Form it 212 ATT Claim for Historic Barn Rehabilitation Credit 2021

What is the Form IT 212 ATT Claim For Historic Barn Rehabilitation Credit

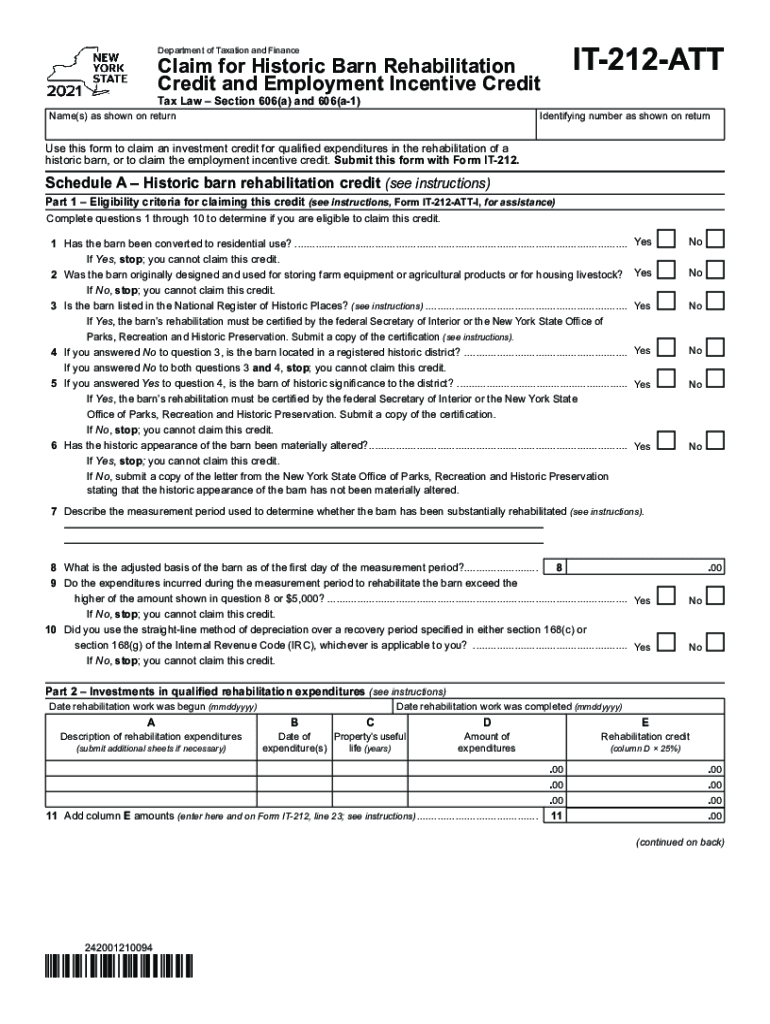

The Form IT 212 ATT is a tax form used in New York to claim a credit for the rehabilitation of historic barns. This credit is designed to encourage the preservation and restoration of barns that have historical significance. It allows property owners to receive a financial benefit when they invest in the restoration of these structures, thus promoting cultural heritage and maintaining the state's architectural history. The form captures essential details about the property, the nature of the rehabilitation work performed, and the costs incurred during the process.

How to use the Form IT 212 ATT Claim For Historic Barn Rehabilitation Credit

To use the Form IT 212 ATT, taxpayers must first ensure they meet the eligibility criteria, which include owning a qualifying historic barn and completing eligible rehabilitation work. Once eligibility is confirmed, the form should be filled out with accurate information regarding the property and the rehabilitation expenses. Taxpayers must provide documentation supporting their claims, such as invoices and receipts. After completing the form, it should be submitted according to the specified filing methods to ensure proper processing by the relevant tax authority.

Steps to complete the Form IT 212 ATT Claim For Historic Barn Rehabilitation Credit

Completing the Form IT 212 ATT involves several key steps:

- Gather necessary documents, including receipts for rehabilitation expenses and proof of ownership.

- Fill out the form with accurate information, ensuring all sections are completed as required.

- Calculate the credit amount based on the eligible expenses incurred during the rehabilitation process.

- Review the form for accuracy and completeness before submission.

- Submit the form by the deadline, either online or via mail, as per the guidelines provided by the tax authority.

Eligibility Criteria

To qualify for the credit claimed through Form IT 212 ATT, certain eligibility criteria must be met. The barn in question must be recognized as a historic structure, either listed on the National Register of Historic Places or designated by a state or local government. Additionally, the rehabilitation work must meet specific standards to ensure the preservation of the barn's historical integrity. Property owners must also provide documented evidence of the expenses incurred during the rehabilitation to support their claim.

Required Documents

When filing the Form IT 212 ATT, taxpayers need to provide several key documents to substantiate their claims. These documents typically include:

- Receipts and invoices for all rehabilitation work completed.

- Proof of ownership of the barn, such as a deed or tax bill.

- Documentation demonstrating the barn's historical significance, such as a certificate of listing on the National Register.

- Any additional forms or schedules required by the tax authority to support the claim.

Form Submission Methods

The Form IT 212 ATT can be submitted through various methods to accommodate taxpayer preferences. Options typically include:

- Online submission through the state's tax portal, which may provide a streamlined process.

- Mailing a physical copy of the completed form to the designated tax office address.

- In-person submission at local tax offices, if available, for those who prefer direct interaction.

Legal use of the Form IT 212 ATT Claim For Historic Barn Rehabilitation Credit

The legal use of the Form IT 212 ATT is governed by state tax laws that outline the eligibility and requirements for claiming the historic barn rehabilitation credit. Taxpayers must ensure compliance with these regulations to avoid penalties or disqualification of their claims. Proper documentation and adherence to submission deadlines are crucial for the legal validity of the claim. Understanding the legal framework surrounding the form helps taxpayers navigate the process effectively and ensures that their claims are recognized by the tax authorities.

Quick guide on how to complete form it 212 att claim for historic barn rehabilitation credit

Complete Form IT 212 ATT Claim For Historic Barn Rehabilitation Credit effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the resources required to create, edit, and eSign your documents quickly without delays. Handle Form IT 212 ATT Claim For Historic Barn Rehabilitation Credit on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign Form IT 212 ATT Claim For Historic Barn Rehabilitation Credit without hassle

- Find Form IT 212 ATT Claim For Historic Barn Rehabilitation Credit and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Edit and eSign Form IT 212 ATT Claim For Historic Barn Rehabilitation Credit and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 212 att claim for historic barn rehabilitation credit

Create this form in 5 minutes!

How to create an eSignature for the form it 212 att claim for historic barn rehabilitation credit

The best way to create an e-signature for your PDF file online

The best way to create an e-signature for your PDF file in Google Chrome

The best way to make an e-signature for signing PDFs in Gmail

The best way to make an e-signature right from your mobile device

The way to generate an electronic signature for a PDF file on iOS

The best way to make an e-signature for a PDF on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to it 212?

airSlate SignNow is a user-friendly platform designed to help businesses send and eSign documents efficiently. The solution simplifies the signing process, making it easier for users to manage their documents effectively. Understanding it 212 is crucial for businesses looking to leverage signatory services while ensuring compliance and efficiency.

-

What are the key features of airSlate SignNow in relation to it 212?

The key features of airSlate SignNow include customizable templates, real-time collaboration, and advanced security measures. These functionalities directly align with it 212, as they enhance document management and make the signing process seamless for users. By incorporating these features, businesses can improve workflow efficiency signNowly.

-

Is airSlate SignNow a cost-effective solution for managing documents and eSigning regarding it 212?

Yes, airSlate SignNow is known for being a cost-effective solution for document management and eSigning, especially in the context of it 212. Users can choose from various pricing plans that fit different business needs, ensuring that costs remain manageable. This allows companies to optimize their resources while benefiting from essential signing features.

-

How does airSlate SignNow enhance productivity while handling it 212?

airSlate SignNow enhances productivity by streamlining the document signing process, which directly impacts the efficiency of it 212-related tasks. Businesses can send, sign, and manage documents quickly, reducing the turnaround time signNowly. This efficiency allows teams to focus on their core activities, driving better results.

-

Can airSlate SignNow integrate with other tools relevant to it 212?

Yes, airSlate SignNow offers integrations with various popular tools that are relevant to it 212, including CRM and project management platforms. These integrations allow for seamless connectivity and data transfer between systems, enhancing workflow and reducing manual errors. This interoperability ensures that users can leverage their existing tools while using airSlate SignNow.

-

What security measures does airSlate SignNow implement for it 212-related documents?

airSlate SignNow prioritizes security with advanced encryption and authentication features, ensuring that all it 212-related documents are protected. This commitment to security helps users maintain compliance with regulations and safeguard sensitive data during the signing process. Businesses can have peace of mind knowing their documents are secure.

-

How can businesses benefit from using airSlate SignNow for it 212?

Businesses can benefit from airSlate SignNow for it 212 by gaining a reliable and efficient signing solution that reduces delays and errors. The platform's user-friendly interface improves user adoption rates, leading to faster implementation. By streamlining existing processes, companies can enhance overall productivity and customer satisfaction.

Get more for Form IT 212 ATT Claim For Historic Barn Rehabilitation Credit

- Bill of sale of automobile and odometer statement for as is sale colorado form

- Construction contract cost plus or fixed fee colorado form

- Painting contract for contractor colorado form

- Trim carpenter contract for contractor colorado form

- Fencing contract for contractor colorado form

- Hvac contract for contractor colorado form

- Landscape contract for contractor colorado form

- Commercial contract for contractor colorado form

Find out other Form IT 212 ATT Claim For Historic Barn Rehabilitation Credit

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast