FTB Publication 1005 Pension and Annuity Guidelines FTB Publication 1005 Pension and Annuity Guidelines Form

Understanding the FTB Publication 1005 Pension and Annuity Guidelines

The FTB Publication 1005 provides essential guidelines for taxpayers regarding pension and annuity income in California. This publication outlines how to report pension and annuity income, detailing the types of income that are taxable and those that may be exempt. Understanding these guidelines is crucial for ensuring compliance with state tax laws and accurately reporting income on tax returns. The publication also clarifies the differences between various pension plans, including public and private pensions, and how they affect tax obligations.

Steps to Complete the FTB Publication 1005 Pension and Annuity Guidelines

Completing the FTB Publication 1005 involves several key steps to ensure proper reporting of pension and annuity income. First, gather all relevant documents, including 1099-R forms and any other statements received from pension providers. Next, review the guidelines to determine which income is taxable and which may be excluded. Fill out the necessary sections of your California tax return, referencing the publication for specific instructions on how to report different types of income. Finally, ensure that all calculations are accurate and that you have included any applicable deductions or credits related to pension income.

Legal Use of the FTB Publication 1005 Pension and Annuity Guidelines

The FTB Publication 1005 is legally recognized as a resource for taxpayers in California. It serves as an authoritative guide for understanding how pension and annuity income should be reported for state tax purposes. Compliance with these guidelines helps prevent potential legal issues, such as audits or penalties for incorrect reporting. Taxpayers are encouraged to refer to this publication when preparing their tax returns to ensure adherence to state laws and regulations.

Key Elements of the FTB Publication 1005 Pension and Annuity Guidelines

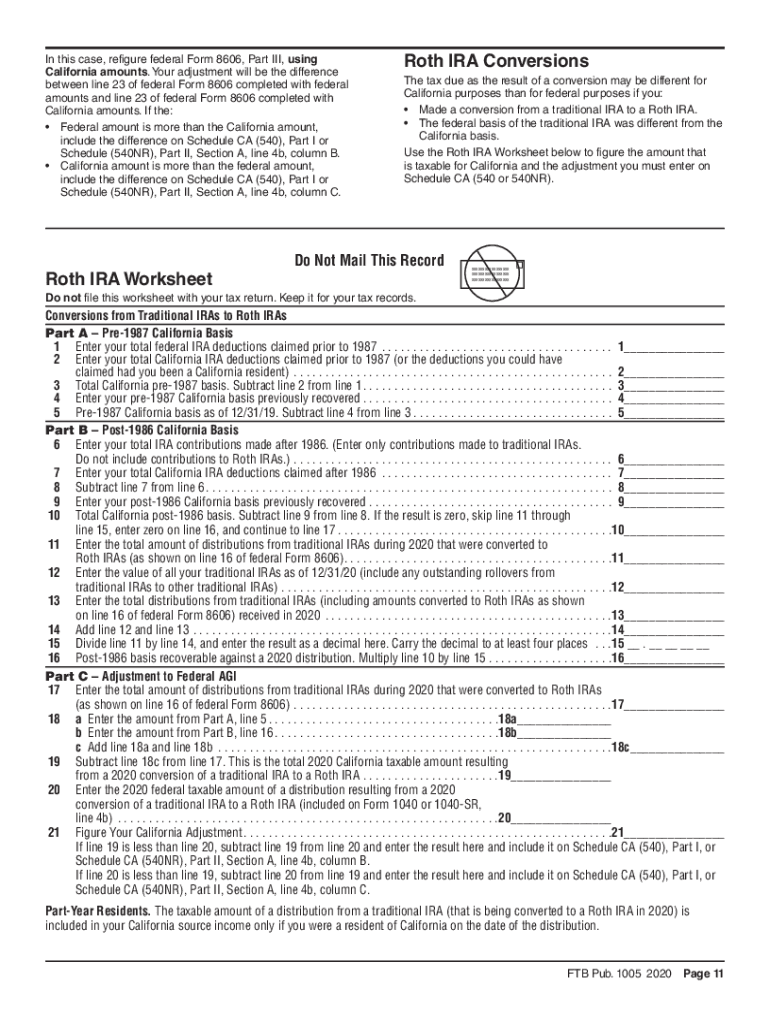

Several key elements are highlighted in the FTB Publication 1005 that taxpayers should be aware of. These include:

- Types of pension and annuity income that must be reported.

- Exemptions available for certain types of income.

- Instructions for completing the necessary tax forms.

- Information on how to handle rollovers and transfers between retirement accounts.

- Details on tax implications for beneficiaries of pensions.

Examples of Using the FTB Publication 1005 Pension and Annuity Guidelines

To illustrate the application of the FTB Publication 1005, consider the following examples:

- A retired public employee receiving monthly pension payments must report this income as taxable on their state tax return.

- A taxpayer who rolled over funds from a 401(k) to an IRA may not need to report this as taxable income, depending on the circumstances outlined in the publication.

- Beneficiaries receiving a lump-sum distribution from a deceased relative's pension plan must follow specific guidelines for reporting this income.

Filing Deadlines and Important Dates for the FTB Publication 1005

Taxpayers must be aware of important deadlines when filing their returns that include pension and annuity income. Typically, California tax returns are due on April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check the latest updates from the FTB regarding any changes to filing deadlines, especially for taxpayers who may qualify for extensions or special circumstances.

Quick guide on how to complete 2020 ftb publication 1005 pension and annuity guidelines 2020 ftb publication 1005 pension and annuity guidelines

Effortlessly Prepare FTB Publication 1005 Pension And Annuity Guidelines FTB Publication 1005 Pension And Annuity Guidelines on Any Device

The management of online documents has become increasingly favored by both businesses and individuals. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without any delays. Manage FTB Publication 1005 Pension And Annuity Guidelines FTB Publication 1005 Pension And Annuity Guidelines on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The Simplest Method to Edit and eSign FTB Publication 1005 Pension And Annuity Guidelines FTB Publication 1005 Pension And Annuity Guidelines with Ease

- Locate FTB Publication 1005 Pension And Annuity Guidelines FTB Publication 1005 Pension And Annuity Guidelines and click Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Highlight relevant sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which takes just a few seconds and holds the same legal standing as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method of sending your form, be it by email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and eSign FTB Publication 1005 Pension And Annuity Guidelines FTB Publication 1005 Pension And Annuity Guidelines and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2020 ftb publication 1005 pension and annuity guidelines 2020 ftb publication 1005 pension and annuity guidelines

The best way to create an eSignature for a PDF online

The best way to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The best way to generate an electronic signature from your smartphone

The way to generate an eSignature for a PDF on iOS

The best way to generate an electronic signature for a PDF file on Android

People also ask

-

What is a pub pension and how does it work?

A pub pension is a benefit plan specifically designed for employees within the public sector, providing retirement income based on the employee's salary and years of service. It typically involves contributions from both the employee and employer, accumulating funds over time to provide financial security in retirement.

-

How does airSlate SignNow facilitate pub pension document management?

airSlate SignNow allows organizations managing pub pensions to streamline the processes associated with document signing and management. With our platform, users can easily send, eSign, and store critical documents securely, ensuring quick access and compliance throughout the pension administration.

-

What are the pricing options for airSlate SignNow for managing pub pension documents?

Our pricing plans are designed to be cost-effective, offering various tiers to suit different organizational needs, including those managing pub pensions. Depending on your requirements—such as the number of users and document volume—you can choose a plan that provides the best value without compromising on features.

-

Can airSlate SignNow integrate with other tools used for pub pensions?

Yes, airSlate SignNow is equipped with seamless integrations that can connect with other software commonly used in managing pub pensions. This includes HR platforms, payroll systems, and document management tools, enhancing workflow efficiency and reducing data entry errors.

-

What are the key benefits of using airSlate SignNow for pub pension processes?

Using airSlate SignNow for pub pension processes ensures greater efficiency, reduced paperwork, and enhanced security. Its user-friendly interface and robust features allow for quicker turnaround times and improved accuracy in document handling, ultimately aiding in effective pension management.

-

What features does airSlate SignNow offer specifically for pub pension documentation?

airSlate SignNow offers several features tailored for pub pension documentation, including customizable templates, advanced signing options, and audit trail capabilities. These tools empower organizations to manage their pension documents with precision and ensure compliance with legal requirements.

-

How secure is airSlate SignNow when handling pub pension documents?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive pub pension documents. Our platform utilizes advanced encryption and multi-factor authentication to protect data, ensuring that your documents remain confidential and secure throughout the signing process.

Get more for FTB Publication 1005 Pension And Annuity Guidelines FTB Publication 1005 Pension And Annuity Guidelines

Find out other FTB Publication 1005 Pension And Annuity Guidelines FTB Publication 1005 Pension And Annuity Guidelines

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple