New York City, Yonkers, and MCTMT Department of Taxation 2021

What is the New York City, Yonkers, and MCTMT Department of Taxation?

The New York City, Yonkers, and MCTMT Department of Taxation is responsible for administering tax laws and collecting taxes within these jurisdictions. This department oversees various taxes, including income taxes, property taxes, and the Metropolitan Commuter Transportation Mobility Tax (MCTMT). It ensures compliance with state regulations and provides guidance to taxpayers regarding their obligations.

Steps to complete the New York City, Yonkers, and MCTMT Department of Taxation

Completing forms for the New York City, Yonkers, and MCTMT Department of Taxation involves several key steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Determine your filing status and eligibility for any deductions or credits.

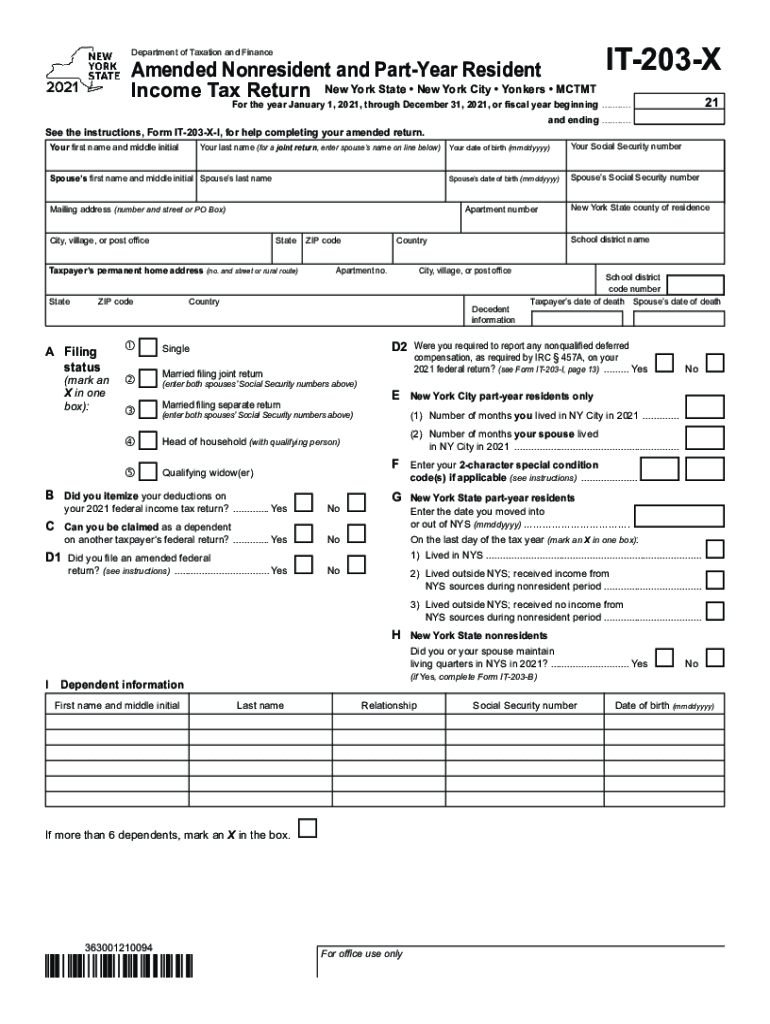

- Fill out the appropriate forms, such as the IT-203-X for amended returns, ensuring all information is accurate.

- Review your completed forms for errors or omissions before submission.

- Submit your forms electronically or via mail, adhering to the deadlines set by the department.

Filing Deadlines / Important Dates

Filing deadlines for the New York City, Yonkers, and MCTMT taxes are crucial for compliance. Typically, individual income tax returns are due on April fifteenth. However, if this date falls on a weekend or holiday, the deadline may shift to the next business day. It is essential to stay informed about any changes in deadlines, especially for amended returns like the IT-203-X, which may have different submission timelines.

Required Documents

When filing with the New York City, Yonkers, and MCTMT Department of Taxation, certain documents are necessary to ensure a smooth process. Commonly required documents include:

- W-2 forms from employers.

- 1099 forms for other income sources.

- Proof of residency, such as utility bills or lease agreements.

- Previous year’s tax return for reference.

- Any relevant documentation for deductions or credits claimed.

Penalties for Non-Compliance

Failure to comply with the regulations set by the New York City, Yonkers, and MCTMT Department of Taxation can result in significant penalties. These may include:

- Late filing penalties, which can accumulate over time.

- Interest on unpaid taxes, calculated from the due date until the payment is made.

- Potential legal action for severe non-compliance cases.

Eligibility Criteria

Eligibility for filing with the New York City, Yonkers, and MCTMT Department of Taxation often depends on factors such as residency status, income level, and specific tax situations. Generally, individuals must meet the following criteria:

- Be a resident of New York City or Yonkers for part or all of the tax year.

- Have a taxable income that meets the minimum threshold set by the department.

- Fulfill any additional requirements based on the specific tax form being filed.

Quick guide on how to complete new york city yonkers and mctmt department of taxation

Effortlessly Prepare New York City, Yonkers, And MCTMT Department Of Taxation on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, enabling you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources you need to generate, alter, and electronically sign your documents quickly and without complications. Manage New York City, Yonkers, And MCTMT Department Of Taxation on any device through airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The easiest way to modify and eSign New York City, Yonkers, And MCTMT Department Of Taxation with minimal effort

- Locate New York City, Yonkers, And MCTMT Department Of Taxation and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the document or conceal sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a standard wet ink signature.

- Review the information carefully and click on the Done button to save your modifications.

- Select your preferred method to send your form: via email, SMS, invite link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searching, or mistakes that necessitate printing additional copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign New York City, Yonkers, And MCTMT Department Of Taxation while ensuring outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new york city yonkers and mctmt department of taxation

Create this form in 5 minutes!

How to create an eSignature for the new york city yonkers and mctmt department of taxation

The best way to create an e-signature for your PDF document in the online mode

The best way to create an e-signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The best way to make an e-signature from your mobile device

The way to generate an electronic signature for a PDF document on iOS devices

The best way to make an e-signature for a PDF file on Android devices

People also ask

-

What is airSlate SignNow's it 203 x feature?

The it 203 x feature within airSlate SignNow allows users to efficiently manage document workflows through seamless eSigning capabilities. This powerful tool streamlines the signing process, making it easier for businesses to send and receive important documents quickly and securely.

-

How does pricing work for the it 203 x feature?

airSlate SignNow offers flexible pricing plans that include the it 203 x feature at competitive rates. Customers can choose plans based on their needs, ensuring they receive the best value for their document signing and management solutions.

-

What benefits does airSlate SignNow provide with the it 203 x feature?

The it 203 x feature offers numerous benefits including enhanced efficiency, reduced turnaround times, and lower operational costs for document handling. By utilizing this feature, businesses can improve their workflow and focus on core activities while ensuring compliance and security.

-

Is the it 203 x feature easy to integrate with other tools?

Yes, airSlate SignNow's it 203 x feature easily integrates with a wide variety of applications, such as CRM and project management tools. This flexibility allows for a smoother workflow and enables users to consolidate their operations seamlessly.

-

Can I customize the it 203 x feature for my business needs?

Absolutely! The it 203 x feature allows for customization, letting businesses tailor their document workflows to match specific requirements. With user-friendly settings, you can configure the feature according to your organization's unique processes.

-

What kinds of documents can I manage with the it 203 x feature?

You can manage a wide range of documents using the it 203 x feature, including contracts, agreements, and consent forms. This versatility makes airSlate SignNow an ideal solution for various business sectors needing efficient document handling.

-

How secure is the it 203 x feature in airSlate SignNow?

The it 203 x feature includes robust security measures such as encryption and secure storage to protect sensitive information. With airSlate SignNow, businesses can trust that their documents are safeguarded during the signing and sharing processes.

Get more for New York City, Yonkers, And MCTMT Department Of Taxation

- Sheetrock drywall contract for contractor colorado form

- Flooring contract for contractor colorado form

- Agreement or contract for deed for sale and purchase of real estate aka land or executory contract colorado form

- Notice of intent to enforce forfeiture provisions of contact for deed colorado form

- Final notice of forfeiture and request to vacate property under contract for deed colorado form

- Buyers request for accounting from seller under contract for deed colorado form

- Buyers notice of intent to vacate and surrender property to seller under contract for deed colorado form

- General notice of default for contract for deed colorado form

Find out other New York City, Yonkers, And MCTMT Department Of Taxation

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now