appropriate form and securely keep it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage PERMIT NUMBER 001 NEVADA DEPARTMENT OF TAXATION COMBINED SALES AND USE TAX RETURN Please Enter Your 10 Digit TID Number Without on any platform using airSlate SignNow apps for Android or iOS and enhance any document-based procedure today.

The Simplest Way to Modify and eSign PERMIT NUMBER 001 NEVADA DEPARTMENT OF TAXATION COMBINED SALES AND USE TAX RETURN Please Enter Your 10 Digit TID Number Without Effortlessly

- Find PERMIT NUMBER 001 NEVADA DEPARTMENT OF TAXATION COMBINED SALES AND USE TAX RETURN Please Enter Your 10 Digit TID Number Without and click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign PERMIT NUMBER 001 NEVADA DEPARTMENT OF TAXATION COMBINED SALES AND USE TAX RETURN Please Enter Your 10 Digit TID Number Without while ensuring outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct permit number 001 nevada department of taxation combined sales and use tax return please enter your 10 digit tid number without

Create this form in 5 minutes!

How to create an eSignature for the permit number 001 nevada department of taxation combined sales and use tax return please enter your 10 digit tid number without

The best way to create an eSignature for your PDF document online

The best way to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

How to make an eSignature from your smart phone

The way to generate an electronic signature for a PDF document on iOS

How to make an eSignature for a PDF file on Android OS

People also ask

-

What is the purpose of the PERMIT NUMBER 001 NEVADA DEPARTMENT OF TAXATION COMBINED SALES AND USE TAX RETURN?

The PERMIT NUMBER 001 NEVADA DEPARTMENT OF TAXATION COMBINED SALES AND USE TAX RETURN is essential for businesses to report and pay sales and use taxes in Nevada. It ensures compliance with state tax laws. Fulfilling these requirements helps avoid penalties and ensures that businesses remain in good standing with the Nevada Department of Taxation.

-

How do I correctly enter my TID number for the sales tax return?

You should enter your 10-digit TID number without any dashes when filling out the PERMIT NUMBER 001 NEVADA DEPARTMENT OF TAXATION COMBINED SALES AND USE TAX RETURN. This is crucial for accurate processing. Make sure the number is up to date to avoid delays in your tax return submissions.

-

Where should I send my completed sales and use tax return?

Once completed, you should mail the original PERMIT NUMBER 001 NEVADA DEPARTMENT OF TAXATION COMBINED SALES AND USE TAX RETURN to STATE OF NEVADA SALES/USE, PO BOX 52609, PHOENIX, AZ 85072-2609. This ensures it signNowes the appropriate department for processing. Be sure to send it well before the deadline to avoid penalties.

-

Are there penalties for late submission of the sales tax return?

Yes, failing to submit the PERMIT NUMBER 001 NEVADA DEPARTMENT OF TAXATION COMBINED SALES AND USE TAX RETURN on time can result in penalties and interest charges. These fees can accumulate quickly, increasing the total amount due. It's vital to adhere to the submission deadlines to minimize costs.

-

What are the benefits of using airSlate SignNow for my tax documents?

Using airSlate SignNow can simplify the process of managing your PERMIT NUMBER 001 NEVADA DEPARTMENT OF TAXATION COMBINED SALES AND USE TAX RETURN and related documents. Its easy-to-use platform allows for electronic signatures and secure document management. This improves efficiency and ensures your tax submissions are completed accurately and on time.

-

Can I track the status of my submitted return using airSlate SignNow?

Yes, airSlate SignNow provides functionalities that allow you to track the status of your submitted documents, including the PERMIT NUMBER 001 NEVADA DEPARTMENT OF TAXATION COMBINED SALES AND USE TAX RETURN. You can receive notifications about document status. This feature enhances transparency and keeps you informed throughout the process.

-

Is airSlate SignNow compliant with Nevada state tax regulations?

Absolutely, airSlate SignNow is designed to be compliant with state regulations, including the requirements for the PERMIT NUMBER 001 NEVADA DEPARTMENT OF TAXATION COMBINED SALES AND USE TAX RETURN. This compliance ensures that your electronic filings adhere to legal standards. Businesses can use it reassuringly, knowing they meet all necessary legal obligations.

Get more for PERMIT NUMBER 001 NEVADA DEPARTMENT OF TAXATION COMBINED SALES AND USE TAX RETURN Please Enter Your 10 Digit TID Number Without

- Erfc7b request for estimates of retirement benefits for erfc 2001 andor vrs members form

- Mission statement the goal of texas tech university form

- Erfc7b request for estimates of retirement benefits for erfc 2001 andor vrs members 515647199 form

- Std report form

- Individual provider time form

- Send documentation to doh wa form

- Mco authorization forms better health together

- 18004401561 form

Find out other PERMIT NUMBER 001 NEVADA DEPARTMENT OF TAXATION COMBINED SALES AND USE TAX RETURN Please Enter Your 10 Digit TID Number Without

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now