Nevada Sales Tax Form 2016-2026

What is the Nevada Sales Tax Form

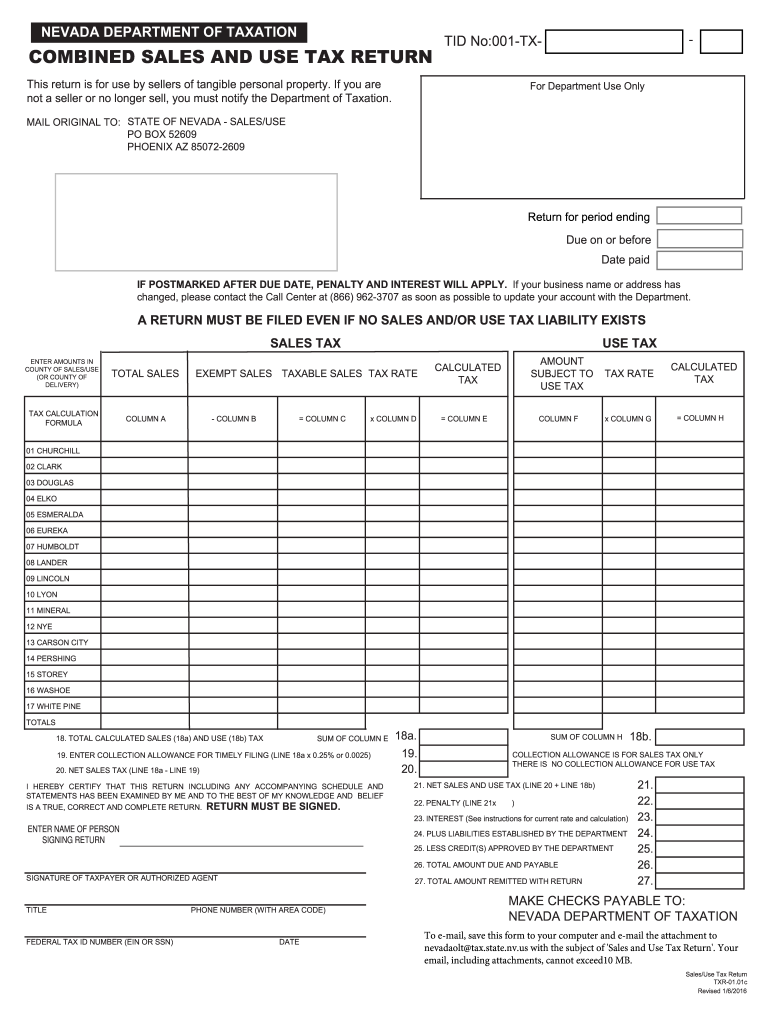

The Nevada Sales Tax Form, often referred to as the combined sales and use tax return Nevada form, is a crucial document for businesses operating within the state. This form is used to report and remit sales and use taxes collected from customers. It is essential for compliance with state tax regulations and helps ensure that businesses fulfill their tax obligations accurately and on time. The form captures various details, including total sales, taxable sales, and the amount of tax due, making it a vital tool for financial reporting.

How to use the Nevada Sales Tax Form

Using the Nevada Sales Tax Form involves several steps to ensure accurate reporting. First, businesses must gather all relevant sales data for the reporting period. This includes total sales figures, exemptions, and any deductions applicable. Next, the form should be filled out with precise information, ensuring that all required fields are completed. After filling out the form, businesses can calculate the total tax due and prepare for submission. It is important to keep a copy of the completed form for record-keeping and future reference.

Steps to complete the Nevada Sales Tax Form

Completing the Nevada Sales Tax Form requires careful attention to detail. Follow these steps for accurate completion:

- Gather sales records for the reporting period.

- Identify taxable and exempt sales.

- Fill in the form with total sales, taxable sales, and exemptions.

- Calculate the total tax due based on the applicable tax rate.

- Review the form for accuracy before submission.

These steps help ensure that businesses comply with state tax laws and avoid potential penalties.

Key elements of the Nevada Sales Tax Form

The Nevada Sales Tax Form includes several key elements that are essential for proper reporting. These elements typically consist of:

- Business name and address

- Reporting period

- Total sales amount

- Taxable sales amount

- Exemptions claimed

- Total tax due

Each of these components plays a significant role in determining the overall tax liability for the business.

Filing Deadlines / Important Dates

Timely filing of the Nevada Sales Tax Form is critical to avoid penalties. The deadlines for filing typically follow a monthly or quarterly schedule, depending on the business's tax liability. Businesses should be aware of the specific due dates for their reporting periods to ensure compliance and avoid late fees. It is advisable to mark these dates on the calendar and prepare the forms in advance to facilitate timely submission.

Form Submission Methods (Online / Mail / In-Person)

The Nevada Sales Tax Form can be submitted through various methods, providing flexibility for businesses. Options include:

- Online submission through the Nevada Department of Taxation's website.

- Mailing a completed paper form to the appropriate tax office.

- In-person submission at designated tax offices.

Each method has its own processing times and requirements, so businesses should choose the one that best suits their needs.

Quick guide on how to complete state of nevada tax forms 2016 2019

Your assistance manual on how to set up your Nevada Sales Tax Form

If you wish to learn how to generate and transmit your Nevada Sales Tax Form, here are some concise guidelines on how to streamline tax submission considerably.

To begin, all you need to do is create your airSlate SignNow account to revolutionize your document management online. airSlate SignNow is an exceptionally user-friendly and powerful document solution that enables you to adjust, produce, and finalize your tax forms with ease. With its editor, you can alternate between text, check boxes, and eSignatures, and revisit to modify information as necessary. Simplify your tax management with sophisticated PDF editing, eSigning, and intuitive sharing.

Adhere to the steps outlined below to complete your Nevada Sales Tax Form in just a few minutes:

- Open your account and begin working on PDFs within minutes.

- Utilize our directory to find any IRS tax form; browse through different versions and schedules.

- Press Get form to access your Nevada Sales Tax Form in our editor.

- Populate the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to affix your legally-recognized eSignature (if necessary).

- Review your document and correct any mistakes.

- Save changes, print your version, send it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Please keep in mind that paper filing can result in increased return mistakes and delays in reimbursements. Naturally, before e-filing your taxes, review the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct state of nevada tax forms 2016 2019

FAQs

-

Can I avoid the California state income tax on startup IPO capital gains by moving out of state (say to Nevada) before the IPO?

If you are no longer a resident of California when you receive the income, you will not pay California state taxes on it. But...not being a resident of California is not as simple as just "picking up and moving" to Nevada. California treats anyone who has established a domicile in California and who is temporarily absent from the state as a California resident. And if you maintain any ties to the state of California - if you continue to work there, or maintain an apartment there "just for occasional visits", or keep your bank accounts or your driver's license or your voter's registration or your car registration there, or store your goods there - there is a nonzero chance that California will treat your absence from the state as temporary no matter when you move. You have to demonstrate intent to completely abandon the state in order to ensure that California will not treat you as a resident. And California will interpret all of the factors that surround your departure when considering intent, not just the fact of a physical move. We've answered this question any number of times in the past few months, and the answer never changes. If you don't want to be taxed as a California resident, you need to completely, and totally, abandon the state. And if you can't, or don't want to, do that, then you need to accept the fact that California will tax you as a resident.

-

How can I fill out the income tax return of the year 2016-17 in 2018?

There is no option to file online return but you can prepare an offline return and went to the officer of your jurisdiction income tax commissioner and after his permission you can file the return with his office.

-

What percent of people don't have the intelligence to fill out tax forms?

Recent statistics that I've seen indicate that about 66% of electronically filed returns are filed by paid preparers. This doesn't necessarily mean that these filers don't have the intelligence but it does indicate that they have a level of discomfort and anxiety and prefer the solace of having a paid preparer fill out and transmit the forms. It all depends on the level of complexity of the form. For the young wage earner living at home with his or her parents, who is able to operate a computer and can operate simple tax return software, I would think that 80% should be intelligent enough to fill out tax forms. Especially because the software is designed to prompt and assist (and check the arithmetic).One of America's most respected jurists, Judge Learned Hand, offers a more thoughtful observation on the law of taxation: ‘In my own case the words of such an act as the Income Tax ... merely dance before my eyes in a meaningless procession; cross-reference to cross-reference, exception upon exception—couched in abstract terms that offer no handle to seize hold of—leave in my mind only a confused sense of some vitally important, but successfully concealed, purport, which it is my duty to extract, but which is within my power, if at all, only after the most inordinate expenditure of time. I know that these monsters are the result of fabulous industry and ingenuity, plugging up this hole and casting out that net, against all possible evasion; yet at times I cannot help recalling a saying of William James about certain passages of Hegal [sic]: that they were no doubt written with a passion of rationality; but that one cannot help wondering whether to the reader they have any significance save that the words are strung together with syntactical correctness.’ Ruth Realty Co. v. Horn, 222 Or. 290, 353 P.2d 524, 526 n. 2 (Or. 1960) (citing 57 Yale L.J. 167, 169 (1947)), overruled on other grounds by Parr v. DOR, 276 Or. 113, 553 P.2d 1051 (Or. 1976). The Humorist Dave Barry had this observation "The IRS is working hard to develop a tax form so scary that merely reading it will cause the ordinary taxpayer's brain to explode.” His candidate for the best effort so far is Schedule J Form 1118 "Separate Limitation Loss Allocations and Other Adjustments Necessary to Determine Numerators of Limitations fraction, Year end Recharacterization Balance and Overall Foreign Loss Account Balances"And don’t forget this observation from Albert Einstein “The hardest thing to understand in the world is the income tax. “ So if Al had trouble understanding taxes, I don't see how a mere mortal has any chance.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

Can I print a notice of intent form to homeschool in Nevada, fill it out, and turn it in?

It's best to ask homeschoolers in your state. Every state has different laws. What works in one may not work in another.This looks like the information you need: Notice of Intent (NOI)

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

I worked in two different states this year (and two different companies), will I have to fill out state income tax forms for both?

A2A BUT We need more information to give you an accurate answer. There are 50 different states and 43 of them have some form of individual income tax laws, so that is 1,849 different possibilities of how to answer this question. That is before we even factor in that you did not tell us how long you lived in either state, which could be a day or 364 days.I can give you the probably answer which is yes you will most likely need to file with two states this year. Take a look at your two W2’s and at the bottom you will see what state(s) your earnings were reported to. If the W2’s have different states then absolutely you should file a return with both states, because what is on the W2 will be presumed to be accurate, even if your presence in the state did not actually rise to the level of needing to file. The biggest question will become if you are filing as a resident, non-resident or part-year resident. Your filing status can make a difference in how much tax you owe and unfortunately it is not as simple as just thinking you lived in a place for only part of the year so you were automatically a part-year resident.This is one of those situations where I would advise you that your taxes this year are complex enough that you really need to go to a professional to have your taxes done. That person should be able to review the specifics of your situation and advise you how to file.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

Create this form in 5 minutes!

How to create an eSignature for the state of nevada tax forms 2016 2019

How to make an electronic signature for your State Of Nevada Tax Forms 2016 2019 in the online mode

How to generate an electronic signature for your State Of Nevada Tax Forms 2016 2019 in Chrome

How to create an eSignature for signing the State Of Nevada Tax Forms 2016 2019 in Gmail

How to create an eSignature for the State Of Nevada Tax Forms 2016 2019 straight from your smartphone

How to generate an electronic signature for the State Of Nevada Tax Forms 2016 2019 on iOS

How to generate an eSignature for the State Of Nevada Tax Forms 2016 2019 on Android

People also ask

-

What is the Nevada sales tax return form?

The Nevada sales tax return form is a document that businesses use to report their sales and pay the appropriate sales tax to the state. It is crucial for ensuring compliance with Nevada tax regulations and helps avoid potential penalties. This form can be easily accessed and submitted online through the airSlate SignNow platform.

-

How do I fill out the Nevada sales tax return form using airSlate SignNow?

Filling out the Nevada sales tax return form with airSlate SignNow is simple and intuitive. Our platform provides easy-to-follow templates that guide you through the necessary sections and calculations. Additionally, you can collaborate with your team in real-time to ensure accuracy before submission.

-

What features does airSlate SignNow offer for managing the Nevada sales tax return form?

airSlate SignNow offers a range of features specifically tailored for managing the Nevada sales tax return form. Features include customizable templates, eSignature capabilities, and document storage options that enhance workflow efficiency. These tools help businesses streamline their tax reporting and filing processes signNowly.

-

Is there a cost associated with using airSlate SignNow for the Nevada sales tax return form?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for all business sizes. Our pricing plans are flexible, allowing you to choose the one that fits your needs and budget. This investment facilitates easy and efficient management of the Nevada sales tax return form and other essential documents.

-

Can I integrate airSlate SignNow with other software for the Nevada sales tax return form?

Absolutely! airSlate SignNow supports integrations with various accounting and business software, making it easier to manage your Nevada sales tax return form. Popular integrations include QuickBooks, Xero, and others, enabling seamless data transfer and reducing manual entry errors. This integration improves your overall efficiency in handling sales tax documentation.

-

What are the benefits of using airSlate SignNow for my Nevada sales tax return form?

Using airSlate SignNow for your Nevada sales tax return form offers numerous benefits, including enhanced accuracy, faster processing times, and improved compliance. The platform's eSignature feature allows for quick approvals, while built-in reminders help you meet filing deadlines. Overall, it simplifies the tax reporting process for businesses.

-

Do I need prior experience to use airSlate SignNow for the Nevada sales tax return form?

No prior experience is necessary to use airSlate SignNow for the Nevada sales tax return form. Our user-friendly interface and step-by-step guidance make it accessible for everyone, regardless of technical skills. You can easily learn how to navigate the platform while efficiently managing your tax documents.

Get more for Nevada Sales Tax Form

Find out other Nevada Sales Tax Form

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later