Instructions for Form it 203 Nonresident and Part Year 2020

Understanding the IT 203 X Form

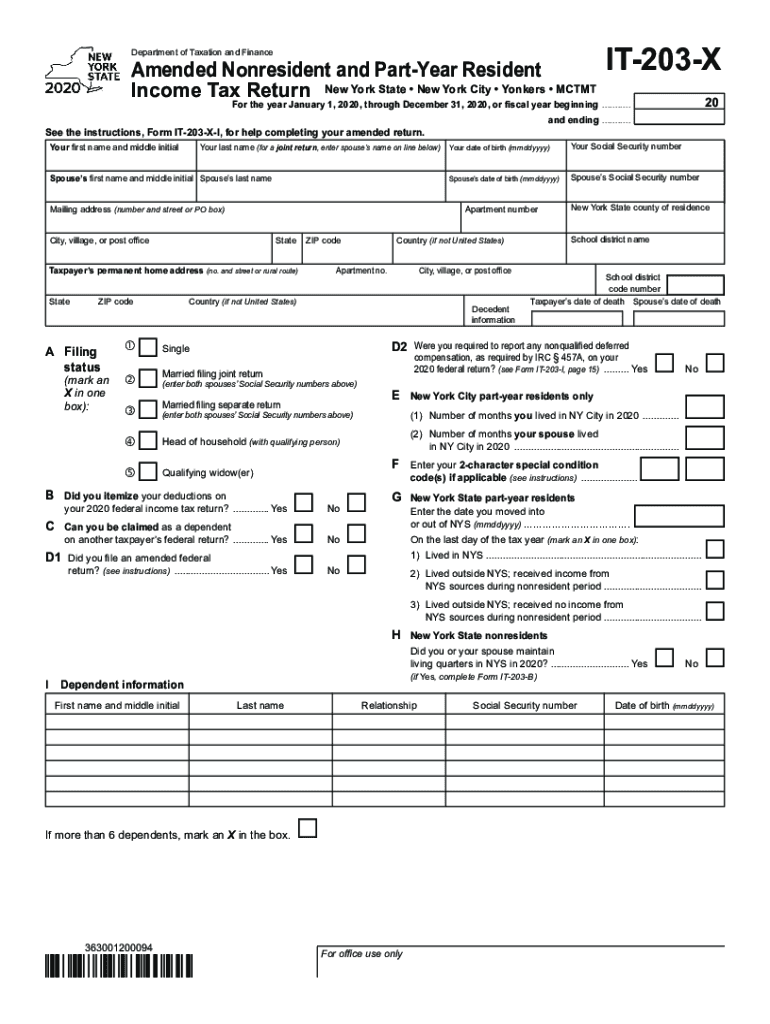

The IT 203 X form is used by nonresidents and part-year residents of New York to report income and calculate their tax obligations. It is essential for individuals who earn income in New York but do not reside there full-time. This form allows taxpayers to claim credits and deductions applicable to their specific situations, ensuring compliance with state tax laws.

Steps to Complete the IT 203 X Form

Completing the IT 203 X form involves several key steps:

- Gather all necessary documentation, including income statements and any relevant tax forms.

- Fill out personal information, such as your name, address, and Social Security number.

- Report your income earned in New York, including wages, interest, and dividends.

- Claim any applicable deductions and credits to reduce your taxable income.

- Review your completed form for accuracy before submission.

Legal Use of the IT 203 X Form

The IT 203 X form is legally binding when completed accurately and submitted according to New York State tax regulations. It is crucial to ensure that all information provided is truthful and complete, as discrepancies can lead to penalties or audits. Utilizing an electronic signature through a reliable platform can enhance the legal validity of your submission.

Filing Deadlines for the IT 203 X Form

Timely filing of the IT 203 X form is essential to avoid penalties. The deadline for submitting this form typically aligns with the federal tax filing deadline, which is usually April 15. However, if you are unable to meet this deadline, it is advisable to file for an extension to prevent late fees.

Required Documents for the IT 203 X Form

To accurately complete the IT 203 X form, you will need several documents, including:

- W-2 forms from employers for income earned in New York.

- 1099 forms for other income sources, such as freelance work or interest.

- Documentation supporting any deductions or credits claimed.

- Previous year’s tax return for reference.

Obtaining the IT 203 X Form

The IT 203 X form can be obtained from the New York State Department of Taxation and Finance website. It is available in both digital and printable formats, allowing taxpayers to choose the method that best suits their needs. Additionally, tax preparation software often includes this form, simplifying the filing process.

Quick guide on how to complete instructions for form it 203 nonresident and part year

Complete Instructions For Form IT 203 Nonresident And Part Year effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents swiftly without interruptions. Manage Instructions For Form IT 203 Nonresident And Part Year on any device using airSlate SignNow's Android or iOS applications and simplify any document-centric process today.

How to edit and eSign Instructions For Form IT 203 Nonresident And Part Year with ease

- Locate Instructions For Form IT 203 Nonresident And Part Year and then click Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Verify the details and then click on the Done button to save your modifications.

- Choose how you'd like to share your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choice. Edit and eSign Instructions For Form IT 203 Nonresident And Part Year while ensuring exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form it 203 nonresident and part year

Create this form in 5 minutes!

How to create an eSignature for the instructions for form it 203 nonresident and part year

The best way to generate an electronic signature for your PDF file in the online mode

The best way to generate an electronic signature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF document on Android

People also ask

-

What is the IT 203 X form and why is it important?

The IT 203 X form is a tax amendment form used in New York State to correct previously filed tax returns. It is important because it ensures that your tax records are accurate and up to date, preventing future issues with the tax authorities.

-

How does airSlate SignNow simplify the completion of the IT 203 X form?

airSlate SignNow simplifies the completion of the IT 203 X form by providing an easy-to-use platform for digitally filling out and signing your documents. This efficiency not only saves time but also reduces the chances of errors in your submission.

-

Is there a cost associated with using airSlate SignNow for the IT 203 X form?

Yes, airSlate SignNow operates on a subscription-based pricing model. However, the cost is generally quite competitive when compared to traditional methods of sending and signing documents, making it a cost-effective solution for managing the IT 203 X form.

-

Can I store my IT 203 X form documents securely with airSlate SignNow?

Absolutely! airSlate SignNow provides secure cloud storage for all your documents, including the IT 203 X form. This ensures that your sensitive information is protected and easily accessible whenever you need it.

-

Are there integrations available for the IT 203 X form with other software?

Yes, airSlate SignNow seamlessly integrates with various software applications, allowing you to manage the IT 203 X form alongside your other tools. This integration enhances workflow efficiency and minimizes manual data entry.

-

What features does airSlate SignNow offer for the IT 203 X form?

Key features of airSlate SignNow for the IT 203 X form include electronic signatures, customizable templates, and real-time tracking of document status. These features streamline the process, making it easier for users to manage their tax amendments.

-

Can I access the IT 203 X form on mobile devices?

Yes, airSlate SignNow is mobile-friendly, allowing you to access and complete the IT 203 X form from your smartphone or tablet. This flexibility enables you to manage your documents on the go.

Get more for Instructions For Form IT 203 Nonresident And Part Year

Find out other Instructions For Form IT 203 Nonresident And Part Year

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure