Form it 212 ATTClaim for Historic Barn Rehabilitation 2020

What is the Form IT 212 ATTClaim For Historic Barn Rehabilitation

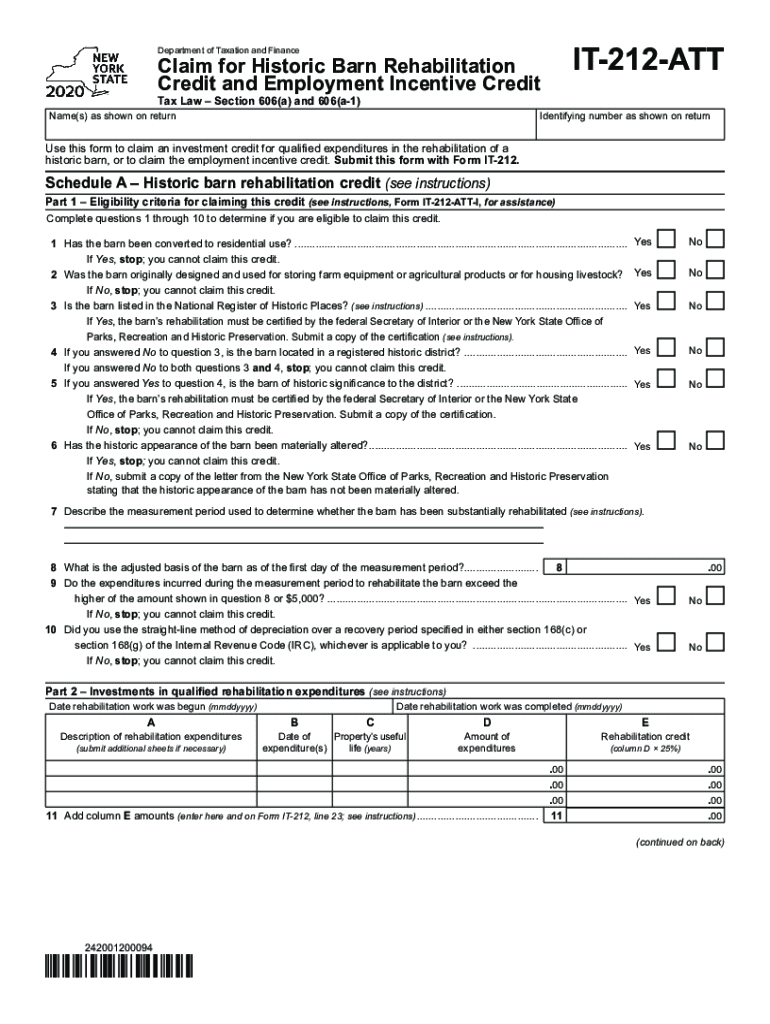

The Form IT 212 ATTClaim is specifically designed for property owners in New York who are seeking tax credits for the rehabilitation of historic barns. This form allows individuals to claim a credit against their state income tax for qualified rehabilitation expenditures. The program aims to encourage the preservation of historic agricultural structures, ensuring they remain functional and contribute to the community's heritage. By completing this form, applicants can receive financial incentives that support their restoration efforts.

How to use the Form IT 212 ATTClaim For Historic Barn Rehabilitation

Using the Form IT 212 ATTClaim involves several steps to ensure proper submission and eligibility for tax credits. First, gather all necessary documentation that supports your claim, including receipts and records of the rehabilitation work completed. Next, fill out the form accurately, providing detailed information about the property and the expenses incurred. It is crucial to follow the instructions closely to avoid errors that could delay processing. Once completed, submit the form along with your state tax return to the appropriate tax authority.

Steps to complete the Form IT 212 ATTClaim For Historic Barn Rehabilitation

Completing the Form IT 212 ATTClaim requires careful attention to detail. Follow these steps:

- Gather all relevant documentation, including invoices and contracts related to the rehabilitation.

- Fill out the form, ensuring that all sections are completed accurately.

- Calculate the total eligible expenses and ensure they align with the guidelines provided by the state.

- Review the form for any errors or omissions before submission.

- Submit the completed form with your state income tax return by the specified deadline.

Eligibility Criteria

To qualify for the tax credits associated with the Form IT 212 ATTClaim, applicants must meet specific eligibility criteria. The property must be a historic barn located in New York State, recognized for its historical significance. Additionally, the rehabilitation work must adhere to the standards set forth by the state, ensuring that the integrity of the barn is preserved. It is also necessary for applicants to demonstrate that the expenses incurred are directly related to the rehabilitation process.

Required Documents

When submitting the Form IT 212 ATTClaim, certain documents are required to support your claim. These may include:

- Invoices and receipts for all rehabilitation work performed.

- Photographic evidence of the barn before and after rehabilitation.

- Documentation proving the historical significance of the barn.

- Any permits or approvals obtained during the rehabilitation process.

Form Submission Methods

The Form IT 212 ATTClaim can be submitted through various methods, ensuring convenience for applicants. You can file the form online through the state’s tax portal, which allows for quick processing and confirmation. Alternatively, you may choose to submit a paper version via mail, ensuring that you send it to the correct tax authority. In-person submissions are also an option at designated tax offices, providing assistance if needed.

Quick guide on how to complete form it 212 att2020claim for historic barn rehabilitation

Easily Prepare Form IT 212 ATTClaim For Historic Barn Rehabilitation on Any Device

Digital document management has become increasingly favored among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without delays. Handle Form IT 212 ATTClaim For Historic Barn Rehabilitation on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

Transform and Electronically Sign Form IT 212 ATTClaim For Historic Barn Rehabilitation Effortlessly

- Locate Form IT 212 ATTClaim For Historic Barn Rehabilitation and click on Get Form to begin.

- Use the tools at your disposal to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with features specifically offered by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of sharing the form, whether via email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Form IT 212 ATTClaim For Historic Barn Rehabilitation to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 212 att2020claim for historic barn rehabilitation

Create this form in 5 minutes!

How to create an eSignature for the form it 212 att2020claim for historic barn rehabilitation

The best way to generate an eSignature for your PDF online

The best way to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The way to create an eSignature straight from your smartphone

How to create an electronic signature for a PDF on iOS

The way to create an eSignature for a PDF document on Android

People also ask

-

What is attclaim in relation to airSlate SignNow?

Attclaim is a feature within airSlate SignNow that allows users to manage electronic signatures efficiently. By utilizing attclaim, businesses can streamline their document workflows while ensuring compliance and security.

-

How much does airSlate SignNow cost for using attclaim?

The pricing for airSlate SignNow varies based on the features and the number of users. The attclaim feature offers competitive pricing options that make it accessible for businesses of all sizes looking to simplify their eSigning needs.

-

What are the key features of attclaim in airSlate SignNow?

attclaim includes several features designed to enhance document management, such as customizable templates, remote signing capabilities, and real-time tracking. These features help businesses save time and improve their productivity.

-

How does attclaim benefit my business?

Using attclaim can signNowly boost your business's efficiency by reducing the time spent on document handling. It also enhances security and compliance, leading to better customer satisfaction and trust in your processes.

-

Can attclaim be integrated with other software?

Yes, attclaim can seamlessly integrate with various CRM systems, project management tools, and cloud storage services. This integration feature allows businesses to maintain their existing workflows while benefiting from airSlate SignNow's eSigning capabilities.

-

Is there a free trial available for attclaim in airSlate SignNow?

Yes, airSlate SignNow offers a free trial period where you can explore the attclaim feature along with other functionalities. This trial allows potential users to assess how attclaim can meet their specific needs before making a commitment.

-

What types of documents can I sign using attclaim?

attclaim enables users to eSign a wide range of documents including contracts, proposals, and agreements. This versatility makes it an essential tool for businesses that handle various documentation types.

Get more for Form IT 212 ATTClaim For Historic Barn Rehabilitation

Find out other Form IT 212 ATTClaim For Historic Barn Rehabilitation

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile