Form it 203 X Amended Nonresident and Part Year Resident Income Tax Return Tax Year 2024-2026

What is the Form IT 203 X Amended Nonresident And Part Year Resident Income Tax Return Tax Year

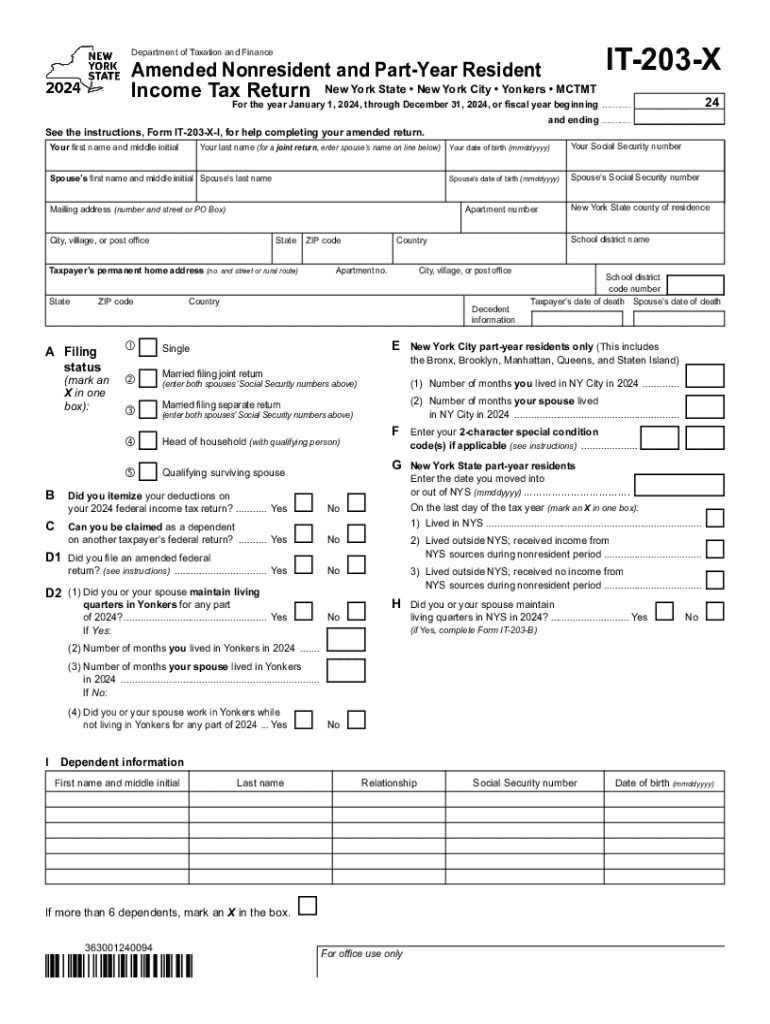

The Form IT 203 X is specifically designed for nonresident and part-year resident taxpayers in the United States who need to amend their previously filed income tax returns. This form allows individuals to correct errors or make changes to their tax information for a specific tax year. It is essential for ensuring that taxpayers accurately report their income and claim any deductions or credits they may be eligible for, thereby aligning their tax obligations with the current tax laws.

How to use the Form IT 203 X Amended Nonresident And Part Year Resident Income Tax Return Tax Year

Using the Form IT 203 X involves several steps. First, taxpayers must gather their original tax return and any relevant documents that support the changes they wish to make. Next, they need to complete the form by providing updated information, including corrected income, deductions, and credits. After filling out the form, it should be reviewed for accuracy before submission. Finally, the amended return can be filed either by mail or electronically, depending on the submission options available for the specific tax year.

Steps to complete the Form IT 203 X Amended Nonresident And Part Year Resident Income Tax Return Tax Year

Completing the Form IT 203 X requires careful attention to detail. Here are the steps to follow:

- Obtain the Form IT 203 X from the appropriate tax authority or website.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Indicate the tax year you are amending.

- Provide the corrected amounts for income, deductions, and credits.

- Explain the reason for the amendment in the designated section.

- Review the completed form for accuracy and completeness.

- Sign and date the form before submission.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Form IT 203 X. Generally, amended returns must be filed within three years of the original due date of the return being amended. Taxpayers should also keep in mind any specific deadlines for the tax year they are amending, as these can vary. Filing within the appropriate timeframe ensures compliance and avoids potential penalties.

Required Documents

To successfully complete the Form IT 203 X, taxpayers need to gather several documents. These typically include:

- The original tax return for the year being amended.

- Any additional documents that support the changes being made, such as W-2s, 1099s, or receipts for deductions.

- Any correspondence from the tax authority regarding the original return.

Having these documents ready will facilitate a smoother amendment process.

Eligibility Criteria

Eligibility to use the Form IT 203 X is generally limited to nonresident and part-year resident taxpayers who have previously filed a tax return for the relevant tax year. Taxpayers must have a valid reason for amending their return, such as correcting errors or claiming missed deductions. It is important to ensure that the changes made comply with current tax laws and regulations.

Create this form in 5 minutes or less

Find and fill out the correct form it 203 x amended nonresident and part year resident income tax return tax year 772083192

Create this form in 5 minutes!

How to create an eSignature for the form it 203 x amended nonresident and part year resident income tax return tax year 772083192

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form IT 203 X Amended Nonresident And Part Year Resident Income Tax Return Tax Year?

The Form IT 203 X Amended Nonresident And Part Year Resident Income Tax Return Tax Year is a tax form used by nonresidents and part-year residents to amend their previously filed New York State income tax returns. This form allows taxpayers to correct errors or make changes to their income, deductions, or credits. It's essential for ensuring accurate tax reporting and compliance.

-

How can airSlate SignNow help with the Form IT 203 X Amended Nonresident And Part Year Resident Income Tax Return Tax Year?

airSlate SignNow provides a streamlined platform for electronically signing and sending the Form IT 203 X Amended Nonresident And Part Year Resident Income Tax Return Tax Year. Our easy-to-use interface simplifies the process, allowing users to complete and submit their amended returns quickly and securely. This saves time and reduces the hassle of traditional paper filing.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of individuals and businesses. Our plans include various features for managing documents, including the Form IT 203 X Amended Nonresident And Part Year Resident Income Tax Return Tax Year. You can choose a plan that fits your budget and requirements, ensuring you get the best value for your eSignature needs.

-

Is airSlate SignNow secure for submitting sensitive tax documents?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for submitting sensitive documents like the Form IT 203 X Amended Nonresident And Part Year Resident Income Tax Return Tax Year. We utilize advanced encryption and security protocols to protect your data throughout the signing process. You can trust us to keep your information confidential and secure.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow offers integrations with various tax preparation software, enhancing your workflow when dealing with forms like the Form IT 203 X Amended Nonresident And Part Year Resident Income Tax Return Tax Year. This allows you to seamlessly manage your documents and eSignatures within your existing systems, improving efficiency and productivity.

-

What features does airSlate SignNow offer for managing tax forms?

airSlate SignNow includes a range of features designed to simplify the management of tax forms, including the Form IT 203 X Amended Nonresident And Part Year Resident Income Tax Return Tax Year. Key features include customizable templates, automated reminders, and real-time tracking of document status. These tools help ensure that your tax documents are handled efficiently and accurately.

-

How long does it take to complete the Form IT 203 X Amended Nonresident And Part Year Resident Income Tax Return Tax Year using airSlate SignNow?

Using airSlate SignNow, completing the Form IT 203 X Amended Nonresident And Part Year Resident Income Tax Return Tax Year can be done in a matter of minutes. Our user-friendly platform guides you through the process, allowing you to fill out and eSign your form quickly. This efficiency helps you meet deadlines without unnecessary delays.

Get more for Form IT 203 X Amended Nonresident And Part Year Resident Income Tax Return Tax Year

Find out other Form IT 203 X Amended Nonresident And Part Year Resident Income Tax Return Tax Year

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now