it 203 Nonresident and Part Year Resident Income Tax Return Information 2022

What is the IT 203 Nonresident and Part-Year Resident Income Tax Return?

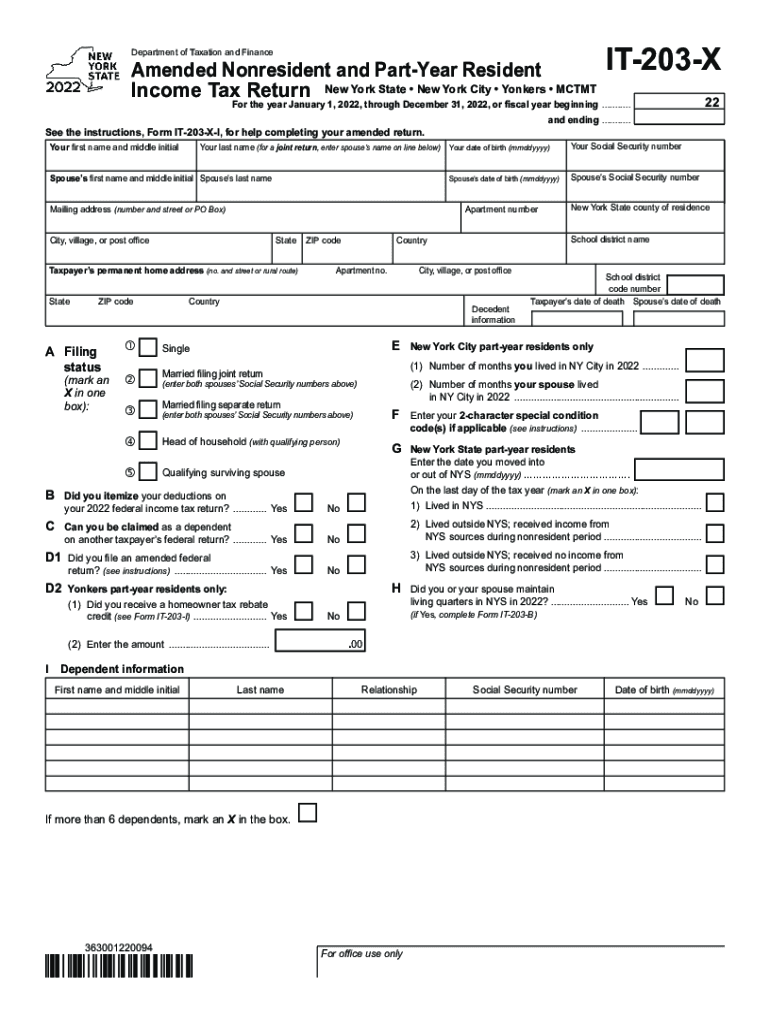

The IT 203 form is designed for nonresident and part-year resident individuals who earn income in New York State. This form allows taxpayers to report their New York source income and calculate their tax liability. It is essential for individuals who do not reside in New York for the entire tax year but have income sourced from the state. Understanding this form is crucial for compliance with state tax regulations and ensuring accurate reporting of income.

Steps to Complete the IT 203 Nonresident and Part-Year Resident Income Tax Return

Completing the IT 203 involves several steps to ensure accuracy and compliance:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Determine your residency status and the amount of income earned in New York.

- Fill out the IT 203 form, entering your income, deductions, and credits accurately.

- Calculate your tax liability based on your New York source income.

- Review the completed form for accuracy before submission.

Key Elements of the IT 203 Nonresident and Part-Year Resident Income Tax Return

Several key elements are essential when filling out the IT 203 form:

- Personal Information: Include your name, address, and Social Security number.

- Income Reporting: Accurately report all income earned in New York State.

- Deductions and Credits: Identify any applicable deductions or credits that may reduce your tax liability.

- Signature: Ensure the form is signed and dated to validate the submission.

Filing Deadlines / Important Dates for the IT 203

It is crucial to be aware of the filing deadlines for the IT 203 form to avoid penalties:

- The IT 203 must be filed by April 15 of the year following the tax year.

- If April 15 falls on a weekend or holiday, the deadline is extended to the next business day.

- Extensions may be available, but they require filing a separate request.

Legal Use of the IT 203 Nonresident and Part-Year Resident Income Tax Return

The IT 203 form is legally binding when completed correctly and submitted on time. It complies with New York State tax laws, ensuring that nonresidents and part-year residents fulfill their tax obligations. Proper use of this form helps avoid legal issues and ensures that taxpayers are in good standing with state tax authorities.

Required Documents for Filing the IT 203

To complete the IT 203 form accurately, certain documents are required:

- W-2 forms from employers reporting income earned in New York.

- 1099 forms for any freelance or contract work conducted in the state.

- Records of any other income sources related to New York.

- Documentation for deductions or credits claimed on the return.

Quick guide on how to complete it 203 nonresident and part year resident income tax return information

Complete IT 203 Nonresident And Part year Resident Income Tax Return Information seamlessly on any device

Digital document management has gained traction among companies and individuals alike. It offers an ideal environmentally-friendly substitute to traditional printed and signed paperwork, allowing you to obtain the correct format and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly without obstacles. Handle IT 203 Nonresident And Part year Resident Income Tax Return Information on any platform using airSlate SignNow's Android or iOS applications and simplify your document-focused tasks today.

How to edit and eSign IT 203 Nonresident And Part year Resident Income Tax Return Information effortlessly

- Obtain IT 203 Nonresident And Part year Resident Income Tax Return Information and then click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important parts of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Craft your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Select your delivery method for the form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious searches for forms, or mistakes that necessitate reprinting document copies. airSlate SignNow addresses all your document management needs within a few clicks from your preferred device. Alter and eSign IT 203 Nonresident And Part year Resident Income Tax Return Information to ensure effective communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct it 203 nonresident and part year resident income tax return information

Create this form in 5 minutes!

How to create an eSignature for the it 203 nonresident and part year resident income tax return information

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to it 203?

airSlate SignNow is a powerful digital signature solution that simplifies the process of sending and signing documents electronically. With the growing demand for efficient document management, it 203 highlights the importance of adopting digital solutions like SignNow to enhance business productivity.

-

How does the pricing structure of airSlate SignNow compare to other solutions in the context of it 203?

airSlate SignNow offers competitive pricing tailored to various business needs, making it an affordable choice in the realm of it 203. With different plans catering to both small and large organizations, users can choose a cost-effective solution that fits their budget while gaining access to robust features.

-

What key features does airSlate SignNow offer related to it 203?

airSlate SignNow provides several key features essential for document management, such as customizable workflows, secure eSignatures, and templates. These features align with the goals outlined in it 203 by streamlining processes and improving efficiency across organizations.

-

What are the benefits of using airSlate SignNow as per it 203 guidelines?

The benefits of using airSlate SignNow include enhanced convenience, improved turnaround times, and reduced paperwork, all of which support the initiatives of it 203. By facilitating seamless eSigning and document sharing, businesses can boost productivity and ensure compliance with modern standards.

-

Can I integrate airSlate SignNow with other business tools within the framework of it 203?

Yes, airSlate SignNow easily integrates with other popular business tools and applications, enhancing its functionality in the context of it 203. These integrations allow for a more cohesive workflow, making it simple to manage documents alongside your existing tools.

-

Is airSlate SignNow secure and compliant with it 203 standards?

Absolutely! airSlate SignNow prioritizes security and compliance with industry requirements, including those set forth by it 203. With features like encryption, secure storage, and audit trails, you can trust that your documents are protected throughout the signing process.

-

How can small businesses benefit from using airSlate SignNow according to it 203?

Small businesses can greatly benefit from airSlate SignNow as it offers a cost-effective solution that streamlines document workflows, in line with it 203 recommendations. By leveraging this tool, small businesses can save time and reduce overhead costs associated with traditional signing methods.

Get more for IT 203 Nonresident And Part year Resident Income Tax Return Information

- Notice of default in payment of rent as warning prior to demand to pay or terminate for residential property tennessee form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for nonresidential or commercial property 497326806 form

- Notice of intent to vacate at end of specified lease term from tenant to landlord for residential property tennessee form

- Notice of intent to vacate at end of specified lease term from tenant to landlord nonresidential tennessee form

- Notice of intent not to renew at end of specified term from landlord to tenant for residential property tennessee form

- Notice of intent not to renew at end of specified term from landlord to tenant for nonresidential or commercial property 497326810 form

- Tennessee termination lease form

- Notice of breach of written lease for violating specific provisions of lease with right to cure for residential property from 497326814 form

Find out other IT 203 Nonresident And Part year Resident Income Tax Return Information

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word

- How Can I Send Sign Word

- Send Sign Document Online

- Send Sign Document Computer

- Send Sign Document Myself

- Send Sign Document Secure

- Send Sign Document iOS